Wire-to-Board Connector Market Analysis

The Wire-to-Board Connector Market is expected to register a CAGR of 5.75% during the forecast period.

- Wire-to-Board connector system addresses the needs of the fast-changing electronics industry by providing a single system with different mating and voltage configurations. This allows the manufacturers to design various models around a single connector type and footprint pattern.

- The wire-to-board connector design varies from miniature to heavy-duty industrial connectors and also gratifies the economical requirements of the consumers. This simplifies the issues related to maintenance, manufacturing, and repair where it can easily replace specific, affected subsystems, thereby reducing machine downtimes.

- The wire-to-board market is likely to be driven by the rising trend of growing usage across the consumer electronics sector along with its application in the connecting peripheral device. This can be attributed to the fact of increasing application of computer and communication technology all over the world. On the basis of application, the market is finding its usage primarily across the automotive, medical, and data/telecom sector.

- The growing demand for high-speed connectivity and transmission bandwidth are the other factors driving the growth of the wire-to-board connector market. One of the dynamics fueling this market is the emergence of IoT technology due to the Increasing demand for high-bandwidth and high-speed connectivity along with its application across multiple end-user industries.

- The market is driven by multiple product range across the wire-to-board connectors with a 5 mm pitch size, which is expected to grow during the forecast period. This is mainly because of the growing HVAC system controls in the residential application, where air conditioners and heaters, washing machines, refrigerators, stoves, and cooktops are maximally used. The 10.16 mm pitch size connectors are driven by the growing application across robotics, medical, communication, and office automation. However, increasing network complexity with continuous optimization of component size may hinder the market growth.

Wire-to-Board Connector Market Trends

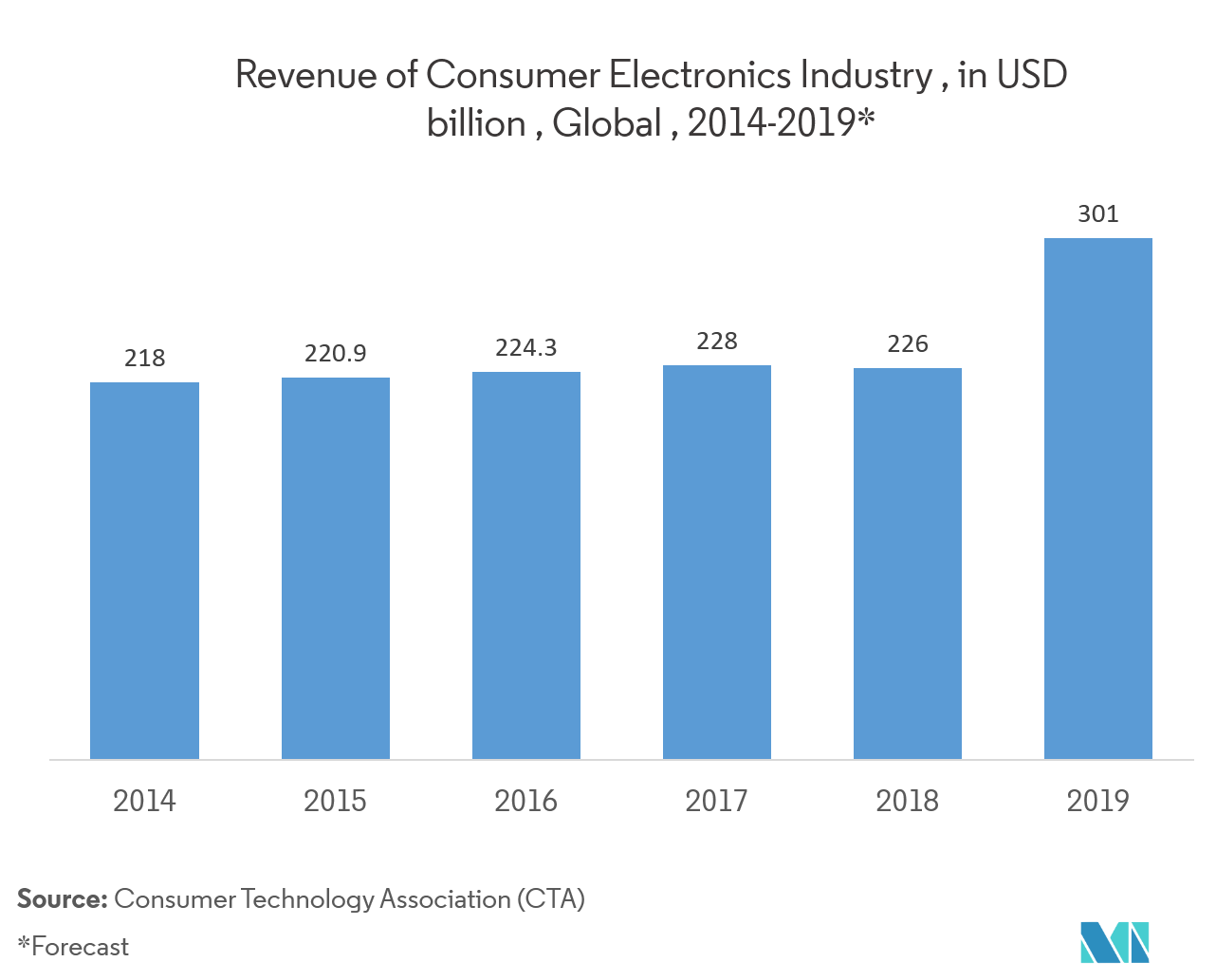

Consumer Electronics Segment is Expected to Expand at a Significant Rate

- Major trends influencing consumer electronics market revolves across size, form, and choice of material used for various type of applications, product miniaturization, ease of use, diminishing carbon footprints, and wireless data access converge.

- Advancement in new technologies is expected to drive the advances in applications of wire to board connectors such as True HD TVs based on LED/OLED backlight displays, roll-able printed electronics, flash memory, touchscreen technology, or data streaming as a replacement for traditional media, such as CD or DVD.

- Computing, Consumer, and Communication (3C) are the main drivers in the consumer electronics industry, characterized by strong convergence and driven by a consumer demand for functional integration, that allows manufacturers to penetrate into new or existing market segments.

- The increasing penetration of smart speakers, smart thermostats, etc., increase the need for wire-on-board connectors that occupy a small footprint. For instance, consider GradConn’s fine-pitch wire-to-board range of solutions in the range of 0.031 inches and 0.039-inch pitch. These wire-on-board connectors offer tiny PCB footprints and low-profile mounted heights suitable for video cameras, portable GPS systems, along with mature electronics, such as laptops and tablets. Molex is another prominent company to offer wire-on-board solutions suitable for smart home solutions among others.

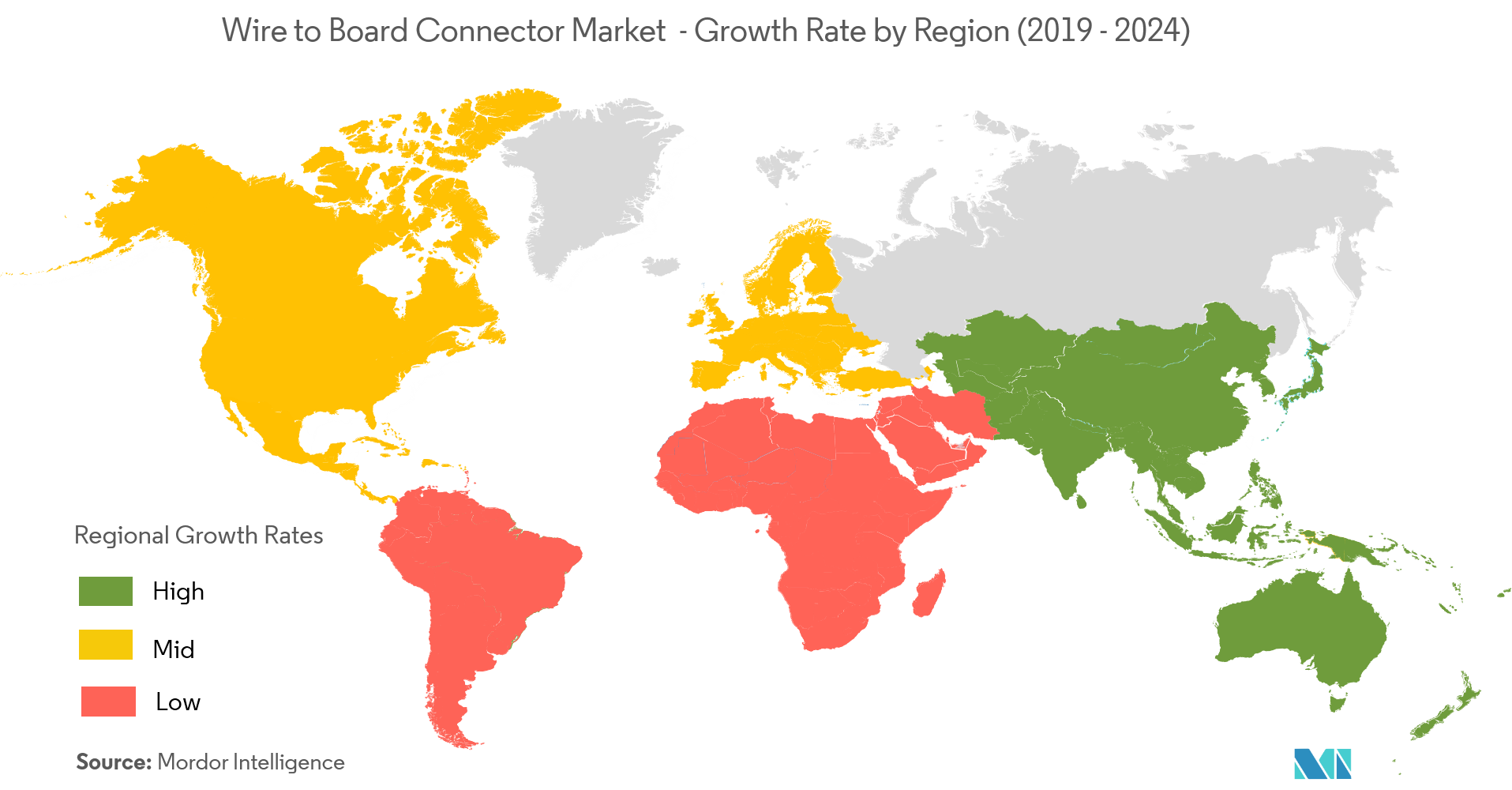

Asia-Pacific is Expected to Occupy Largest Share in Wire-to-Board Connector Market

- The market and applications for wire-to-board connectors continue to evolve across different segment of the Asia-Pacific region. The rising growth of the consumer electronics market along with the increasing end-user applications across the various industry will gradually improve the productivity and efficiencies in the production process, throughout the supply chain. With the rise in industry 4.0, there is a growing demand for IIoT across the various end-user industry across the region during the forecast period.

- The IIoT adoption is poised to gain pace as Siemens has collaborated with Alibaba as a part of EUR 20 billion agreement, which is expected to allow them to leverage each other’s technology and resources to build an IoT solution to support Industry 4.0, which further aids China’s manufacturing up-gradation.

- Some of the relevant Industry 4.0 projects in the japan include the Mitsubishi-led e-Factory Initiative, which focuses on factory automation and the Industry 4.1J program, led by NTT, which focuses on secure cloud-based data processing.

- The future of the electronics connector market looks promising with the growing opportunities from the automotive & transportation and telecom/ datacom sector, due to rise in the computer and peripheral along with the consumer electronics industry across the Asia-Pacific region.

- Moreover, China is one of the largest production bases for wire-to-board connectors. The local segment has been growing steadily and is expected to do so at 10% annually, in terms of total sales until 2020, representing the same rate as the local connectors industry. According to the China Industry Information, the global connectors market will be on the scale of USD 60 billion by 2020 from USD 54.2 billion in 2016.

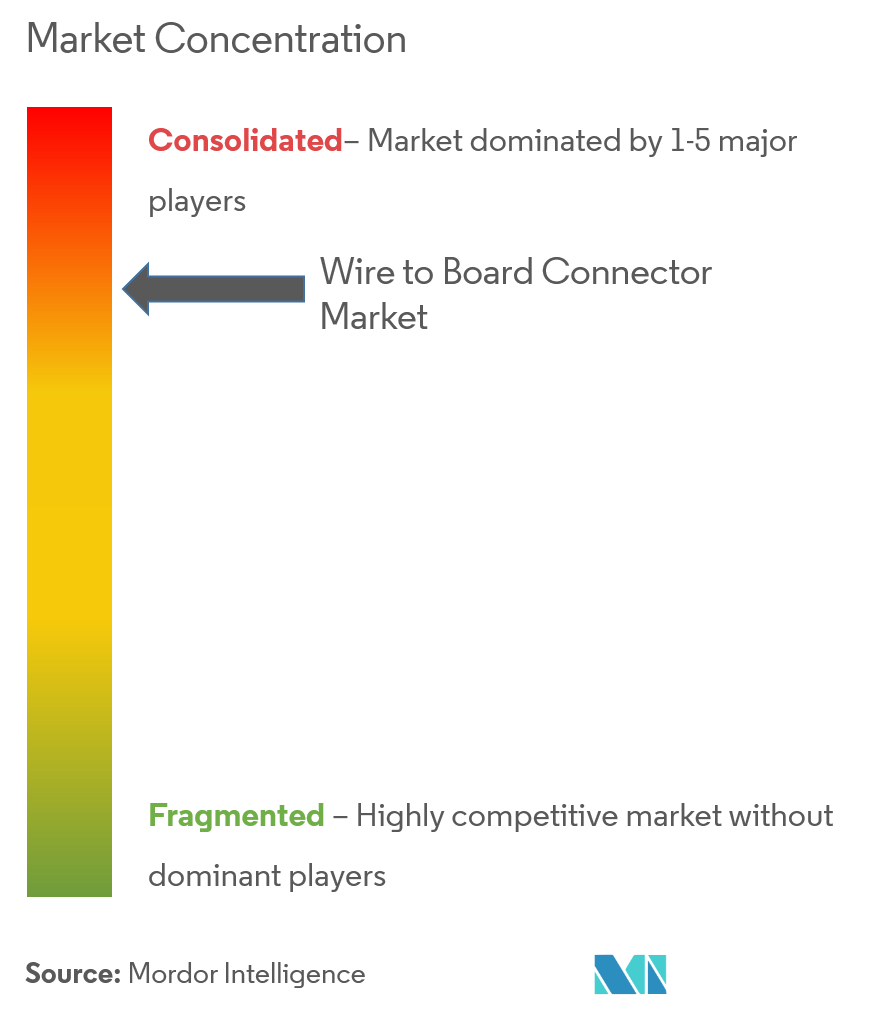

Wire-to-Board Connector Industry Overview

The wire to board connector market is consolidated due to the marketconsists of large global connector manufacturers, along with a huge base of Chinese manufacturers. Some of the major players are3M Co., Molex LLC,TE ConnectivityLtd,Amphenol Corporation,Harting Technology Group,J.S.T. MFG. Co. Ltd,ERNI Deutschland GmbH,Kyocera Corporation,Samtec Inc., Phoenix Contact GmbH & Co. KG,Wago Corporation, among others.

- September 2019 - Molexreleasedthe MicroTPA 2.00mm Wire-to-Board and Wire-to-Wire Connector System, providing electrical and mechanical reliability in a high-temperature design that meets a diverse range of industry requirements. The connectors are suitedfor the consumer and automotive markets needing a compact wire-to-board and wire-to-wire connector system, with a current rating up to 2.5A for use within constrained spaces.

- Septemeber 2019 -Measurement Specialties Inc., a subsidiary of TE Connectivity Ltd. signed a definitive agreement to acquire Silicon Microstructures Inc. from Elmos Semiconductor AG. The acquisition of Silicon Microstructures will expand TE’s global leadership in pressure sensing technology, particularly in medical, transportation, and industrial applications. Upon completion, the transaction would bring together SMI’s micro-electro-mechanical systems (MEMS) sensor technology design and manufacturing capabilities, with TE’s operational scale, customer base, and existing sensors technologies into more comprehensive global sensing solutions offering for customers.

Wire-to-Board Connector Market Leaders

-

Molex LLC

-

TE Connectivity Ltd

-

Amphenol Corporation

-

3M Company

-

Samtec Inc.

- *Disclaimer: Major Players sorted in no particular order

Wire-to-Board Connector Industry Segmentation

Wire-to-board connectors, generally utilize crimp technology, that is used to interconnect printed circuit boards (PCBs) by using contacts/terminals attached (crimped) to wires, which are then inserted into the relevant housing to complete the connector system assembly. A wire-to-board connector refers to those connectors that connect a bunch of wires or a wire with a printed circuit board (PCB). Connectors are used to join subsections of circuits together. Moreover, a connector is used where it may be desirable to disconnect the subsections at some future time, such as across the power inputs, peripheral connections, or boards which may need to be replaced.

| By End User Vertical | Consumer Electronics |

| IT and Telecommunication | |

| Automotive | |

| Aerospace and Defense | |

| Other End User Verticals | |

| Geography | North America |

| Europe | |

| Asia-Pacific | |

| Latin America | |

| Middle East & Africa |

Wire-to-Board Connector Market Research FAQs

What is the current Wire-to-Board Connector Market size?

The Wire-to-Board Connector Market is projected to register a CAGR of 5.75% during the forecast period (2025-2030)

Who are the key players in Wire-to-Board Connector Market?

Molex LLC, TE Connectivity Ltd, Amphenol Corporation, 3M Company and Samtec Inc. are the major companies operating in the Wire-to-Board Connector Market.

Which is the fastest growing region in Wire-to-Board Connector Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Wire-to-Board Connector Market?

In 2025, the Asia Pacific accounts for the largest market share in Wire-to-Board Connector Market.

What years does this Wire-to-Board Connector Market cover?

The report covers the Wire-to-Board Connector Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Wire-to-Board Connector Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Wire-to-Board Connector Industry Report

Statistics for the 2025 Wire-to-Board Connector market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Wire-to-Board Connector analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.