Vehicle Toll Collection and Access System Market Analysis

The Vehicle Toll Collection and Access System Market is expected to register a CAGR of greater than 8% during the forecast period.

Some of the major factors driving the growth of the market are the increasing construction of roads and highways in developing countries, vehicle theft detection, fuel efficiency, and limited traffic congestion. However, limited awareness about new technology in developing countries may hinder the growth of the market.

The market is primarily driven by advancements in the toll collection systems in North America and Europe. The toll collection system incorporates the entire manufacturing and installation of hardware and software components. The market was dominated by North America, followed by Europe and Asia-Pacific.

Road tolls are levied traditionally for specific access or infrastructure purposes. However, the evolution of technology has made it possible to implement tolling policies based on a multitude of usage concepts. The charging concepts are currently based on suiting different requirements, regarding the purpose of the charge, charging policy, and the infrastructural network, among others.

Vehicle Toll Collection and Access System Market Trends

Electronic Toll Collection is Expected to Witness the Highest Growth Rate

- The electronic toll collection market is expected to witness the highest CAGR of over 10%, during the forecast period (2020-2025).

- Electronic toll collection helps predominantly in reducing traffic at tollbooths, by collecting tolls without cash and without requiring cars to stop. There are several technologies that are being used for collecting tolls electronically. The technologies are dedicated short range communications (DSRC) technology and automatic number plate recognition (ANPR).

- In DSRC technology, RFID (Radio-Frequency Identification) tags are used to scan the vehicle entry/exit at tollbooth, whereas ANPR uses camera to identify the vehicle license plate. The above technologies are used to automate the toll collection process and avoid long queues at toll booths. Additionally, these technologies not only improve vehicle theft detection, but can track vehicles crossing the signal and over speeding vehicles.

- Other advantages of this method for motorists include fuel savings and reduced exhaust emissions, by reducing or eliminating deceleration, acceleration, and waiting time. However, RFID tags have been popularly adopted across the world, as compared to other technologies. For electronic toll collection system, the trend of shifting from barrier based ETC to open road tolling (ORT) or fee flow tolling, has been gradually growing, especially in countries facing high traffic congestions at toll roads.

North America Dominated the Market, but Asia-Pacific is Expected to Witness the Highest Growth Rate

- North America dominated the global market, with a market share of more than 30%, in 2018. However, Asia-Pacific is expected to witness the fastest CAGR during the forecast period.

- In India, according to the Ministry of Road Transportation and Highways, the length of National Highways increased to 103,933 km in 2017, from 92,581 km in 2014. With growing concerns regarding traffic congestions, India launched FASTag, an ETC system using RFID technology, operated by the National Highway Authority of India (NHAI), in September 2014. In August 2017, NHAI announced that they were planning to launch FASTag at all 371 toll plazas across the National Highways, by October 2017. By the end of 2017, the country had nearly 365 toll plazas with a single lane dedicating to FASTag users.

- In November 2017, the Ministry of Road Transportation and Highways proposed to make FASTags mandatory to all new four-wheeler vehicles sold on or after December 1, 2017. As of 2017, the number of RFID FASTag reached 750,000 vehicles, and the government expected the number to reach 2.5 million by 2018. In July 2018, the above authority also proposed to mandate FASTags and vehicle tracking systems, for all commercial vehicles seeking a national permit.

- In China, in 2017, the country added nearly 8,130 km of expressways to its toll road networks, resulting in a toll road network at over 171,100 km, contributing to 3.6% of all roads, ~60% of which are highways. The country’s tollway system is extensive, as the toll varies from one expressway to another. For instance, the country charges a high toll of CNY 0.66 per kilometer, travelling through Jinji Expressway, while charging a lower toll of CNY 0.33 per kilometer through the Jingshi Expressway (in Beijing).

Vehicle Toll Collection and Access System Industry Overview

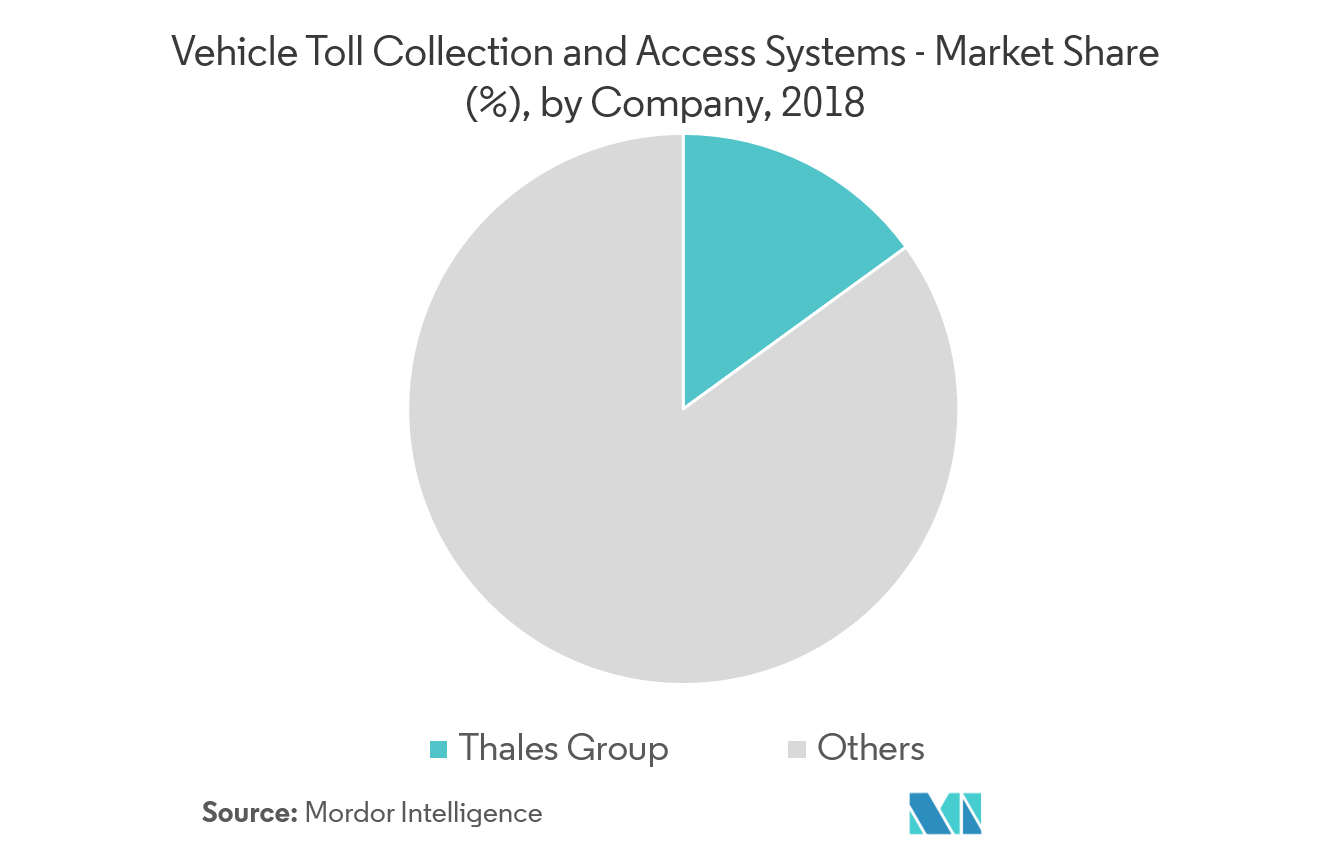

The market is being tapped by many players, resulting in a highly competitive market environment. Some of the major players in the market are Thales Group, Siemens AG, Magnetic Autocontrol GmbH, Transcore Holdings Inc., Mitsubishi Heavy Industries Ltd, and other players. Thales Group dominated the market, in 2018.

Vehicle Toll Collection and Access System Market Leaders

-

Thales Group

-

Magnetic Autocontrol GmbH

-

Transcore Holdings Inc.

-

Mitsubishi Heavy Industries Ltd

-

Nedap NV

- *Disclaimer: Major Players sorted in no particular order

Vehicle Toll Collection and Access System Industry Segmentation

Every construction project and road need maintenance and recovery. The cost of maintenance and recovery of highways, roads, bridges, and tunnels is collected directly or indirectly from the public, under toll collection.

A toll management system (TMS) is put in place to collect revenue and recover the capital outlay incurred on construction, repairs, maintenance, and the expenses caused by toll operation by concessionaires and private organizations, to provide reduced travel time and an increased level of service to end users.

| By Toll Collection Type | Barrier Toll Collection | ||

| Entry/Exit Toll Collection | |||

| Electronic Toll Collection | |||

| By Application Type | Bridges | ||

| Roads | |||

| Tunnels | |||

| Geography | North America | United States | |

| Canada | |||

| Mexico | |||

| Europe | Germany | ||

| United Kingdom | |||

| France | |||

| Italy | |||

| Rest of Europe | |||

| Asia-Pacific | China | ||

| Japan | |||

| India | |||

| South Korea | |||

| Rest of Asia-Pacific | |||

| Rest of the World | Brazil | ||

| South Africa | |||

| Other Countries | |||

Vehicle Toll Collection and Access System Market Research FAQs

What is the current Vehicle Toll Collection and Access System Market size?

The Vehicle Toll Collection and Access System Market is projected to register a CAGR of greater than 8% during the forecast period (2025-2030)

Who are the key players in Vehicle Toll Collection and Access System Market?

Thales Group, Magnetic Autocontrol GmbH, Transcore Holdings Inc., Mitsubishi Heavy Industries Ltd and Nedap NV are the major companies operating in the Vehicle Toll Collection and Access System Market.

Which is the fastest growing region in Vehicle Toll Collection and Access System Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Vehicle Toll Collection and Access System Market?

In 2025, the North America accounts for the largest market share in Vehicle Toll Collection and Access System Market.

What years does this Vehicle Toll Collection and Access System Market cover?

The report covers the Vehicle Toll Collection and Access System Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Vehicle Toll Collection and Access System Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Electronic Toll Collection Industry Report

Statistics for the 2025 Vehicle Toll Collection and Access System market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Vehicle Toll Collection and Access System analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.