UAE Construction Market Analysis

The UAE Construction Market size is estimated at USD 42.75 billion in 2025, and is expected to reach USD 52.66 billion by 2030, at a CAGR of 4.26% during the forecast period (2025-2030).

COVID-19 affected the construction market in Dubai, leading to a temporary suspension of work and reducing the net profit of the industry. The government is concentrating on smart cities and plans to digitize up to 1,000 government services and put more than 2,000 wireless hotspots in place.

Liberal trade policies in the country are attracting foreign investors and boosting the UAE construction market. The construction industry is the core of the UAE economy, and it expects rapid growth in the coming years. The construction industry plays a vital role in the economic upliftment and development of the country.

The United Arab Emirates focuses on economic diversification to lessen its dependency on the oil and gas sector. The country has been adopting long-term growth strategies, and the construction industry is turning to prefabricated buildings.

The United Arab Emirates has various transportation infrastructure projects under construction, such as the USD 2.7 billion Sheikh Zayed double-deck road scheme. It also has unconventional transport projects, such as the USD 5.9 billion proposed hyperloop project between Dubai and Abu Dhabi.

Smart cities are evolving increasingly as governments worldwide look for solutions to ensure more environmentally friendly and effective infrastructure development. To provide better living conditions to the residents, buildings, green areas, and public services must all remain connected to a single automated infrastructure. These shifts prompted the building and industrial industries to adopt new technology and seek more sustainable and computerized alternatives.

Moreover, with ongoing investment and technological advancements, the country is investing in diverse projects. These large-scale investments aim to provide housing opportunities for lower-income groups, create new employment, and diversify the country's economy.

The UAE construction sector is expected to attain moderate post-pandemic growth in the coming years. The UAE government is focusing on investment in energy and infrastructure, including utilities, decarbonization, transportation, renewable and nuclear energy generation, and fixing the ongoing water scarcity. The region's significant commitment and resources indicate various mega-project opportunities for construction and engineering companies.

Recent project announcements in the country include the Dubai Municipality's plan to build a strategic sewerage tunnel, Abu Dhabi National Oil Company's (ADNOC) Al-Nouf seawater treatment plant, and other mega construction projects like the redevelopment of Mina Rashid in Dubai and the Dubai International Financial Centre Expansion 2.0.

UAE Construction Market Trends

Rise in Demand from the Tourism Sector

Over the years, particularly in sectors such as real estate, tourism, and infrastructure, the United Arab Emirates has been experiencing significant economic growth. It has increased construction work, attracting many companies bidding for lucrative contracts.

In the first two months of 2023, according to industry experts, Dubai welcomed around 3.1 million tourists, representing a 42% increase compared with the same period last year. In the first two months of the year, the increase in inbound tourism also benefited the lower and midtier segments of the hospitality sector, which saw a rise of 7 to 8 basis points in occupancy revenue per available room of 15%.

In April 2023, Miral, an Abu Dhabi real estate development company, announced its expansion of 16,900 sq. m to Yas Island's Waterworld because of its popularity with locals and foreign visitors. The expansion, scheduled to be completed in 2025, will add 3.3 km of slide sections and increase the number of visitors by 20%, with the addition of 18 new thrill rides and other entertainment expected to make the park a total of more than 60 experiences.

Construction Projects in the Pipeline to Boost the Market

The industry outlook seems promising as the government continues its infrastructure plans through diverse government ambitions, such as the Sheikh Zayed Housing Programme, the Energy Strategy 2050, and the Dubai Tourism Strategy.

Infrastructure projects are vital to the country's economic expansion, as the Emirate and GCC have significant infrastructure needs. Thus, it seeks to build efficient transport and logistics networks and reliable, clean energy supplies.

Also, Israel and the United Arab Emirates achieved a deal to normalize ties, opening up investment options. The countries decided to develop a joint strategy to boost cooperation in the energy sector. Abu Dhabi aims to sustain long-term growth. Abu Dhabi's share of the pipeline is estimated to grow in the coming years as the government prioritizes efforts to expand the Emirate's economic base beyond oil. The Abu Dhabi government aims to attract 7.9 million tourists annually by 2030 under its Abu Dhabi 2030 Plan. Furthermore, the Emirate hopes to grow its retail and office space to 4 million and 7.5 million sq. m by 2030.

The country has about half of the pipeline value of Saudi Arabia, with USD 288 billion in planned projects. An additional concern for the UAE construction is that the USD 125 billion of future projects in the country is low compared to the USD 145 billion projects in execution, suggesting a shrinking market.

UAE Construction Industry Overview

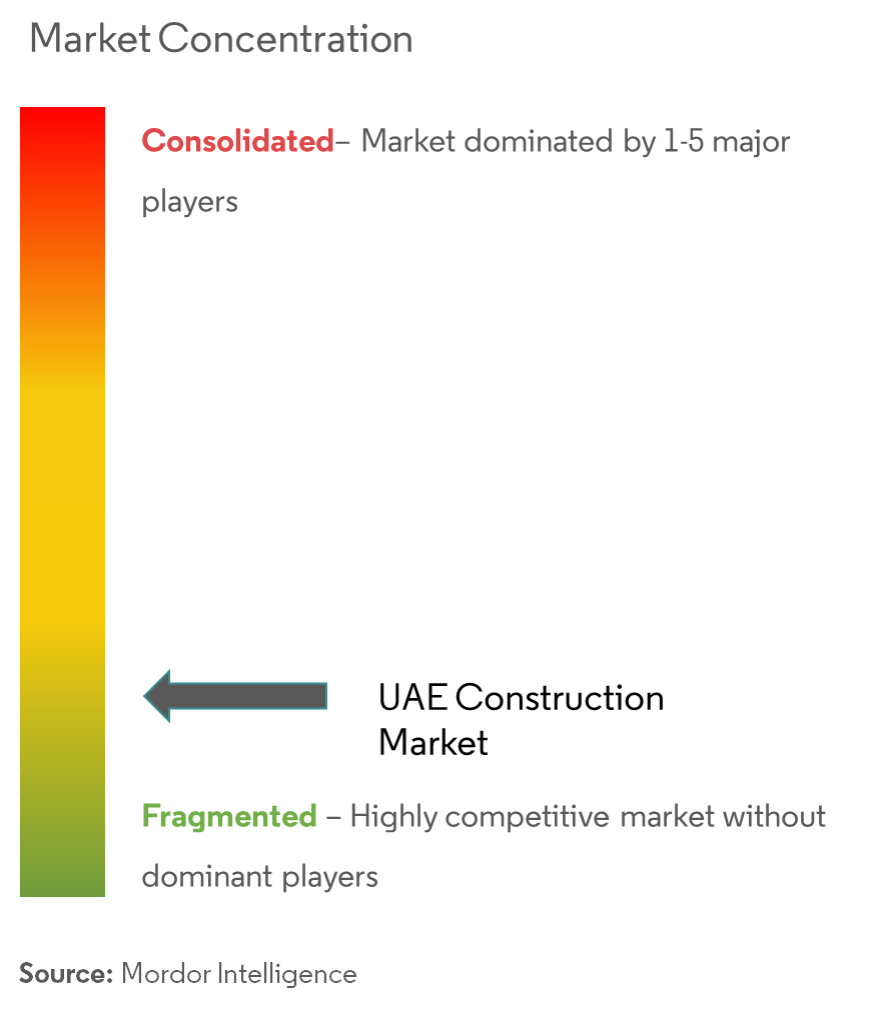

The UAE construction market is very competitive, with considerable international players present. The United Arab Emirates has diversified its economy from oil dependence. Diversification also includes investments in tourism, hospitality, and other sectors, contributing to increased construction projects and promoting competition within the sector. The market for construction companies in the country is substantial due to its strategically placed position as an economic and trade hub of the Middle East. The market is also characterized by an evident degree of consolidation, with several players holding significant shares.

UAE Construction Market Leaders

-

AE Arma-Electropanc

-

Aegion Corp.

-

Bechtel

-

CB&I LLC

-

Consolidated Contractors Group

- *Disclaimer: Major Players sorted in no particular order

UAE Construction Market News

November 2023: Dubai-based developer Wasl granted a construction contract worth AED 1.2 billion (USD 1.4 billion) to China State Construction Engineering Corp., a Beijing-based company, to construct The Island, a 26-acre development that is expected to be the first in the region to allow legal gaming. A total of 1,400 hotel rooms are planned for the development.

September 2023: Hassan Allam Holding, one of Egypt's leading construction companies, announced its expansion into the United Arab Emirates on the occasion of 'Building Boundless Horizons: From Egypt to the UAE'.

August 2023: ADNOC Gas, the world's leading integrated gas processing company, announced that it was awarded a contract for AED 13.1 billion (USD 3.6 billion). This contract will enable ADNOC Gas to extend its gas processing facilities in the United Arab Emirates by commissioning new facilities and providing an optimal supply to the RUWAIS Industrial Complex.

UAE Construction Industry Segmentation

The construction market includes several activities covering upcoming, ongoing, and growing construction projects in different sectors. It has but is not limited to geotechnical (underground structures) and superstructures in residential, commercial, and industrial systems, infrastructure construction (like roads, railways, and airports), and power generation and transmission-related infrastructure.

A complete background analysis of the UAE construction market, including the assessment of the economy and contribution of sectors in the economy, market overview, market size estimation for key segments, and emerging trends in the market segments, market dynamics, and geographical trends, and COVID-19 impact, is covered in the report.

The UAE construction market is segmented by sector (commercial construction, residential construction, industrial construction, infrastructure (transportation) construction, and energy and utility construction). The report offers market size and forecasts for all the above segments in value (USD).

| By Sector | Commercial Construction |

| Residential Construction | |

| Industrial Construction | |

| Infrastructure (Transportation) Construction | |

| Energy and Utilities Construction |

UAE Construction Market Research FAQs

How big is the UAE Construction Market?

The UAE Construction Market size is expected to reach USD 42.75 billion in 2025 and grow at a CAGR of 4.26% to reach USD 52.66 billion by 2030.

What is the current UAE Construction Market size?

In 2025, the UAE Construction Market size is expected to reach USD 42.75 billion.

Who are the key players in UAE Construction Market?

AE Arma-Electropanc, Aegion Corp., Bechtel, CB&I LLC and Consolidated Contractors Group are the major companies operating in the UAE Construction Market.

What years does this UAE Construction Market cover, and what was the market size in 2024?

In 2024, the UAE Construction Market size was estimated at USD 40.93 billion. The report covers the UAE Construction Market historical market size for years: 2020, 2021, 2022, 2023 and 2024. The report also forecasts the UAE Construction Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

UAE Construction Industry Report

Statistics for the 2025 UAE Construction market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. UAE Construction analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.