Subsea Well Access & BOP System Market Analysis

The Subsea Well Access and BOP System Market is expected to register a CAGR of less than 6% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. Presently the market has now reached pre-pandemic levels.

- Over the medium term, factors such as rising deepwater offshore development activities, owing to the increasing viability of offshore oil and gas projects, it is expected to drive the subsea well access and BOP system market globally.

- On the other hand, higher oil price volatility during recent years, owing to the supply-demand gap, geopolitics, and several other factors, has been restraining the growth of the subsea well access and BOP system market.

- Nevertheless, to efficiently prevent an accident, digitalization and advancements in BOP technology after the Deepwater Horizon oil spill of April 2010 is expected to act as an opportunity for the Subsea Well Access and BOP System Market.

- South America region is expected to have the highest growth rate during the forecast period, primarily due to the rapidly developing offshore activities in the region, over the forecast period.

Subsea Well Access & BOP System Market Trends

Vessel-based Well Access Systems to Dominate the Market

- The oil and gas industry is engaged in a growing movement to identify new techniques and technologies to help maximize revenues from existing brownfields and new assets by enhancing their output.

- Hence, the industry is moving toward the vessel-based/ rigless well-access system. The rigless well intervention is a system in which smaller vessels and light well access technology are used to perform well operations, avoiding the need for a larger drillship or rig and associated riser pipework.

- Vessel-based good access systems have lower Operating Expenditure (OPEX) than rig-based well access systems and contain multipurpose vessel-based services, which reduces mobilization/demobilization costs. With cost-effective good intervention and decommissioning, rigless technology offers a route to realizing greater efficiencies for many operators.

- Moreover, the production from the deepwater fields is expected to reach 7.6 million barrels per day by 2025 and 9 million barrels per day by 2040. The need for a vessel-based well access system is anticipated to rise in the coming years due to opportunities offered by the upcoming discoveries and drilling activities.

- Hence, with the increasing deepwater and ultra-deepwater activities in the South American, North American, and European regions, Vessel-based well access systems are anticipated to dominate the market.

Europe is expected to Dominate the Market

- Europe is expected to dominate the subsea well access and BOP system market and grow significantly over the forecast period.

- Further, in 2021, the subsidiary company of HMH, MHWirth AS, was hired by GMGS to supply a topsides drilling equipment package worth roughly USD 83 million. These contracts' combined scope will be implemented aboard a drillship managed by GMGS. The anticipated delivery date is December 2023.

- Furthermore, the Norwegian parliament has opened most of the North Sea, the Norwegian Sea, and the Barents Sea South (including the Southeast) for petroleum activities. The Norwegian Petroleum Directorate has estimated that around 47% of all the remaining resources on the shelf are still undiscovered.

- Moreover, in the second week of December 2022, 66 offshore rigs were available in Northwestern Europe. Comparing this to earlier in the year, there were five fewer rigs. In contrast, 55 offshore rigs were advertised and contracted. This region's utilization rate of marketed offshore oil rigs was 88.7 percent that month.

- Therefore, rising offshore oil and gas activities in the region are expected to increase the demand for subsea well access and BOP system market over the forecast period in the European region.

Subsea Well Access & BOP System Industry Overview

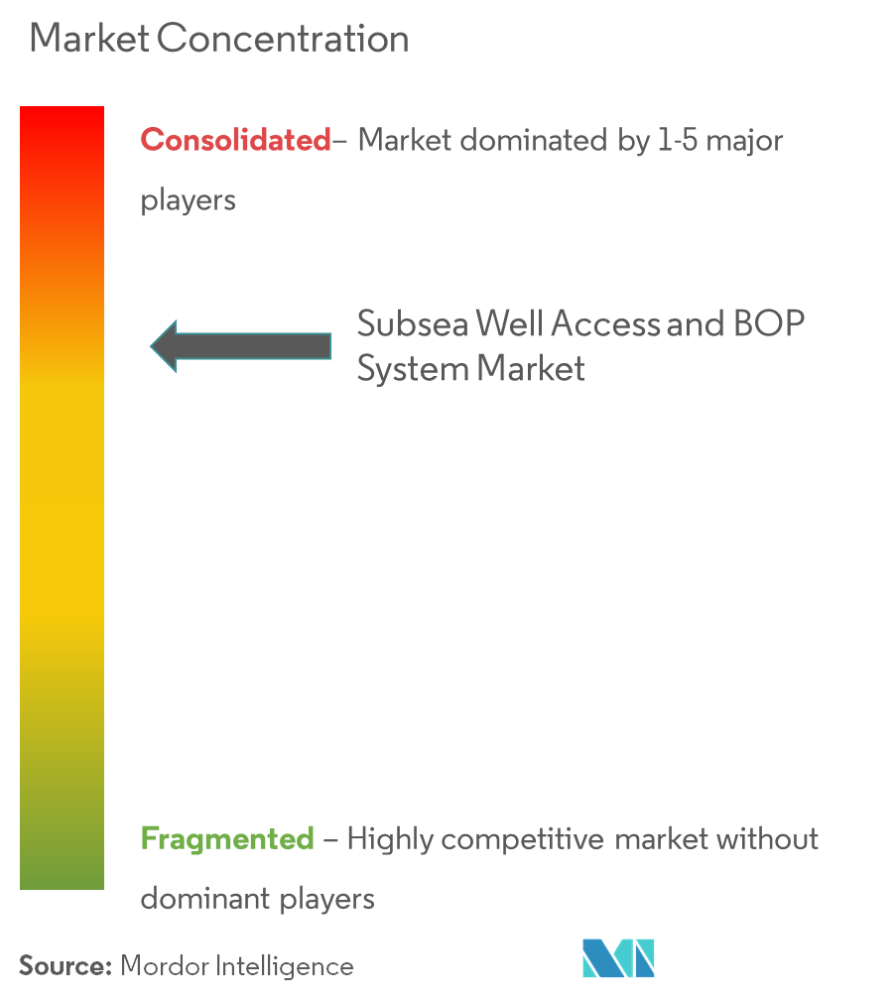

The Subsea Well Access and BOP System Market is partially consolidated due to the small number of companies operating in the industry. The key players in this market include (not in particular order) Baker Hughes Company, Schlumberger Limited, National Oilwell Varco Inc., Shandong Kerui Holding Group Co. Ltd, and Weatherford International PLC.

Subsea Well Access & BOP System Market Leaders

-

Baker Hughes Company

-

Schlumberger Limited

-

National Oilwell Varco Inc.

-

Shandong Kerui Holding Group Co. Ltd

-

Weatherford International Plc.

- *Disclaimer: Major Players sorted in no particular order

Subsea Well Access & BOP System Market News

- June 2022: FTAI Ocean, a Fortress Transportation and Infrastructure Investors LLC division, received a new well-intervention tower system from a UK-based company, Osbit. The system is 40 meters tall and comprises 1,300 tonnes of equipment. Osbit claims that the system will allow riser- and riderless-based well intervention operations in up to 1,500 meters of water.

- May 2022: The American energy services and technology company Baker Hughes introduced the MS-2 Annulus Seal, a new subsea wellhead technology. According to the company, the seal can significantly reduce operating rig expenses by reducing overall wellhead installation costs owing to reduced rig trips.

Subsea Well Access & BOP System Industry Segmentation

A subsea blowout preventer is a pressure control device in subsea oil and gas wells. Its primary function is to stop wellhead releases of gas and oil that are out of control. Subsea E&P activities are expanding, which is linked to reasons like growing environmental concerns.

The market is segmented by subsea well access system type, subsea BOP system type, and geography. By subsea well access system type, the market is segmented into vessel-based well access systems and rig-based well access systems. By subsea BOP system type, annular BOP, and ram BOP. The geography includes North America (the United States, Canada, rest of North America), Europe (Russia, United Kingdom, Norway, and the rest of Europe), Asia-Pacific (Australia, China, India, Indonesia, rest of Asia-Pacific), South America (Brazil, Venezuela, rest of South America), Middle-East and Africa (Saudi Arabia, Iran, Qatar, Egypt, rest of Middle-East and Africa)). The report also covers the market size and forecasts for the subsea well access and BOP system market across the major regions. For each segment, the market sizing and forecasts have been done based on revenue (USD Billion).

| Subsea Well Access System - By Type | Vessel-based Well Access Systems | ||

| Rig-based Well Access Systems | |||

| Subsea BOP System - By Type | Annular BOP | ||

| Ram BOP | |||

| Geography | North America | United States | |

| Canada | |||

| Rest of North America | |||

| Europe | Russia | ||

| United Kingdom | |||

| Norway | |||

| Rest of Europe | |||

| Asia-Pacific | Australia | ||

| China | |||

| India | |||

| Indonesia | |||

| Rest of Asia-Pacific | |||

| South America | Brazil | ||

| Venezuela | |||

| Rest of South America | |||

| Middle-East and Africa | Saudi Arabia | ||

| Iran | |||

| Qatar | |||

| Egypt | |||

| Rest of Middle-East and Africa | |||

Subsea Well Access & BOP System Market Research FAQs

What is the current Subsea Well Access and BOP System Market size?

The Subsea Well Access and BOP System Market is projected to register a CAGR of less than 6% during the forecast period (2025-2030)

Who are the key players in Subsea Well Access and BOP System Market?

Baker Hughes Company, Schlumberger Limited, National Oilwell Varco Inc., Shandong Kerui Holding Group Co. Ltd and Weatherford International Plc. are the major companies operating in the Subsea Well Access and BOP System Market.

Which is the fastest growing region in Subsea Well Access and BOP System Market?

South America is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Subsea Well Access and BOP System Market?

In 2025, the Europe accounts for the largest market share in Subsea Well Access and BOP System Market.

What years does this Subsea Well Access and BOP System Market cover?

The report covers the Subsea Well Access and BOP System Market historical market size for years: 2021, 2022, 2023 and 2024. The report also forecasts the Subsea Well Access and BOP System Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Subsea Well Access and BOP System Industry Report

Statistics for the 2025 Subsea Well Access and BOP System market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Subsea Well Access and BOP System analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.