Sorbitol Market Analysis

The Sorbitol Market size is estimated at USD 1.35 billion in 2025, and is expected to reach USD 1.86 billion by 2030, at a CAGR of 6.56% during the forecast period (2025-2030).

As the COVID-19 outbreak continued to spread globally, it has disrupted the entire supply chain, affecting the manufacturers' consumption patterns and investment plans by forcing companies to adopt different and new operations policies with an eye on health and well-being problems for manufacturers in the production line. COVID-19 has led to a decrease in the demand for sugar worldwide and has impacted the sugar industry, which is driving the demand for sorbitol. Consumers have become more conscious about their health and looking for food products that offer them health benefits. Also, the awareness regarding the harmful effect of sugar on health is increasing among consumers, and therefore, people are more inclined toward low-calorie and low-sugar food products, which drives the market.

Moreover, the increasing prevalence of diabetes and the rising number of health-conscious people is increasing the demand for sorbitol in the food industry as it offers low-calorie and low-sugar content. For instance, According to the U.S. Department of Health & Human Services, approximately 34.2 million people in the U.S. are suffering from diabetes which makes it about 10.5% of the population.

Growing consumer perception towards product benefits derived from natural ingredients is expected to drive the demand. The shift in preference towards organic personal care & cosmetic products owing to health & safety factors is expected to positively influence market growth. Increasing demand for low-calorie artificial sweeteners, particularly for diabetic patients, is likely to surge in sorbitol market growth. Also, raising awareness about dietary supplements and their nutritional benefits is also likely to have a positive impact on the industry in the near future. The demand for sorbitol will increase among consumers and in various industries due to rising health concerns and more inclination of consumers towards healthy products to lead a healthy lifestyle.

Sorbitol Market Trends

Increasing Demand From Emerging Countries

The shift in preference for convenience, driven largely by urbanization, a growing number of women in the workforce, and rising household incomes, among others, are driving the demand for artificial sweeteners, such as sorbitol, in emerging economies. Sorbitol is mainly used in the manufacture of confectionery, baked goods, and chocolate as a sweetener or moisture-stabilizing agent. The moisture-stabilizing action of sorbitol makes it a preferable choice for products that dry or harden faster, thus maintaining freshness during storage. Heart diseases and health issues are also a major concern in emerging countries. This is likely to drive the market for artificial sweeteners, which is one among the emerging food sweeteners that are non-caloric sweeteners and are 600 times sweeter than sugar.

North America Holds Significant Market Share

Rising concerns among the North American population regarding the adverse health effects caused due to the degradation of packaged goods, like bread rolls, frozen desserts, and chocolates, are expected to promote the usage of sorbitol, as it helps enhance the shelf life of such products. The market in the United States is now identified as saturated, in the case of both natural and artificial sweeteners, thereby leading to a slow pace of growth. Mexico is a high potential market for natural and artificial sweetener products. The country has a high proportion of obese population. The Mexican government's decision to increase the tax on sugary drinks by 10% highlights its serious intent to reduce sugar consumption. Over the review period, sugar consumption was adversely affected by strong campaigns from the government, primarily to spread awareness regarding the harmful effects of obesity. These factors are responsible for the highly competitive nature of the food sweetener market in the country.

Sorbitol Industry Overview

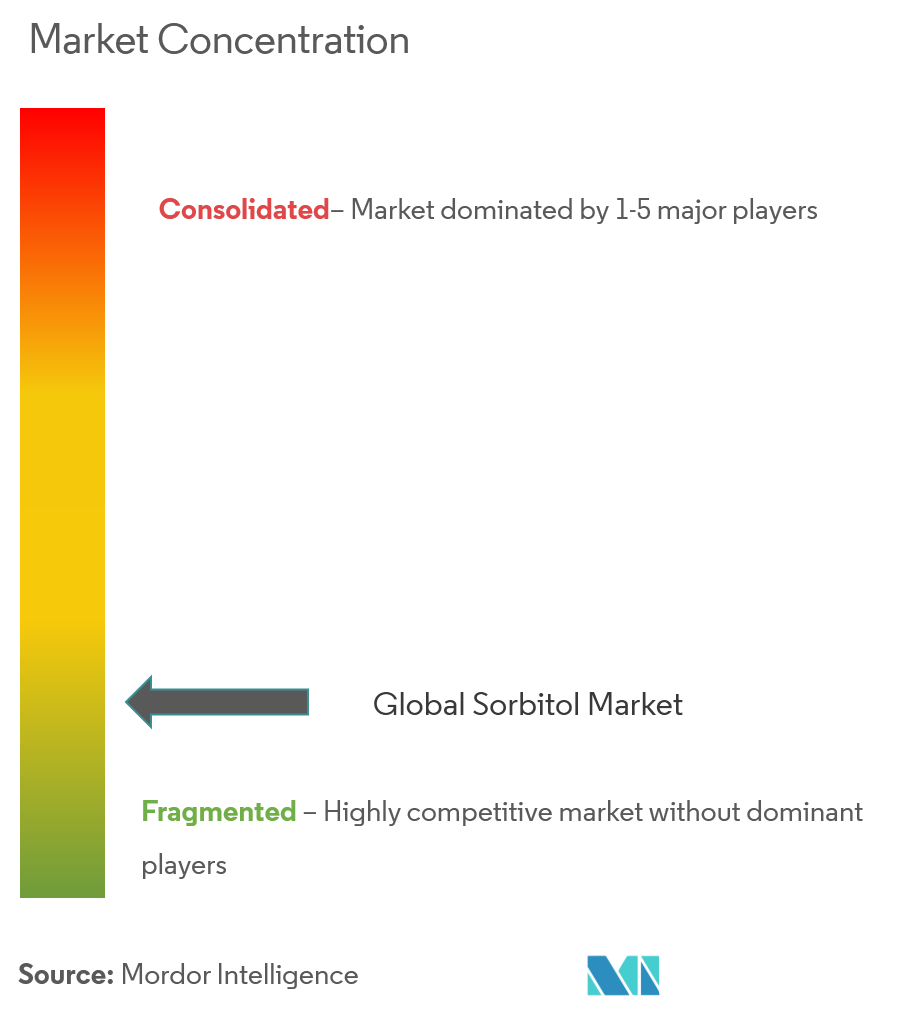

The global sorbitol market is currently competitive with the presence of major players such as Cargill, Merck, DuPont, Archer Daniels Midland Company, American International Foods Inc., SPI Pharma Inc., etc., altogether accounting for the highest market share. Strong brand loyalty for brands like Cargill and DuPont in emerging countries is the primary reason for these players enjoying a strong foothold in these markets. Acquisitions and new product launches are the most preferred growth strategies. Leading companies are focusing on expansions and partnerships. The market leaders are focused on launching innovative, low-calorie, and natural ingredient-based products. Huge investments have been made in R&D to develop products for specific needs.

Sorbitol Market Leaders

-

Cargill Inc.

-

DuPont

-

Archer-Daniels-Midland Company

-

Roquette Freres

-

Tereos Group

- *Disclaimer: Major Players sorted in no particular order

Sorbitol Market News

- In 2021, Archer Daniels Midland Company, a global leader in nutrition and agricultural origination and processing, announced today that it has completed its acquisition of Sojaprotein, a leading European provider of non-GMO soy ingredients in Chicago.

- In 2021, US-based food processor Cargill plans to acquire the bio-industrial business of the British specialty chemical maker Croda for about USD 1 billion to is continuing its push into biobased chemicals in Europe, Asia, and the Netherlands.

- In 2020, Ingredion has signed a strategic distribution agreement with Batory Foods. The arrangement has been integrated for Ingredion's distributor's presence in Southern California for helping food and beverage manufacturers to get the ingredients which they require for producing and bringing their products to the market.

Sorbitol Industry Segmentation

Sorbitol, a sweet-tasting crystalline compound found in some fruit, is a sugar alcohol that the human body metabolizes slowly. Sorbitol is used to impart taste and sweetness. The global sorbitol market is segmented by type into liquid sorbitol and powder/crystal sorbitol. By applications, it is segmented into confectionery, bakery, frozen food, dietary supplements, beverages, pharmaceuticals, cosmetics, and personal care. By Geography, the market is segmented into North America, Europe, Asia-Pacific, South America, and Middle-East and Africa. For each segment, the market sizing and forecasts have been done on the basis of value (in USD million).

| By Product Type | Liquid Sorbitol | ||

| Powder/Crystal Sorbitol | |||

| By Application | Confectionery | ||

| Bakery | |||

| Frozen Food | |||

| Dietary Supplements | |||

| Beverages | |||

| Pharmaceuticals | |||

| Cosmetics and Personal Care | |||

| Geography | North America | United States | |

| Canada | |||

| Mexico | |||

| Rest of North America | |||

| Europe | Spain | ||

| United Kingdom | |||

| Germany | |||

| France | |||

| Italy | |||

| Russia | |||

| Rest of Europe | |||

| Asia-Pacific | China | ||

| Japan | |||

| India | |||

| Australia | |||

| Rest of Asia-Pacific | |||

| South America | Brazil | ||

| Argentina | |||

| Rest of South America | |||

| Middle-East and Africa | South Africa | ||

| Saudi Arabia | |||

| Rest of Middle-East and Africa | |||

Sorbitol Market Research FAQs

How big is the Sorbitol Market?

The Sorbitol Market size is expected to reach USD 1.35 billion in 2025 and grow at a CAGR of 6.56% to reach USD 1.86 billion by 2030.

What is the current Sorbitol Market size?

In 2025, the Sorbitol Market size is expected to reach USD 1.35 billion.

Who are the key players in Sorbitol Market?

Cargill Inc., DuPont, Archer-Daniels-Midland Company, Roquette Freres and Tereos Group are the major companies operating in the Sorbitol Market.

Which is the fastest growing region in Sorbitol Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Sorbitol Market?

In 2025, the North America accounts for the largest market share in Sorbitol Market.

What years does this Sorbitol Market cover, and what was the market size in 2024?

In 2024, the Sorbitol Market size was estimated at USD 1.26 billion. The report covers the Sorbitol Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Sorbitol Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Sorbitol Industry Report

Statistics for the 2025 Sorbitol market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Sorbitol analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.