Thin Layer Deposition Market Analysis

The Thin Layer Deposition Market is expected to register a CAGR of 15.25% during the forecast period.

- Thin-film semiconductor deposition is a next-generation technology which is achieving rapid acceptance across various industries. Range of applications of thin-film semiconductor in solar panels will create an increasing demand in thin-film semiconductor deposition manufacturing.

- The demand for thin layer deposition semiconductors has increased due to their advantages such as lightweight, higher efficiency, less space consumption, and flexibility in shape. They are widely used in various applications such as solar panels, DRAMs, microprocessors, and wearable technologies among others.

- The market is largely driven by the increasing demand for microelectronics and flexible electronics such as flexible display & batteries. Moreover, the need for miniaturization of the circuit had supplemented the growth of Thin-layer deposition market. The requirement for advanced OLED displays will further boost the demand in the coming years.

- Moreover, the surge in demand of sensors in the smartphone industry and increasing application of solar systems in household equipment, transportation facilities, and aircrafts are expected to create numerous opportunities for the growth of thin-layer deposition market in the coming years.

- However, restraints associated with the thin layer deposition market is huge initial investment required for setting up a new manufacturing facility for thin layer deposition and increasing the cost of raw materials.

Thin Layer Deposition Market Trends

Increase in Demand for Microelectronics and Consumer Electronics to Fuel the Demand

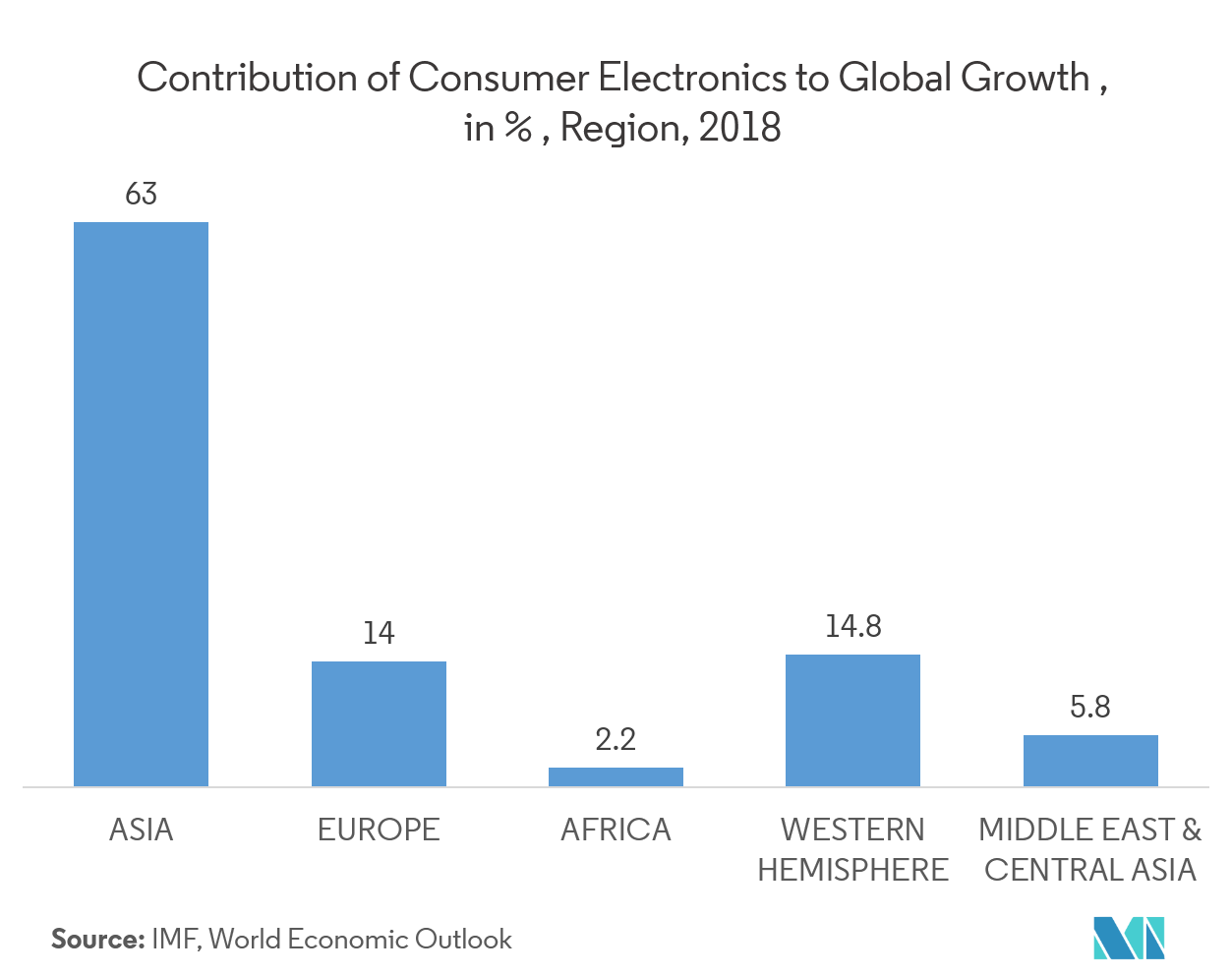

- The rise in the sale of microelectronics and consumer electronics is expected to fuel the demand for semiconductor ICs, during the forecast period. The increase in demand for semiconductor ICs is projected to improve the production capacity of semiconductor device manufacturers, which, in turn, may augment the demand for the atomic layer deposition market.

- Besides, governments and industry stakeholders are keenly following the advancements in the microelectronics industry, as these technologies might potentially disrupt and boost the Internet of Things. The industry has been investing in enhancing chip performance too. For e.g. in June 2018, Applied Materials Inc. announced a breakthrough in materials engineering, which accelerated chip performance in the AI and Big Data era. The company’s unique integrated materials solution combines dry clean, Atomic Layer Deposition (ALD), Physical Vapor Deposition (PVD), and Chemical Vapor Deposition (CVD) on the Endura platform, enabling the customers to quicken the adoption of cobalt.

- Many of the manufacturing companies prefer the atomic layer deposition technique to produce smaller components with comparatively low costs with the demand for miniaturization growing every day. As device requirements push toward smaller and more spatially demanding structures, ALD has demonstrated potential advantages over alternative deposition methods, such as chemical vapor deposition (CVD) and various physical vapor deposition (PVD) techniques, due to its conformality and control over materials thickness and composition. This broad adoption of ALD,CVD, PVD is expected to fuel the growth of the market studied.

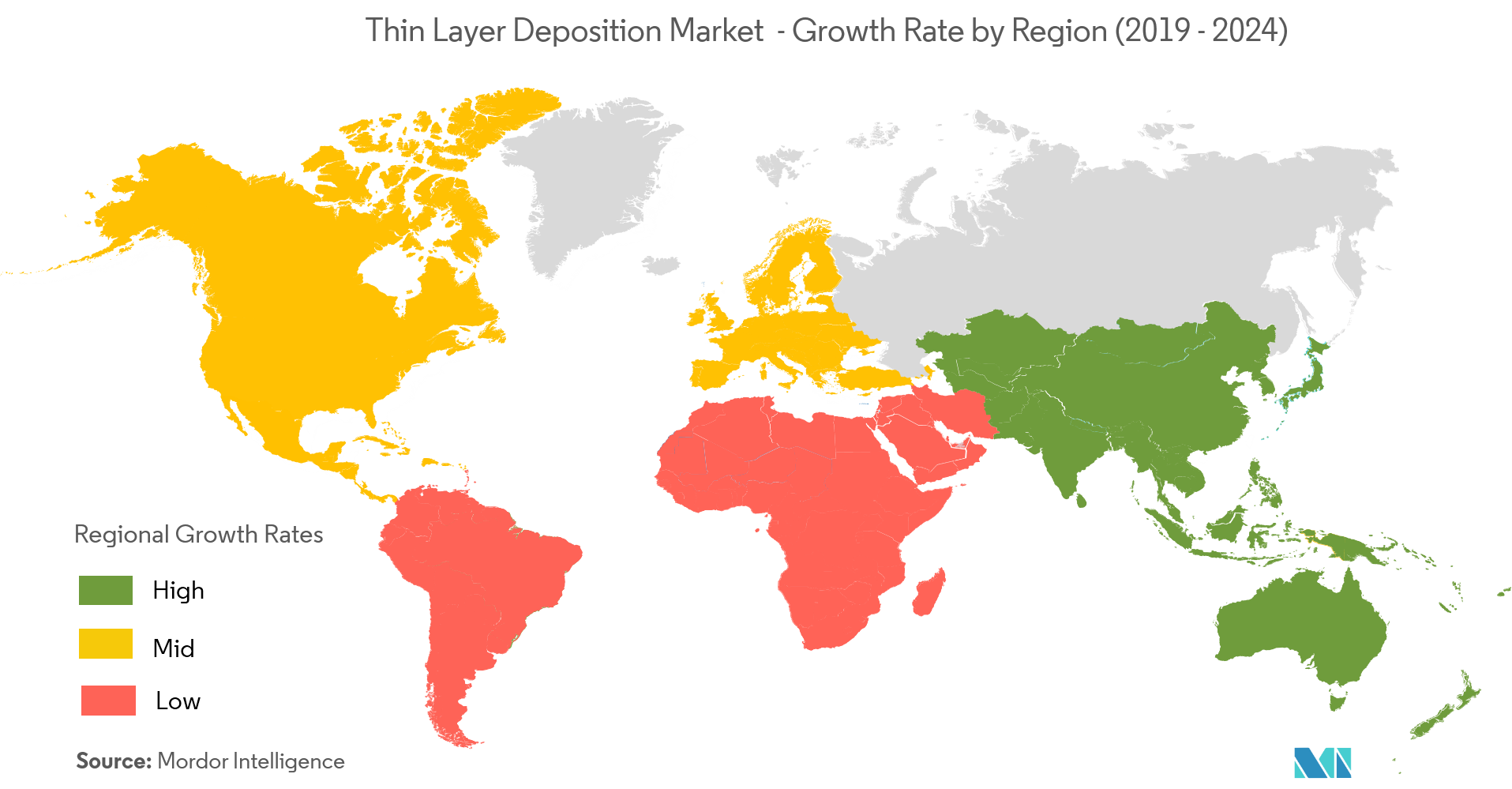

Asia- Pacific Region to Dominate the Market

- Asia-Pacific accounted for the most significant market share in the thin layer deposition market. The growth of the regional market can be attributed to the progression of electronics and semiconductor industries, mainly in China. The deep-rooted electronics manufacturing bases in China, South Korea, and Taiwan led to an increased demand for deposition technologies.

- The rise in industrialization and increase in the number of end-user industries in developing economies, such as China and India, have offered numerous untapped opportunities. Moreover, China, Indonesia, Japan, South Korea, and Taiwan have led the thin layer deposition growth, due to increasing solar panel manufacturing and installations. For instance, on May 31, 2018, the Chinese government announced subsidy reductions for photovoltaic power generation, widely known as the 531 Policy.

- Moreover, the rising demand for electronic components in the automotive industry is anticipated to increase the demand for semiconductors, in the region. This, in turn, directly impacts the growth of the market studied, in a positive manner.

Thin Layer Deposition Industry Overview

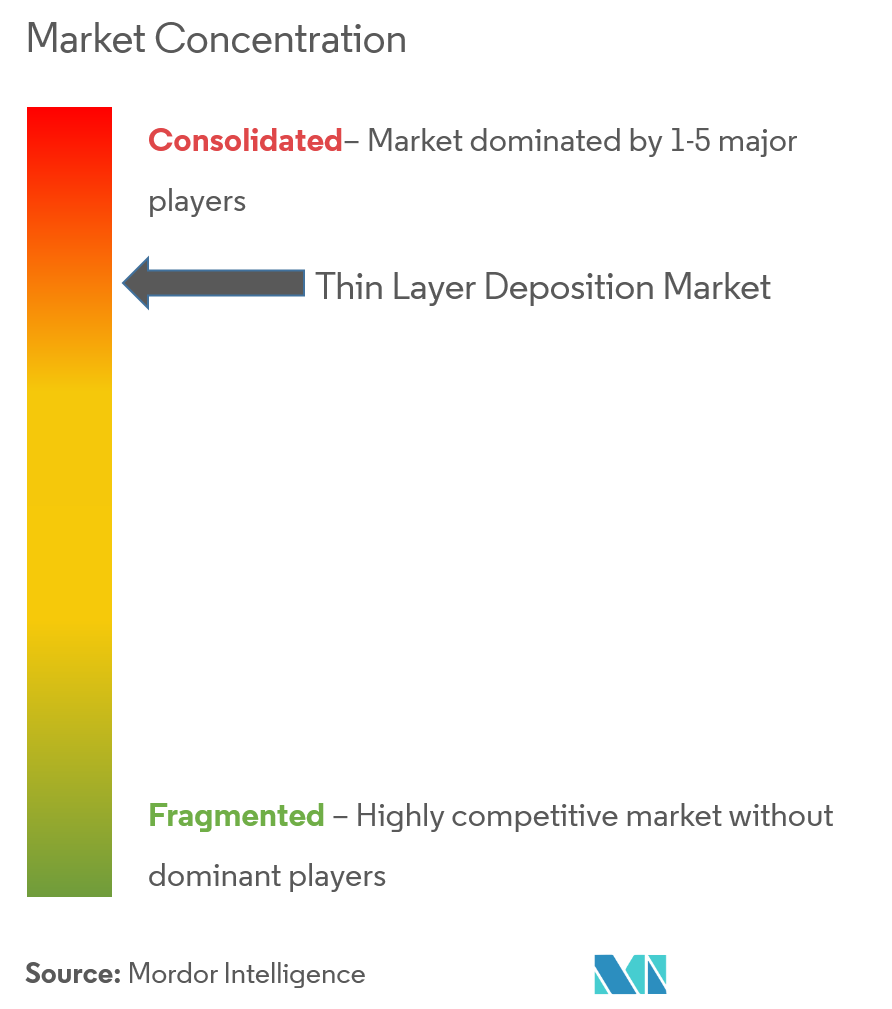

The thin layer depositionmarket is a highly competitive market and is currently dominated by a few players from Asia-Pacific, followed by those in North America and Europe, with their technological expertise in deposition technology. The global market is expected to be consolidated in nature, and the major players with a prominent share in the market are focusing on expanding their customer base across foreign countries by leveraging on strategic collaborative initiatives to increase their market share and their profitability.

- July 2019 -Applied Materials, Inc.announced a definitive agreement under which Applied will acquire all outstanding shares ofKokusai Electric Corporation for USD 2.2 billionin cash from global investment firm KKR.

- March 2019 - INORCOAT, provider of large PVD coating systems for heavy and big substrates developed a system of moving magnetrons. This development has brought in ease to handle parts and to support the process of PVD to achieve required efficacy and productivity for its potential customer and existing client.

Thin Layer Deposition Market Leaders

-

Applied Materials

-

Lam Research Corporation

-

Veeco Instruments Inc.

-

IHI Hauzer Techno Coating B.V.

-

Tokyo Electron Limited

- *Disclaimer: Major Players sorted in no particular order

Thin Layer Deposition Industry Segmentation

Thin Film Deposition is the method of applying a very thin film of material between a few nanometers to about 100 micrometers, or the thickness of a few atoms onto a substrate surface to be coated, or onto a previously deposited coating to form layers. Thin Film Deposition is usually divided into three categories such as Chemical Deposition, Physical Vapor Deposition, and Atomic layer Deposition coating systems.

| By Deposition Technology | Physical Vapor Deposition (PVD) |

| Chemical Vapor Deposition (CVD) | |

| Atomic Layer Deposition (ALD) | |

| Geography | North America |

| Europe | |

| Asia-Pacific | |

| Rest of the World |

Thin Layer Deposition Market Research FAQs

What is the current Thin Layer Deposition Market size?

The Thin Layer Deposition Market is projected to register a CAGR of 15.25% during the forecast period (2025-2030)

Who are the key players in Thin Layer Deposition Market?

Applied Materials, Lam Research Corporation, Veeco Instruments Inc., IHI Hauzer Techno Coating B.V. and Tokyo Electron Limited are the major companies operating in the Thin Layer Deposition Market.

Which is the fastest growing region in Thin Layer Deposition Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Thin Layer Deposition Market?

In 2025, the Asia Pacific accounts for the largest market share in Thin Layer Deposition Market.

What years does this Thin Layer Deposition Market cover?

The report covers the Thin Layer Deposition Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Thin Layer Deposition Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Thin Layer Deposition Industry Report

Statistics for the 2025 Thin Layer Deposition market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Thin Layer Deposition analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.