UAE Product Testing lab Market Analysis

The UAE Product Testing Lab Services Market is expected to register a CAGR of 5% during the forecast period.

UAE Product Testing lab Market Trends

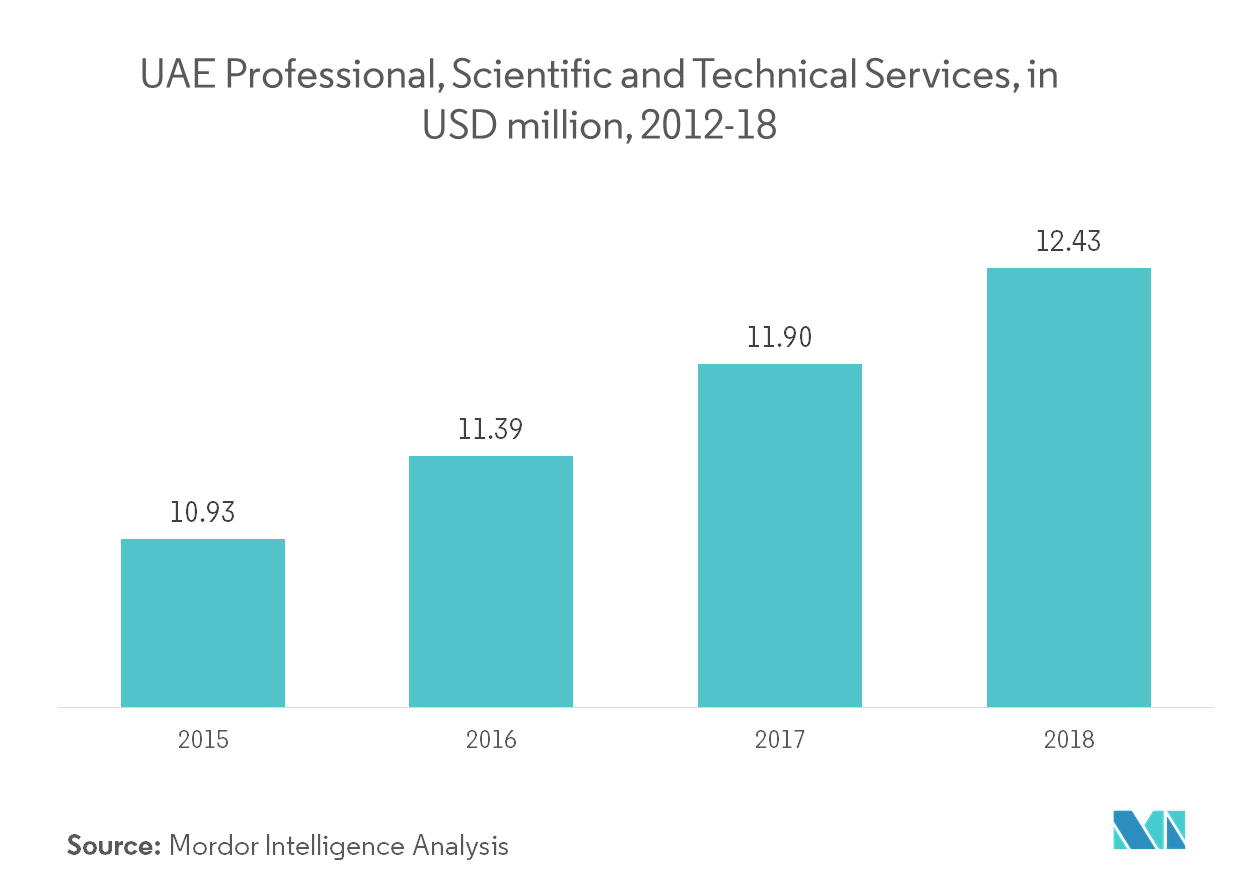

The United Arab Emirates as a Business Hub

The country was sparsely populated in the 1960s. However, the population has increased since then. Though the nation’s GDP was heavily dependent on agriculture and fishing, it is now a modern trading economy with one of the highest per capita GDP. A lot of this can be attributed to the vast oil wealth, which was commercially explored in the 1960s and 1970s, with the help of government funding, resulting in numerous investments in various industries. The primary objective of these investments was to reduce the nation’s dependence on fossil fuels. The investments were made in construction, ICT, transport, and infrastructure projects. The relative political stability in the country, aided by a high quality of life and high tax incentives and support for business and small enterprises, has attracted significant amounts of FDI. The United Arab Emirates is geographically placed at the crossroads of East and West, which is beneficial for investors, as the country has huge potential to be a trading hub. Another major industry to attract investments is innovation and technology. Dubai’s Department of Economic Development decided to set up a dedicated incubator to support the rapidly growing SMEs (small and medium-sized enterprises), promising entrepreneurial ventures through all their stages of development.

Industrial Sector Holds Major Market Share

Industrial testing plays a prominent role throughout the various stages of product life cycle. These stages may range from R&D to qualification, to manufacturing and operations. The primary objective of industrial testing is to ensure the safety and efficiency of raw materials, components, and systems. Some of the most popular industry testing services include mechanical testing, metallurgic testing, chemical analysis, environmental and corrosion testing, endurance testing, electromagnetic compatibility testing, functional testing, non-destruction testing, and calibration testing. With the UAE market becoming increasingly regulated, the pressure on operators to ensure the safety and quality of their products is at an all-time high.

Industrial testing is the largest sector in the market studied. Considering the growing manufacturing sector, testing services have become a prominent part of the production process. Some of the most popular industries with a high dependency on testing services are the oil and gas fields, water supply and treatment, power, chemical and fertilizers, food processing, and cement industries. Moreover, the country is hosting World Expo 2020 in Dubai, under the theme ‘Connecting Minds, Creating the Future’. World Expos attract millions of visitors, and this is the first time it is being hosted in Middle East & Africa. Business collaborations are expected to increase post World Expo 2020.

UAE Product Testing lab Industry Overview

The UAE product testing lab services market is fragmented in nature, with the presence of small-, medium-, and large-sized companies. The report offers an analysis of the company overview, key financial metrics, service offerings, industry solutions, geographical network, and recent developments of the key players operating in the market (Intertek Group PLC, Al Hoty-Stanger Laboratories, Lonestar Technical Services LLC, Independent Soil Testing Laboratories LLC, Gray Mackenzie Engineering Services LLC, Wimpey Laboratories, Geoscience Testing Laboratory (GTL), and Thomas Bell-Wright International Consultants). With a high number of companies entering the lucrative Middle Eastern market, the competition among brands is extremely high. Thus, businesses cannot afford to launch a faulty product, as it can drastically affect their brand value. Hence, investment in product testing services is rapidly increasing in the United Arab Emirates.

UAE Product Testing lab Market Leaders

-

Intertek Group PLC

-

Al Hoty-Stanger Laboratories

-

Lonestar Technical Services LLC

-

Independent Soil Testing Laboratories LLC

-

Gray Mackenzie Engineering Services LLC

- *Disclaimer: Major Players sorted in no particular order

UAE Product Testing lab Industry Segmentation

The market has been segmented by end user. This report also highlights market trends, technological innovations, and government policies and initiatives. Additionally, the report includes investment analysis and competitive landscape, along with a detailed outlook for the future of the market in the United Arab Emirates.

| By End User | Agriculture, Fishing, and Forestry |

| Industrial | |

| Construction | |

| Pharmaceutical | |

| Engineering Services | |

| Other End Users |

UAE Product Testing lab Market Research FAQs

What is the current UAE Product Testing Lab Services Market size?

The UAE Product Testing Lab Services Market is projected to register a CAGR of 5% during the forecast period (2025-2030)

Who are the key players in UAE Product Testing Lab Services Market?

Intertek Group PLC, Al Hoty-Stanger Laboratories, Lonestar Technical Services LLC, Independent Soil Testing Laboratories LLC and Gray Mackenzie Engineering Services LLC are the major companies operating in the UAE Product Testing Lab Services Market.

What years does this UAE Product Testing Lab Services Market cover?

The report covers the UAE Product Testing Lab Services Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the UAE Product Testing Lab Services Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Product Testing lab Services in UAE Industry Report

Statistics for the 2025 UAE Product Testing Lab Services market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. UAE Product Testing Lab Services analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.