Uncooled Infrared Imaging Market Analysis

The Uncooled Infrared Imaging Market is expected to register a CAGR of 8.5% during the forecast period.

- Over the last ten years, uncooled IR imaging systems have reached a sensibility that was previously only possible with cooled IR imagers through improved development and manufacturing processes using microsystem technology. This is usually implemented in detectors stabilized in temperatures between -30°C to +30°C or not stabilized at all.

- The uncooled IR cameras are based on thermal detectors instead of quantum detectors. The advancements in thermal imaging over the last decade, especially with semiconductor manufacturing and emerging micromachining, enabled the production of small intricate structures at low cost and drove the demand for thermal detectors.

- The uncooled IT imagers collect the light at 8μm to 12μm spectral band. The band provides better penetration through smoke, dust, smog, water vapor, etc., due to its higher bandwidth from 3 μm to 5 μ m spectral band.

- Currently, the market studied is primarily driven by the demand from the commercial segment. With the growing portfolio of inexpensive uncooled IR imagers, in addition to the classic applications, many other fields of application have also increased, such as smartphones. The original application for IR imagers started in the military sector for the sight of rifles, where it is used for target recognition in darkness or poor visibility.

- While cooling systems continue to find increasing applications in the military sector, the growing popularity of uncooled systems can be attributed to their compact design and energy-efficient and low-maintenance operation. In March 2021, Microsoft received a 10-year deal with the United States Army for augmented reality headgear valued at up to USD 21.9 billion.

- More than 120,000 Microsoft HoloLens augmented reality headsets will be delivered to the US Army. It will be able to show a map and compass and use thermal imaging to detect persons in the dark.

Uncooled Infrared Imaging Market Trends

Increasing Application in Automotive Sector will Foster Growth

- Autonomous vehicles use sensors in conjunction with imaging technologies to control driving functions. The information picked up by the thermal imaging systems of the vehicles is fed into the vehicle's control system, interpreted, and used to safely put the vehicle through its paces.

- Incidents like the Uber accident in Arizona show the challenges persistent for AV systems to 'see' and react to pedestrians in every condition, especially in inclement weather like thick fog or blinding sun glare. Real scenarios like these open new avenues for thermal cameras that are the most effective in quickly identifying and classifying potential hazards to help the vehicle react accordingly.

- FLIR's Boson thermal camera that features a 12-µm pitch vanadium oxide (VOx) uncooled detector has been launched to avoid the above incidents. This device is paired with machine-learning algorithms for object classification, with the ADK providing critical data from the infrared portion of the electromagnetic spectrum to improve the decision-making of AVs.

- Furthermore, in September 2022, Lynred, in collaboration with Umicore, developed a thermal sensing technology to improve the performance of Pedestrian Autonomous Emergency Braking (PAEB) systems in adverse lighting conditions at an affordable cost. The EU project HELIAUS funds the development to boost the performance of automotive applications.

- In addition to these applications, FLIR Systems recently published a white paper outlining the role of new Infrared (IR) camera technologies in addressing the difficulties of high-speed automotive testing. The paper adds that infrared cameras with uncooled detectors can measure temperature accurately at extremely high speeds.

- According to IEA, it is anticipated that the sales of plug-in electric light vehicles (PEV) will reach around 6.7 million units. Germany could become the largest market for plug-in electric vehicles as over one in three new cars sold in the country were electric vehicles. Such developments will further boost the demand for uncooled infrared imaging in the automotive sector.

North America will Continue to Dominate the Market

- Uncooled IR imaging systems have applications in the ADAS technologies, in conjunction with imaging technologies, to control driving functions. The information picked up by the thermal imaging systems of the vehicles is fed into the vehicle's control system, interpreted, and used to safely put the vehicle through its paces.

- North America is one of the largest automotive manufacturing hubs in the world. The region's economic growth posed an impact on the sale of passenger and commercial vehicles. The car sector in the United States sold around 14.9 million light vehicle units in 2021, according to the US Bureau of Economic Analysis. This statistic comprises approximately 3.3 million automobiles and just under 11.6 million light truck units sold at retail.

- Housing prominent automakers (over 13 major auto manufacturers) and vendors offering radar sensors (Bosch and Lockheed Martin, among others), the region is expected to emerge as a source of innovation and is estimated to hold a significant market share. The region is also likely to be one of the pioneers in adopting ADAS-enabled vehicles and self-driven transportation solutions. According to Deutsche Bank, the US ADAS unit production volume is expected to reach 18.45 million by 2021.

- The defense industry remains the most critical consumer of uncooled infrared imaging systems. Backed by the highest defense budget in the world, the US military is expected to continue to drive the growth of the infrared imaging industry. The US Military has a firm focus on the development of Vanadium Oxide technology. All thermal imaging equipment used by militaries across the world uses uncooled detectors. Moreover, the region is regarded as the highest spending region for its military and defense expenditure driven by the United States. In FY 2021, President Joe Biden signed a USD 777.7bn annual military budget into law.

- In October 2021, the US army awarded Leonardo DRS Inc. a contract to build improved infrared machinegun weapon sights with autonomous aiming. The US army has awarded Leonardo DRS a second contract for the Family of Weapon Sight-Crew Served (FWS-CS). For the LRIP phase, a firm, fixed-price contract worth USD 18.9 million has been awarded.

- The system integrates a high-resolution 10um high-definition thermal focal plane array, color day camera, laser range finder, and ballistic solution calculator to auto-adjust reticles for range and environmental conditions, allowing users to fire the weapon precisely with the disturbed reticle technology.

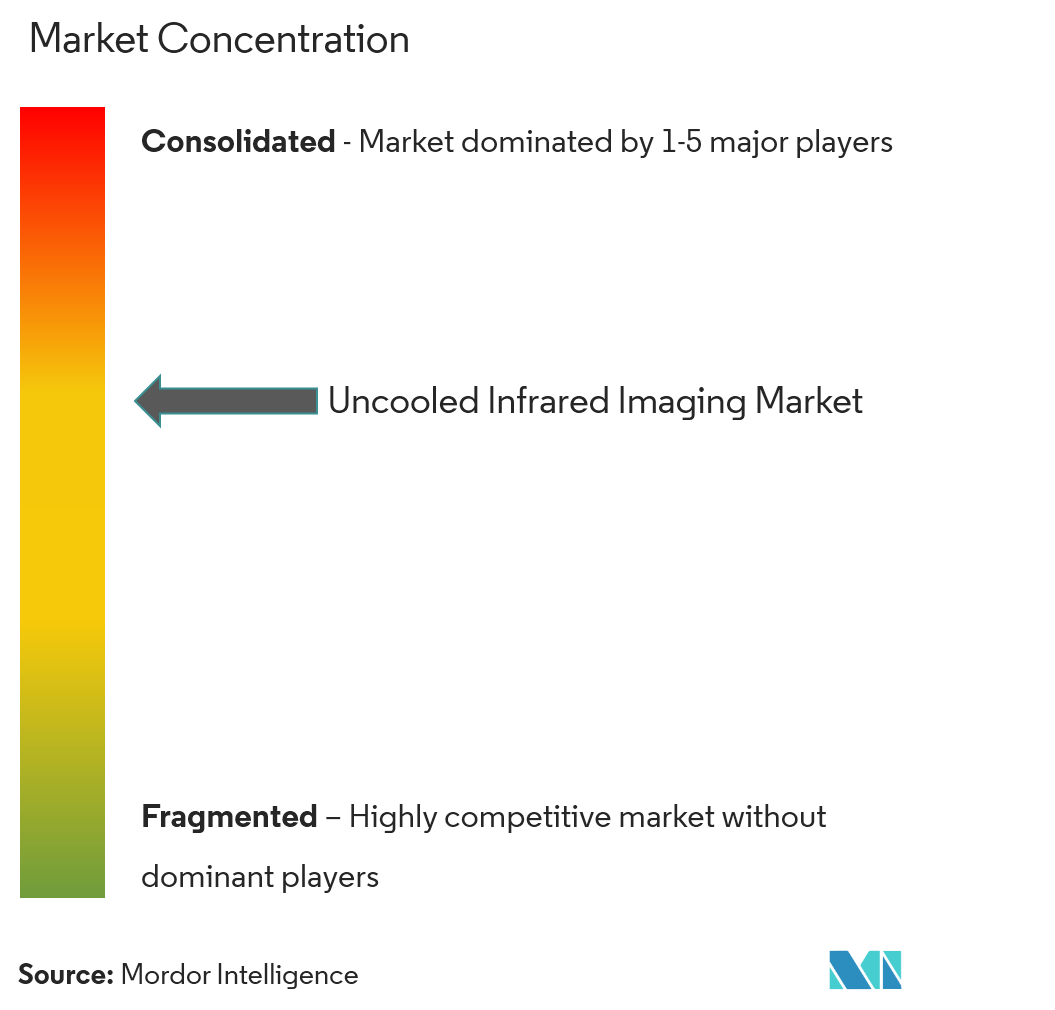

Uncooled Infrared Imaging Industry Overview

The Uncooled Thermal Imaging market is highly consolidated. The market is expected to put forth impressive volumes in the near future due to the wide range of commercial applications that the products like imagers have. Some of the recent developments in the market are as follows: -

- February 2022 - LAMpAS has launched a high-speed I.R. camera funded by European Union. The company's New Infrared Technologies S.L. (NIT) has developed a high-speed uncooled I.R. camera specifically adapted to the requirements of LAMPAS processes. The camera can detect the heat accumulated during laser surface structuring processes.

- April 2021 - FLIR Systems has launched a radiometric version of the boson thermal imaging camera module, representing the uncooled thermal imaging technology within a small, lightweight, and low-power package.

Uncooled Infrared Imaging Market Leaders

-

Xenics NV

-

BAE Systems, Inc.

-

Cantronic Systems Inc.

-

Teledyne Digital Imaging Inc.

-

Teledyne FLIR LLC

- *Disclaimer: Major Players sorted in no particular order

Uncooled Infrared Imaging Market News

- April 2022 - Dahua Technology has announced a new entry-level thermal hybrid camera series. The lineup includes new-and-improved versions of three of Dahua's 8MP cameras, a 256-channel server, and third generation thermal hybrid camera series, offering high-quality, dual-lens technology for the North American market.

- April 2022 - Teledyne FLIR, a part of Teledyne Technologies Incorporated, announced the Boson+ long wave infrared thermal camera module with a 20 millikelvin (mK) or less thermal sensitivity. The Boson+ includes a redesigned 640 x 512 resolution, 12-micron pixel pitch detector with a noise equivalent differential temperature (NEDT) of 20 mK or less, which offers significantly enhanced detection, recognition, and identification (DRI) performance.

Uncooled Infrared Imaging Industry Segmentation

The study on the uncooled infrared imaging market is segmented by various applications, such as automotive, military, consumer electronics, mapping, and surveying, among others. The report also provides geographical analysis and recent developments in the market studied. Further, the report covers the impact of COVID-19 on the studied market.

| By Application | Automotive |

| Military | |

| Consumer Electronics | |

| Mapping and Surveying | |

| Other Applications | |

| By Geography | North America |

| Europe | |

| Asia Pacific | |

| Rest of the World |

Uncooled Infrared Imaging Market Research FAQs

What is the current Uncooled Infrared Imaging Market size?

The Uncooled Infrared Imaging Market is projected to register a CAGR of 8.5% during the forecast period (2025-2030)

Who are the key players in Uncooled Infrared Imaging Market?

Xenics NV, BAE Systems, Inc., Cantronic Systems Inc., Teledyne Digital Imaging Inc. and Teledyne FLIR LLC are the major companies operating in the Uncooled Infrared Imaging Market.

Which is the fastest growing region in Uncooled Infrared Imaging Market?

North America is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Uncooled Infrared Imaging Market?

In 2025, the North America accounts for the largest market share in Uncooled Infrared Imaging Market.

What years does this Uncooled Infrared Imaging Market cover?

The report covers the Uncooled Infrared Imaging Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Uncooled Infrared Imaging Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Uncooled Infrared Imaging Industry Report

Statistics for the 2025 Uncooled Infrared Imaging market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Uncooled Infrared Imaging analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.