Syringe Filling Machine Market Analysis

The Syringe Filling Machine Market is expected to register a CAGR of 9% during the forecast period.

- In recent years there has been a growing demand for prefilled syringes as there has been an increased need for patient safety, improved working conditions, and reduced cost of production in the pharmaceutical industry. The market has seen several new developments and With Hikma Pharmaceuticals being the latest to launch a new prefilled syringe capability in the United States in September 2019. The company would be supplying heparin sodium injection, USP, 5000 units/mL in prefilled syringe form.

- Also, the growing demand to treat chronic diseases that require continuous vaccination is expected to boost the adoption of the syringe filling machines over the forecast period.

- According to Eurosurveillance's article on Hepatitis B and C prevalence and incidence in key population groups with multiple risk factors in the EU/ EEA, an estimated 71.1 million people are chronically infected with the hepatitis B virus (HBV) and hepatitis C virus (HCV), respectively. As the vaccines for such cases are available in pre-filled syringes form, its increased consumption is expected to boost the market growth.

- In February 2019 - BD launched BD HylokTM, its new glass pre-fillable syringe for the administration of viscous solutions such as hyaluronic acid dermal fillers available in 1ml long format, with additional sizes to be introduced in the future, and comes with an extensive data package to support product or drug manufacturers developmental, technical and registration efforts..

Syringe Filling Machine Market Trends

Increased Shelf Life and Reduction Of Wastage

- It is estimated that the medication stored inside of a prefilled syringe cartridge will remain sterile for approximately two to three years when compared to a standard syringe which can be sterile for only 12 hours when filled. Also, the prefilled syringes have lesser overfill when compared to manual filling. It is estimated that for a 0.5 ml vial, the USP recommends 20-25% overfill. In contrast, for 0.5 ml, the required overfills are less than 2%. As a result, potentially 18-23% more doses can be produced.

- Also, With the increasing technological disruptions taking place across industries, owing to the wide-adoption of Industry 4.0 and automation amongst others, the pharmaceutical industry is adopting new and effective methods of drug creation. Pharmaceutical syringe filling equipment allows companies to streamline the syringe packing process as these are capable of filling up to hundreds of syringes per minute.

- The pharmaceutical syringe filling equipment maintains longer sterility and provides precise, automated control over barriers, tips, and additional accessories required for syringes. Moreover, the manufacturers can bring the the overal cost down with the help of high output pharmaceutical syringe filling machines.

- In March 2019, the pharmaceutical packaging company Schott Kaisha expanded its capacity to manufacture vials, pre-filled syringes, and sterile solutions. The company’s expansion plans include new sites in Gujarat and North India, along with the expansion and up-gradation of existing plants in Daman and Jambusar in Gujarat. These developments are expected to augment the market growth in the emerging economies as the pharmaceutical companies start adopting these machines for their drug creation.

- The market is witnessing a rising need for infused product manufacturers for sufficient filling machinery for CBD and THC products. The CBD oil cartridges require filling equipment that can provide detailed parts, and simple changeover, and cleanup, quick turnaround, among other factors, due to which pharmaceutical companies have been more inclined towards syringe filling machine for CBD applications.

- In February 2019, Optima Pharma introduced its MultiUse filler machine designed to process different types of containers in a flexible and fully automated way. Optima’s MultiUse Filler fills vials, syringes, and cartridges with one machine and allows for small batch sizes and different container types. These initiatives by various pharmaceutical companies will further stimulate market growth.

North America is Expected to Hold Significant Share

- The CDC, FDA, and NASEN are the main regulatory bodies in the North American region. These regulatory bodies have been increasingly promoting the safety of the patients that are administered with vaccines. The prefilled syringes are going to play an important role in the administration of the vaccine in the US as there are rising concerns about the overdose of vaccines administered to children.

- Furthermore, this region has seen significant developments in the syringe filling machines, most recently NC-based Mission Health in Asheville, installed two RIV automated IV compounding systems from ARxIUM that sterile-fill liquids and lyophilized products into IV syringes, and bags for administration to Mission Health patients.

- Also, The increasing number of chronic diseases in the region that require frequent vaccine usage is one of the prominent factors contributing to the growth of the market over the forecast period. According to the hepatitis B foundation, Up to 80,000 Americans will become newly infected with Hepatitis B each year, and more than 2 million Americans are chronically infected. More and more manufacturers in this region are getting approval for prefilled syringes for Hepatitis B vaccines. Dynavax was one of the major pharma company to receive FDA approval for their pre-filled syringe vaccine HEPLISAV-B in March 2018.

- The technological advancements in the region in terms of robotics is one of the prominent factors that would drive the growth of the syringe filling machine in the region. For instance, FP Developments that provide syringe filling and handling, vial filling and handling, mark and verify, track-and-trace, unique device identification (UDI) uses a Universal Robots UR-3 robotic arm to perform aseptic syringe filling and capping.

Syringe Filling Machine Industry Overview

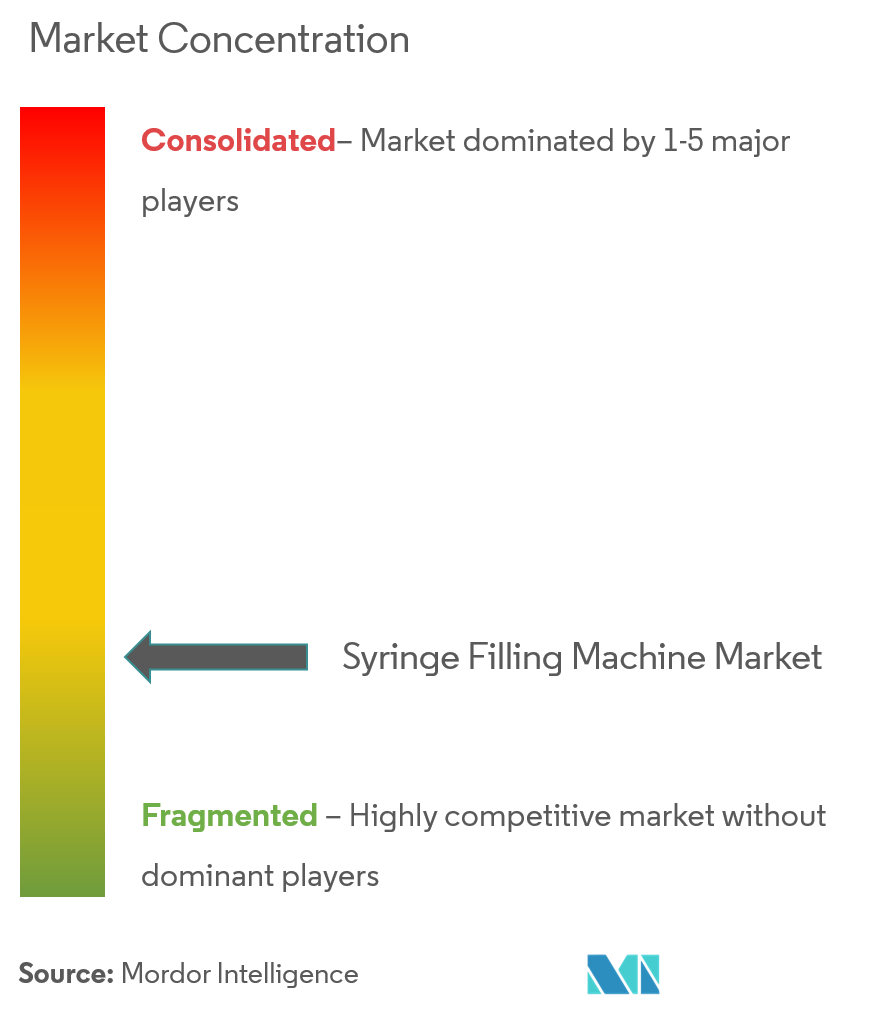

The market is highly fragmented with the presence of some key players such as Nordson Corporation, Romaco Group, and many smaller players. Innovation and cost have been a crucial factor for the companies operating in this market.

- April 2019 - Pharmaceutics International, Inc. (Pii), a Contract Development and Manufacturing Organization (CDMO) and Automated Systems of Tacoma, LLC (AST), a provider of flexible aseptic filling systems, announce their partnership on the new GENiSYSR filling machine for syringes, cartridges, and vials.GENiSYSR's adaptive approach uses flexible robotic automation to process ready-to-fill vials, syringes, and cartridges on the same machine. Both peristaltic and rotary piston dispensing systems are available to accurately fill each container directly on an electronic balance to provide up to 100% in-process fill weight inspection.

- December 2019 - Steriline, launched its robotic nest filling machine, the new machine is a compact filling machine specifically designed to be used in laboratories.

Syringe Filling Machine Market Leaders

-

Nordson Corporation

-

Romaco Group

-

Added Pharma B.V.

-

OPTIMA packaging group GmbH

-

Automated Systems of Tacoma (AST)

- *Disclaimer: Major Players sorted in no particular order

Syringe Filling Machine Industry Segmentation

A syringe filling machine fills the pre-sterile syringes with the desired drug. It also enables the user for batch filling of syringes for industries such as pharmaceutical and hospital pharmacy. This report segments the market by Type (Automated, Semiautomated, Manual), End-user Industry(Pharmaceutical, CDMO, and Other End-user Industries) and Geography.

| By Type | Automated |

| Semi-Automated | |

| Manual | |

| Geography | North America |

| Europe | |

| Asia Pacific | |

| South America | |

| Middle East and Africa |

Syringe Filling Machine Market Research FAQs

What is the current Syringe Filling Machine Market size?

The Syringe Filling Machine Market is projected to register a CAGR of 9% during the forecast period (2025-2030)

Who are the key players in Syringe Filling Machine Market?

Nordson Corporation, Romaco Group, Added Pharma B.V., OPTIMA packaging group GmbH and Automated Systems of Tacoma (AST) are the major companies operating in the Syringe Filling Machine Market.

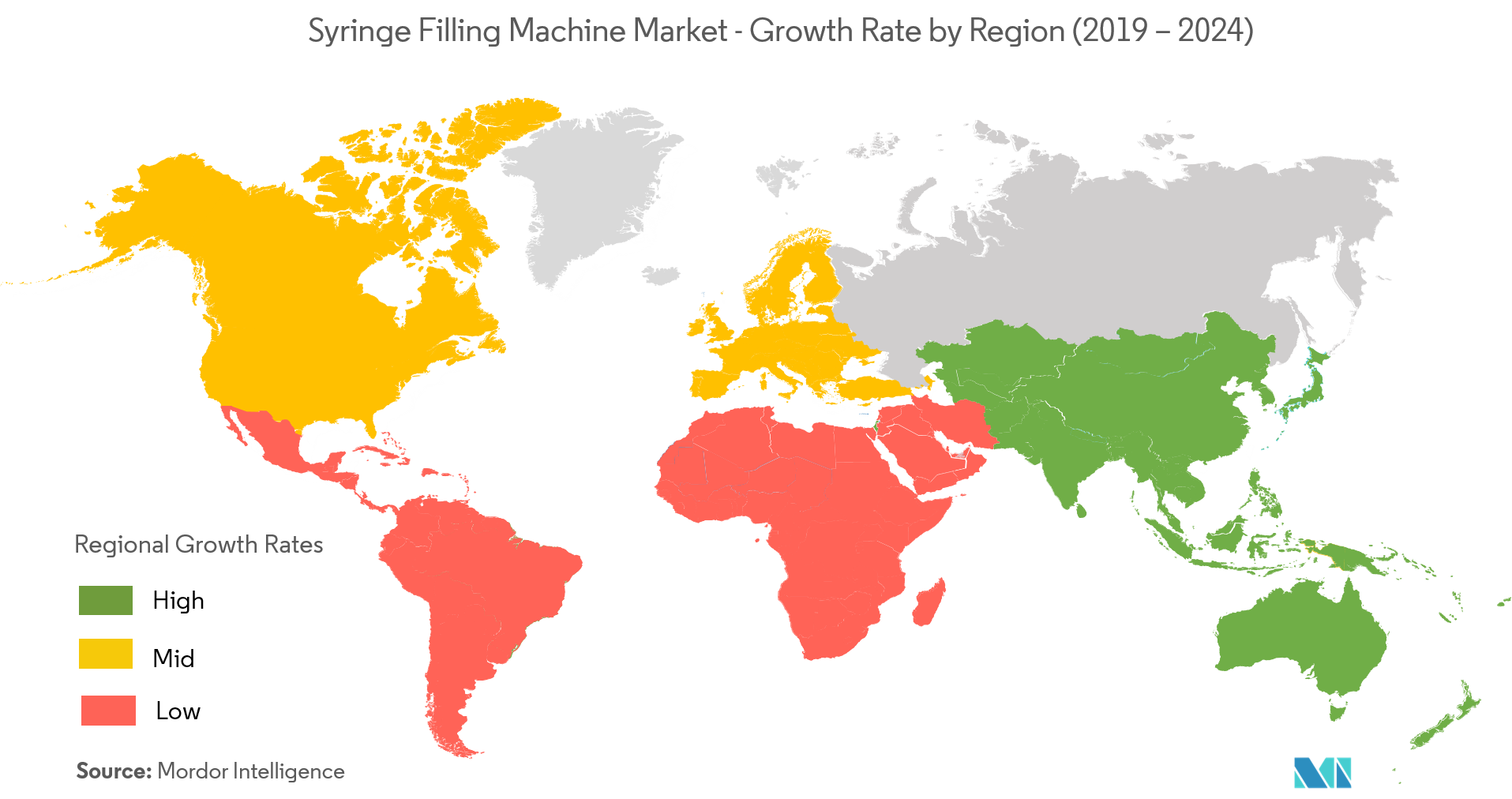

Which is the fastest growing region in Syringe Filling Machine Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Syringe Filling Machine Market?

In 2025, the North America accounts for the largest market share in Syringe Filling Machine Market.

What years does this Syringe Filling Machine Market cover?

The report covers the Syringe Filling Machine Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Syringe Filling Machine Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Brazil POS Terminal Industry Report

Statistics for the 2025 Syringe Filling Machine market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Syringe Filling Machine analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.