UAE Home Furniture Market Analysis

The UAE Home Furniture Market size is estimated at USD 2.69 billion in 2025, and is expected to reach USD 3.24 billion by 2030, at a CAGR of 3.79% during the forecast period (2025-2030).

The UAE home furniture market is experiencing robust growth, supported by strong economic fundamentals and increasing consumer affluence. With the UAE's GDP per capita reaching USD 51,405 in 2022, there has been a notable shift in consumer spending patterns towards premium and luxury furniture. The market is characterized by a diverse mix of local and international brands, offering both traditional and contemporary home furnishings designs. The real estate sector's vibrancy, evidenced by 13,236 buildings under construction in 2022, continues to drive demand for residential furniture across various price segments.

The market is witnessing a significant transformation in consumer preferences, particularly in the luxury segment. Dubai's position as a luxury hub, accounting for nearly 30% of the Middle Eastern luxury market, has influenced furniture buying patterns, with UAE citizens allocating approximately 30% of their monthly salaries to luxury goods. This trend has led to increased demand for high-end home furniture featuring premium materials, sophisticated designs, and superior craftsmanship. Wood remains the predominant material choice, complemented by high-quality fittings and finishing materials that cater to the discerning tastes of affluent consumers.

The digital transformation of the furniture retail landscape is reshaping consumer buying behavior, with 34% of consumers reporting increased online furniture shopping frequency. Retailers are responding by enhancing their digital presence and implementing omnichannel strategies, including virtual reality technologies for product visualization and seamless online-to-offline experiences. Major furniture retailers are investing in e-commerce platforms, mobile applications, and digital payment solutions to provide convenient shopping experiences while maintaining competitive pricing strategies.

The market is experiencing a notable surge in sustainable and environmentally conscious home decor designs, reflecting growing environmental awareness among consumers. Manufacturers are increasingly incorporating eco-friendly materials and production processes, while retailers are expanding their sustainable furniture collections. The trend towards open-plan living spaces and multi-functional modern furniture is gaining momentum, particularly in urban areas where space optimization is crucial. Additionally, the growing expatriate population, which comprises over 88% of the UAE's total population, is influencing furniture design preferences, leading to a fusion of international styles with traditional Middle Eastern aesthetics.

UAE Home Furniture Market Trends

Rising Demand for Luxury Furniture Products

The growing emphasis on improved and trendy home decor has encouraged UAE consumers to opt for unique and designer luxury furniture products, supported by robust economic growth and high disposable income levels. With more than 90% of the population residing in urban areas and rising disposable income per capita, the preference for luxury furniture products remains consistently high among UAE consumers. This trend is particularly evident as UAE citizens typically allocate around 30% of their monthly salaries toward luxury goods, demonstrating a strong cultural affinity for premium home furnishings.

The market has witnessed significant traction for international luxury furniture manufacturers, particularly Italian companies such as Natuzzi, B&B Italia, and Poltrona Frau, who have established their presence through dedicated showrooms and multi-brand retail stores. Well-established brands increasingly choose locations like Dubai as platforms to promote their products, solidifying the UAE's position as a desirable shopping destination for luxury goods. Home-grown multibrand retailers like Aati, operating since 1982, have also played a crucial role in developing the luxury furniture segment by offering collections from a wide range of European and American brands, including Bentley Home, Fendi Casa, and Ralph Lauren Home.

Construction and Real Estate Development

The robust construction activity in the UAE continues to be a significant driver for the home furniture market, with the number of buildings under construction showing a steady increase from 11,519 units in 2020 to 13,236 units in 2022. This surge in construction activity is complemented by several gigantic housing projects scheduled for completion, such as the city of Mohammed bin Rashid, which includes 55,000 residential units slated to end in 2023, and Reem Island, comprising 37,000 housing units. These large-scale developments create substantial opportunities for furniture manufacturers and retailers to cater to new homeowners and investors.

The development of key megaprojects, including Baccarat Hotel and Residences Dubai, Atlantis, the Royal, and various other residential communities, has further stimulated furniture demand. For instance, the 3,400-home Baniyas North development, featuring 57 kilometers of cycle paths, two dozen mosques, four schools, and two medical clinics, is scheduled for completion by September 2023. Additionally, the UAE government's announcement of USD 4.7 billion investment in over 23,000 new residential units across the country over the next five years demonstrates the strong potential for sustained home furniture market growth through new housing developments.

Kitchen and Living Space Evolution

The transformation of residential kitchens into new living rooms in modern UAE homes has emerged as a powerful market driver, reflecting consumers' evolving preferences for multifunctional living spaces. Consumers in the UAE market are extensively interested in designing kitchens to their own level of preference and taste, with various factors such as kitchen designs and types of kitchen furniture becoming extremely important in the current scenario. This trend is particularly evident in Dubai, where high-end consumers and societies are actively seeking kitchens with unique finishes, designs, and colors, while modular furniture that efficiently uses spaces and reduces working times is gaining significant popularity.

The investment in kitchen spaces has reached unprecedented levels, with UAE consumers spending between AED 170,000-420,000 on revamping their kitchens. The industry is witnessing high consumer preference for German and Italian style kitchens, owing to their high-end appeal and luxurious finishing. White kitchens have become particularly popular in Dubai, transforming the kitchen into a cool oasis in the hottest weather conditions, while various contrast designs that do not create an aesthetic conflict are preferred by consumers, including combinations of wood and metal, bright and neutral designs, and smooth lacquer finishes.

Population Growth and Urbanization

The UAE's remarkable population growth, increasing from 9.28 million in 2020 to 9.96 million in 2022, coupled with rapid urbanization, has created substantial demand for residential furniture. This demographic expansion has been accompanied by a significant rise in the number of households, creating a robust foundation for sustained furniture market growth. The population growth is particularly impactful as it includes a diverse mix of expatriates and nationals, each bringing their unique preferences and requirements for home furnishings.

The urbanization trend has been particularly influential in shaping furniture demand, with more than 90% of the UAE's population residing in urban areas. This urban concentration has led to the development of new residential communities and housing projects, each requiring complete indoor furniture solutions. The presence of more than 170 nationalities in key urban centers like Abu Dhabi and Dubai has created a diverse market for furniture products, with retailers and manufacturers adapting their offerings to cater to various cultural preferences and lifestyle needs.

Segment Analysis: By Material

Wood Furniture Segment in UAE Home Furniture Market

Wooden furniture dominates the UAE home furniture market, commanding approximately 73% of the total market share in 2024. The segment's prominence is driven by the widespread use of premium materials like teak, mahogany, oak, and maple in wooden furniture manufacturing. The wood furniture segment benefits from the strong preference among UAE consumers for natural materials that bring warmth and elegance to their living spaces. Major raw materials utilized include MDF and solid wood, complemented by various fittings and finishing materials. The segment's strength is further reinforced by the massive construction projects in Dubai and other emirates, which continue to drive demand for wooden furniture products. The market has also seen increasing demand for high-end luxury wooden furniture items, particularly in residential projects and hotel developments across the UAE.

Metal Furniture Segment in UAE Home Furniture Market

The metal furniture segment is projected to experience the highest growth rate of approximately 6% during the forecast period 2024-2029. This growth is primarily driven by the increasing popularity of light and portable metal furniture in modular styles, with a strong focus on artistic designs and functionality. The segment is witnessing significant innovation in manufacturing processes, with technologies like CNC (Computer Numerically Controlled) and CAD/CAM (Computer-Aided Design and Manufacturing) ensuring high accuracy and superior quality in metal furniture production. The trend toward mixed metal furniture, such as coffee tables incorporating gold elements and comfortable iron chairs with flowing lines, is gaining substantial traction in the market. The segment's growth is further supported by the rising demand for durable outdoor furniture, where metals like wrought iron and aluminum are preferred for their longevity and weather resistance.

Remaining Segments in Material Segmentation

The plastic and other furniture segment plays a vital role in the UAE home furniture market by offering affordable and versatile solutions. This segment includes various plastic products that serve as substitutes for metallic and wooden furniture, particularly in outdoor and casual settings. The segment has gained traction due to its lightweight nature, easy maintenance, and weather-resistant properties. Additionally, furniture items incorporating heavy fabric and leather work have found significant acceptance among UAE consumers. The segment also includes innovative materials and composite solutions that cater to specific needs in the market, such as durability in outdoor conditions and flexibility in design options.

Segment Analysis: By Type

Bedroom Furniture Segment in UAE Home Furniture Market

The bedroom furniture segment dominates the UAE home furniture market, commanding approximately 26% market share in 2024. This segment's prominence is driven by the expanding expatriate population and growing consumer base for furniture in the country. The segment encompasses a wide range of products including beds, mattresses, wardrobes, dressers, and nightstands, with mattresses generating the highest revenue within bedroom furniture items. Modern bedroom furniture typically includes king-sized beds, bedside tables, dressing tables, and mirrors, with materials ranging from natural wood to medium-density fiberboard, engineered wood, metal, and melamine. White remains a bold and distinctive color choice for master bedrooms, while soft shades like gray, pink, or burnt orange are popular for adding elegant touches to bedroom spaces.

Kitchen Furniture Segment in UAE Home Furniture Market

The kitchen furniture segment is projected to experience the highest growth rate of approximately 7% during 2024-2029. This robust growth is attributed to the increasing emphasis on kitchens becoming the new living rooms in modern homes, reflecting consumers' preferences for feeling good and eating well in hygienic settings. The segment is witnessing high consumer interest in designing kitchens to personal preferences, with modular furniture gaining significant popularity due to their efficient space utilization and reduced working times. In Dubai particularly, high-end consumers are seeking kitchens with unique finishes, designs, and colors, with many willing to spend between AED 170,000-420,000 on kitchen furniture renovations. The trend towards German and Italian-style kitchens remains strong, driven by their high-end appeal and luxurious finishing.

Remaining Segments in UAE Home Furniture Market By Type

The remaining segments in the UAE home furniture market include living room furniture, dining room furniture, and other furniture types, each serving distinct consumer needs. The living room furniture segment features popular items like sofa sets in various materials including velvet, fleece, and cotton-silk blends. The dining room furniture segment caters to different living spaces, with apartment dwellers preferring four-seater dining sets while villa residents opt for eight-seater arrangements. The other furniture segment encompasses specialized categories such as outdoor furniture, study furniture, and home storage furniture solutions, contributing to the market's diversity and comprehensive product offerings.

Segment Analysis: By Distribution Channel

Specialty Stores Segment in UAE Home Furniture Market

Specialty stores dominate the UAE home furniture market, commanding approximately 43% of the total market share in 2024. These stores have established themselves as the preferred destination for furniture shopping due to their extensive product ranges, specialized expertise, and superior customer service. Players like IKEA, Pottery Barn, Home Center, Al-Futtaim Ace, and Pan Emirates Home Furnishings have emerged as popular specialty retailers in the UAE market. The success of specialty stores can be attributed to their ability to offer comprehensive furniture collections, maintain high brand awareness, and ensure customer satisfaction through personalized services. These stores have also witnessed higher footfall owing to their ability to showcase furniture products in realistic room settings, allowing customers to better visualize how pieces would look in their homes.

Online Segment in UAE Home Furniture Market

The online distribution channel is experiencing remarkable growth in the UAE home furniture market, projected to grow at approximately 10% during 2024-2029. This surge is driven by increasing internet penetration, growing consumer comfort with online shopping, and the convenience of doorstep delivery services. E-commerce platforms are investing heavily in technologies like 3D visualization and augmented reality to enhance the online furniture shopping experience. Major retailers are adopting omnichannel strategies, developing mobile applications and brand websites to capture the growing digital consumer base. The segment's growth is further supported by the rising adoption of click-and-collect services, exclusive online deals, and the expansion of e-commerce infrastructure by retailers to ensure seamless delivery and installation services.

Remaining Segments in Distribution Channel

The UAE home furniture market is also served through home centers, flagship stores, and other distribution channels, each playing a unique role in meeting diverse consumer needs. Home centers focus on providing comprehensive home improvement solutions alongside furniture, while flagship stores serve as strategic locations for well-known brands to showcase their premium collections and enhance brand perception. Other distribution channels include pop-up stores, social media marketplaces, and department stores, which contribute to the market's diversity by offering various purchasing options and price points. These channels collectively ensure wide market coverage and cater to different consumer segments, from budget-conscious buyers to luxury furniture seekers.

UAE Home Furniture Industry Overview

Top Companies in UAE Home Furniture Market

The UAE home furniture market features prominent players like IKEA, Home Centre, Royal Furniture, PAN Emirates Home Furnishings, Pottery Barn, Danube Home, Marina Home, Homes R Us, Natuzzi, and Home Box. Companies are increasingly focusing on an omnichannel presence, with significant investments in mobile applications and brand websites to enhance customer experience. Product innovation trends include smart furniture integration, sustainable manufacturing practices, and customizable solutions. Operational strategies emphasize door-to-door delivery services, virtual consultations, and augmented reality applications for product visualization. Companies are expanding their physical presence through franchise models while simultaneously strengthening their digital capabilities. Strategic moves include partnerships with international brands, development of private labels, and implementation of innovative marketing campaigns to capture market share.

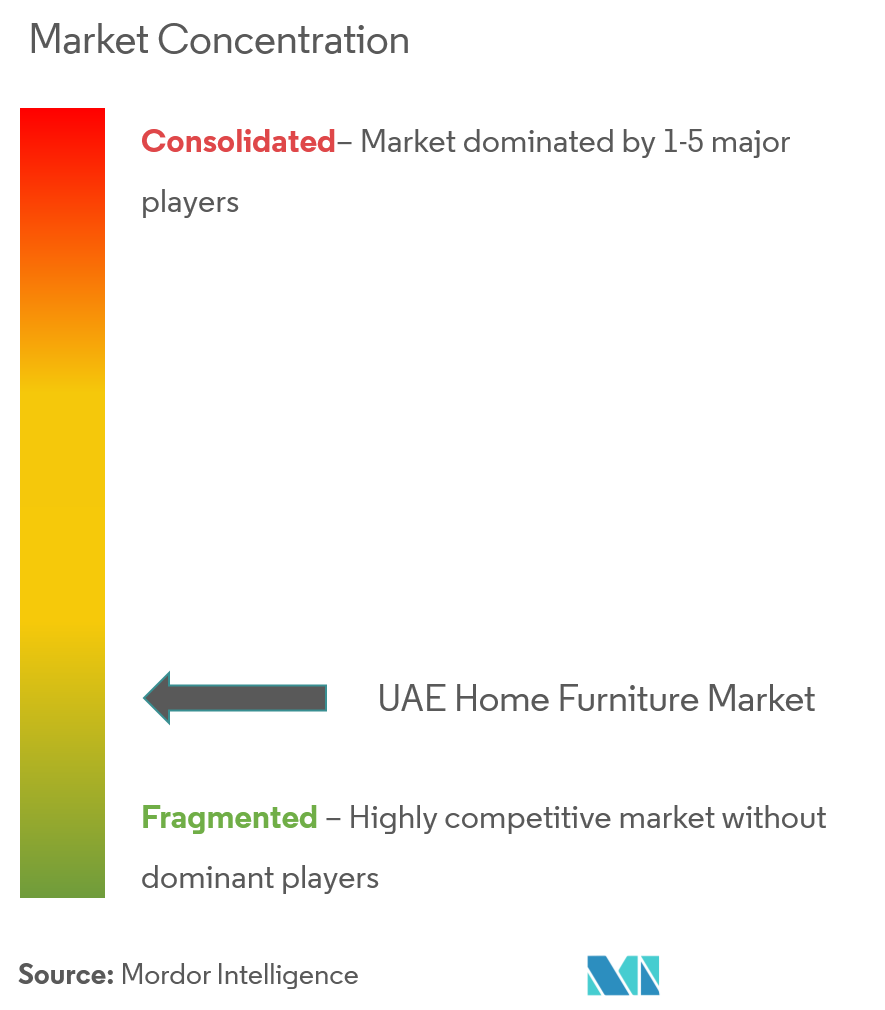

Mixed Market Structure with Growing Competition

The UAE home furniture market exhibits a fragmented yet highly competitive structure, characterized by the presence of both local and international players. Global conglomerates like IKEA operate alongside regional specialists such as PAN Emirates and Danube Home, creating a dynamic competitive environment. The market demonstrates moderate consolidation, with established players maintaining strong brand equity through quality products and service excellence. Companies are increasingly focusing on vertical integration, from manufacturing to retail, to maintain control over quality and costs.

The market is witnessing significant transformation through strategic partnerships and collaborations between local and international brands. Traditional furniture retailers are adapting to changing market dynamics by incorporating modern retail concepts and digital solutions. The competitive landscape is further intensified by the emergence of specialty stores and online furniture players, forcing established companies to innovate and diversify their offerings. Market players are actively pursuing expansion opportunities through franchise models and strategic acquisitions to strengthen their market position.

Innovation and Adaptation Drive Market Success

Success in the UAE home furniture market increasingly depends on companies' ability to adapt to evolving consumer preferences and technological advancements. Incumbents are focusing on product differentiation through design innovation, sustainable manufacturing practices, and integration of smart features. The development of strong distribution networks, both physical and digital, remains crucial for market penetration. Companies are investing in customer experience enhancement through personalized services, virtual reality solutions, and efficient after-sales support to maintain a competitive advantage.

Market contenders can gain ground by focusing on niche segments and innovative business models. The rising demand for customized modern furniture and sustainable products presents opportunities for new entrants to establish their presence. Companies must consider the high concentration of expatriate consumers and their diverse preferences while developing product strategies. The threat of substitution remains low due to the essential nature of furniture and home goods products, but players must stay vigilant about changing consumer preferences and potential regulatory changes regarding sustainability and product safety standards. Success in this market requires a balanced approach between traditional retail excellence and digital innovation.

UAE Home Furniture Market Leaders

-

IKEA

-

Home Centre

-

PAN Emirates Home Furnishings

-

Danube Home

-

Pottery Barn

- *Disclaimer: Major Players sorted in no particular order

UAE Home Furniture Market News

- In June 2023, The FITOUT, a prominent provider of comprehensive interior solutions in the Middle East and a subsidiary of Union Properties, partnered with Gurian, an Italian furniture manufacturing company. This collaboration aims to diversify product offerings and introduce Italy's finest luxury furniture to the UAE market.

- In June 2023, Vivium Holding, a forward-thinking single-family office, announced a strategic distribution agreement with Kettal, a renowned Spanish outdoor furniture brand known for its focus on design and innovation. The collaboration includes the debut of Kettal's first store in the United Arab Emirates early next year, adding to Vivium Holding's expanding investment portfolio.

UAE Home Furniture Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

-

4.2 Market Drivers

- 4.2.1 Rise in E-commerce is Driving the Market

- 4.2.2 Rise in Construction and Real Estate Sector Drives the Furniture Market

-

4.3 Market Restraints

- 4.3.1 Economic Fluctuations

- 4.3.2 High Competition in the Furniture Market

-

4.4 Market Opportunities

- 4.4.1 Smart and Connected Furniture

- 4.5 Value Chain Analysis

-

4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Technology Innovations in the Industry

- 4.8 Impacts of COVID-19 on the market

- 4.9 Insights on Imports and Exports of Furniture type

- 4.10 Insights on Demographics and Buying Patterns among Consumers in the United Arab Emirates

5. MARKET SEGMENTATION

-

5.1 By Material

- 5.1.1 Wood Furniture

- 5.1.2 Metal Furniture

- 5.1.3 Plastic and Other Furniture

-

5.2 By Type

- 5.2.1 Living Room Furniture

- 5.2.2 Kitchen Furniture

- 5.2.3 Dining Room Furniture

- 5.2.4 Bedroom Furniture

- 5.2.5 Other Furniture

-

5.3 By Distribution Channel

- 5.3.1 Home Centers

- 5.3.2 Flagship Stores

- 5.3.3 Specialty Stores

- 5.3.4 Online Stores

- 5.3.5 Other Distribution Channels

-

5.4 By Emirates

- 5.4.1 Dubai

- 5.4.2 Abu Dhabi

- 5.4.3 Sharjah

- 5.4.4 Others

6. COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

-

6.2 Company Profiles

- 6.2.1 Inter IKEA Group

- 6.2.2 Home Centre

- 6.2.3 Royal Furniture

- 6.2.4 PAN Emirates Home Furnishings

- 6.2.5 Pottery Barn

- 6.2.6 Danube Home

- 6.2.7 Marina Home

- 6.2.8 Homes R Us

- 6.2.9 Natuzzi

- 6.2.10 Home Box

- 6.2.11 Others (Al Khalid Furniture Factory LLC, Space 3, Tm Furniture Industry)*

- *List Not Exhaustive

7. MARKET OPPORTUNTIES AND FUTURE TRENDS

8. DISCLAIMER

UAE Home Furniture Industry Segmentation

Furniture encompasses objects designed for a range of human activities, including seating, dining, storage, work, and sleep. It serves the dual purpose of providing ergonomic support and acting as a platform for functional and decorative items. The furniture market forecast is segmented by material, type, end-user, distribution channel, and Emirates. The market is segmented by material: wood furniture, metal furniture, plastic furniture, and other material furniture (glass, etc). By type, the market is segmented into living room, kitchen furniture, dining room furniture, bedroom furniture, and other furniture (outdoor furniture, etc). By distribution channel, the market is segmented into home centers, flagship stores, specialty stores, online, and other distribution channels (local dealers), and by Emirates, the market is segmented into Dubai, Abu Dhabi, Sharjah, and Others (Ajman). The report offers market size and forecasts for the UAE furniture market in terms of revenue (USD million) for all the above segments.

| By Material | Wood Furniture |

| Metal Furniture | |

| Plastic and Other Furniture | |

| By Type | Living Room Furniture |

| Kitchen Furniture | |

| Dining Room Furniture | |

| Bedroom Furniture | |

| Other Furniture | |

| By Distribution Channel | Home Centers |

| Flagship Stores | |

| Specialty Stores | |

| Online Stores | |

| Other Distribution Channels | |

| By Emirates | Dubai |

| Abu Dhabi | |

| Sharjah | |

| Others |

UAE Home Furniture Market Research FAQs

How big is the UAE Home Furniture Market?

The UAE Home Furniture Market size is expected to reach USD 2.69 billion in 2025 and grow at a CAGR of 3.79% to reach USD 3.24 billion by 2030.

What is the current UAE Home Furniture Market size?

In 2025, the UAE Home Furniture Market size is expected to reach USD 2.69 billion.

Who are the key players in UAE Home Furniture Market?

IKEA, Home Centre, PAN Emirates Home Furnishings, Danube Home and Pottery Barn are the major companies operating in the UAE Home Furniture Market.

What years does this UAE Home Furniture Market cover, and what was the market size in 2024?

In 2024, the UAE Home Furniture Market size was estimated at USD 2.59 billion. The report covers the UAE Home Furniture Market historical market size for years: 2020, 2021, 2022, 2023 and 2024. The report also forecasts the UAE Home Furniture Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

UAE Home Furniture Market Research

Mordor Intelligence provides a comprehensive analysis of the UAE home furniture industry. We combine extensive research methodology with deep market insights. Our report covers the full range of residential furniture segments. This includes categories such as bedroom furniture, living room furniture, and kitchen furniture. We analyze emerging trends in modern furniture, traditional furniture, and contemporary furniture styles. Additionally, we examine the growing demand for wooden furniture, upholstered furniture, and modular furniture solutions. Our expertise also extends to home decor and home furnishings, providing stakeholders with actionable intelligence on furniture retail dynamics.

The report, available as an easy-to-download PDF, offers valuable insights for stakeholders in the household furniture sector. It caters to manufacturers of custom furniture and retailers of luxury furniture and smart furniture solutions. Our analysis covers the evolution of online furniture retail and the growing popularity of RTA furniture. We also explore innovations in home office furniture and dining room furniture segments. The report examines trends in kids furniture and home storage furniture solutions. Furthermore, it addresses the emerging market for indoor furniture designed specifically for UAE consumers. Stakeholders benefit from our detailed examination of furniture and home goods market dynamics, supported by comprehensive data and strategic recommendations.