US Food Hydrocolloids Market Analysis by Mordor Intelligence

The US Food Hydrocolloids Market is expected to register a CAGR of 4.9% during the forecast period.

- Consumer preference for natural ingredients and the varied applications of hydrocolloids in the food and beverage industry are some of the reasons for the uptick in demand.

- The changing consumer demographics in terms of lifestyle changes and growing working population resulting in consumer demand for convenience and processed foods. This is seen as an opportunity for the manufacturers to adopt hydrocolloids in their manufacturing process.

- The market is largely driven by increased Research & Development and innovations in hydrocolloids.

US Food Hydrocolloids Market Trends and Insights

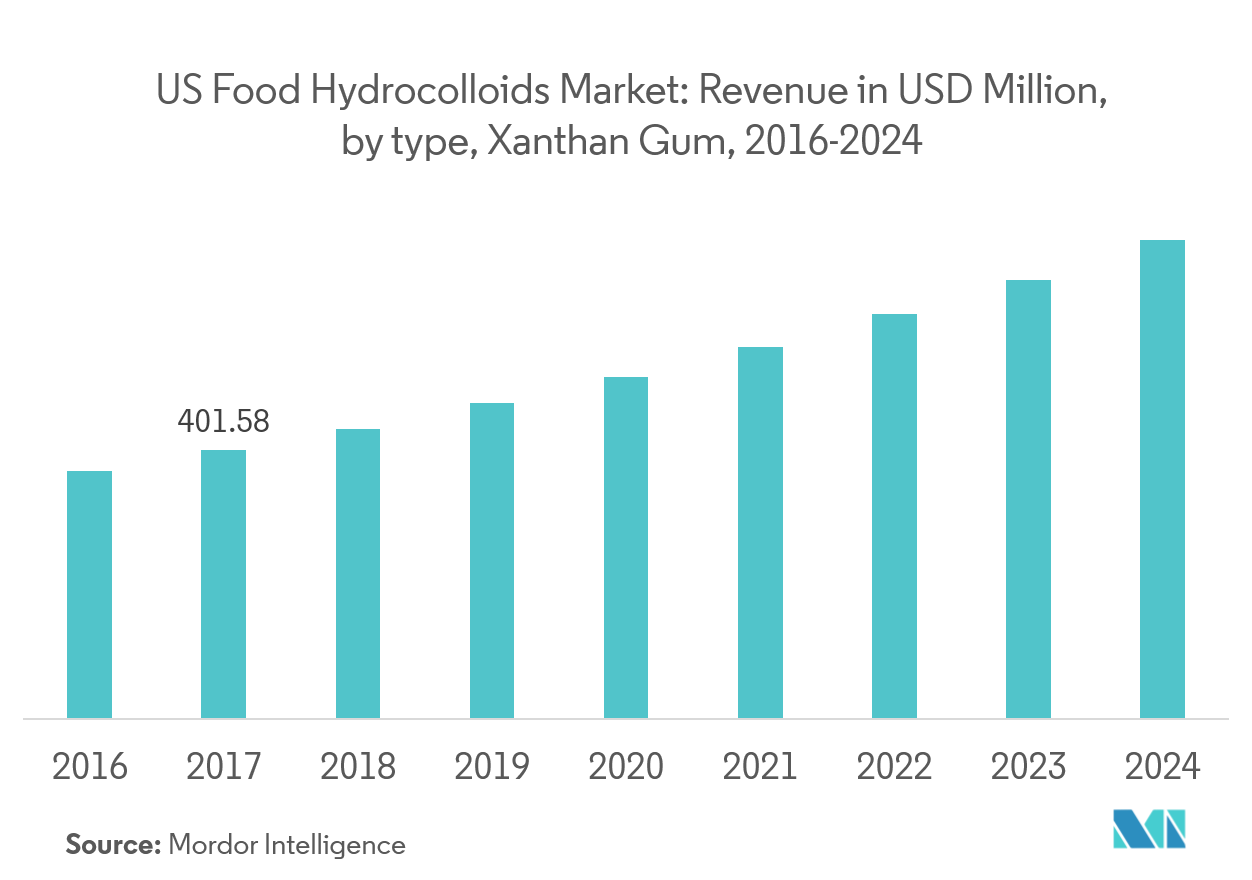

Xanthan Gum Is the Fastest Growing Segment

Xanthum gum is a hydrocolloid of bacterial origin, obtained from the fermentation of carbohydrates by Xanthomonas Campestris. There is an increase in demand for Xanthan gum as it has emerged as a low price alternative to guar gum in a wide range of food applications. Xanthum gum as an emulsifier found its applications including salad dressings, sauces, non-fat milk, dairy products, baked and frozen foods. The growth of the food & beverage industry is anticipated to augment market growth during the forecast period.

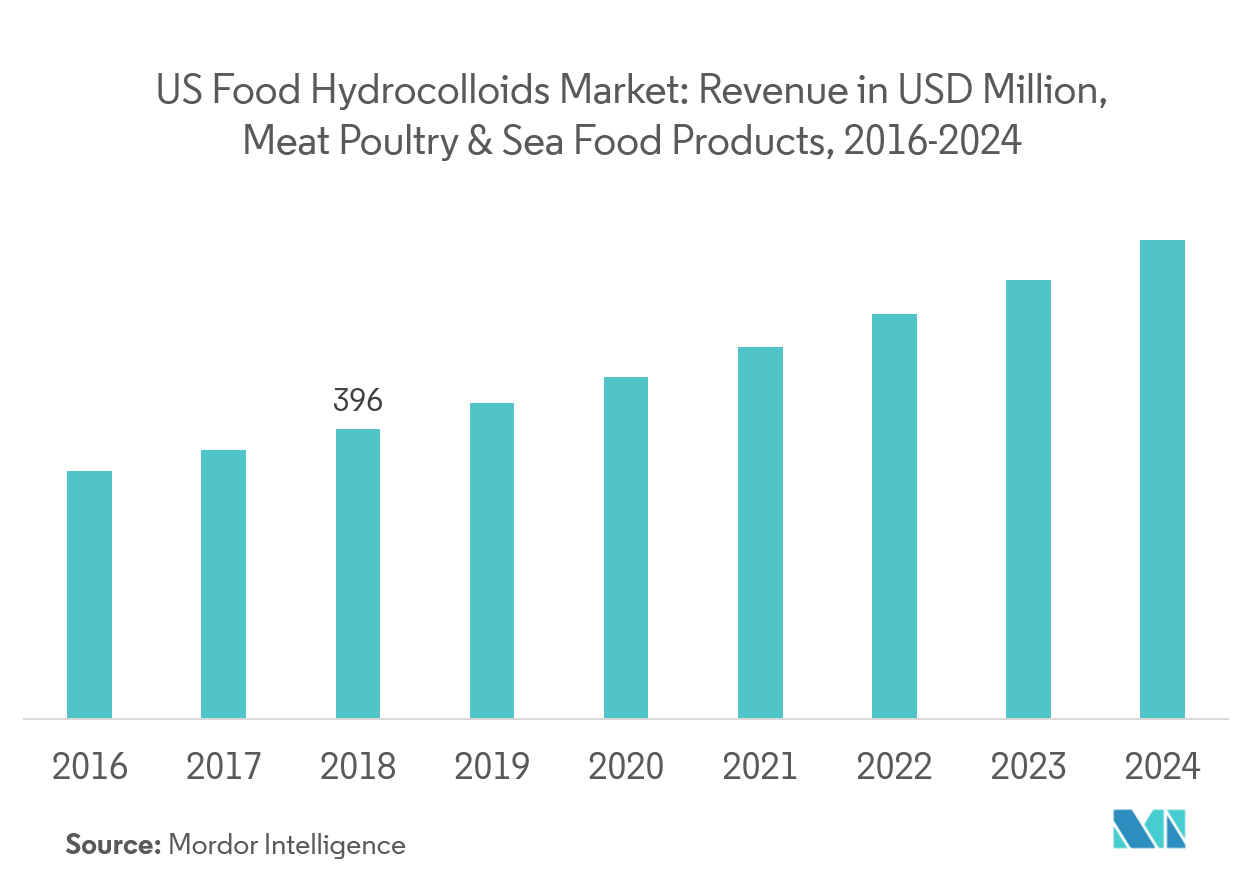

Meat Poultry & Sea Food Products Emerges as the Largest Consumer of the Market

Hydrocolloids are specifically used as chopping and brine additives, emulsifiers, color stabilizers, maturing agents, flavor and shelf life improvers in meat, poultry and seafood products. The meat product quality is increased by blends, marinades, and seasonings. Shelf life and safety of products are also increased to provide high quality food products. In the US, hydrocolloid substances are used effectively to enhance quality for all types of meat, poultry, and seafood products. Phosphate-based specialties help to enhance flavor, texture and reduce moisture loss of processed meats.

Competitive Landscape

US Food Hydrocolloids Market includes the company profiles of Cargill, Incorporated, CP Kelco, Dupont, Kerry Group, Royal DSM N.V., Hawkins Watts Limited, J.F. Hydrocolloids, Inc., Ashland, Behn Meyer, TIC Gums, Inc, IBERAGAR and Darling Ingredients Inc. Dsm and Haixing strengthened hydrocolloids business in November 2017 with the acquisition of Inner Mongolia Rainbow Biotechnology Co., Ltd. (China). This acquisition was made to expand their global business of sustainable and innovative hydrocolloid solutions applied in food, beverage, and personal care products to provide texture and stability.

US Food Hydrocolloids Industry Leaders

Cargill, Incorporated

CP Kelco

Dupont

Kerry Group

Royal DSM N.V.

- *Disclaimer: Major Players sorted in no particular order

US Food Hydrocolloids Market Report Scope

The scope ofUS Food Hydrocolloids Market is segmented byType (Starch, Gelatin gum, Xanthan gum, carrageenan and Others), Application (Bakery, Dairy & Frozen Desserts, Confectionery, Meat Poultry & Sea Food Products, Beverages, and Others)

| Starch |

| Gelatin gum |

| Xanthan gum |

| Carrageenan |

| Others |

| Bakery |

| Dairy & Frozen Products |

| Oils & Fats |

| Confectionary |

| Meat Poultry & Sea Food Products |

| Beverages |

| Others |

| By Type | Starch |

| Gelatin gum | |

| Xanthan gum | |

| Carrageenan | |

| Others | |

| By Application | Bakery |

| Dairy & Frozen Products | |

| Oils & Fats | |

| Confectionary | |

| Meat Poultry & Sea Food Products | |

| Beverages | |

| Others |

Key Questions Answered in the Report

What is the current US Food Hydrocolloids Market size?

The US Food Hydrocolloids Market is projected to register a CAGR of 4.9% during the forecast period (2025-2030)

Who are the key players in US Food Hydrocolloids Market?

Cargill, Incorporated, CP Kelco, Dupont, Kerry Group and Royal DSM N.V. are the major companies operating in the US Food Hydrocolloids Market.

What years does this US Food Hydrocolloids Market cover?

The report covers the US Food Hydrocolloids Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the US Food Hydrocolloids Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Page last updated on:

US Food Hydrocolloids Market Report

Statistics for the 2025 US Food Hydrocolloids market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. US Food Hydrocolloids analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.