White Biotech Market Analysis

The White Biotech Market is expected to register a CAGR of 9.95% during the forecast period.

The white biotechnology industry is experiencing a significant transformation driven by technological advancements and changing industrial practices. Companies are increasingly adopting innovative fermentation technologies and enzyme engineering techniques to develop sustainable biotechnology solutions across various sectors. The integration of artificial intelligence and machine learning in bioprocess optimization has enabled more efficient production methods and improved yield rates. According to industry surveys in 2022, approximately 66% of Americans and 80% of young Americans aged between 18-34 years expressed willingness to pay more for sustainable products, highlighting the growing market acceptance of bio-based solutions.

The industry is witnessing substantial developments in bio-based materials and sustainable ingredients. In May 2023, Evonik launched the TEGO Cycle additives portfolio to transform plastic waste into valuable plastics, demonstrating the industry's commitment to circular economy principles. The portfolio is designed to save energy during mechanical recycling and enhance polymer quality, representing a significant advancement in industrial biotechnology. This trend is particularly evident in the packaging and consumer goods sectors, where companies are increasingly replacing traditional petrochemical-based materials with bio-based alternatives.

The cosmetics and personal care segment is emerging as a key growth area for white biotechnology applications. In February 2023, Givaudan unveiled RetiLife, a 100% natural-origin retinol crafted through biotechnology, marking a significant milestone in sustainable biotechnology ingredient development. This innovation reflects the industry's shift towards environmentally responsible beauty solutions and demonstrates the expanding capabilities of clean biotechnology in creating high-performance, sustainable alternatives to traditional synthetic ingredients.

The food and agriculture sectors are witnessing revolutionary changes through industrial biotechnology applications. In April 2023, CULT Food Science announced a partnership with biotech startup JellaTech to launch collagen-enhanced pet foods using functional animal-free collagen, showcasing the versatility of biotechnology in creating sustainable nutrition solutions. The industry is seeing increased adoption of industrial enzyme-based solutions in food processing, particularly in brewing, baking, and dairy applications, leading to improved product quality and reduced environmental impact. These developments are reshaping traditional manufacturing processes while addressing growing consumer demands for sustainable and clean-label products.

White Biotech Market Trends

Increasing Consumer Demand for Products with Low Environmental Impacts

Consumers are increasingly making purchasing decisions based on environmental considerations and seeking out products that use sustainable materials or processes and have minimal negative effects on the environment. This shift in consumer behavior is evidenced by recent surveys, with a 2022 study in South Korea revealing that over 72% of consumers consider eco-friendly certification labels as a crucial factor in their purchasing decisions. Similarly, according to GreenPrint's consumer survey in 2022, 66% of Americans and 80% of young Americans aged between 18-34 years expressed willingness to pay more for sustainable products compared to less sustainable alternatives. Furthermore, among consumers shopping for environmentally friendly products, 72% actively check labels or third-party certifications on product packaging to confirm environmental claims.

The rising awareness and demand for sustainable products have encouraged manufacturers across various industries to incorporate bio-based ingredients and environmentally friendly processes in their production. Bio-based products have demonstrated potential in saving limited fossil resources, reducing greenhouse gas emissions, and offering high biodegradability and full composability. Consumer behavior, especially in developed regions, is increasingly affected by green product qualities, with recent research showing consumers' willingness to pay a premium for more sustainable products. This trend has led to rapid growth in demand for products from clean, green manufacturing processes, including sustainable biomanufacturing and biochemical processing, owing to the rising environmental consciousness among consumers globally. Many consumers now recognize the term bio-based in conjunction with green products and perceive that bio-based ingredients enhance product desirability, making them willing to consider premium pricing.

Dedicated Policies and Enhanced Government Efforts to Promote the Use of Biotechnology

Governments worldwide are implementing comprehensive policies and providing substantial financial support to accelerate the adoption of biotechnology across various sectors. In March 2023, the Indian government announced plans to launch a Bio E-3 (biotechnology for environment, economy, and employment) policy to boost biotechnology-based manufacturing for green growth, aiming to attract Rs. 10,000 crore investments. The policy strategically implements biotechnology for the production of agri-food, veterinary products, paints, and dyes. Additionally, in January 2022, the United States Environmental Protection Agency announced a new initiative for streamlining the review of biofuels and chemicals that can significantly replace higher GHG-emitting fossil fuels, providing a significant push to the biofuels market.

The regulatory landscape continues to evolve with supportive frameworks and funding mechanisms. For instance, the US Department of Energy announced more than $97 million in funding for 33 projects that would support high-impact technology research and development to accelerate the bioeconomy. These projects focus on improving the performance and lowering the cost and risk of technologies used to produce biofuels, biopower, and bioproducts from biomass and waste resources. In Europe, the European Commission has developed a demand-based innovation policy for bio-based products, aiming to promote the bio-based products market and stimulate innovation by strengthening the demand base. China has also been investing heavily in industrial biotechnology to increase agricultural productivity, with numerous incentives for producers and preferential tax treatment for selected firms in the emerging biochemical industries. The industrial enzyme market is also seeing growth as a result of these supportive policies, which are integral to advancing green biotechnology initiatives.

Segment Analysis: By Type

Biofuels Segment in White Biotech Market

The biofuels segment continues to dominate the white biotech market, holding approximately 39% of the market share in 2024. This significant market position is primarily driven by the increasing global demand for renewable energy resources and the pressing need to reduce carbon emissions across various industries. The segment's growth is further bolstered by stringent government regulations promoting the use of biofuels, particularly in the transportation sector. Major economies worldwide are implementing mandatory blending requirements for biofuels, with several countries increasing their ethanol blending targets. The segment's dominance is also attributed to the rising adoption of biofuels in aviation, marine, and heavy industries as a sustainable alternative to conventional fossil fuels.

Biomaterials Segment in White Biotech Market

The biomaterials segment is emerging as the fastest-growing segment in the white biotech market, projected to grow at approximately 12% during the forecast period 2024-2029. This remarkable growth is driven by increasing applications in medical devices, tissue engineering, and drug delivery systems. The segment is witnessing substantial investments from pharmaceutical companies and research institutions, particularly in developing advanced biocompatible materials. The rising demand for sustainable and eco-friendly materials in various industries, coupled with technological advancements in biomaterial production processes, is fueling this growth. Additionally, the increasing focus on personalized medicine and regenerative therapies is creating new opportunities for biomaterial applications in healthcare.

Remaining Segments in White Biotech Market by Type

The biochemicals and industrial enzymes segments play crucial roles in shaping the white biotech market landscape. The biochemicals segment is particularly significant in the production of bio-based chemicals, polymers, and other industrial products, offering sustainable alternatives to petroleum-based chemicals. This segment is gaining traction in various industries, including cosmetics, pharmaceuticals, and food processing. The industrial enzymes segment, while smaller in market share, is vital in multiple industrial applications, including food processing, animal feed, and textile manufacturing. These segments are benefiting from increasing environmental awareness and the global shift towards sustainable manufacturing processes, with industrial fermentation and biochemical processing playing key roles in their development.

Segment Analysis: By Application

Bioenergy Segment in White Biotech Market

The bioenergy segment continues to dominate the white biotech market, commanding approximately 39% of the total market share in 2024. This significant market position is primarily driven by the increasing global focus on renewable energy resources and the pressing need to reduce carbon emissions across industries. The segment's growth is further bolstered by supportive government policies and mandates for biofuel adoption worldwide, particularly in major economies like the United States, Brazil, and European Union countries. The rising demand for bioethanol, biodiesel, and other biofuel alternatives has created a robust ecosystem for bioenergy applications, with many leading companies investing in advanced biotechnology processes to enhance production efficiency and reduce costs.

Food and Beverage Segment in White Biotech Market

The food and beverage segment is emerging as the fastest-growing application area in the white biotech market, with an expected growth rate of approximately 12% during the forecast period 2024-2029. This remarkable growth is driven by increasing consumer demand for natural ingredients, clean-label products, and sustainable food processing methods. The segment is witnessing significant innovation in enzyme applications, particularly in bakery products, beverages, and dairy processing. The adoption of white biotechnology in this sector is also being fueled by its ability to enhance food quality, extend shelf life, and improve nutritional content while maintaining environmental sustainability. Manufacturers are increasingly incorporating biotech-derived ingredients and enzymes to meet the growing consumer preference for healthier and more sustainable food options.

Remaining Segments in White Biotech Market by Application

The white biotech market's other significant segments include pharmaceuticals, feed, and various industrial applications. The pharmaceutical segment represents a substantial portion of the market, driven by the increasing use of biotechnology in drug development and production processes. The feed segment, though smaller, plays a crucial role in developing sustainable animal nutrition solutions and improving feed efficiency. Other industrial applications encompass various sectors such as textiles, paper and pulp, and personal care products, where white biotechnology offers sustainable alternatives to traditional chemical processes. These segments collectively contribute to the market's diverse application portfolio and demonstrate the versatility of white biotechnology in addressing various industrial challenges, with industrial biocatalysis and industrial bioproducts enhancing their effectiveness.

White Biotech Market Geography Segment Analysis

White Biotech Market in North America

North America represents a highly developed market for white biotechnology, driven by strong research capabilities, technological advancement, and supportive government policies. The region benefits from well-established infrastructure, the presence of major industrial biotech companies, and an increasing focus on sustainable production methods. The United States, Canada, and Mexico form the key markets in this region, with each country showcasing distinct growth characteristics based on their industrial development, regulatory frameworks, and adoption rates of industrial biotechnology solutions.

White Biotech Market in the United States

The United States dominates the North American white biotech landscape as the largest market in the region. The country's leadership position is supported by extensive research and development activities, a strong presence of major biotechnology companies, and increasing adoption across various end-use industries. The country accounts for approximately 83% of the North American market share. The growth is primarily driven by rising consumer demand for sustainable products, government support through various initiatives and funding programs, and increasing applications in sectors like pharmaceuticals, food and beverages, and biofuels.

White Biotech Market in Canada

Canada emerges as the fastest-growing market in North America with a projected growth rate of approximately 10% during 2024-2029. The country's growth is fueled by its abundant biomass resources, strong focus on sustainable development, and increasing investments in biotechnology research. Canada's commitment to reducing greenhouse gas emissions and promoting bio-based alternatives has created favorable conditions for market expansion. The country's robust agricultural sector provides a strong foundation for feedstock supply, while government initiatives supporting clean technology development further accelerate market growth.

White Biotech Market in Europe

Europe represents a mature market for white biotechnology, characterized by strong research capabilities, stringent environmental regulations, and high adoption of sustainable technologies. The region's market is driven by increasing environmental concerns, strong government support for bio-based products, and growing consumer awareness about sustainable alternatives. Key markets including Germany, the United Kingdom, France, Spain, and Italy demonstrate varying levels of market maturity and growth potential, influenced by their industrial base, research capabilities, and regulatory frameworks.

White Biotech Market in Germany

Germany leads the European white biotech market, holding approximately 20% of the regional market share. The country's dominant position is attributed to its strong industrial base, significant investments in biotechnology research and development, and robust presence of major industry players. Germany's leadership in chemical and pharmaceutical industries, coupled with its strong focus on sustainable production methods, drives market growth. The country's commitment to environmental protection and circular economy principles further strengthens its position in the white biotech sector.

White Biotech Market in the United Kingdom

The United Kingdom demonstrates the highest growth potential in the European region, with an expected growth rate of approximately 10% during 2024-2029. The country's market is driven by increasing investments in biotechnology research, strong government support for sustainable technologies, and growing demand for bio-based products. The UK's commitment to reducing carbon emissions and transitioning to a bio-based economy creates significant opportunities for market expansion. The presence of leading research institutions and biotechnology companies further supports market growth.

White Biotech Market in Asia-Pacific

The Asia-Pacific region represents a rapidly evolving market for white biotechnology, characterized by increasing industrialization, growing environmental awareness, and rising investments in biotechnology research. The region encompasses diverse markets including China, Japan, India, and Australia, each with unique market dynamics and growth drivers. The market benefits from abundant biomass resources, a growing industrial base, and an increasing focus on sustainable development across various sectors.

White Biotech Market in China

China emerges as the dominant force in the Asia-Pacific white biotech market. The country's leadership position is supported by its large industrial base, significant investments in biotechnology research, and strong government support for sustainable technologies. China's focus on environmental protection, coupled with its growing chemical and pharmaceutical industries, drives market growth. The country's commitment to developing its biotechnology sector through various initiatives and policies further strengthens its market position.

White Biotech Market in India

India represents the fastest-growing market in the Asia-Pacific region. The country's market growth is driven by increasing investments in biotechnology research, growing environmental awareness, and rising demand for sustainable products. India's strong agricultural base provides abundant feedstock for white biotechnology applications, while government initiatives supporting biotechnology development create favorable conditions for market expansion. The country's growing industrial sector and increasing focus on sustainable production methods further accelerate market growth.

White Biotech Market in South America

South America demonstrates significant potential in the white biotechnology market, driven by its rich biodiversity, strong agricultural base, and growing focus on sustainable development. Brazil emerges as the largest market in the region, while Argentina shows the highest growth potential. The region's market benefits from abundant biomass resources, increasing investments in biotechnology research, and growing awareness about sustainable alternatives. Government initiatives supporting biotechnology development, coupled with rising demand for bio-based products across various sectors, contribute to market growth. The region's strong agricultural sector provides a reliable source of feedstock for white biotechnology applications.

White Biotech Market in Middle East & Africa

The Middle East & Africa region presents emerging opportunities in the white biotechnology market, with South Africa and Saudi Arabia as key markets. South Africa leads the regional market and demonstrates the highest growth potential. The region's market is driven by increasing environmental awareness, growing investments in biotechnology research, and rising demand for sustainable solutions. Government initiatives supporting sustainable development and technological advancement contribute to market growth. The region's diverse biological resources and growing industrial base provide opportunities for white biotechnology applications across various sectors.

White Biotech Industry Overview

Top Companies in White Biotech Market

The white biotech market features prominent players like BASF SE, Cargill Inc., Archer Daniels Midland, Novozymes A/S, and DuPont, among others, leading the innovation landscape. These industrial biotechnology companies are increasingly focusing on developing novel enzyme-based solutions and bio-based materials through extensive research and development initiatives. Strategic partnerships and collaborations have become crucial for expanding product portfolios and accessing new markets, particularly in emerging economies. Operational agility is demonstrated through investments in state-of-the-art production facilities and the adoption of advanced biotechnology processes. Market leaders are emphasizing sustainability and environmental responsibility by developing eco-friendly alternatives to traditional chemical processes. Geographic expansion strategies, particularly in Asia-Pacific and Latin America, are being pursued through both organic growth and strategic acquisitions.

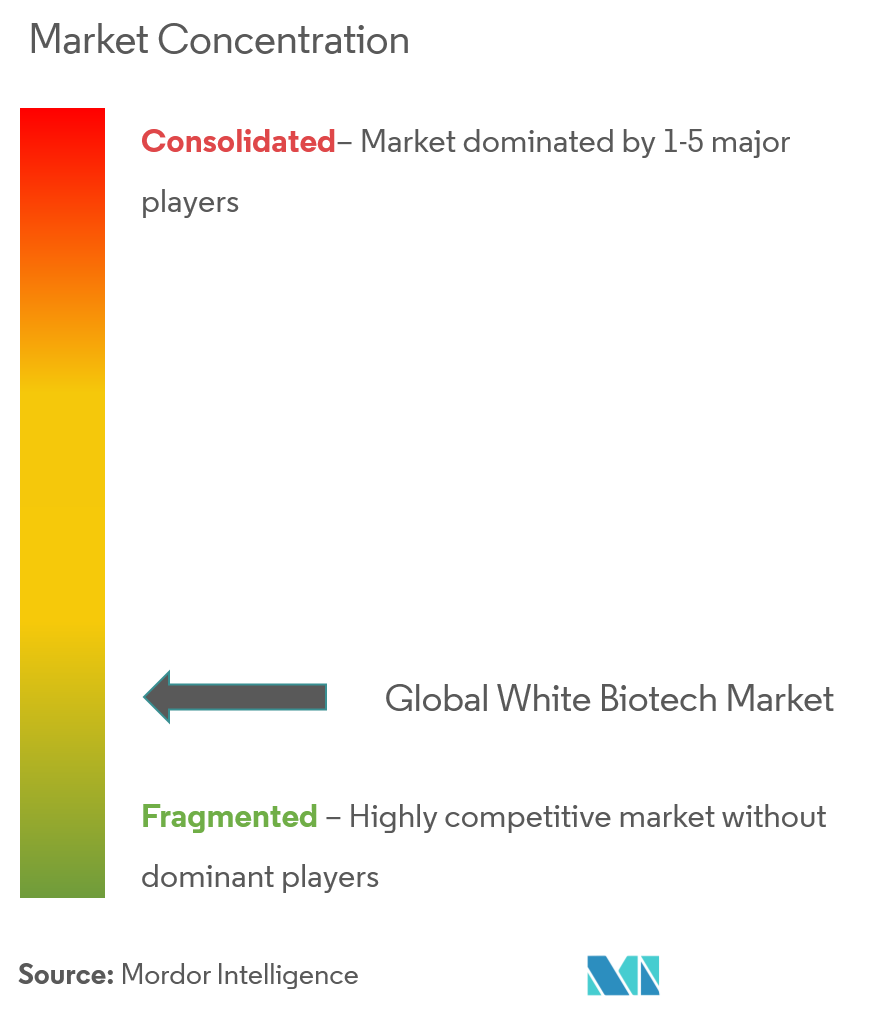

Diverse Players Shape Dynamic Market Structure

The white biotech market exhibits a mix of global conglomerates and specialized biotechnology firms, creating a moderately fragmented competitive landscape. Large multinational corporations leverage their extensive research capabilities and global distribution networks to maintain market leadership, while specialized players focus on niche applications and innovative solutions. The market is characterized by ongoing consolidation through mergers and acquisitions, as larger companies seek to acquire innovative technologies and expand their geographical presence. Joint ventures and strategic alliances are becoming increasingly common, particularly in emerging markets where local expertise is crucial for market penetration.

The competitive dynamics are further shaped by the presence of regional players who possess strong local market knowledge and established customer relationships. Market consolidation is driven by the need to achieve economies of scale, access new technologies, and strengthen market position in key geographical regions. Companies are increasingly focusing on vertical integration strategies to secure raw material supply and enhance control over the value chain. The industry has witnessed a trend of cross-border acquisitions, particularly targeting companies with proprietary technologies or a strong regional presence.

Innovation and Sustainability Drive Future Success

Success in the white biotech market increasingly depends on companies' ability to develop innovative, sustainable solutions while maintaining cost competitiveness. Incumbent players are focusing on strengthening their research and development capabilities, expanding their product portfolios, and developing customized solutions for specific industry applications. Building strong relationships with end-users through technical support and collaborative development projects has become crucial for maintaining market share. Companies are also investing in digital technologies and automation to improve operational efficiency and reduce production costs. The ability to navigate regulatory requirements and obtain necessary certifications across different regions remains a critical success factor.

For contenders looking to gain ground, focusing on niche applications and developing specialized solutions offers a viable entry strategy. Success factors include building strong intellectual property portfolios, establishing strategic partnerships with established players, and maintaining flexibility in production processes to meet changing market demands. Companies must also address the growing end-user concentration in key industries such as food and beverages, pharmaceuticals, and biofuels. The threat of substitution from traditional chemical processes remains a consideration, particularly in price-sensitive markets. Regulatory support for sustainable biotechnology and environmental protection creates opportunities for companies offering innovative bio-based solutions. Additionally, the industrial enzyme market is a critical component of this industry, driving advancements in industrial microbiology and enhancing the capabilities of white biotechnology companies.

White Biotech Market Leaders

-

Dupont De Nemours, Inc.

-

Novozymes A/S

-

Lonza Group Ltd

-

Koninklijke DSM NV

-

BASF SE

- *Disclaimer: Major Players sorted in no particular order

White Biotech Market News

- March 2023: Danisco Animal Nutrition launched AXTRA Prime, an optimized enzyme blend created to address significant changes in piglet production in the United States. The company claims that it enhances gut health, improves nutrient digestion, and produces measurable performances in swine.

- December 2021: BASF Venture Capital (BVC) made a strategic investment in Bota Biosciences Ltd (Bota Bio), an innovative industrial synthetic biotech company based in Hangzhou, China. Bota Bio specializes in developing cutting-edge biotechnology platforms that facilitate the sustainable and cost-effective production of high-value products for a wide range of industrial applications, including sweeteners, vitamins, personal care items, and crop protection products.

- June 2021: Eucodis expanded its CalBcollection with novel immobilized variants like EUCODIS CalB01 optimized for applications in organic solvents, EUCODIS CalB02 optimized for aqueous media, and EUCODIS wildtype-CalB.

White Biotech Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

-

4.1 Market Drivers

- 4.1.1 Increasing Consumer Demand for Products with Low Environmental Impacts

- 4.1.2 Dedicated Policies and Government Efforts to Promote the use of Biotechnology

-

4.2 Market Restraints

- 4.2.1 Deteriorating Fertility of Agricultural Lands

-

4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Type

- 5.1.1 Biofuels

- 5.1.2 Biomaterials

- 5.1.3 Biochemicals

- 5.1.4 Industrial Enzymes

-

5.2 By Application

- 5.2.1 Bioenergy

- 5.2.2 Pharmaceuticals

- 5.2.3 Food and Beverages

- 5.2.4 Feed

- 5.2.5 Other Applications

-

5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Spain

- 5.3.2.5 Italy

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Rest of Middle-East and Africa

6. COMPETITIVE LANDSCAPE

- 6.1 Strategies Adopted by Leading Players

- 6.2 Market Positioning Analysis

-

6.3 Company Profiles

- 6.3.1 EUCODIS Bioscience GmbH

- 6.3.2 Dupont De Nemours Inc.

- 6.3.3 Koninklijke DSM NV

- 6.3.4 BASF SE

- 6.3.5 Evonik Industries AG

- 6.3.6 Lonza Group Ltd

- 6.3.7 Laurus Labs

- 6.3.8 Corbion NV

- 6.3.9 Novozymes

- 6.3.10 Archer Daniels Midland Company

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

White Biotech Industry Segmentation

White biotechnology, also known as industrial biotechnology, refers to the use of enzymes and microorganisms to produce bio-based products for use in sectors, such as chemicals, food and feed, healthcare, consumer goods, and automotive.

The white biotech market is segmented on the basis of type, application, and geography. Based on type, the white biotech market report is segmented into biofuels, biomaterials, biochemicals, and industrial enzymes. Based on application, the market report is segmented into bioenergy, pharmaceuticals, food and beverage, feed, and other applications. By geography, the market is segmented into North America, Europe, Asia-Pacific, South America, Middle East, and Africa.

The market sizing has been done in value terms in USD for all the above-mentioned segments.

| By Type | Biofuels | ||

| Biomaterials | |||

| Biochemicals | |||

| Industrial Enzymes | |||

| By Application | Bioenergy | ||

| Pharmaceuticals | |||

| Food and Beverages | |||

| Feed | |||

| Other Applications | |||

| Geography | North America | United States | |

| Canada | |||

| Mexico | |||

| Rest of North America | |||

| Europe | Germany | ||

| United Kingdom | |||

| France | |||

| Spain | |||

| Italy | |||

| Rest of Europe | |||

| Asia-Pacific | China | ||

| Japan | |||

| India | |||

| Australia | |||

| Rest of Asia-Pacific | |||

| South America | Brazil | ||

| Argentina | |||

| Rest of South America | |||

| Middle-East and Africa | South Africa | ||

| Saudi Arabia | |||

| Rest of Middle-East and Africa | |||

White Biotech Market Research FAQs

What is the current White Biotech Market size?

The White Biotech Market is projected to register a CAGR of 9.95% during the forecast period (2025-2030)

Who are the key players in White Biotech Market?

Dupont De Nemours, Inc., Novozymes A/S, Lonza Group Ltd, Koninklijke DSM NV and BASF SE are the major companies operating in the White Biotech Market.

Which is the fastest growing region in White Biotech Market?

Asia-Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in White Biotech Market?

In 2025, the North America accounts for the largest market share in White Biotech Market.

What years does this White Biotech Market cover?

The report covers the White Biotech Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the White Biotech Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

White Biotech Market Research

Mordor Intelligence provides a comprehensive analysis of the industrial biotechnology and white biotechnology sectors. We leverage our extensive expertise in industrial microbiology and biochemical processing. Our research covers the full spectrum of industrial biotech applications, including industrial fermentation, industrial enzyme development, and industrial biocatalysis processes. The report is available as an easy-to-download PDF, offering detailed insights into sustainable biotechnology practices and clean biotechnology innovations. It focuses particularly on leading industrial biotechnology companies and emerging market trends.

This detailed market analysis benefits stakeholders across the industrial bioproducts value chain. It offers crucial insights into sustainable biomanufacturing practices and industrial biocatalyst applications. The report examines the evolving landscape of green biotechnology and provides comprehensive coverage of the industrial enzyme market dynamics. Our analysis includes detailed profiling of key industrial biotech companies and white biotechnology companies, alongside crucial data on industrial microbiology market developments. The assessment of the industrial biotechnology market size delivers actionable intelligence for strategic decision-making, supported by robust analysis of current trends and future growth opportunities.