Thailand Textile Market Size

| Study Period | 2020 - 2030 |

| Base Year For Estimation | 2024 |

| Forecast Data Period | 2025 - 2030 |

| Historical Data Period | 2020 - 2023 |

| CAGR | 0.70 % |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Thailand Textile Market Analysis

The Thailand Textile Market is expected to register a CAGR of greater than 0.7% during the forecast period.

Thailand's textile industry is a major non-western entity that constitutes more than 2,000 garment companies and an almost equal number of textile firms, most of which are located around Bangkok and eastern Thailand. The textile and apparel industry of the country plays a key role in the country's GDP and export revenue. The textile industry in the country is quite expansive in nature, with a greater level of proficiency in the production, design, and sale of home textiles. It is a world-renowned silk producer, which also manufactures spin or twists yarn. It is also excelling in the latest trend of eco-friendly finishing, dyeing, and printing services, which meet global standards, although it has to deal with some issues.

Domestic consumer demand is lower in the Thai textile and garments industry, due to lower purchasing power, which is compelling the players to scour foreign markets to sell their textile and apparel products. Also, the textile industry in the country faces a shortage of raw materials. For instance, it produces hardly 2% of the raw cotton that is in demand for its cotton fabric manufacturing. This may hinder the newer market opportunities as compared with China and India. Currently, the garment industry supports more than 1 million employees, while the textile industry employs about 200,000 people, making these two industries the second most important employment sector in the country.

Thailand Textile Market Trends

This section covers the major market trends shaping the Thailand Textile Market according to our research experts:

Non-woven Textiles Segment is Expected to Witness a High Growth

Non-woven materials are used in a wide range of applications in the paper and packaging, automobile, agriculture, construction, textiles, healthcare, and medical industries. They are made of cross-laid, parallel-laid, or randomly laid webs tied up with adhesives or thermoplastic fibers. The material has properties of cushioning, thermal insulation, flame retardancy, strength, stretch, and softness. The non-woven materials segment is anticipated to witness significant growth in Thailand, owing to its multiple applications and the increasing demand for the same in the country, especially in the automobile industry. The properties such as being lightweight, high moldability, and durability, make these substances suitable to be used in vehicle components. The healthcare industry is also a significant contributor to the growth of the non-woven materials segment. Increasing safety measures while undergoing medical surgeries and other medical operations are anticipated to positively affect the market studied in the future.

Increasing Textile Exports from Thailand are Driving the Market Growth

Thailand has been focusing on exports its textiles to many countries including the United States, Japan, the United Kingdom, Russia, China, and others. The textile especially the garment industry is expanding its footprint globally, while the government is aiming at becoming more involved with the industry by providing export credits and the development of vocational training. The private sector has partnered with the government to boost innovation in the textile industry and bring modern technology into the industrial processes of weaving, finishing, printing, knitting, and dying. Presently, the focus is on modernizing technology for greater efficiency, as well as improving the skills of people working in the sector and increasing the competence of businesses operating in the textile and apparel industry. Thailand's home textile products, including bedding, curtains, bathroom textiles, and carpets, are exported throughout the world. Factors such as their delicate designs and hand-woven processes, ensuring that products achieve a premium quality that is widely recognized around the world which is anticipated to help the market to record more revenues in the forecast period.

Thailand Textile Industry Overview

The textile industry in the country faces competition with other low-cost manufacturing countries, such as Bangladesh, Vietnam, and Cambodia. Hence, the country needs to transform from a lower market, where the competition is huge, to a market that offers innovative products with fewer competitors and higher added value. The sector is made up of a few big firms and a large number of small and medium enterprises (SMEs) and more than 90% of them fall under SMEs.

Thailand Textile Market Leaders

-

Thai Textile Industry Public Company Limited

-

Thai Toray Textile Mills Public Company Ltd

-

Textile Prestige Public Company Limited

-

Thanulux Public Company Limited

-

Luckytex (Thailand) Public Company Limited

*Disclaimer: Major Players sorted in no particular order

Thailand Textile Market News

- In 2020, Thanulux officially launched Erawan Uniforms & Workwear Center and expanded its business into the Uniforms & Workwear product market.

Thailand Textile Market Report - Table of Contents

1. INTRODUCTION

1.1 Study Assumptions and Market Definition

1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET INSIGHTS AND DYNAMICS

4.1 Market Overview

4.2 Market Drivers

4.3 Market Restraints/Challenges

4.4 Market Opportunities

4.5 Value Chain Analysis

4.6 Industry Attractiveness - Porter's Five Forces Analysis

4.7 Technological Innovation in the Industry

4.8 Impact of COVID-19 on the Textile Industry

5. MARKET SEGMENTATION

5.1 By Application

5.1.1 Clothing Application

5.1.2 Industrial/Technical Application

5.1.3 Household Application

5.2 By Material Type

5.2.1 Cotton

5.2.2 Jute

5.2.3 Silk

5.2.4 Synthetics

5.2.5 Wool

5.2.6 Other Material Types

5.3 By Process

5.3.1 Woven

5.3.2 Non-woven

6. COMPETITIVE LANDSCAPE

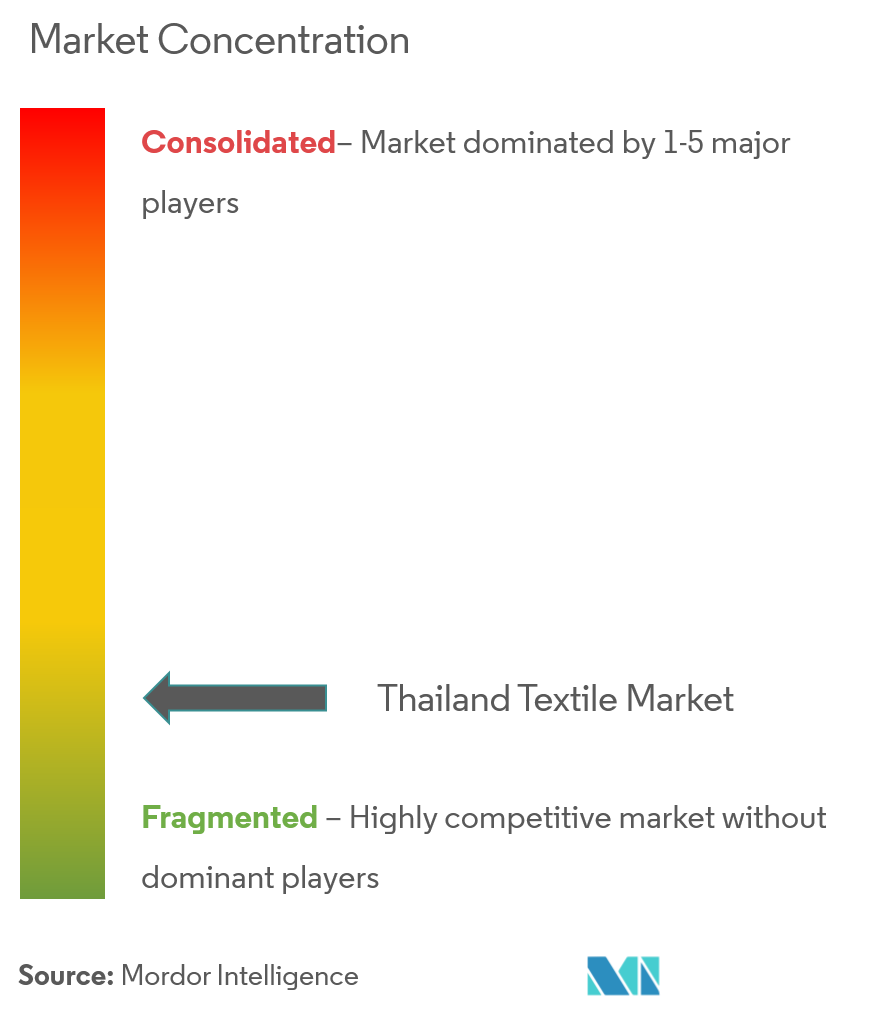

6.1 Market Concentration Overview

6.2 Company Profiles

6.2.1 Thanulux Public Co Ltd

6.2.2 Textile Prestige Public Co Ltd

6.2.3 Nan Yang Textile Group

6.2.4 Thai Textile Industry Public Co Ltd

6.2.5 Erawan Textile Co Ltd

6.2.6 Luckytex (Thailand) Public Co Ltd

6.2.7 High-Tech Apparel Co Ltd

6.2.8 Hong Seng Knitting Co Ltd

6.2.9 Thai Toray Textile Mills Public Co Ltd

6.2.10 Thai Acrylic Fibre Co Ltd*

- *List Not Exhaustive

7. FUTURE OF THE MARKET

8. DISCLAIMER

Thailand Textile Industry Segmentation

The report aims to provide a detailed analysis of Thailand textile industry. It focuses on market dynamics, technological trends, and insights on the geographical segments and the process, material, and application types. Also, it analyses the major players and the competitive landscape in the global textile industry. By Application Type, the Textile Industry in Thailand is Segmented into Clothing Application, Industrial/Technical Application, and Household Application, by Material into Cotton, Jute, Silk, Synthetics, and Wool, and by Process into Woven and Non-woven. The report offers market size and forecasts for the Thailand textile industry in Value (USD million) for all the above segments.

| By Application | |

| Clothing Application | |

| Industrial/Technical Application | |

| Household Application |

| By Material Type | |

| Cotton | |

| Jute | |

| Silk | |

| Synthetics | |

| Wool | |

| Other Material Types |

| By Process | |

| Woven | |

| Non-woven |

Thailand Textile Market Research FAQs

What is the current Thailand Textile Market size?

The Thailand Textile Market is projected to register a CAGR of greater than 0.7% during the forecast period (2025-2030)

Who are the key players in Thailand Textile Market?

Thai Textile Industry Public Company Limited, Thai Toray Textile Mills Public Company Ltd, Textile Prestige Public Company Limited, Thanulux Public Company Limited and Luckytex (Thailand) Public Company Limited are the major companies operating in the Thailand Textile Market.

What years does this Thailand Textile Market cover?

The report covers the Thailand Textile Market historical market size for years: 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Thailand Textile Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Thailand Textile Industry Report

Statistics for the 2025 Thailand Textile market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Thailand Textile analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.