Tracking-as-a-Service Market Analysis

The Tracking-as-a-Service Market is expected to register a CAGR of 25.08% during the forecast period.

- Tracking-as-a-service helps industries to monitor their day-to-day business processes. With a proper tracking solution in place, businesses can get proper information about their operations and assets, know about asset availability and productivity, and access them from a single source. Such solutions maintain an accurate record of all the assets, providing a clear picture of how assets are utilized in each process. Currently, almost every business that relies on assets to get things done can benefit from a properly implemented tracking solution.

- Automation in the retail industry has resulted in the increased demand for a cloud-based solution like tracking-as-a-service. Moreover, the growing use of electronic monitoring for personal and professional work is anticipated to boost the market growth of tracking-as-a-service.

- Factors such as increasing usage of mobile technology, the increasing need to improve fleet operator efficiency, the emergence of eye tracking systems, and the use of electronic monitoring systems for monitoring purposes are factors driving the market.

- Another key factor stimulating the market's growth is the increasing Internet of things (IoT) adoption. Smart-connected devices help to track the shipments of goods in real-time. Also, governments worldwide are mandating GPS tracking in all new vehicles in a bid to maintain driver safety. Vehicle tracking solutions offered through the cloud improve fleet operator efficiencies at lower costs.

- Many industries have privacy concerns regarding electronic monitoring, restraining enterprises from adopting the solution. There is even a chance of a security breach by intruders interrupting the tracking software.

- COVID-19 also challenged market growth to a great extent. Vendors serving the transportation and logistics industry were hit the most due to a lack of investment.

Tracking-as-a-Service Market Trends

Transportation and Logistics have Shown Highest Adoption of TaaS

- Transportation is a crucial element in modern society. Tracking solutions adopted by the transportation and logistics sector improve vehicle maintenance. Improved maintenance helps to extend the life of vehicles. It may also help in preventing delays that may be caused when the vehicles break down.

- Private companies offering ride-sharing and car services, such as Uber, Lyft, and Roam, have witnessed snowballing growth over the past few years. Location data for tracking is a crucial asset to these companies.

- While a majority of the companies involved have in-house analytical capabilities, the growing volumes and complexities involved in the data are expected to drive collaborations between these companies and tracking as a service provider over the forecast period.

- Another trend driving the market in this sector is the increasing adoption of IoT by trucking and logistics companies, which are also using IoT to track packages and make sure deliveries reach customers on time, as well as saving fuel and implementing predictive maintenance plans for their vehicles, by using tracking data.

- A Public Transport Tracking Solution (PTTS) is being developed by Trafiksol using TaaS applications that assist with letting people know about the arrivals and departures of public transport under PTTS and will also indicate the current position with respect to individual stops/ stations. A User will be able to track their respective vehicle through a mobile app to know the vehicle's exact position on the map. A common payment card will be provided to users through which they can pay on any public transport under PTTS.

North America To Hold The Largest Market Share

- North America is expected to be the largest market for the Tracking-as-a-Service market. Most Tracking-as-a-Service vendors, such as AT&T Inc., Motorola Solutions Inc., and Honeywell International Inc., are based in the North American region.

- The growth can be attributed to increasing advances in automation technology, especially in the logistics and transportation sector in the region. The adoption of warehouse or delivery robots is growing at an increasing pace, and hence, the adoption of these services is increasing.

- The region is also witnessing an expansion in the criminal offender monitoring market. Most areas in the US have compelled the use of offender tracking equipment for sexual offenders. The market will also continue to grow in the region as the regulatory bodies in North America are encouraging the installation of GPS tracking devices in private passenger vehicles.

- Companies like FieldLogix are helping its passenger transportation organizations throughout North America improve their route planning and customer service with GPS fleet tracking technology. Transportation organizations use FieldLogix's transportation tracking system to meet the performance requirements of their contracts.

- For instance, in July 2022, to complement its market-leading fleet management solutions, Lytx Inc., a global leader in video telematics solutions, introduced the Lytx Asset Tracking Service. Fleet managers searching for a streamlined method of tracking down and controlling their powered equipment can use the Asset Tracking Service, which is now offered in the United States and Canada. The business also disclosed a number of brand-new maintenance improvements for its Fleet Tracking Service, set for release later this year.

- According to interviews by the ICCT, 40-50% of trucking fleets in Canada are currently using telematics systems. The electronic logging device (ELD) mandates in the United States and Canada has created a ripe market for the adoption of telematics systems.

Tracking-as-a-Service Industry Overview

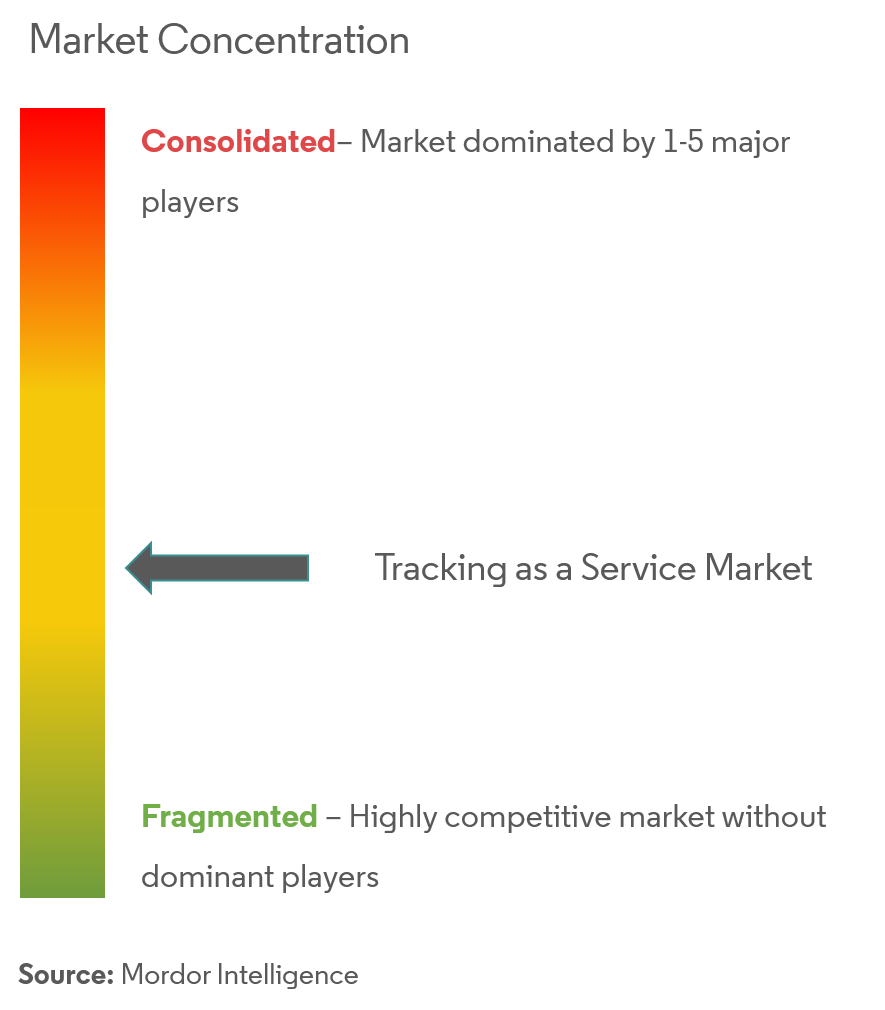

The presence of many vendors characterizes the tracking-as-a-service market. These vendors focus on developing cloud computing solutions with added features and supplying them at competitive prices. The increasing demand for cloud computing services is expected to strengthen the market's competitive environment. To increase their footprint in this global market, the vendors are investing in developing specific and customized cloud-based solutions.

In March 2022, the leading software platform for home service providers, Housecall Pro and Mojio, partnered to create Force by Mojio, the first fleet management solution designed particularly for small businesses. Mojio is a leading connected mobility platform and provider of SaaS solutions. The alliance makes it simpler for home service professionals to track their company vehicles, enhance operations, and modernize the client experience by combining Force by Mojio's real-time telemetry data with Housecall Pro's all-in-one platform.

Tracking-as-a-Service Market Leaders

-

Wabco (Asset Trackr)

-

Zebra Technologies Corp.

-

Geotab, Inc.

-

Blackline Safety Corp.

-

Verizon Communications

- *Disclaimer: Major Players sorted in no particular order

Tracking-as-a-Service Market News

- July 2022 - The state transport department's vehicle location tracking system was introduced by the chief minister of Himachal Pradesh, India. The emergency response assistance system 112 has integrated the car position tracking gadget and the panic button system. When the panic button is hit, a signal is sent to 112 via satellite, alerting the police. When an emergency arises, the device would promptly and accurately convey information about the vehicle.

- March 2022 - A new service for seamless cross-border shipping to more than 220 countries, including the US, UK, Germany, and Australia, was launched, according to the tech-enabled logistics and fulfillment platform Shiprocket. The company said that thanks to unified tracking capabilities, vendors can now track all of their shipments, independent of the carrier they use, and provide real-time tracking updates through email and SMS to their end consumers.

Tracking-as-a-Service Industry Segmentation

Tracking-as-a-service can be defined as a platform or cloud-based solution used in the supply chain and logistics industry to track inventories, vehicles, and assets. The platform is used by enterprises in retail and manufacturing industries, where goods are delivered regularly, and the deployment of a tracking system is necessary for remote monitoring. Cloud-based tracking systems are gaining popularity because the data can be transmitted instantly in a cloud-based ICT infrastructure.

The market is segmented by Deployment (On Cloud and On-premise), End-user Industry (Retail, Manufacturing, E-commerce, Transportation and Logistics, and Healthcare), and Geography. The market sizes and forecasts are provided in terms of value (USD million) for all the above segments.

| Deployment | On Cloud |

| On-premise | |

| End-user Industry | Retail |

| Manufacturing | |

| E-commerce | |

| Transportation and Logistics | |

| Healthcare | |

| Other End-user Industries | |

| Geography | North America |

| Europe | |

| Asia-Pacific | |

| Latin America | |

| Middle East & Africa |

Tracking-as-a-Service Market Research FAQs

What is the current Tracking-as-a-Service Market size?

The Tracking-as-a-Service Market is projected to register a CAGR of 25.08% during the forecast period (2025-2030)

Who are the key players in Tracking-as-a-Service Market?

Wabco (Asset Trackr), Zebra Technologies Corp., Geotab, Inc., Blackline Safety Corp. and Verizon Communications are the major companies operating in the Tracking-as-a-Service Market.

Which is the fastest growing region in Tracking-as-a-Service Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Tracking-as-a-Service Market?

In 2025, the North America accounts for the largest market share in Tracking-as-a-Service Market.

What years does this Tracking-as-a-Service Market cover?

The report covers the Tracking-as-a-Service Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Tracking-as-a-Service Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Tracking-as-a-Service Industry Report

Statistics for the 2025 Tracking-as-a-Service market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Tracking-as-a-Service analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.