US Reverse Logistics Market Size

| Study Period | 2020 - 2029 |

| Base Year For Estimation | 2023 |

| Forecast Data Period | 2024 - 2029 |

| Historical Data Period | 2020 - 2022 |

| CAGR | > 11.00 % |

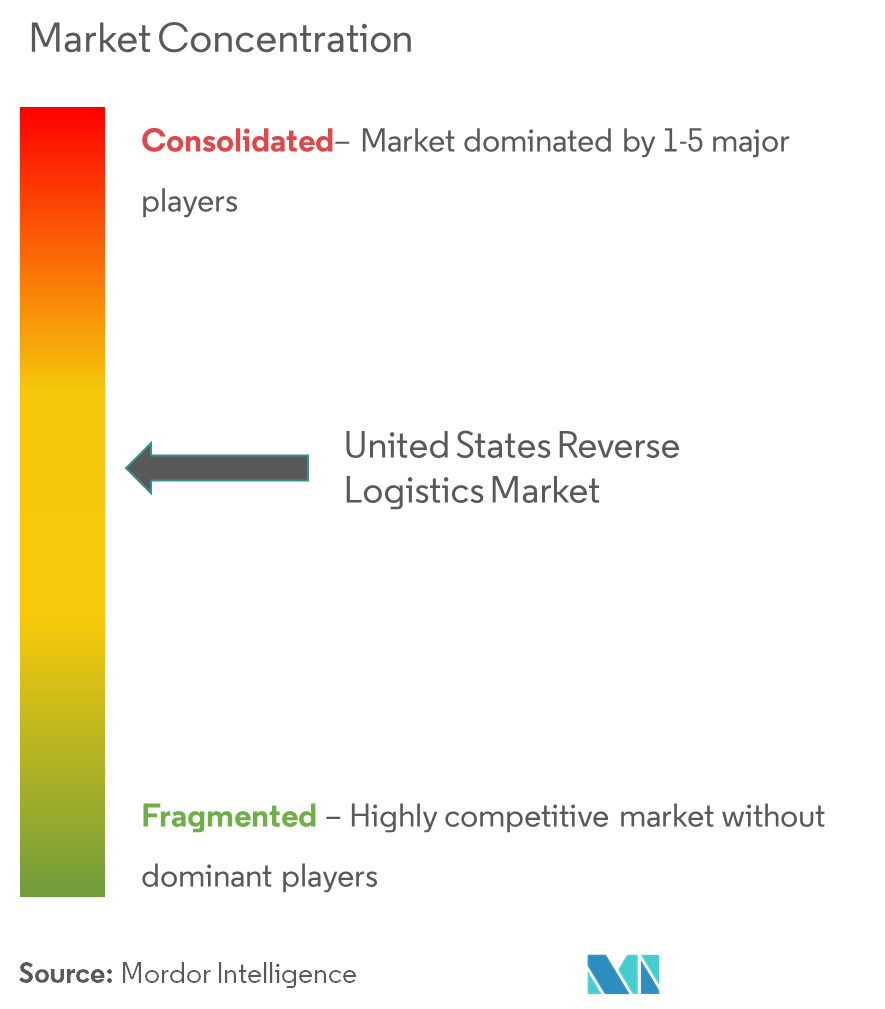

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

US Reverse Logistics Market Analysis

- Online shopping and sales continue to grow at a rapid pace. As retailers and delivery companies move increasing numbers of outbound packages, they must also address the issue of rising volume of return goods. Around USD 120 billion of e-commerce purchases were returned in 2017. Online purchased goods are three times more likely to be returned than those made in a general physical store. Though returns pose challenges for retailers, they find it challenging to limit returns because customers increasingly see returns as a critical part of online shopping experience. The reputation for fast, free, and friendly returns can earn customer loyalty, while a poor return experience can easily drive them away. With GBP 5 billion worth of returns ending up in landfills, apart from the waste from packaging, retailers are also struggling to make their reverse supply chains highly sustainable. To control the associated costs and improve customer experience, retailers are trying several strategies. Retailers with an existing physical presence have started embracing omnichannel returns, allowing returns of online purchases at existing physical stores. Emerging technologies, such as automated parcel lockers, and smartphone apps, are creating a more seamless return experience. However, retailers still see returns as a significant challenge to be overcome, and as a cost center, which has created opportunities for innovation for all players in the reverse logistics industry.

- Reverse logistics is more complicated than forward logistics. Retailers want shipping companies that create new efficiencies and cut costs. According to an industry survey, 60% of active online shoppers say that free returns are a vital part of a good returns experience.

- The US auto industry recorded the sales of 17.3 million vehicles in 2018, beating the industry expectations. Reverse logistics cost in the US auto and auto components industry is significant.

- Additionally, companies are looking to outsource non-traditional logistics requirements, such as reverse logistics, order processing, inventory management, distribution, and labeling and packaging. This is expected to provide more opportunities for logistics service providers (LSPs).

US Reverse Logistics Market Trends

This section covers the major market trends shaping the US Reverse Logistics Market according to our research experts:

Growth in E-commerce and Technology Propels the Demand for Efficient Return Logistics

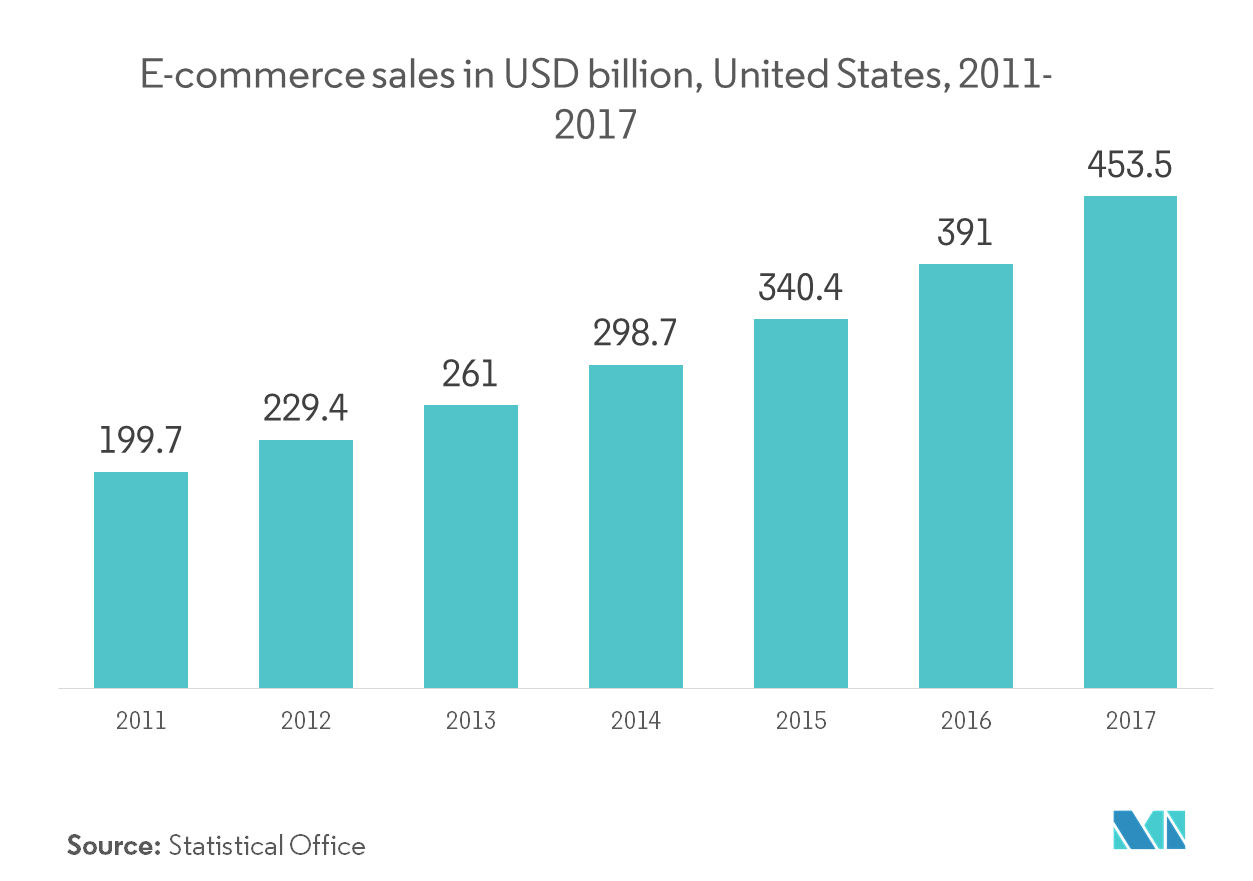

The rapid growth in e-commerce is one of the major drivers of the forward and reverse logistics in the United States. In 2017, the online retail sales in the United States reached USD 453.5 billion, registering a growth rate of 16%, from USD 390 billion in 2016. The physical retail stores sales increased by 3.4%. The online retail sales accounted for 8.9% of the total retail sales, in 2017. The continuing surge of e-commerce was fueling a rise in the number of packages returned. As e-commerce grabs a greater share of the retail market, the overall retail return rate may continue to climb, especially the rate of goods returned via shipping, adding pressure to the entire reverse supply chain.

Technology is also playing a crucial role in other segments of the reverse supply chain. One popular software provider is Optoro, which combines historical pricing and individual product data into an algorithm that tells companies where they should route each return item, to the most profitable disposition path for a return, i.e., resale, liquidation, repair, recycling, or something else. Optoro claims that its smart routing dramatically improves the profitability of returned inventory.

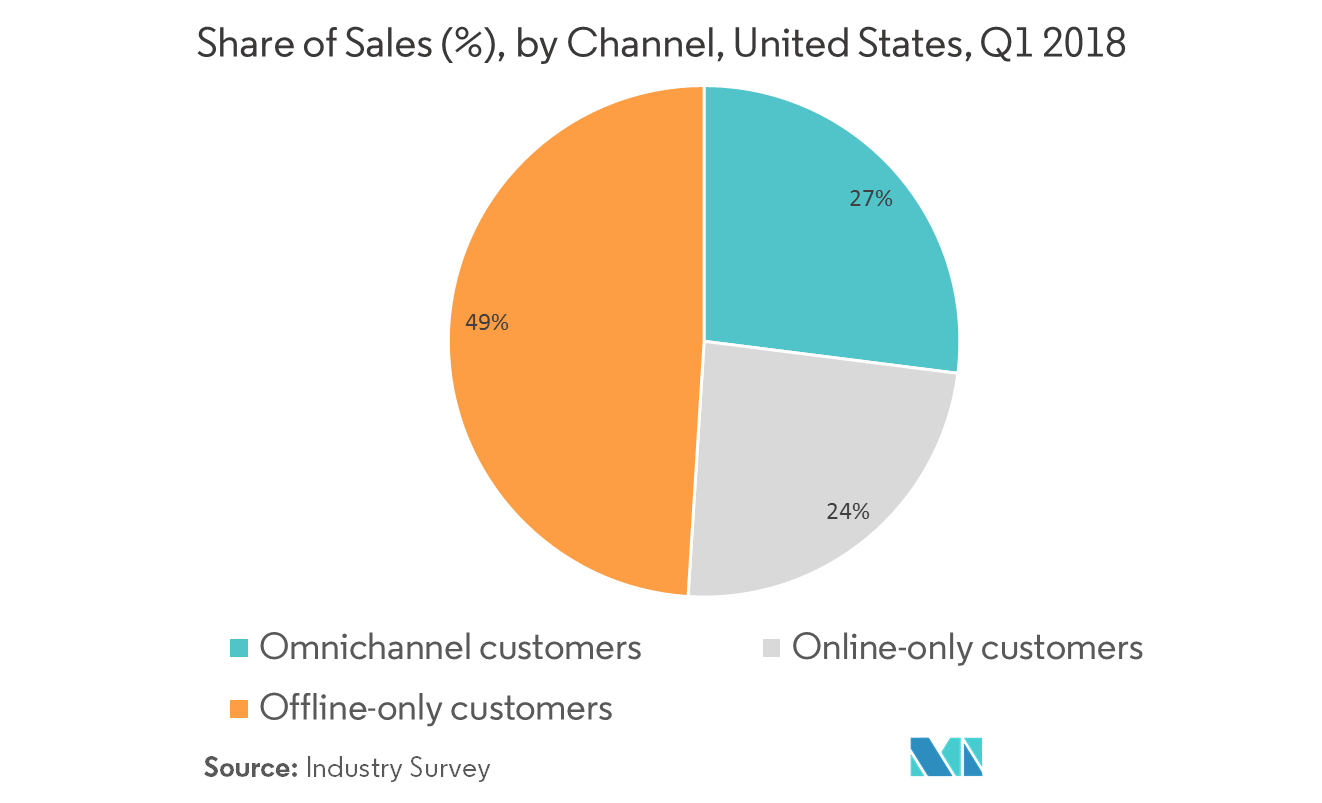

Growing Popularity for Omnichannel Returns

Another growing trend is the omnichannel returns, in which merchants are making returns more convenient, by allowing consumers to return online items in physical locations. BORIS returns (buy online and return in store) not only save merchants the cost of first-mile return shipping, but also encourage additional purchases. According to a UPS survey, 66% of online shoppers made a new purchase when returning in store, compared to 44% when returning online. In addition to being better for retailers, 58% of e-commerce shoppers preferred to make returns at brick-and-mortar stores rather than mail them. Moreover, despite this preference, the shoppers are much more likely to ship their e-commerce returns than bring them to a store. Delivery companies are also expanding physical access points in high-population areas. Recently, Walgreens agreed to provide FedEx package pickup and delivery service at 7,500 stores. UPS Access Point offers services through a network of 4,000 locations, such as dry cleaners and convenience stores. Happy Returns is a startup that collects and aggregates loose return items at kiosks in malls or stores. It provides online-only retailers with a physical channel for collecting returns. Retailers save on shipping, customers get their refunds immediately and avoid the hassle of packing their item, and malls get additional foot traffic.

US Reverse Logistics Industry Overview

The reverse logistics market landscape of the United States is becoming highly competitive, with increasing demand from the e-commerce sector and evolution of advanced technologies. Retailers are increasingly turning toward third-party logistics (3PL) providers, to help them establish efficient reverse logistics operations. Logistics firms are well positioned to solve returns issues. These companies can take advantage of their capital, and scale and expertise to solve pain points commonly experienced by retailers, as goods move through the reverse supply chain. This scenario is attracting existing, as well as new player, to focus more on return logistics, thus making the market more competitive. As organizations seek new ways to gain competitive advantage, the often-overlooked returns function can be a potential source. Businesses that pay more attention to returns management are expected to obtain the benefits of delivering a more efficient, consistent, and responsive customer experience, and operate to cut costs, as well as enhance service and profitability.

US Reverse Logistics Market Leaders

-

United Parcel Service

-

FedEx Corporation

-

United States Postal Service

-

Newgistics

-

XPO Logistics

*Disclaimer: Major Players sorted in no particular order

US Reverse Logistics Market Report - Table of Contents

-

1. INTRODUCTION

-

1.1 Scope of the Market

-

1.2 Market Definition

-

1.3 Executive Summary

-

-

2. RESEARCH METHODOLOGY

-

2.1 Study Deliverables

-

2.2 Study Assumptions

-

2.3 Analysis Methodology

-

2.4 Research Phases

-

-

3. MARKET INSIGHTS

-

3.1 Current Market Scenario

-

3.2 Technological Trends and Automation (In-depth Focus on Emerging Startups)

-

3.3 Study on Changing Consumer Behavior and Their Preferences

-

3.4 Spotlight - US E-commerce Industry (Current Scenario, Trends, and Outlook)

-

3.5 Impact of Cost of Returns on Retailers - Analyst's View

-

3.6 Brief on Automotive Reverse Logistics and Aftermarket

-

3.7 Review and Commentary on Emerging Omnichannel Returns

-

3.8 Insights on Closed-loop Supply Chain

-

-

4. MARKET DYNAMICS

-

4.1 Drivers

-

4.2 Restraints

-

4.3 Opportunities

-

4.4 Porter's Five Forces Analysis

-

4.5 Industry Value Chain Analysis

-

-

5. MARKET SEGMENTATION

-

5.1 By Function

-

5.1.1 Transportation

-

5.1.1.1 Road

-

5.1.1.2 Air

-

5.1.1.3 Other Modes of Transportation

-

-

5.1.2 Warehousing (Storage, Distribution, and Consolidation)

-

5.1.3 Other Value-added Services (Return Processing, Restocking, Refurbishment, Disposition, etc.)

-

-

5.2 By End User

-

5.2.1 Consumer and Retail (Covers E-commerce, Consumer Electronics, Apparel and Garment Sectors, etc.)

-

5.2.2 Automotive

-

5.2.3 Healthcare and Pharmaceuticals

-

5.2.4 Other Industrial Activity Sectors

-

5.2.5 Other End Users

-

-

-

6. COMPETITVE LANDSCAPE

-

6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

-

6.2 Market Concentration Overview

-

6.3 Strategies Adopted by Major Players

-

-

7. COMPANY PROFILES

-

7.1 United Parcel Service (UPS)

-

7.2 FedEx Corporation

-

7.3 United States Postal Service (USPS)

-

7.4 XPO Logistics

-

7.5 Newgistics Inc.

-

7.6 Happy Returns Inc.

-

7.7 American Distribution Inc.

-

7.8 DHL

-

7.9 FW Logistics

-

7.10 YRC Worldwide Inc.

-

7.11 DGD Transport

-

7.12 A2B Fulfillment

-

7.13 Optoro

-

7.14 C.H. Robinson Worldwide Inc.

-

7.15 Yusen Logistics

-

7.16 Excelsior Integrated LLC*

-

- *List Not Exhaustive

-

8. INSIGHTS ON OTHER KEY PLAYERS IN THE VALUE CHAIN

-

9. APPENDIX

-

9.1 Economic Statistics - Transport and Storage Sector, Contribution to Economy

-

9.2 Insights on Key Products Returned in the United States

-

9.3 Qualitative and Quantitative Insights on Forward Logistics

-

9.4 Retail Sector Share of GDP

-

9.5 E-commerce Sales as Share of GDP

-

-

10. DISCLAIMER

US Reverse Logistics Industry Segmentation

A complete background analysis of the US reverse logistics market, including an assessment of the economy and contribution of the logistics sector in the economy, along with market overview and market size estimation for the key segments, and emerging trends in the market segments. The report also covers an analysis on the market dynamics and key insights of the market.

| By Function | |||||

| |||||

| Warehousing (Storage, Distribution, and Consolidation) | |||||

| Other Value-added Services (Return Processing, Restocking, Refurbishment, Disposition, etc.) |

| By End User | |

| Consumer and Retail (Covers E-commerce, Consumer Electronics, Apparel and Garment Sectors, etc.) | |

| Automotive | |

| Healthcare and Pharmaceuticals | |

| Other Industrial Activity Sectors | |

| Other End Users |

US Reverse Logistics Market Research FAQs

What is the current US Reverse Logistics Market size?

The US Reverse Logistics Market is projected to register a CAGR of greater than 11% during the forecast period (2024-2029)

Who are the key players in US Reverse Logistics Market?

United Parcel Service, FedEx Corporation, United States Postal Service, Newgistics and XPO Logistics are the major companies operating in the US Reverse Logistics Market.

What years does this US Reverse Logistics Market cover?

The report covers the US Reverse Logistics Market historical market size for years: 2020, 2021, 2022 and 2023. The report also forecasts the US Reverse Logistics Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

US Reverse Logistics Industry Report

Statistics for the 2024 US Reverse Logistics market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. US Reverse Logistics analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.