Software Defined Security Market Analysis

The Software Defined Security Market is expected to register a CAGR of 33.81% during the forecast period.

- Software-defined storage (SDS) is one of the new technologies trending in the enterprise storage market. SDS is part of a larger ecosystem where the software is separated from its respective hardware, revealing the freedom to choose installed hardware depending on the amount of storage needed. SDS enables cost savings while improving performance and flexibility. Thus, enterprises are slowly shifting toward software-defined storage.

- Multiple associations shape how SDS is employed across end-user industries with direct connections to major vendors, most of which are involved in similar endeavors. The Storage Network Industry Association (SNIA) sets standards for the enterprise storage industry. The established storage vendors include IBM, Dell EMC, NetApp, and emerging players, like Atlantis Computing and Falcon Star. Some offer software, like NetApp, IBM, and RedHat, while others offer hyper-converged solutions, like HPE and Dell EMC. Others, like Cisco, offer hardware and partner with SDS software vendors.

- An increase in government regulations and standards for data security, as achieved through the use of cybersecurity solutions and the installation of software, is expected to provide attractive prospects for cyber solutions in the next years. Telstra will expand its new cyber security solutions for federal, state, and municipal governments in Australia in February 2022. The Cyber Detection and Response capacity integrates with government systems and cloud-based services to monitor cyber threats using big data analytics from Telstra's managed security service platform, while Sovereign SecureEdge assists in delivering cloud security, especially in the context of a distributed workforce.

- These online security procedures are meant to ensure safety. To avoid any danger or attack, regulating genuine foundations, present frameworks should be isolated, observed, and guaranteed. Dangers associated with network security are growing, aided by the widespread use and accessibility of cloud companies such as Amazon Web Services for storing sensitive and unique data, which is expected to hinder market growth.

- Over the pandemic, software-defined storage has proven invaluable in rapidly expanding its customer base and accelerating top-line growth. For businesses during COVID-19 that continued to see unabated growth in storage but were unable to scale their Kubernetes container-based data management, there has been constant development primed toward enabling integrational capabilities across the platform case point, the previously mentioned NetApp addition of Kubernetes capability.

Software Defined Security Market Trends

Cloud is Driving Software Defined Security

- There has been a strong shift from a few years ago when most information security professionals saw the cloud as limited and secure. The cloud is now seen as transformational rather than a possible security posture tradeoff, threatening security hardware and infrastructure players, who have profited from growing cyber threats and expanding increasingly connected networks. The cloud may prove to be the driver of security transformation.

- Cloud infrastructure is designed to meet new, emerging needs, particularly in terms of vertical and horizontal scale and security. Cloud settings will typically employ technology and service-centric security solutions that can scale worldwide and smoothly without regard to location.

- Cloud computing has revolutionized how businesses utilize, distribute, and store data, apps, and workloads. It has, however, generated various new security concerns and problems. The risk grows with so much data and public cloud services being stored in the cloud. Several nations, primarily emerging economies, are at the forefront of cloud adoption, aided by end-user demand for digitization. Interconnection bandwidth capacity has been expanding due to increased demand from content, edge services, and last-mile connections to transport-led growing data volumes.

- According to Equinix's Global Interconnection Index (GXI) report, the LATAM region is predicted to dominate interconnection bandwidth capacity installation development by a 50% CAGR, with firms operating in the region contributing 1,479 Tbps by 2023. As the potential of cloud demand grows, several providers are experiencing an increase in adoption, which is driving expenditures.

- Moreover, digitalization will add to cloud delivery pressures and force IT into more software and services and away from hardware-defined tradeoffs. This factor, coupled with buyer consolidation and commoditization, will make infrastructure-as-a-service (IaaS) and managed service providers powered by software-defined abilities much more powerful than conventional hardware vendors. Therefore, due to such determinants, software-defined technologies are predicted to grow in the coming years.

Asia-Pacific Accounts for the Fastest Growing Share in the Software-defined Security Market

- Asia-Pacific is experiencing a rapid increase in the volume of unstructured data across various enterprises in the region, which is stored not only on-premise but also in cloud environments. In addition, with the proliferation of IoT across the region, the data generated at the edge is rapidly increasing. These factors have supported a scalable, reliable, secure storage architecture.

- With high-density countries like China and India still relying on traditional hardware for their storage and the need for digital transformation to keep up with the technological changes, the region presents lucrative business for software-defined storage (SDS) vendors.

- Furthermore, the increasing cyberattacks have compelled China to bolster its defense capabilities. However, the country is also a significant source of origin for cyberattacks in other regions of the world.

- In March 2022, cybersecurity firm Mandiant alleged that a Chinese government-backed hacking organization hacked local government entities in the United States as part of an intelligence-gathering operation. According to the US authorities, the hackers utilized a significant software defect to access the networks of two states' agencies in December 2021. According to the FBI and the US Cybersecurity and Infrastructure Security Agency (CISA), the state agencies targeted included transportation, health, higher education, agricultural, court networks, and systems.

- In particular, hyper-scale and international digital media content providers and public cloud service providers, like Facebook, Google Amazon Web Services (AWS), and Alibaba Cloud, have been fundamental in pushing demand for remote storage services, significantly enhancing their uptake of data center capacity in the Asian region and particularly in Hong Kong over the past few years by building massive-scale platforms.

Software Defined Security Industry Overview

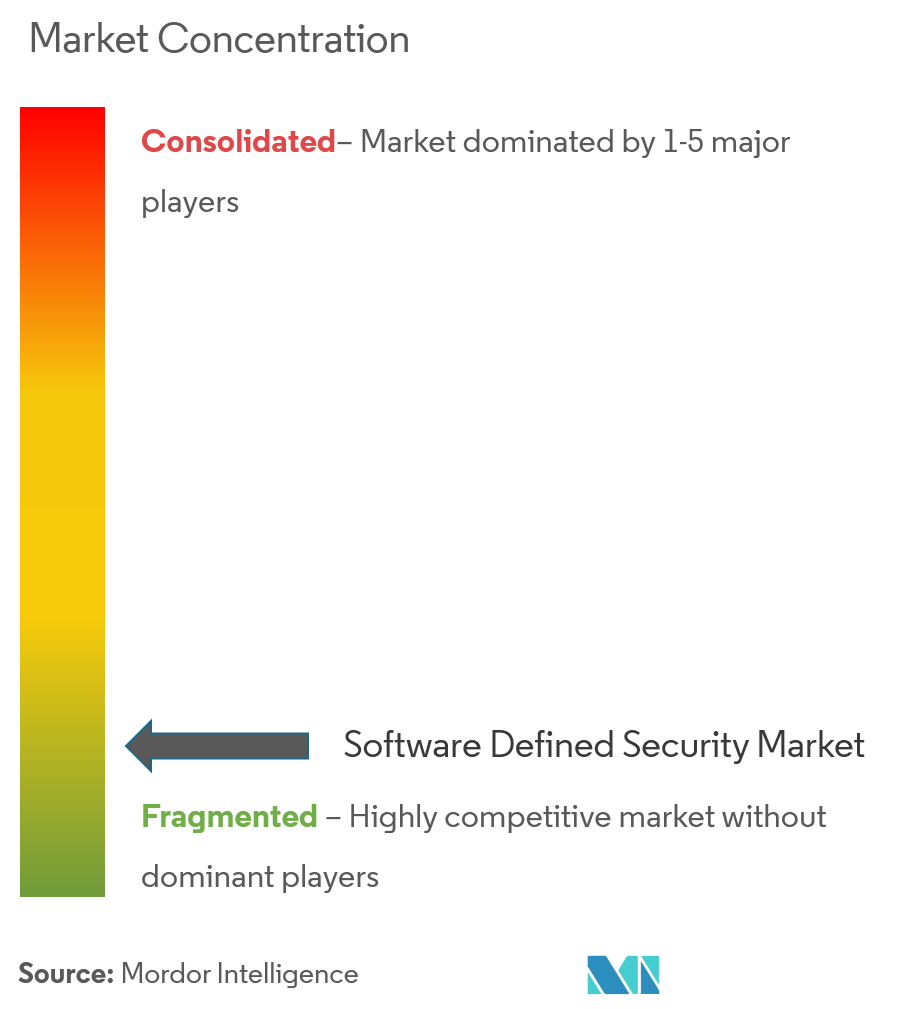

The software-defined security market is highly fragmented, as several cyber threats are forcing governments and respective industries to invest more in cyberspace. Increasing investments drive many new players to offer solutions at lower prices, making the market more competitive. Some key players in the market are Pure Storage Inc., Huawei Technologies Co. Ltd, VMWare Inc. (Dell Inc.), Oracle Corporation, and IBM Corporation. These players constantly innovate and upgrade their product offerings to cater to the increasing market demand.

- January 2023 - Valeo, a top automobile supplier, and global partner, and C2A Security, a leading supplier of automatic vehicle cybersecurity solutions for integrated, autonomous, and EVs, announced a strategic collaboration to augment Valeo's cybersecurity services on their product lines in development and ongoing operations. The new collaboration responds to the industry's requirement for simplified and effective cybersecurity. The collaboration of C2A Security and Valeo will enable the automotive sector to deploy automated cybersecurity, putting security first while allowing innovation and future business.

- October 2022 - Veracode, a leading global supplier of applications security testing tools, announced that its Continuous Software Security Platform had been enhanced to incorporate container safety. Existing customers can now participate in an early access initiative for Veracode Container Security. The new Veracode Container Security service covers the secure configuration, vulnerability scanning, and secrets management systems for container images and is intended to satisfy the demands of cloud-native software engineering teams.

Software Defined Security Market Leaders

-

Pure Storage Inc.

-

Huawei Technologies Co. Ltd

-

VMWare Inc. (Dell Inc.)

-

Oracle Corporation

-

IBM Corporation

- *Disclaimer: Major Players sorted in no particular order

Software Defined Security Market News

- October 2022 - Datadog, Inc., the cloud monitoring and security platform announced the public release of Cloud Security Management. This software combines Cloud Workload Security (CWS), Cloud Security Posture Management (CSPM), incident management, alerting, and reporting features in a single platform to help DevOps and Security staff discover misconfigurations, secure cloud-native applications, and detect threats.

- September 2022 - Cybeats Technologies Inc., a leading supplier of software supply chain risk and security technologies, announced a strategic agreement with Veracode, a major global developer of application security testing solutions. The collaboration will use complementary knowledge to guarantee that consumers obtain the best cybersecurity solutions.

- May 2022 - Oracle increased the built-in security capabilities and services of Oracle Cloud Infrastructure (OCI) to assist clients in protecting their cloud apps and data from potential threats. Five new features, including a new cloud-native and built-in firewall service and additions to Oracle Security Zones and Oracle Cloud Guard, round out OCI's existing extensive security offering. These advancements will help enterprises protect cloud installations and apps by providing easy, prescriptive, and integrated services.

Software Defined Security Industry Segmentation

- Software-defined security enables the implementation of dynamic security in the network through a controller driven by software or an application. Such a security model helps shield several security-related issues, such as network segmentation, threat detection, intrusion alert, and access control, which are regulated and managed by security software. The Software-defined Security Market is segmented by Type (Block, File, Object, and Hyper-converged Infrastructure), Size of Enterprise (Small and Medium Enterprise, and Large Enterprise), End-user Industries (BFSI, Telecom, IT, Government, Other), and Geography (North America, Europe, Asia Pacific, Latin America, and Middle East and Africa). The market sizes and forecasts are provided in terms of value (USD million) for all the above segments.

| By Type | Block |

| File | |

| Object | |

| Hyper-converged Infrastructure | |

| By Size of Enterprise | Small and Medium Enterprise |

| Large Enterprise | |

| By End User | BFSI |

| Telecom and IT | |

| Government | |

| Other End Users | |

| By Geography | North America |

| Europe | |

| Asia-Pacific | |

| South America | |

| Middle-East and Africa |

Software Defined Security Market Research FAQs

What is the current Software Defined Security Market size?

The Software Defined Security Market is projected to register a CAGR of 33.81% during the forecast period (2025-2030)

Who are the key players in Software Defined Security Market?

Pure Storage Inc., Huawei Technologies Co. Ltd, VMWare Inc. (Dell Inc.), Oracle Corporation and IBM Corporation are the major companies operating in the Software Defined Security Market.

Which is the fastest growing region in Software Defined Security Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Software Defined Security Market?

In 2025, the North America accounts for the largest market share in Software Defined Security Market.

What years does this Software Defined Security Market cover?

The report covers the Software Defined Security Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Software Defined Security Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Software Defined Security Industry Report

Statistics for the 2025 Software Defined Security market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Software Defined Security analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.