Smart Utilities Management Market Analysis

The Smart Utilities Management Market is expected to register a CAGR of 18.72% during the forecast period.

- The growing importance of smartening a country's power grid system is heightened by the developing consumer model happening through the rise in decentralized power generation systems, such as Waste-to-Power, and Rooftop Solar PV technologies.

- The advent of smart cities and smart grids is also proving as a major driver for smart utility management adoption. Furthermore, innovation in battery technology is allowing smaller devices with longer operating times. Integration of cloud technologies is also expected to provide opportunities to grow in this area.

- The advent of renewable energy, oil price volatility, climate change policies, changing customer behavior, and cost containment pressure are the few challenges the energy sector is seeking to address on a daily basis.

Smart Utilities Management Market Trends

Power Sector Hits Growth with Meter Data Management System

- A majority of the utilities are currently concentrating on setting up AMI infrastructure for meeting administrative requirements, green power initiatives, and additional business benefits.

- Large volumes of data are being collected, with AMI meters being deployed, but utility providers have not started realizing the benefits of received data and other AMI capabilities to remotely perform transactions, apart from just accepting the monthly billing read.

- Increasing investments in smart grid systems around the world are one of the primary factors driving the growth of these systems. Governments around the world are pushing for the deployment of AMI, in order to automate the existing operations and push technological growth. With smart grid systems offering high efficiency and helping in cost saving, the demand for smart grid is growing, thus having a direct impact on the growth of smart meters.

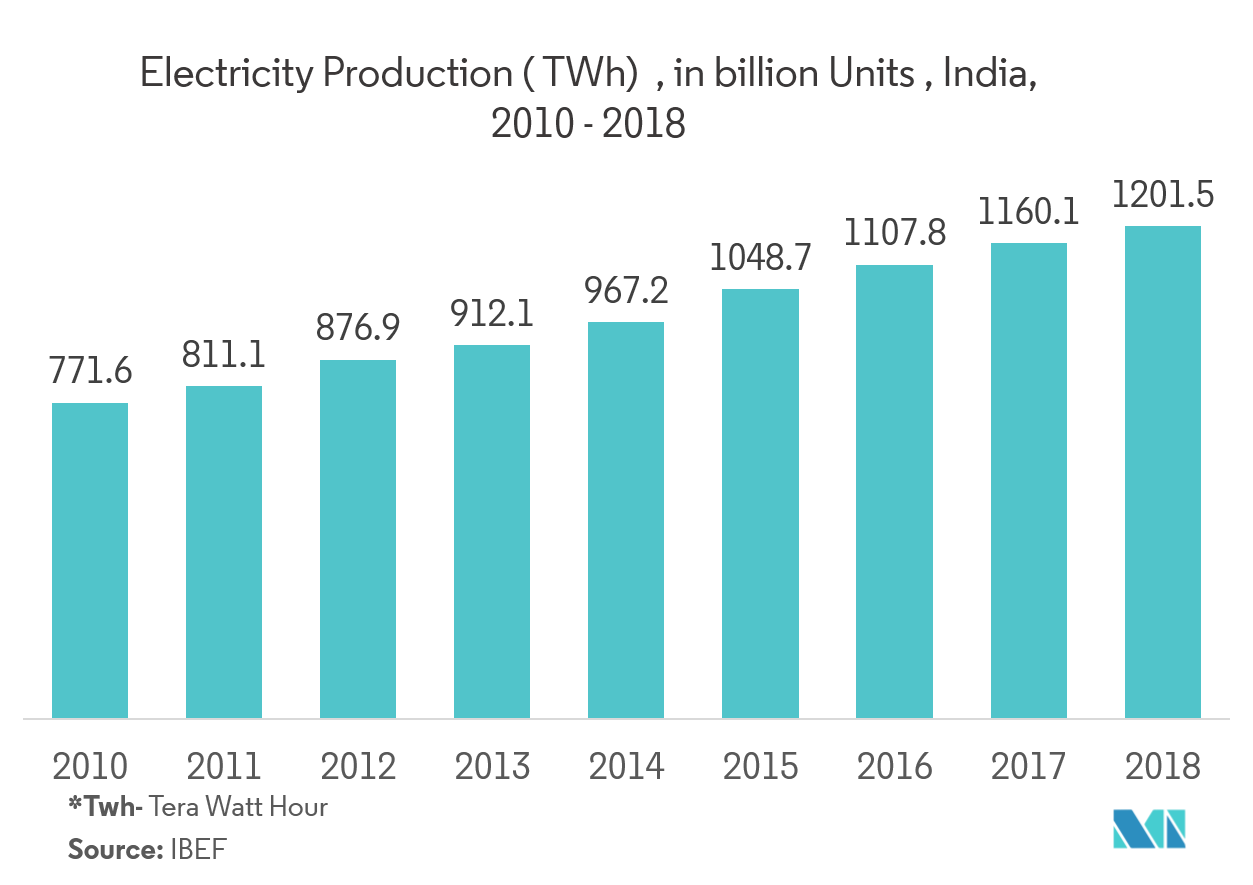

- The Ministry of Power in India launched the India Smart Grid Week (ISGW) since 2015 and it is considered as one of the top five international events on smart grids and smart cities. With the launching of 100 smart city projects by the government of India, water and city gas distribution utilities will also need to equip themselves with the latest technologies for improved operational efficiency and successful integration into the smart city systems.

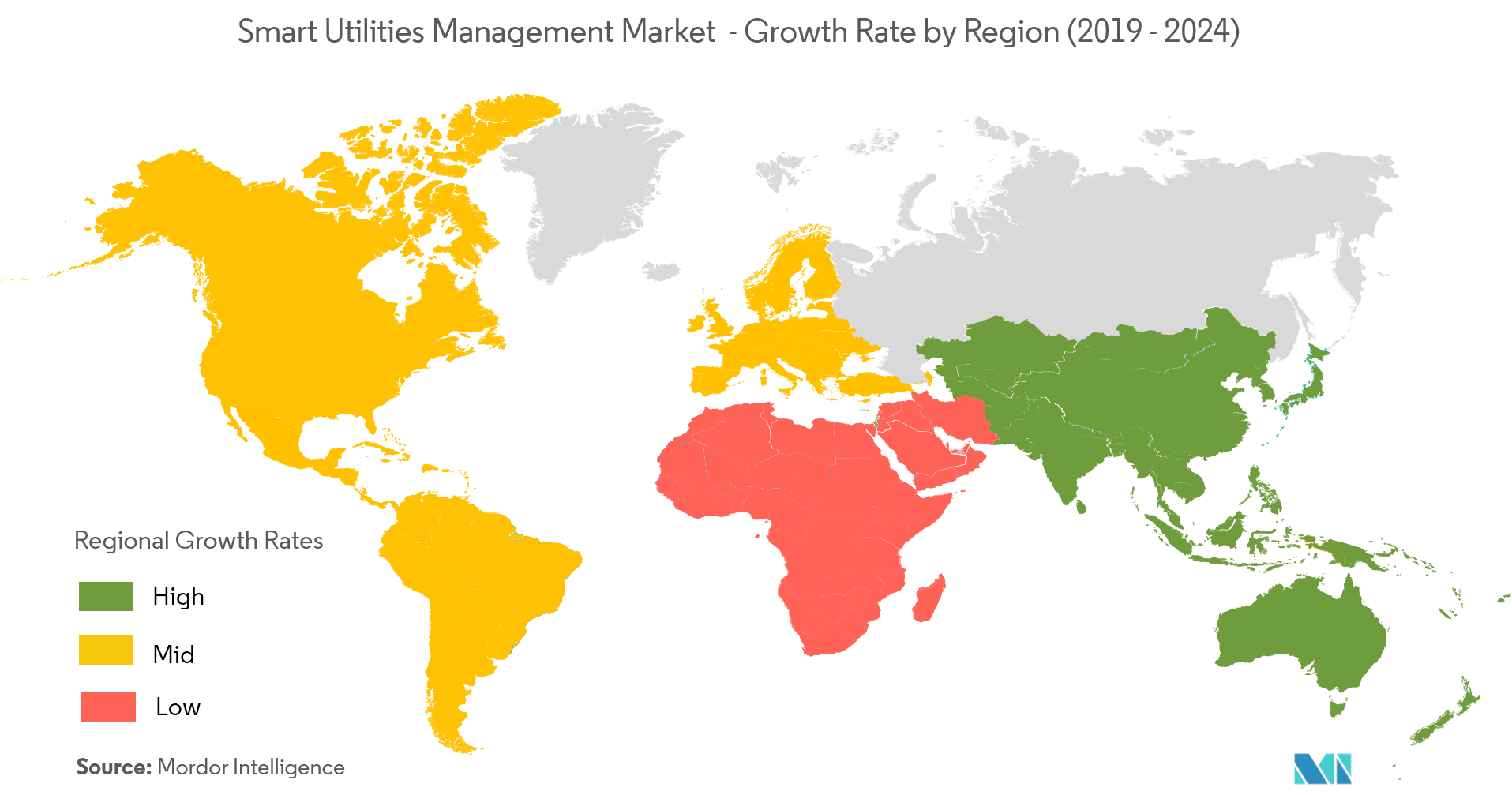

Asia -Pacific to Emerge as the Fastest Growing Market

- In Asia-Pacific, in the recent past, countries, such as Australia, Japan, and South Korea have shown considerable strides in their efforts to smarten their utility network systems.

- For instance, in the case of Japan, its major utilities have committed toward the widespread smart meter rollouts by 2024, that could lead to installations of over 78 million smart meters across residential and low-use customers. The number of smart meters installations exceeded 10 million in 2016. Besides, the four major electric utilities, namely TEPCO, Tohoku Electric Power Co., Hokuriku Electric Power Co., and Kyushu Electric Power Co., have installed 750,000 smart meters in commercial premises, and are planning to complete their rollouts by the end of 2018.

- In China, the State Grid Corporation installed around 90 million units of smart meters in 2014 and 2015. More than 100 local developers of smart meters are focusing on the up gradation of existing core technologies and communication modes, as they are being the major reasons for many concerns in the Chinese smart meters market.

- Similarly, Victoria in Australia has been the first in the race toward a complete smart meter rollout, which was undertaken by SP AusNet and four other electricity distribution providers. Such advancements in the region have led to an increased dependence on smart utilities management software and services, due to the increased efficiency it allows major utility providers.

Smart Utilities Management Industry Overview

The smart utilities management market is highly fragmenteddue to companies around the world increasingly being aware of the technologies. They are also investing in integrating new technologies, in order to produce advanced metering devices with improved performance and efficiency. Some of the key players in the market areIBM Corporation, Atos SE, Honeywell International Inc., ABB Ltd, Cisco Systems Inc., and Siemens AG. These players are constantly innovating and upgrading their product offerings to cater to the increasing market demand.

- April 2019 - Atosannounced that it achieved theInternet of Things (IoT) Partner Specializationin theGoogle Cloud Partner Specialization Program. By earning the Partner Specialization, Atos has proven their expertise and success in building customer solutions in the Internet of Things (IoT) field using Google Cloud Platform technology.

- January 2019 - Siemens partnered with Canadian utilities to research and develop electricalgrid for the future.

Smart Utilities Management Market Leaders

-

IBM Corporation

-

Atos SE

-

Honeywell International Inc.

-

ABB Ltd

-

Siemens AG

- *Disclaimer: Major Players sorted in no particular order

Smart Utilities Management Industry Segmentation

Smart utility network is the culmination of three different but mostly interconnected segments, namely smart meter/advanced metering infrastructure (AMI), smart consumer applications, and grid-level applications. It is further divided into meter data management system, energy monitoring/management, smart distribution management.

| By Type | Meter Data Management System |

| Energy Monitoring/Management | |

| Smart Distribution Management | |

| Geography | North America |

| Europe | |

| Asia-Pacific | |

| Latin America | |

| Middle East & Africa |

Smart Utilities Management Market Research FAQs

What is the current Smart Utilities Management Market size?

The Smart Utilities Management Market is projected to register a CAGR of 18.72% during the forecast period (2025-2030)

Who are the key players in Smart Utilities Management Market?

IBM Corporation, Atos SE, Honeywell International Inc., ABB Ltd and Siemens AG are the major companies operating in the Smart Utilities Management Market.

Which is the fastest growing region in Smart Utilities Management Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Smart Utilities Management Market?

In 2025, the North America accounts for the largest market share in Smart Utilities Management Market.

What years does this Smart Utilities Management Market cover?

The report covers the Smart Utilities Management Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Smart Utilities Management Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Smart Utilities Management Industry Report

Statistics for the 2025 Smart Utilities Management market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Smart Utilities Management analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.