Transparent Electronics Market Analysis

The Transparent Electronics Market is expected to register a CAGR of 25% during the forecast period.

- Growing penetration of touch-enabled electronic devices is driving the market as it can be seen as a substitution for the traditional keypad/keyboard and mouse. This multi-touch technology is in a great demand with multi-touch enabled products such as smartphones & tablets, and they have a big share in the market in future. Consumer electronic products are the ones that contribute maximum to these devices.

- Silicon compounds are expected to have a major impact and can become a driving factor for the transparent electronic materials market. Oxide semiconductors is liable to be transparent which means one can build transparent circuits and this allows to build transparent displays. The application of transparent circuits could be smart windows which change transparency upon changes in the environment (heat, light, voltage).

- The challenges for this industry are lack of skilled labour due to complex functioning and high cost of the end-product which are restraining the market to grow.

Transparent Electronics Market Trends

Transparent Display Through AMOLED in Smartphone to Witness a Market Growth

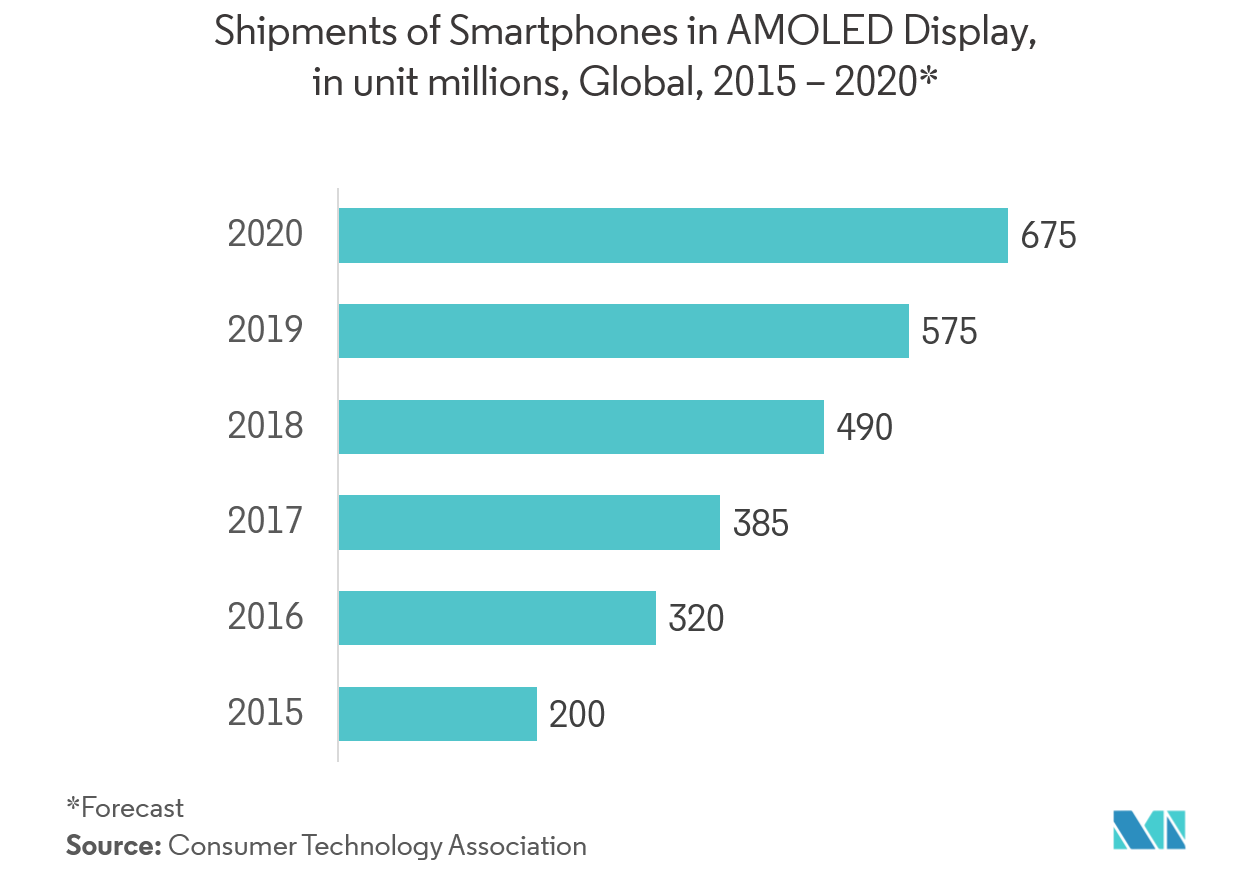

- Over 61% of total smartphone display panels are OLED now and due to the superior properties like less thickness and bright output, mobile manufacturers have been increasingly incorporating AMOLED panels (part of OLED) in their product to generate the transparent display for smartphones.

- Many smartphone companies are edging towards this technology to bring this new revolution in the smartphone. Recently on Oct 2018, Samsung Electronics, held its AMOLED Forum in Shenzhen, China, where they shared its product roadmap with Chinese customers including Huawei, Lenovo, Oppo, Vivo, Xiaomi and ZTE, where they talked about several cutting-edge in-display technologies that will help smartphone makers create the perfect full-screen transparent device through transparent Super AMOLED Plus displays.

- In April 2019, LG, which is yet to launch a foldable smartphone, has successfully received a patent for a foldable display that is also, in large part, transparent. This phone would have touch input via both the front and back no matter how the user holds the phone. The patent also includes a description for a rear camera system with multiple lenses.

- Oppo’s under-display camera tech launched ‘highly transparent’ display material and AI algorithms, where the display is constructed from a highly transparent material that enables light to pass through freely, while the imaging sensor boasts a larger-than-average aperture, sensor size, and pixel density. As Oppo is committed to product and technology innovation that creates a more immersive and comprehensive experience for users, they are in the innovation to fully create a transparent display smartphone with the help of AMOLED panels.

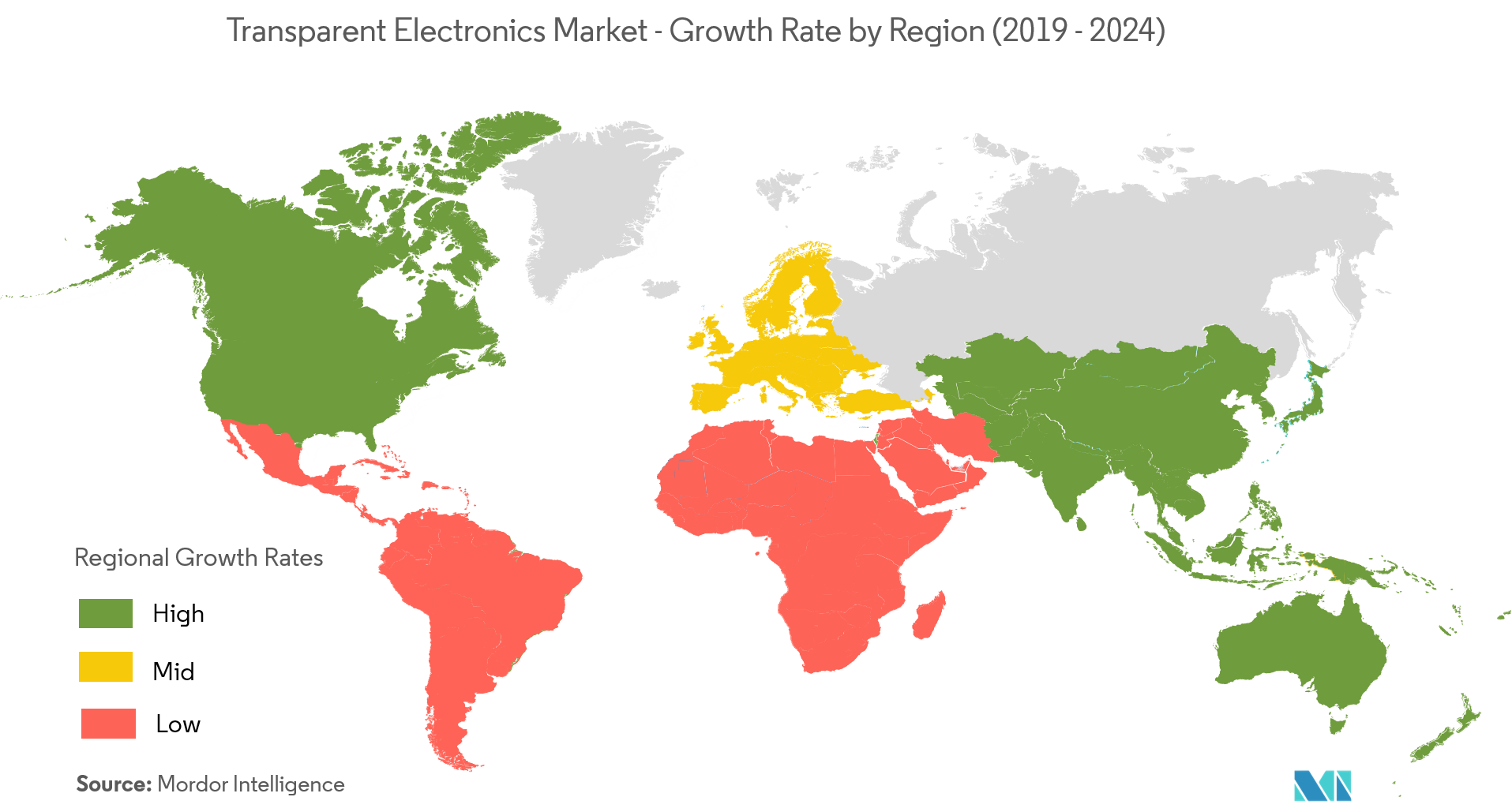

North America Account for Significant Market Share

- North America leverage the largest revenue share in the market as majority of the key market players are situated in United States and one of the key reasons driving the growth in North America is the large number of touch enable devices are used by Americans.

- In United States, residential applications generate high demand for poly-crystalline solar panel in North America, owing to the prominence and high adoption of renewable energy sources in homes and buildings. Researchers at Michigan State University, states that highly transparent solar cells represent the wave of the future for new solar applications. Only about 1.5% of electricity demand in the United States and globally is produced by solar power. But in terms of overall electricity potential, there is an estimated 5 billion to 7 billion square meters of glass surface in the United States. There is a high rate of adoption of transparent solar panels as this technology offers a promising route to inexpensive, widespread solar adoption on small and large surfaces.

- Various transparent displays applications are launching in United States which are helping in growing the market. For instance, on june 2019, LG Business Solutions launched the highly anticipated LG Transparent OLED digital signage display in the United States at InfoComm 2019. This razor-thin see-through display is drafted to deliver a unique customer experience in specialized commercial applications, particularly retail and hospitality.

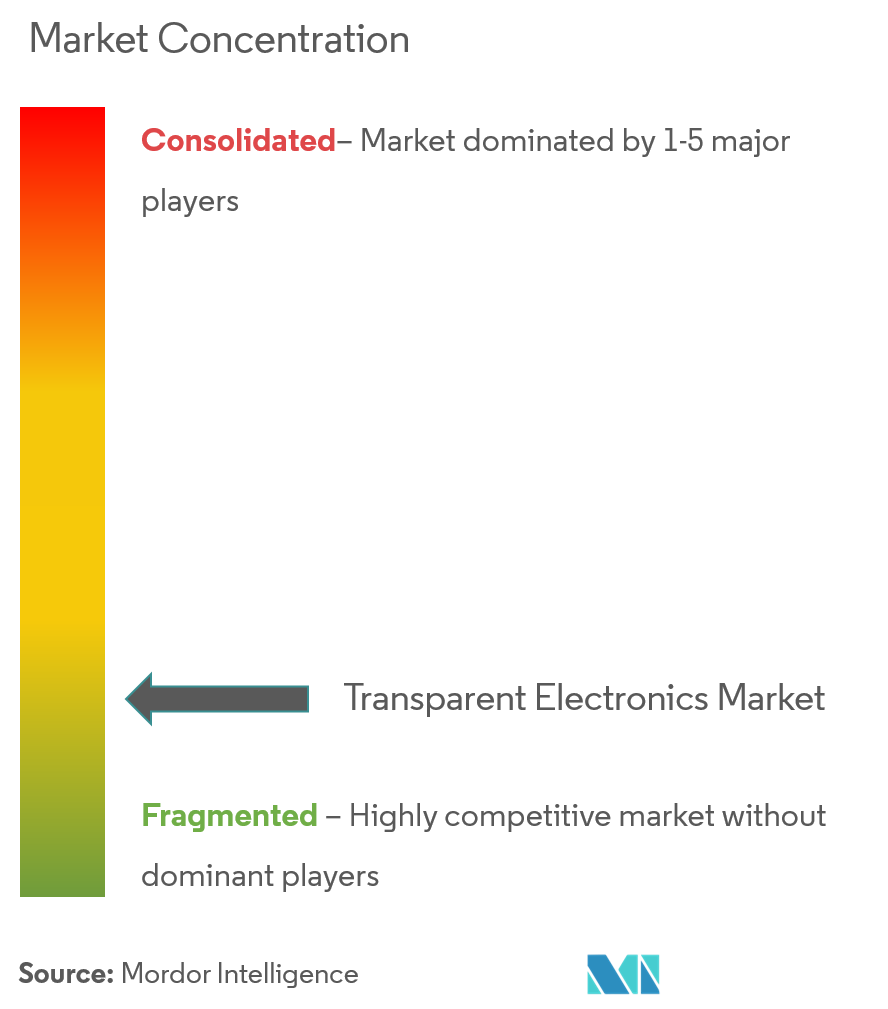

Transparent Electronics Industry Overview

The transparent electronics market is fragmented as it is highly competitive andis mildly concentrated because of the presence of many players conducting business on a national, as well ason an international scale. Key players areBOE Technology Group Co., Brite Solar,ClearLED Ltd., etc. Recent developments in the market are -

- Sep 2019 - Huawei licensed a smartphone with camera, flash, LED indicator, light emitter, and sensor under the screen. The phone is described as possessing a partially-transparent section of display stretching across the width of the device, just below the selfie camera. The transparent display part only becomes semi-transparent between 50-99%, so that status bar icons can be displayed. Here users will be efficient to adjust the transparency of the screen simply by gently touching the screen.

- May 2019 -Tianma Micro-electronics Co. has exhibited new display technologies at Embedded World in Germany. Tianma Micro-electronics Co. demonstrated a novel OLED prototype, which is a 10.3 inch 91 PPI transparent AMOLED panel featuring up to 50% transparency and high brightness.

Transparent Electronics Market Leaders

-

BOE Technology Group Co.

-

Brite Solar

-

ClearLED Ltd

-

Corning Incorporated

-

LG Electronics

- *Disclaimer: Major Players sorted in no particular order

Transparent Electronics Industry Segmentation

Transparent electronics currently have a heterogeneous range of applications and using this technology, nearly every glass setting can be transformed into an electronic device, windows could also be utilized as power generators, automobile windshields could be used to transfer visual information to the driver, which will penetrate more demand in future for its market growth.

| By Product | Transparent Displays |

| Transparent Solar Panels | |

| Smart Windows | |

| Other Products | |

| By End-user Industry Application | Automotive |

| Building Infrastructure | |

| Consumer Electronics | |

| Other End-user Industry | |

| Geography | North America |

| Europe | |

| Asia-Pacific | |

| Rest of the World |

Transparent Electronics Market Research FAQs

What is the current Transparent Electronics Market size?

The Transparent Electronics Market is projected to register a CAGR of 25% during the forecast period (2025-2030)

Who are the key players in Transparent Electronics Market?

BOE Technology Group Co., Brite Solar, ClearLED Ltd, Corning Incorporated and LG Electronics are the major companies operating in the Transparent Electronics Market.

Which is the fastest growing region in Transparent Electronics Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Transparent Electronics Market?

In 2025, the North America accounts for the largest market share in Transparent Electronics Market.

What years does this Transparent Electronics Market cover?

The report covers the Transparent Electronics Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Transparent Electronics Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Transparent Electronics Industry Report

Statistics for the 2025 Transparent Electronics market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Transparent Electronics analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.