South Africa Food Sweetener Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| Forecast Data Period | 2024 - 2029 |

| Historical Data Period | 2019 - 2022 |

| CAGR | 5.80 % |

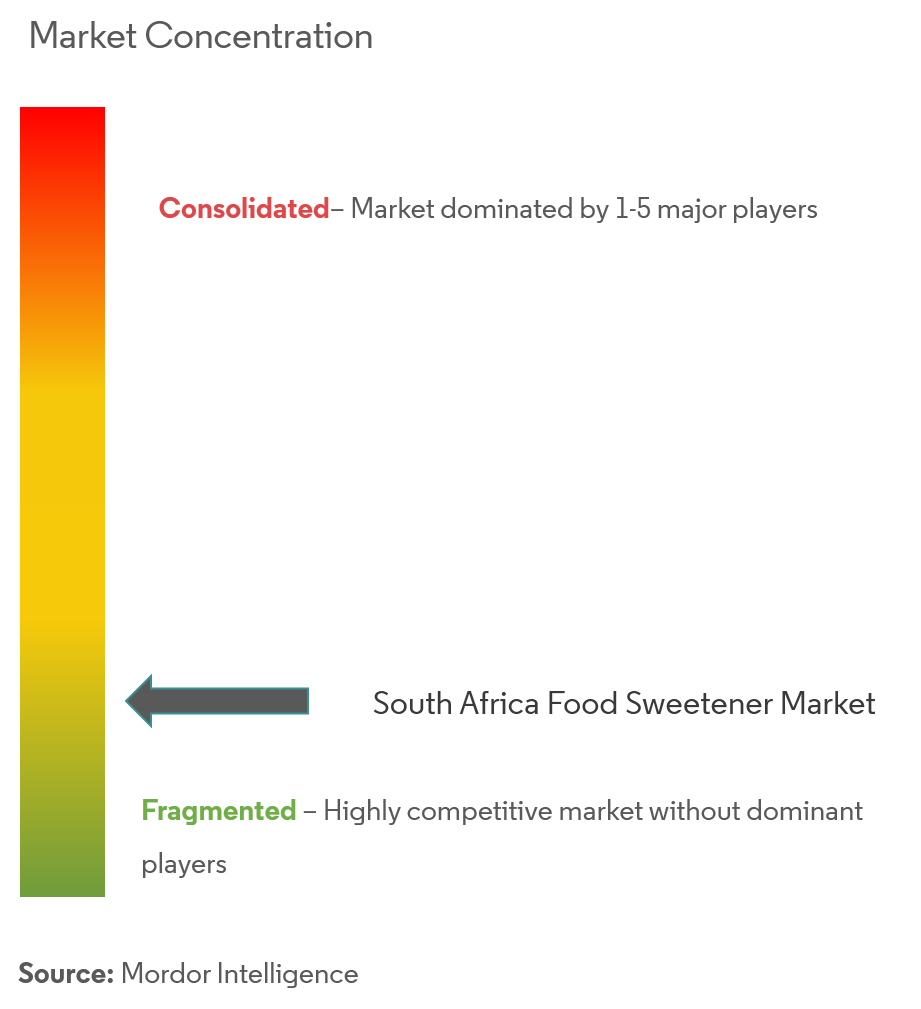

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

South Africa Food Sweetener Market Analysis

South Africa Food Sweeteners Market is forecasted to grow at a rate of 5.8%during the forecast period (2020- 2025).

- South African Food Sweetener market is the largest market in Africa holding around15% of the African market.

- The increasing levy on sugar is also a factor that leads the manufaturers to use sweeteners. Due to the increasing levy manufacturers are trying to reduce the sugar content, and in turn, the calorie content, but without compromising the taste of the final product.

- Even with high growth rates and higher consumption rates, consumers no longer want to consume artificial ingredients and controversy surrounding the possible health effects of artificial sweeteners are hindering the market.

South Africa Food Sweetener Market Trends

This section covers the major market trends shaping the South Africa Food Sweetener Market according to our research experts:

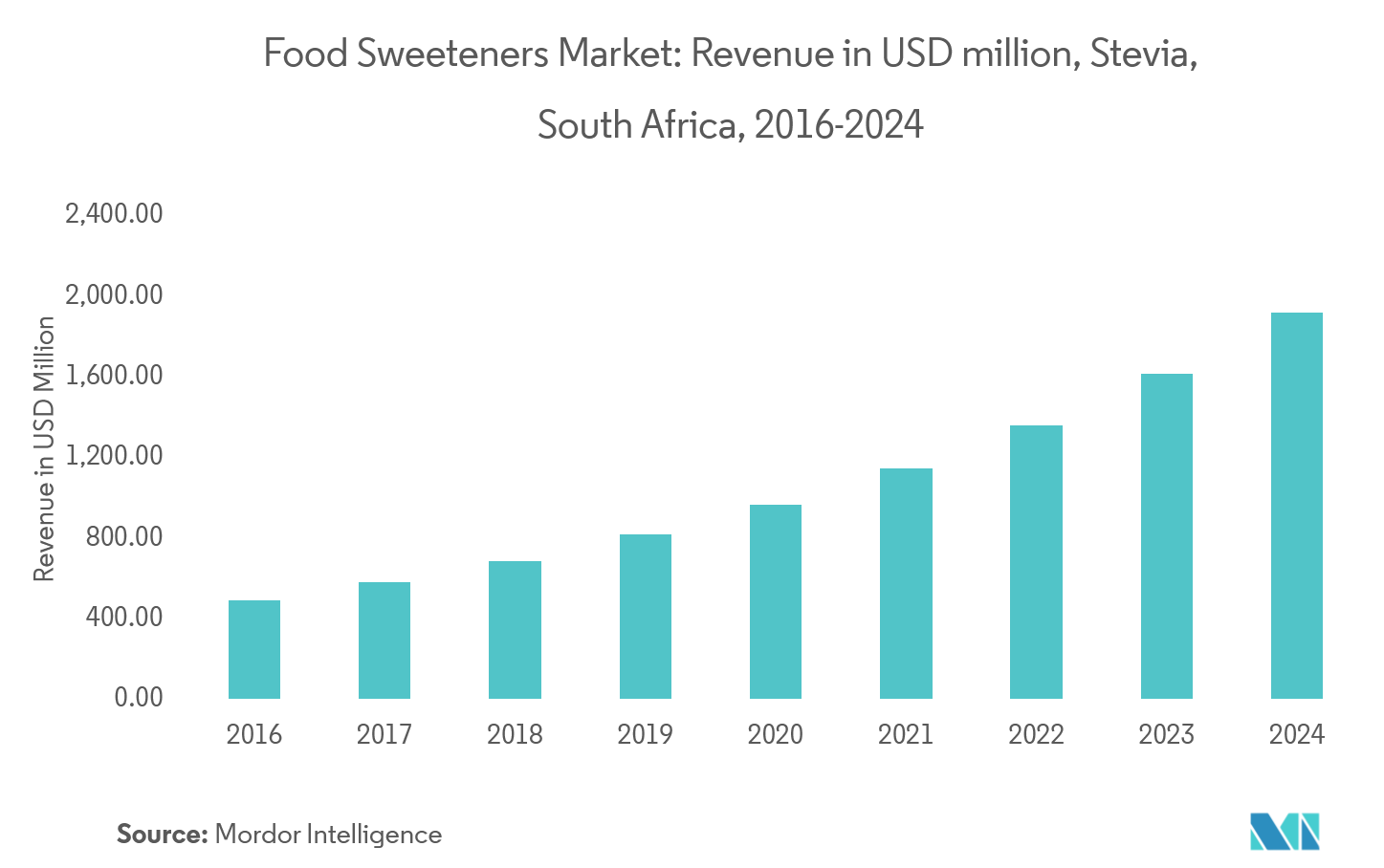

Stevia Is The Growing Sweetener Type

Stevia a natural sweetener, otherwise known as stevia rebaudiana, is known worldwide for its sweet plant leaves. Companies, such as Purecircle are investing heavily in R&D to meet the global demand for plant based sweetener across the entire food and beverage industry. Stevia, has been approved for use in South Africa with the recent promulgation (10 September 2012) of new sweetener regulations. Regulations Relating to the Use of Sweeteners in Foodstuffs, allows the use of extracts of Stevia rebaudiana, in composition and quantities in line with Codex standards, in food and beveglobal stevia consumption could eventually replace 20% to 30% of all dietary sweeteners in the nexrages.

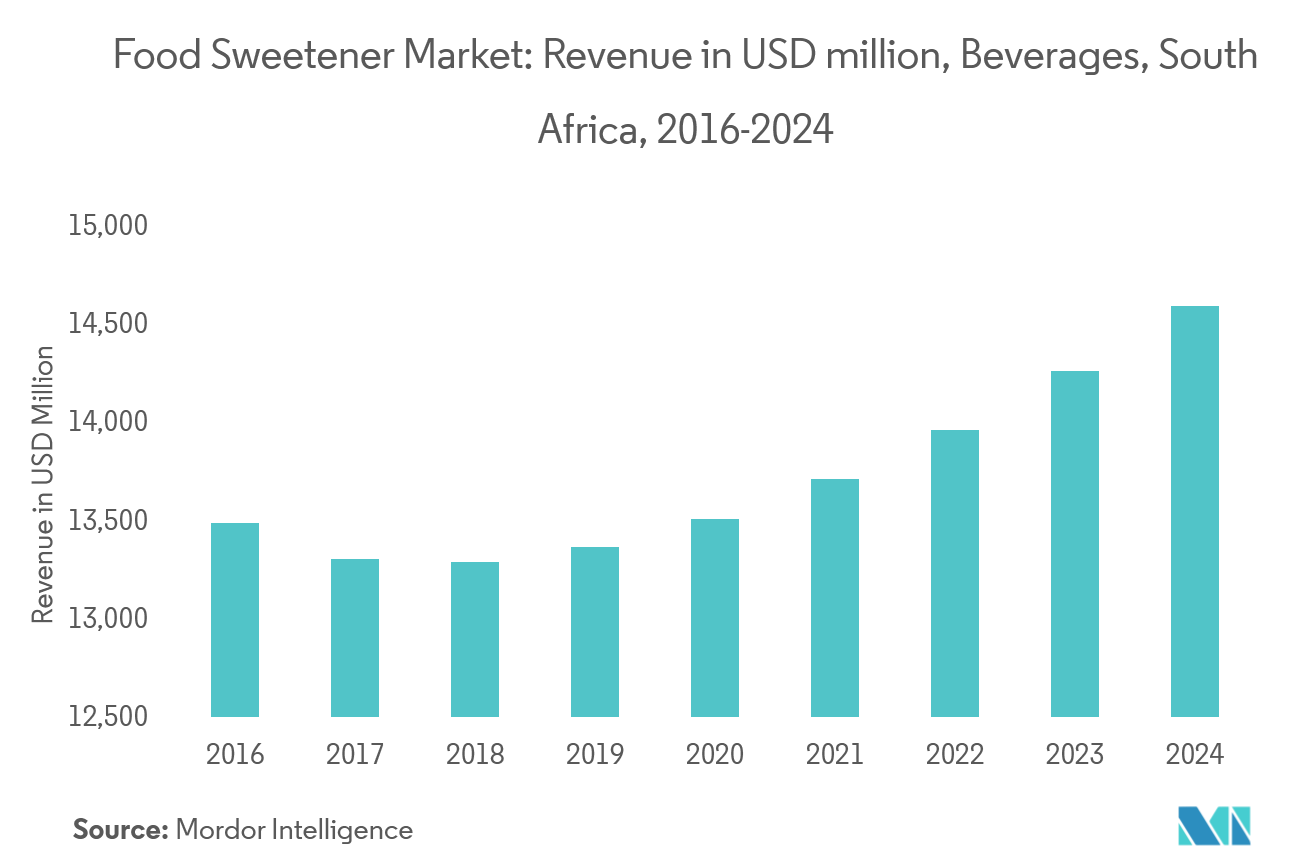

Beverage Segment Is One Of The Major Application Area

Intakes of soft drinks, colas, other sweetened carbonated beverages, and fruit drinks with added sugar have increased dramatically, especially among youth, whereas the intake of milk has declined.The intake of beverages has changed dramatically over the past few decades, coinciding with an increased prevalence of obesity. the South African Revenue Services (SARS) announced that it will start to collect sugar tax from all sweetened beverages, excluding 100% fruit juices. Due to recent studies on the detrimental health impact of beverages containing artificial sweeteners, consumers are increasingly turning to new products, such as ready to drink herbal teas, functional beverages, etc.

South Africa Food Sweetener Industry Overview

South Africa Food Sweetener market is a fragmented with the presence of various local and major players. Players are coming up with various sweeteners to expand their product portfolio and dominate the market. Players are also focusing on natural sweeteners since consumers are more attracted towards natural label.

South Africa Food Sweetener Market Leaders

-

Cargill

-

Tate & Lyle

-

ADM

-

Ingredion

*Disclaimer: Major Players sorted in no particular order

South Africa Food Sweetener Market Report - Table of Contents

-

1. INTRODUCTION

-

1.1 Study Assumptions

-

1.2 Scope of the Study

-

-

2. RESEARCH METHODOLOGY

-

3. EXECUTIVE SUMMARY

-

4. MARKET DYNAMICS

-

4.1 Market Drivers

-

4.2 Market Restraints

-

4.3 Porter's Five Forces Analysis

-

4.3.1 Threat of New Entrants

-

4.3.2 Bargaining Power of Buyers/Consumers

-

4.3.3 Bargaining Power of Suppliers

-

4.3.4 Threat of Substitute Products

-

4.3.5 Intensity of Competitive Rivalry

-

-

-

5. MARKET SEGMENTATION

-

5.1 By Product Type

-

5.1.1 Sucrose

-

5.1.2 Starch Sweeteners and Sugar Alcohols

-

5.1.2.1 Dextrose

-

5.1.2.2 High Fructose Corn Syrup (HFCS)

-

5.1.2.3 Maltodextrin

-

5.1.2.4 Sorbitol

-

5.1.2.5 Xylitol

-

5.1.2.6 Others

-

-

5.1.3 High Intensity Sweeteners (HIS)

-

5.1.3.1 Sucralose

-

5.1.3.2 Aspartame

-

5.1.3.3 Saccharin

-

5.1.3.4 Cyclamate

-

5.1.3.5 Ace-K

-

5.1.3.6 Neotame

-

5.1.3.7 Stevia

-

5.1.3.8 Others

-

-

-

5.2 By Application

-

5.2.1 Dairy

-

5.2.2 Bakery

-

5.2.3 Soups, Sauces and Dressings

-

5.2.4 Confectionery

-

5.2.5 Beverages

-

5.2.6 Others

-

-

-

6. COMPETITIVE LANDSCAPE

-

6.1 Most Active Companies

-

6.2 Most Adopted Strategies

-

6.3 Market Share Analysis

-

6.4 Company Profiles

-

6.4.1 Tate & Lyle PLC

-

6.4.2 Cargill Incorporated

-

6.4.3 Archer Daniels Midland Company

-

6.4.4 Ingredion Incorporated

-

6.4.5 Ajinomoto Co., Inc.

-

6.4.6 PureCircle Limited

-

6.4.7 GLG Life Tech Corporation

-

- *List Not Exhaustive

-

-

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

South Africa Food Sweetener Industry Segmentation

South Africa Food Sweetener Market is segmented by Type into Sucrose, Starch Sweeteners and Sugar Alcohols and High-Intensity Sweeteners. The market is segmented by Application into Dairy, Bakery, Beverages, Soups, Sauces and Dressings, Confectionery and Others.

| By Product Type | ||||||||||

| Sucrose | ||||||||||

| ||||||||||

|

| By Application | |

| Dairy | |

| Bakery | |

| Soups, Sauces and Dressings | |

| Confectionery | |

| Beverages | |

| Others |

South Africa Food Sweetener Market Research FAQs

What is the current South Africa Food Sweetener Market size?

The South Africa Food Sweetener Market is projected to register a CAGR of 5.80% during the forecast period (2024-2029)

Who are the key players in South Africa Food Sweetener Market?

Cargill, Tate & Lyle, ADM and Ingredion are the major companies operating in the South Africa Food Sweetener Market.

What years does this South Africa Food Sweetener Market cover?

The report covers the South Africa Food Sweetener Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the South Africa Food Sweetener Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

South Africa Sugar Alcohol Industry Report

Statistics for the 2024 South Africa Sugar Alcohol market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. South Africa Sugar Alcohol analysis includes a market forecast outlook 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.