South America Soy Protein Ingredients Market Analysis by Mordor Intelligence

The South America Soy Protein Ingredients Market is expected to register a CAGR of 6.81% during the forecast period.

- South America soy protein ingredients market is driven by growing inclination toward vegan diets, the functional efficiency, the cost competitiveness offered by such plant protein products, and their increasing utilization in wide variety of processed foods, especially in the ready-to-eat product category.

- Moreover, the emerging demands for plant-based proteins coupled with gradual preference for meat substitutes have driven themarket forsoy protein ingredients in South America.

South America Soy Protein Ingredients Market Trends and Insights

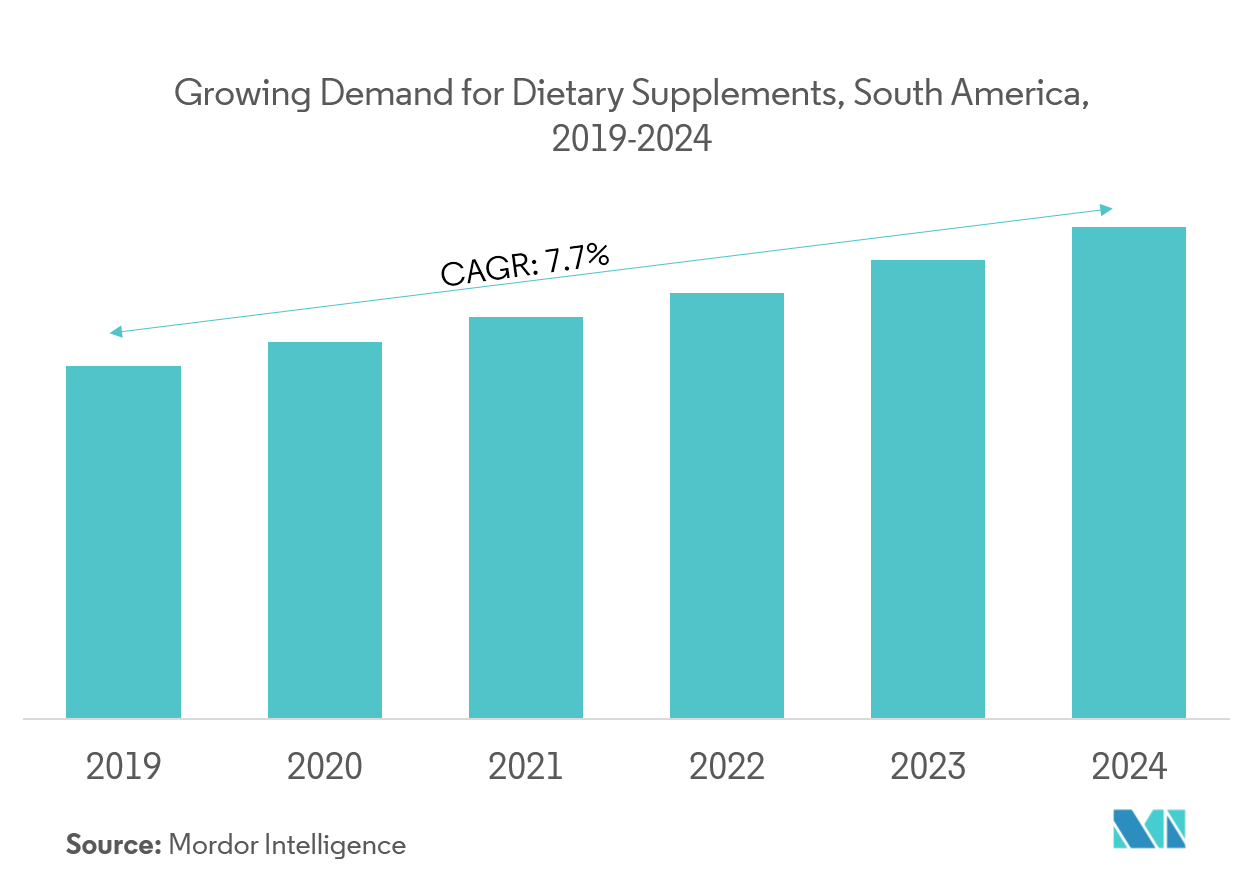

Increasing Demand for Nutritional Products

South American soy protein ingredients market is propelled by demand for sports and nutrition products by athletes, body builders, and recuperating patients. Additionally weight management category is also growing where protein is the main constituent ingredient. A huge lactose intolerant population that drives demand for alternate dairy substitutes, such as soy protein characterizes South America. Further, there is a substantial untapped potential for the GMO-free and clean-label based soy protein ingredients. Manufacturers are seeking eco-friendly ways of cultivating and/or sourcing soybeans in order to process into high quality and safe soy proteins.

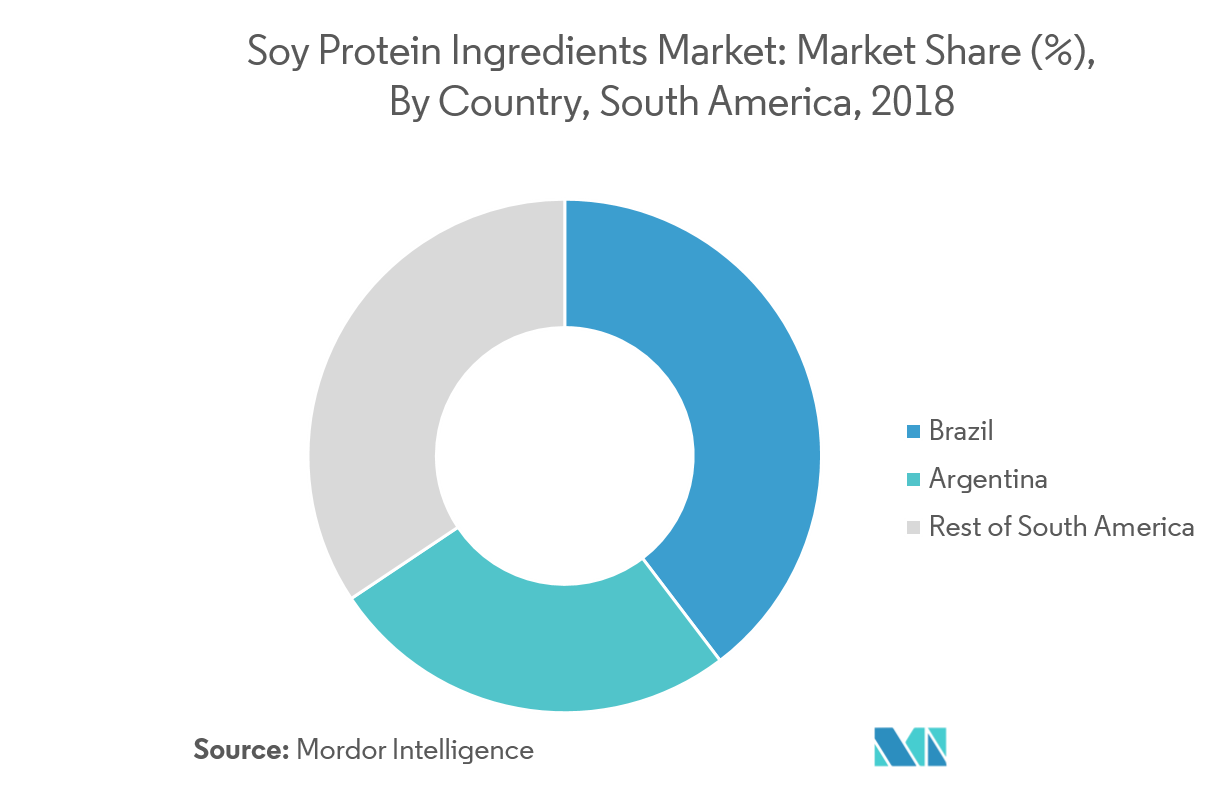

Brazil Holds the Largest Market Share in South America Soy Protein Ingredients Market

Organic soy protein is commonly used in protein and energy bars, breakfast cereals, various processed meats, and meat alternatives for improvement in taste and texture, as well as in a number of muscle gain supplements in the fitness industry. Geographically, the South American market for organic soy protein is segmented into Brazil, Argentina, and Mexico, of which, Brazil contributes the largest share. With an increase in R&D and a surge in soy production in the recent times, many companies have shown interest in setting up manufacturing units in these regions of South America.

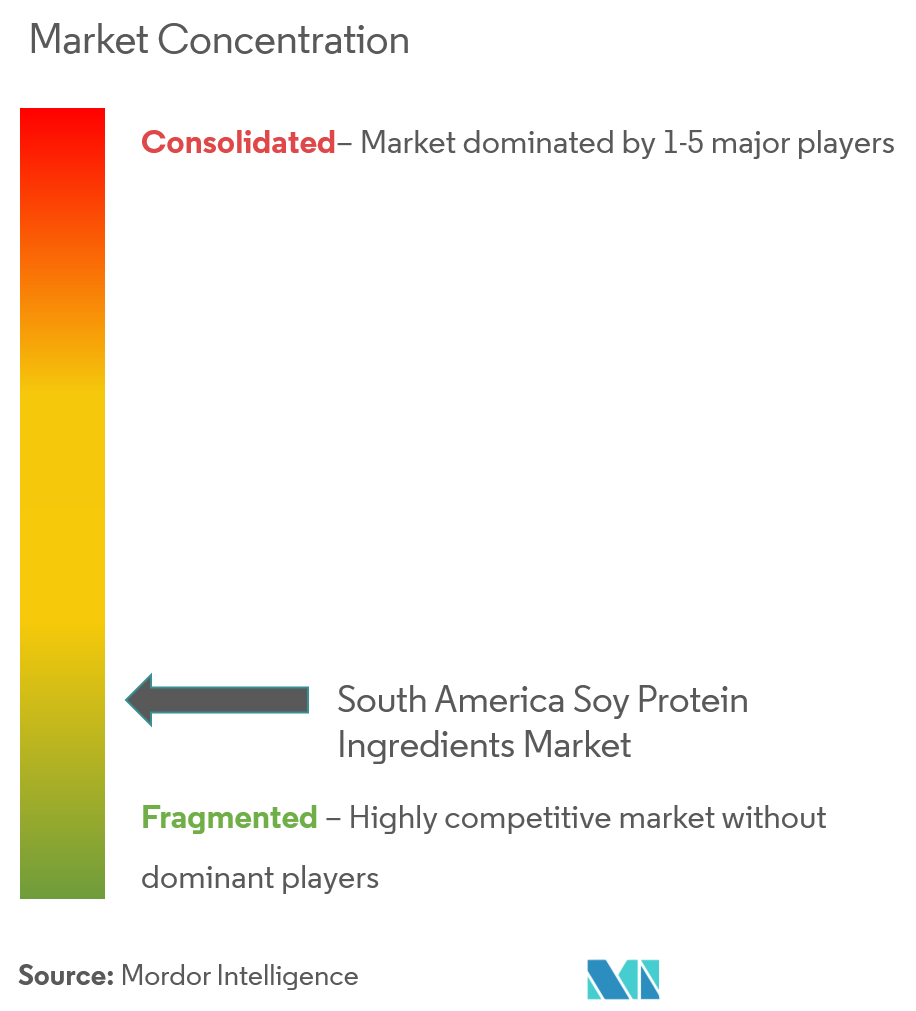

Competitive Landscape

The majorplayers in South America soyprotein ingredientsmarketinclude Ajinomoto,Kerry Group, Tate & Lyle,Dien Inc.,KF Specialty Ingredients, and Arla Foods Ingredients, among others.

South America Soy Protein Ingredients Industry Leaders

-

Ajinomoto

-

Kerry Group

-

Tate & Lyle

-

Dien Inc.

-

Archer Daniels Midland Company

- *Disclaimer: Major Players sorted in no particular order

South America Soy Protein Ingredients Market Report Scope

South America soy protein ingredients market is segmented by type such as soy isolates, soy concentrate, and textured soy protein. On the basis of application, the market is segmented into bakery and confectionery, meat extenders and substitutes, nutritional supplements, beverages, and others. Also, the study provides an analysis of the soy protein ingredients in the emerging and established markets across the region, including Brazil, Argentina, and rest of South America.

| Soy Isolates |

| Soy Concentrate |

| Textured Soy Protein |

| Bakery and Confectionery |

| Meat Extenders and Substitutes |

| Nutritional Supplements |

| Beverages |

| Other Applications |

| South America | Brazil |

| Argentina | |

| Rest of the South America |

| By Type | Soy Isolates | |

| Soy Concentrate | ||

| Textured Soy Protein | ||

| By Application | Bakery and Confectionery | |

| Meat Extenders and Substitutes | ||

| Nutritional Supplements | ||

| Beverages | ||

| Other Applications | ||

| Geography | South America | Brazil |

| Argentina | ||

| Rest of the South America | ||

Key Questions Answered in the Report

What is the current South America Soy Protein Ingredients Market size?

The South America Soy Protein Ingredients Market is projected to register a CAGR of 6.81% during the forecast period (2025-2030)

Who are the key players in South America Soy Protein Ingredients Market?

Ajinomoto, Kerry Group, Tate & Lyle, Dien Inc. and Archer Daniels Midland Company are the major companies operating in the South America Soy Protein Ingredients Market.

What years does this South America Soy Protein Ingredients Market cover?

The report covers the South America Soy Protein Ingredients Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the South America Soy Protein Ingredients Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Page last updated on:

South America Soy Protein Ingredients Market Report

Statistics for the 2025 South America Soy Protein Ingredients market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. South America Soy Protein Ingredients analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.