Unified Network Management Market Size and Share

Unified Network Management Market Analysis by Mordor Intelligence

The Unified Network Management Market is expected to register a CAGR of 18% during the forecast period.

- The increased adoption of technology across various industry verticals has pushed the vendors to integrate cloud solutions and other IT technologies in their operations in order to leverage that to optimize their operations along with improvement in their performance by reduced downtime and better fault resolution.

- The most prominent LAN deployment type is the wireless one, the reason being, it needs considerable low costs to setup as compared to other types. The market is also driven by BYOD increased adoption and upcoming architectures like SDN, which are some of the factors driving the market forward.

- Moreover, the rapidly increasing demand for advanced analytical tools and analytics applications across industries coupled with the ability to provide better cybersecurity and advanced analytics are the main factors driving the unified network management market.

Global Unified Network Management Market Trends and Insights

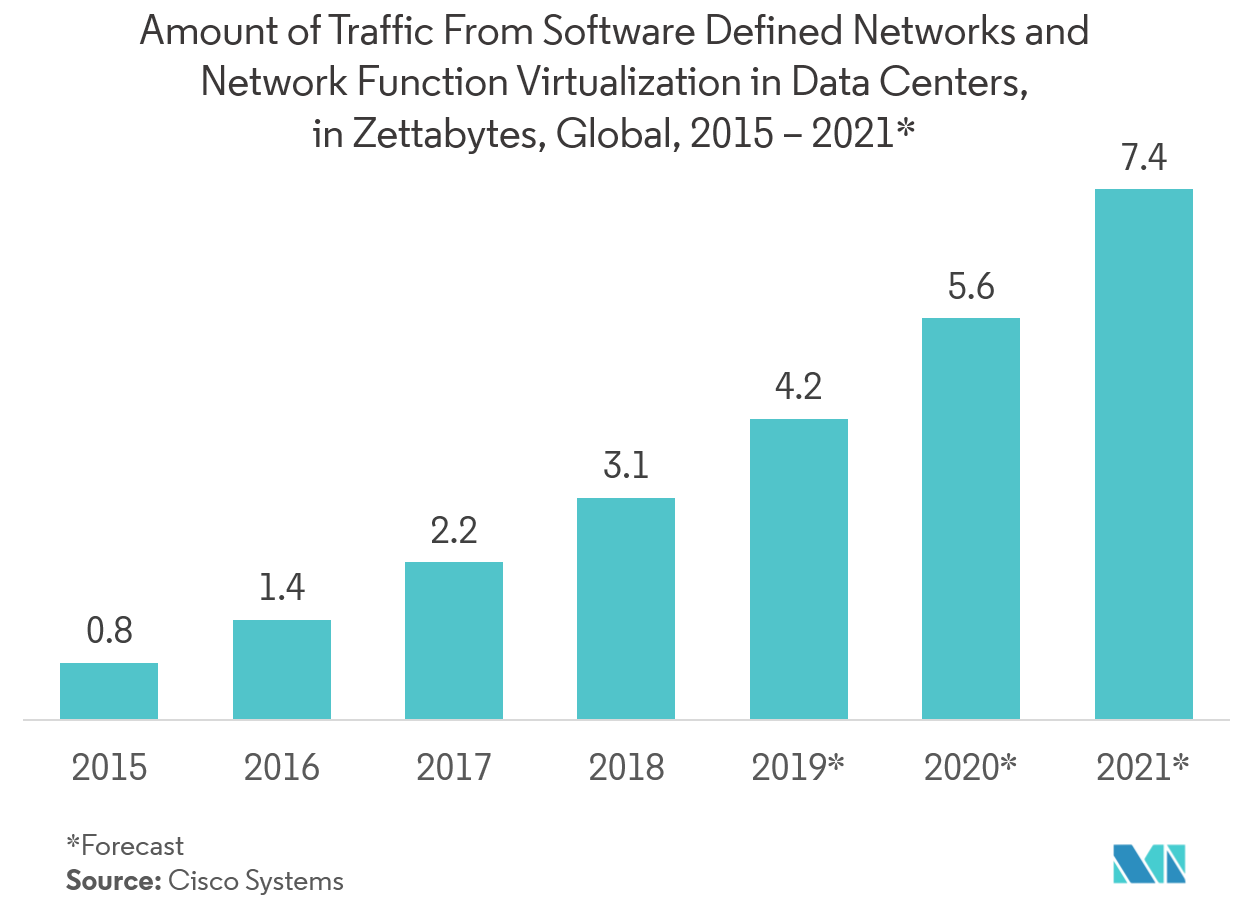

Increasing Adoption of SDN to Drive the Market

- Software Defined Network is considered as one of the disruptive technologies in the area of networking, industries have initiated to build their strategies around this technology as it continues its penetration with an increasing consumer base.

- This has primarily been driven by a need for virtualization of networks in datacentres as there has been an exponential growth in the generation of data. Looking from the network management perspective, one of the major additions in the SDN architecture is the presence of software-based centralized software controller which now allows the abstraction of underlying networking infrastructure for several network services and applications.

- Because of this, the unified network management tools will be able to gather more granular insights and configure faults in runtime. The increasing market presence of SDN is expected to drive the unified network management market.

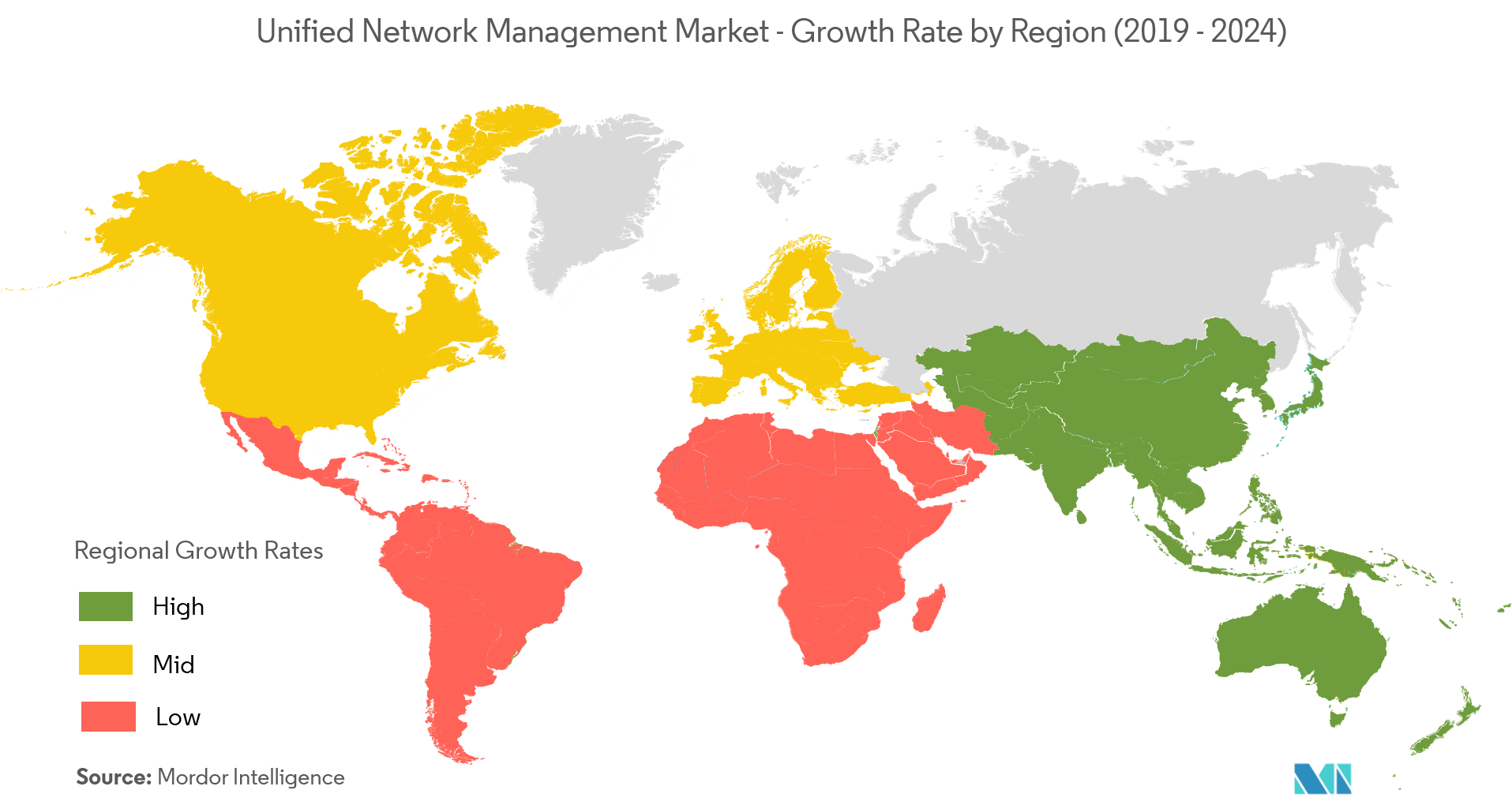

Asia-Pacific to Witness High Growth

- The Asia-Pacific region is expected to witness the fastest growth among all other regions in the market. The growth in this region is primarily driven by a large number of SME’s scaling their business to larger networks and in turn facing complexity in network management.

- The region has also become a lucrative market for many businesses owing to the cost advantages in growing economies and hence has been attracting many organizations which are deploying state of the art network management systems thus inflating the demand for unified network management.

- More and more organizations in this region are adopting cloud solutions for their business operations and as the cloud penetration in the region increases, the need for the expertise to manage the complex network will increase which is also likely to drive the market in the region.

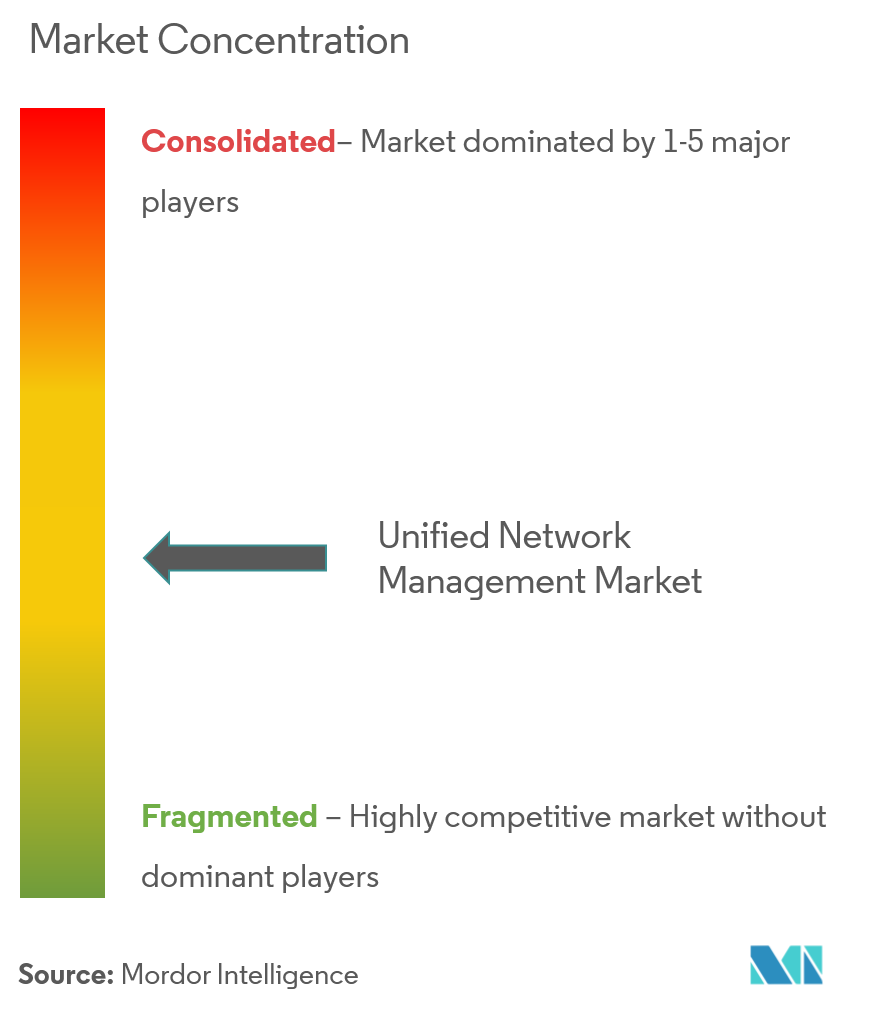

Competitive Landscape

The unified network management market iscompetitive owing to the presence of many small and large players in the market. The market appears to be moderately concentrated. The key strategies adopted by the major players are product and service innovation and mergers and acquisition. Some of the major players in the market areCisco Systems, Inc.,Hewlett Packard Enterprise Company,Huawei Technologies Co., Ltd.,CA Technologies, Inc. among others.

- June 2018 -Extreme Networks, Inc., introduced Extreme Smart Omni-Edge, which not only unifies Wi-Fi and Ethernetbut also Bluetooth and IoT technologies.

- May 2018 -Aerohive Networks announced its successful migration to its third generation Hive Manager Network management and networks application.

Unified Network Management Industry Leaders

-

Cisco Systems, Inc.

-

Hewlett Packard Enterprise Company

-

Huawei Technologies Co., Ltd.

-

Broadcom Inc. (CA Technologies Inc.)

-

Juniper Networks, Inc.

- *Disclaimer: Major Players sorted in no particular order

Global Unified Network Management Market Report Scope

A unified network management solution makes common network functions manageable from a single console. Such functions include planning, configuring, monitoring (including performance, security, and integrity monitoring), handling exceptions, logging, and reporting.

| Small and Medium Enterprise |

| Large Enterprise |

| Network Performance Management |

| Network Monitoring Management |

| Network Configuration Management |

| Network Security Management |

| Network Application Management |

| On-premise |

| Cloud |

| Telecommunication & IT |

| Education |

| Retail |

| Healthcare |

| Government |

| BFSI |

| Other End Users |

| North America |

| Europe |

| Asia-Pacific |

| Latin America |

| Middle East & Africa |

| By Enterprise Size | Small and Medium Enterprise |

| Large Enterprise | |

| By Solution | Network Performance Management |

| Network Monitoring Management | |

| Network Configuration Management | |

| Network Security Management | |

| Network Application Management | |

| By Deployment | On-premise |

| Cloud | |

| By End User | Telecommunication & IT |

| Education | |

| Retail | |

| Healthcare | |

| Government | |

| BFSI | |

| Other End Users | |

| Geography | North America |

| Europe | |

| Asia-Pacific | |

| Latin America | |

| Middle East & Africa |

Key Questions Answered in the Report

What is the current Unified Network Management Market size?

The Unified Network Management Market is projected to register a CAGR of 18% during the forecast period (2025-2030)

Who are the key players in Unified Network Management Market?

Cisco Systems, Inc., Hewlett Packard Enterprise Company, Huawei Technologies Co., Ltd., Broadcom Inc. (CA Technologies Inc.) and Juniper Networks, Inc. are the major companies operating in the Unified Network Management Market.

Which is the fastest growing region in Unified Network Management Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Unified Network Management Market?

In 2025, the North America accounts for the largest market share in Unified Network Management Market.

What years does this Unified Network Management Market cover?

The report covers the Unified Network Management Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Unified Network Management Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Page last updated on:

Unified Network Management Market Report

Statistics for the 2025 Unified Network Management market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Unified Network Management analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.