Well Cementing Services Market Analysis

The Well Cementing Services Market is expected to register a CAGR of greater than 3.55% during the forecast period.

COVID-19 negatively impacted the market in 2020. Presently the market has now reached pre-pandemic levels.

- Over the medium term, owing to the rise in crude oil prices, the industry seems more optimistic than in recent times. Oil and gas companies are planning to invest in the projects put on hold due to the high development cost, which is expected to drive market growth over the study period.

- On the other hand, the volatile oil prices over the recent period, owing to the supply-demand gap, geopolitics, and several other factors, have restrained the growth in the demand for the well-cementing services market.

- Nevertheless, the increasing oil and gas discoveries coupled with the liberalization in the industry worldwide have created new opportunities for the players to invest in. The new emerging markets are several developing nations of the Middle East and Africa, Asia-Pacific, and South America.

- North America is the dominant market for well-cementing services and is expected to remain the market leader during the forecast period.

Well Cementing Services Market Trends

Onshore Segment to Dominate the Market

- Onshore drilling encompasses all the drilling sites located on dry land and accounts for 70% of worldwide oil production. Onshore drilling is similar to offshore drilling but without the difficulty of deep water between the platform and the oil.

- The global crude oil prices have shown signs of recovery and are improving at a good pace, and the onshore projects are easier to kick start than offshore ones. Therefore, riding on the optimism associated with the recovery of crude oil prices, onshore projects are expected to record significant growth over the forecast period, in turn, driving the demand for the well-cementing services market.

- As of the end of 2021, there were 1,309 operational onshore oil rigs in the world, compared with 201 offshore rigs. There was an increase in the global rig fleet in 2021 as oil demand increased again following the economic slump caused by the Covid-19 pandemic.

- In December 2022, an investment of USD 260.23 million was proposed for drilling 53 exploratory wells in Andhra Pradesh, India, 50 in the Godavari on-land petroleum mining lease block of the KG basin, and three in CD-ONHP-2020/1 (OALP-VI) block of the Cuddapah basin. ONGC produces over 4.4 million standard cubic feet of gas and 700 tonnes of oil from the KG basin per day. In accordance with the company's proposals, 50 wells will be explored onshore during the period 2021-28 in the Godavari on-land PML block of the KG basin, located in the East and West Godavari districts.

- In June 2022, The Australian company Timor Resources announced that it would drill three more exploration wells onshore East Timor after certifying 24.2 million barrels of oil and 1.3 billion cubic feet of gas reserves from its first two wells.

- Hence, with the new investment in the onshore oil & gas industry, increasing exploration of unconventional resources, and the crude oil price stability, which in turn are expected to increase the demand for well-cementing services market around the globe.

North America to Dominate the Market

- North America is expected to dominate the Well Cementing Services Market and grow significantly over the forecast period.

- North America has been one of the market leaders in the oil and gas sector, primarily as the United States is the world's largest crude oil producer and has retained its position through 2021.

- In 2021, crude oil production in the United States stood at 23,942 thousand barrels per day, representing a growth of 18.64% compared to 2017 production levels. According to the United States Energy Information Administration, the forecast predicts around 12.4 million b/d crude oil production in 2023, which is expected to create a huge demand for well-cementing services required in the production wells.

- As of November 2022, the United States has 779 active rigs, of which 17 are offshore rigs, 4 Inland water rigs, and 758 onshore rigs. An active rig is considered active when the rig is on the location and is drilling the majority of the week (4 days out of 7 days). This indicates the dominance of fixed assets, such as drilling rigs and production platforms, in the upstream segment of the country. The increase in the number of rigs is directly proportional to the number of investors and energy-related firms investing in the oil and gas industry's activities.

- In August 2022, US Oil E&P company Hess announced an oil discovery in the Green Canyon Block 69 located in the US Gulf of Mexico basin. The construction of drilling and appraisal wells in the block is underway, with production estimated to begin by early 2023. The company also estimates a net production of 30,000 barrels from the US Gulf of Mexico at the end of 2022.

- In February 2022, BP begins operations at its Herschel expansion project in the Gulf of Mexico. As part of the first phase of the project, a subsea production system is going to be developed, as well as the first of up to three wells to be drilled from the Na Kika platform. The first well will increase the platform's annual gross production by 10,600 barrels of oil per day.

- Therefore, increasing oil and gas drilling and completion activities in the region are expected to increase the demand for the Well Cementing Services Market over the forecast period in the North America region.

Well Cementing Services Industry Overview

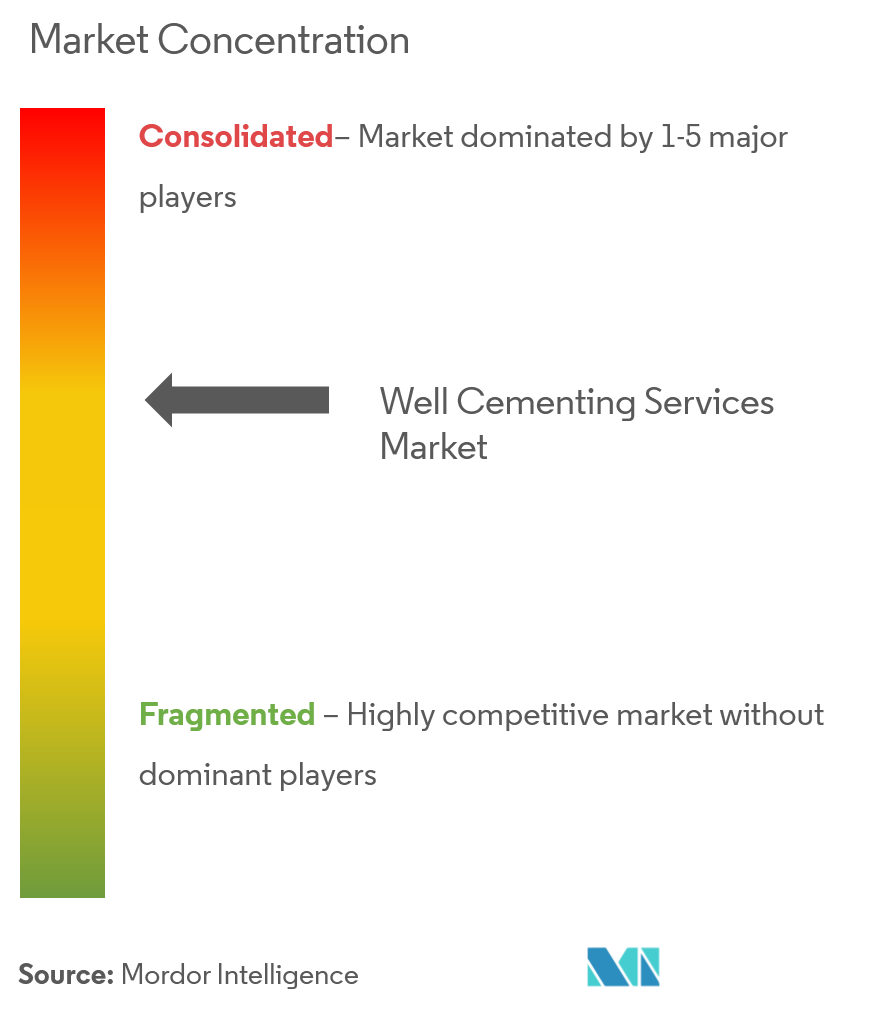

The Well Cementing Services Market is moderately consolidated. Some major companies (not in particular order) include Schlumberger Ltd, Halliburton Company, C&J Services Inc., Trican Well Services, and Baker Hughes Company., among others.

Well Cementing Services Market Leaders

-

Schlumberger Ltd

-

Halliburton Company

-

C&J Services

-

Trican Well Services

-

Baker Hughes Company

- *Disclaimer: Major Players sorted in no particular order

Well Cementing Services Market News

- November 2022: Halliburton Company introduced NeoCem E+ and EnviraCem cement barrier systems for oil and gas applications as part of its portfolio of high-performance, reduced Portland cement systems. These new systems combine specialized materials with Portland cement to achieve synergies between their chemical and physical properties. These reduced Portland systems were engineered by Halliburton using an innovative tailoring process to deliver high performance, compressive strength, and ductility at a lower density than conventional systems, thus enhancing barrier reliability.

- March 2022: the Abu Dhabi National Oil Company (ADNOC) signed framework agreements worth USD 658 million for cementing. This decision has been made to facilitate drilling growth and expand crude oil production. As a result of a competitive filtering process, framework agreements were awarded to Halliburton Worldwide Limited Abu Dhabi, Baker Middle East, Emirates Western Oil Well Drilling & Maintenance Co., NESR Energy Services, and Emjel Oil Field Services.

Well Cementing Services Industry Segmentation

Essentially, well-cementing consists of two principle operations, primary cementing and remedial cementing. Primary cementing involves placing a cement sheath between the casing and the formation. The purpose of remedial cementing is to repair and abandon wells by injecting cement into strategic well locations after primary cementing has been completed.

Well Cementing Services Market is segmented by location of deployment, type, and geography. By location of deployment, the market is segmented into onshore and offshore. By type, the market is segmented into primary, remedial, and others. The report also covers the market size and forecasts for the Well Cementing Services Market across major regions. The market size and forecasts for each segment have been done regarding revenue (USD billion).

| Location of Deployment | Onshore |

| Offshore | |

| Type | Primary |

| Remedial | |

| Other Types | |

| Geography | North America |

| Asia-Pacific | |

| Europe | |

| South America | |

| Middle East & Africa |

Well Cementing Services Market Research FAQs

What is the current Well Cementing Services Market size?

The Well Cementing Services Market is projected to register a CAGR of greater than 3.55% during the forecast period (2025-2030)

Who are the key players in Well Cementing Services Market?

Schlumberger Ltd, Halliburton Company, C&J Services, Trican Well Services and Baker Hughes Company are the major companies operating in the Well Cementing Services Market.

Which is the fastest growing region in Well Cementing Services Market?

North America is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Well Cementing Services Market?

In 2025, the North America accounts for the largest market share in Well Cementing Services Market.

What years does this Well Cementing Services Market cover?

The report covers the Well Cementing Services Market historical market size for years: 2021, 2022, 2023 and 2024. The report also forecasts the Well Cementing Services Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Well Cementing Services Industry Report

Statistics for the 2025 Well Cementing Services market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Well Cementing Services analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.