| Study Period | 2019 - 2030 |

| Base Year For Estimation | 2024 |

| Forecast Data Period | 2025 - 2030 |

| Historical Data Period | 2019 - 2023 |

| CAGR | 27.30 % |

Major Players

*Disclaimer: Major Players sorted in no particular order |

US Mobile Health Market Analysis

The US Mobile Health Market is expected to register a CAGR of 27.3% during the forecast period.

The key factors propelling the growth of the market is growing usage of smartphones, tablets, and mobile technology in healthcare, increasing awareness for chronic diseases, increased usage of mobile health app, increasing focus on personalized medicine and patient-centric approach is also responsible for the growth of the overall market.

The healthcare market research revolves around the emergence of a new channel, for reaching the respondent that is a mobile smartphone, tablets, and associated mobile technology. The healthcare services and the financials-based services are among the most invested businesses in mobile technology in recent years, with importance given toward the data security and device management. A growing opportunity has been observed in the wireless industry being combined with healthcare. The mobile devices cannot be ignored in the marketing research initiatives, and moreover, it is providing one of the biggest opportunities for quantitative research.

In addition, due to the growing health and fitness awareness, around 90% of consumers download mobile health apps in their smartphones and tablets. This improves the accuracy and consistency with which consumers enter health data into apps. The majority of these types of apps are fitness and wellness apps but also disease management apps, such as blood pressure and blood glucose monitors. Thus, the health market is immensely increasing in the United States, due to the increased adoption of mobile in the healthcare industry.

US Mobile Health Market Trends

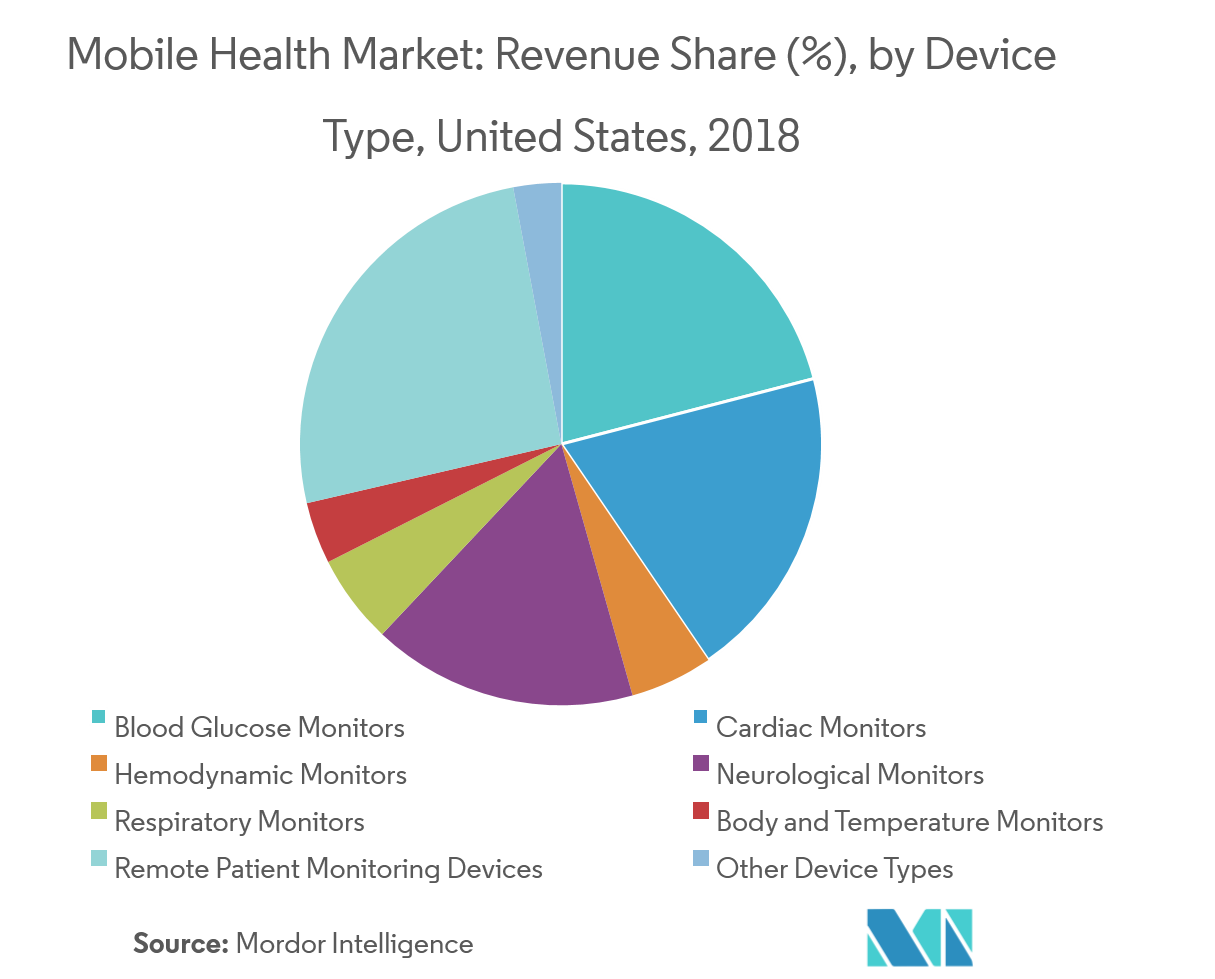

Remote Patient Monitoring Devices is the Leading Segment Under Devices Type that is Expected to Grow During the Forecast Period

The remote patient monitoring devices are widely available across the country, with growing penetration through the wireless technology in every electronic device connected to measure any parameter related to diseases. Apart from that, the diabetic patients and cardiac patients regularly need the monitoring devices, where the mobile devices and apps are highly useful and preferred by both provider and patients. The gradual preference toward neurological and other organs are also reflected by the companies’ new products launched in recent years.

Overall, there are a large number of remote devices, are found operating at home. With major companies investing in the same, it is expected to be one of the major contributors to the revenue growth of the mobile health market.

US Mobile Health Industry Overview

The key players in the market are collaborating with service providers to retain their hold in the US mHealth market. There are also new product launches and industry collaborations are some of the principal growth strategies adopted by marketers.

US Mobile Health Market Leaders

-

AT&T Inc.

-

Athenahealth Inc.

-

Bayer AG

-

Cerner Corporation

-

Cisco Systems Inc.

- *Disclaimer: Major Players sorted in no particular order

US Mobile Health Industry Segmentation

As per the scope of the report, the mobile healthcare integrates the healthcare application in mobile technology for healthcare solutions. Mobile health apps and solutions help clinicians to document more accurate and complete records, improve productivity, access information, and communicate findings and treatments. Mobile health apps and solutions also help to improve health outcomes, reduce error rates and maintain low cost. Thus there has been an increasing use of the mobile health app and solutions that increases the adoption of tablets and smart phones.

| By Service Type | Monitoring Services | Independent Aging Solutions | |

| Chronic Disease Management | |||

| Post-acute Care Services | |||

| Diagnostic Services | Self Diagnosis | ||

| Telemedicine Solutions | |||

| Medical Call Centers Manned by Healthcare Professionals | |||

| Treatment Services | Remote Patient Monitoring Services | ||

| Teleconsultation | |||

| Wellness and Fitness Solutions | |||

| Other Service Types (Clinical Decision Making Tools and Others) | |||

| By Device Type | Blood Glucose Monitors | ||

| Cardiac Monitors | |||

| Hemodynamic Monitors | |||

| Neurological Monitors | |||

| Respiratory Monitors | |||

| Body and Temperature Monitors | |||

| Remote Patient Monitoring Devices | |||

| Other Device Types | |||

| By Stake Holder | Mobile Operators | ||

| Healthcare Providers | |||

| Application/Content Players | |||

| Other Stake Holders | |||

US Mobile Health Market Research FAQs

What is the current US Mobile Health Market size?

The US Mobile Health Market is projected to register a CAGR of 27.3% during the forecast period (2025-2030)

Who are the key players in US Mobile Health Market?

AT&T Inc., Athenahealth Inc., Bayer AG, Cerner Corporation and Cisco Systems Inc. are the major companies operating in the US Mobile Health Market.

What years does this US Mobile Health Market cover?

The report covers the US Mobile Health Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the US Mobile Health Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

US Mobile Health Industry Report

Statistics for the 2025 US Mobile Health market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. US Mobile Health analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.