South America Cereal Bar Market Analysis by Mordor Intelligence

The South America Cereal Bar Market is expected to register a CAGR of 4.3% during the forecast period.

- Consumer demand for convenient and healthy on-the-go snack options has by-far been the primary attribute for sales of cereal bars, in South America. The changing lifestyle of consumers involving the consumption of smaller meals is further leading to the increased consumption of such bars, which is expected to propel the demand for cereal bars

- The traditional diet in South America that is mostly based on starch and sugar provides energy while raising the blood sugar level. Cereal bar, which is composed of healthy grains, along with nutritional ingredients, satisfies both hunger and nutrition, and therefore, is being considered as an all-round product.

South America Cereal Bar Market Trends and Insights

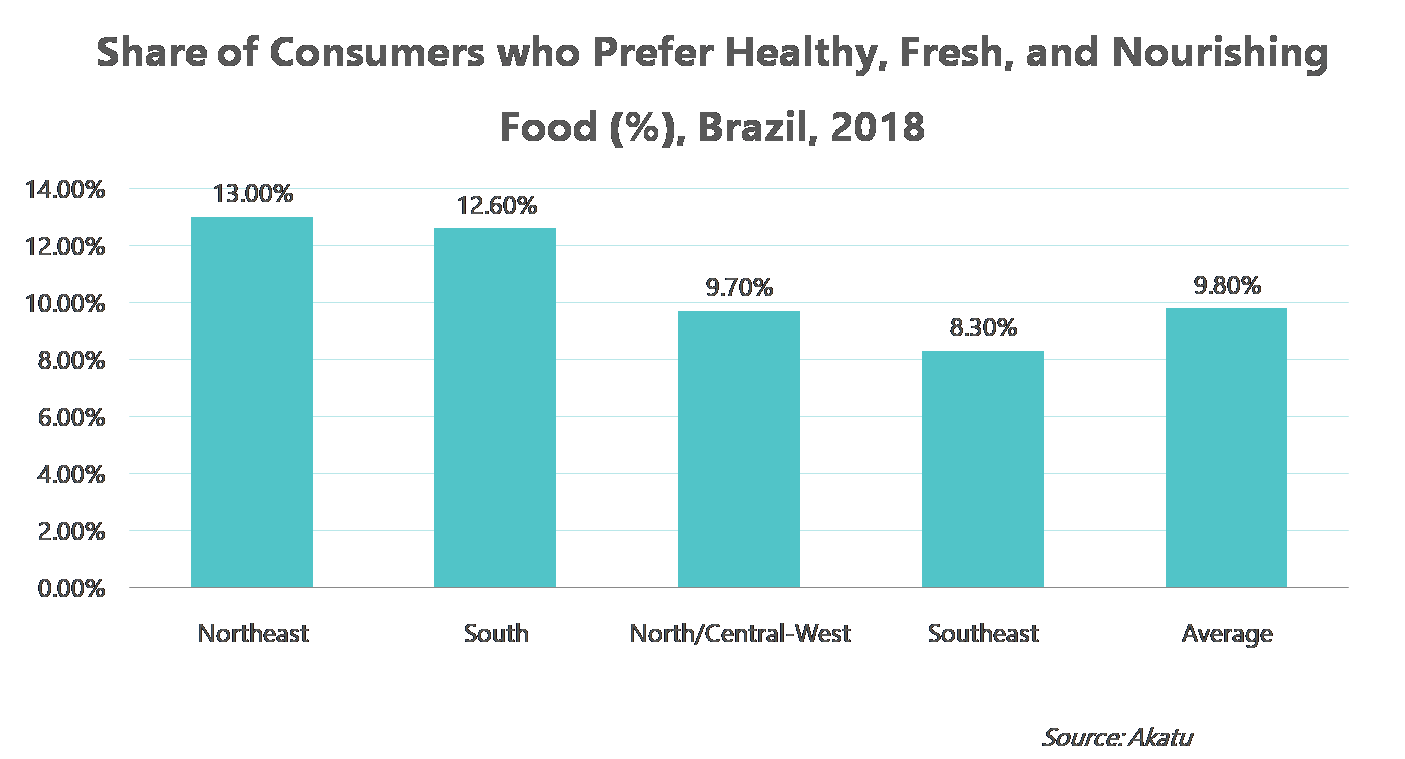

Surge In The Consumption Of Healthy Food

With increasing awareness among consumers about healthy diet, cereal bars have become immensely popular, replacing chocolates, cakes, and biscuits, as convenient options to the consumers. Key players operating in the South American cereal bar market are continuously differentiating their products in terms of flavors, ingredients, size, and packaging, in order to gain a competitive advantage. The rising health consciousness among consumers and the growing popularity of organic foods and beverages are driving the demand for functional cereal bars across the region. To cater to this audience, the vendors are introducing several product categories that are organic and functional.

Granula/Muesli Bar Holds The Major Share

Competitive Landscape

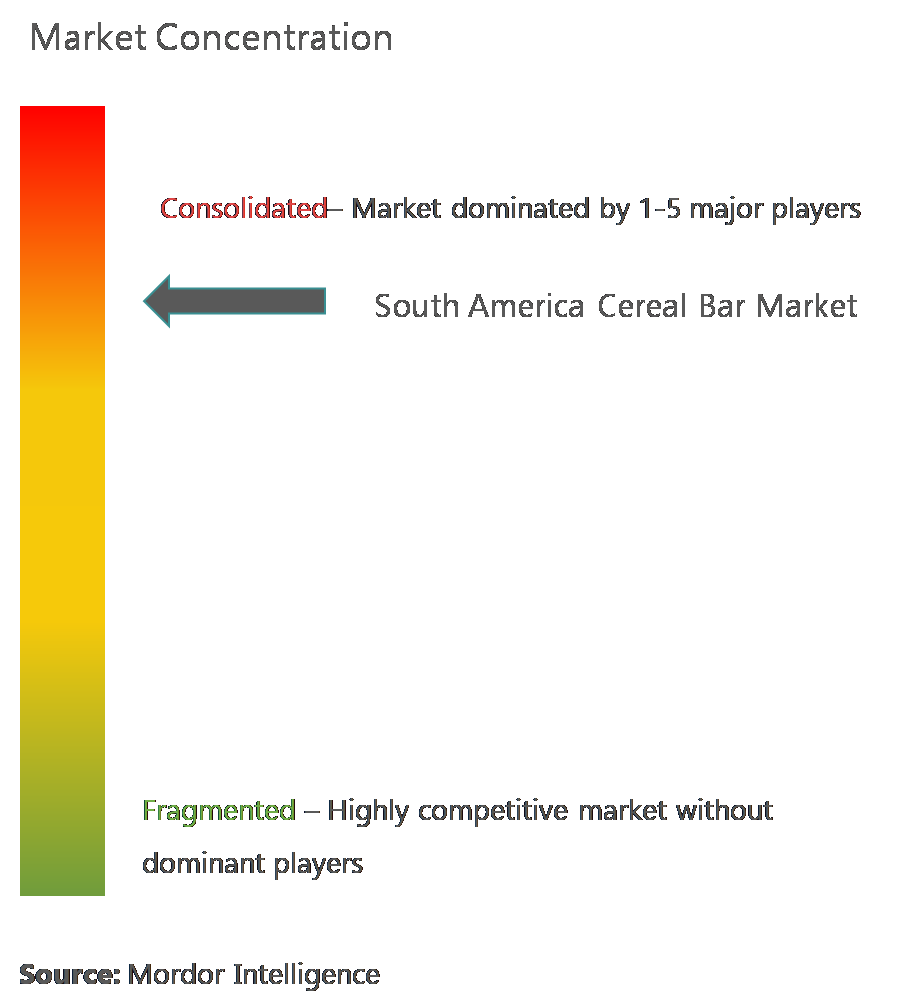

South America cereal bar market is a consolidated market with the major players holding the major market share. Sustainable competitive advantage through product innovation is the main criteria for the growth of the market share of major players across the region. Moreover, companies are using digital and social media advertisements to make consumers aware about the new product launches in the market.

South America Cereal Bar Industry Leaders

-

General Mills Inc.

-

Pepsico, Inc

-

Kellogg Company

-

Mondelez International

-

Nestle SA

- *Disclaimer: Major Players sorted in no particular order

South America Cereal Bar Market Report Scope

The South America Cereal Bar market is segmented by Product Type into Granola/Muesli Bars and Others. The Market is segmented by Distribution Channel into Supermarkets/Hypermarkets, Convenience Stores, Online Retail Stores and Others. The regional analysis by country of the market is also included.

| Granola/Muesli Bars |

| Other Cereal Bars |

| Supermarkets/Hypermarkets |

| Convenience Stores |

| Online Retail Stores |

| Other Distribution Channels |

| Brazil |

| Argentina |

| Rest of South America |

| By Product Type | Granola/Muesli Bars |

| Other Cereal Bars | |

| By Distribution Channel | Supermarkets/Hypermarkets |

| Convenience Stores | |

| Online Retail Stores | |

| Other Distribution Channels | |

| South America | Brazil |

| Argentina | |

| Rest of South America |

Key Questions Answered in the Report

What is the current South America Cereal Bar Market size?

The South America Cereal Bar Market is projected to register a CAGR of 4.3% during the forecast period (2025-2030)

Who are the key players in South America Cereal Bar Market?

General Mills Inc., Pepsico, Inc, Kellogg Company, Mondelez International and Nestle SA are the major companies operating in the South America Cereal Bar Market.

What years does this South America Cereal Bar Market cover?

The report covers the South America Cereal Bar Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the South America Cereal Bar Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Page last updated on:

South America Cereal Bar Market Report

Statistics for the 2025 South America Cereal Bar market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. South America Cereal Bar analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.