Smart Pneumatics Market Analysis

The Smart Pneumatics Market is expected to register a CAGR of 6.94% during the forecast period.

- Growing awareness toward predictive maintenance is driving the market, due to the emergence of industry 4.0 and sophisticated 'smarter' technologies. According to Accenture, predictive maintenance of assets is one matching area of focus, which saves up to 12 percent over scheduled repairs, reducing overall maintenance costs up to 30 percent, and eliminating breakdowns up to 70 percent. For fluid power systems, it means a whole new level of condition and remote monitoring, to the extent that maintenance personnel can determine whether some obstacles has occurred or not.

- Penetration of digitization and IIoT is driving the market. According to vXchnge Holdings Inc., over 80% of industrial manufacturing companies are using or planning to use IoT devices for better energy efficiency, and higher overall levels of production uptime. This enhances the demand of smart pneumatics in the coming years. Recently in May 2019, Emerson has released a new tool to help pneumatic system users conveniently and easily see the potential benefits of integrating IIoT. By connecting the new AVENTICS Smart Pneumatics Analyzer to the pressurized air supply on a present machine, users will have instantaneous analysis options for key machine characteristics such as compressed air consumption and possible leakages.

- Lack of common platform for ethernet, zigbee and profibus is restraining the market to grow as these devices can easily be integrated into wireless systems across the IoT industry via these gateways and due to lack of integration at industrial and manufacturing sector the market for smart pneumatics is challenging to grow.

Smart Pneumatics Market Trends

Oil & Gas in Industrial Segment Holds the Significant Share

- With an increasing demand for energy in the long term but quite unstable in the short term, the oil and gas industry is facing many challenges in its complete value chain and there is a need for major “technological revolution” or massive investment to improve safety, efficiency and competitiveness. Process instrumentation is an integral portion of any process industry as it allows real-time measurement and control of process variables such as levels, flow, pressure, temperature, pH, and humidity.

- Moreover, the Industrial Internet of Things (IIoT) plays a role, where electric actuators equipped with powerful electronics serve as information hubs, providing direct access to a wide variety of both process and diagnostics data for preventative maintenance. Modulating actuators provide enhanced positioning accuracy for control valves to precisely modulate the flow within pipes. In the upstream segment, this is for the flow of crude oil and natural gas; in the midstream segment, it’s for the storage and transportation of resources. In the downstream segment, this is for the refining process of crude oil.

- Due to the criticalness of flow measurements, manufacturers are continuously developing new features for hard and severe applications. One type of flowmeter used in a wide range of industry sectors is the smart Coriolis mass-flowmeter, where multiple process variables such as mass flow, density, and temperature are simultaneously measured, leading to accurate information about other process parameters such as volume flow, concentration, etc.

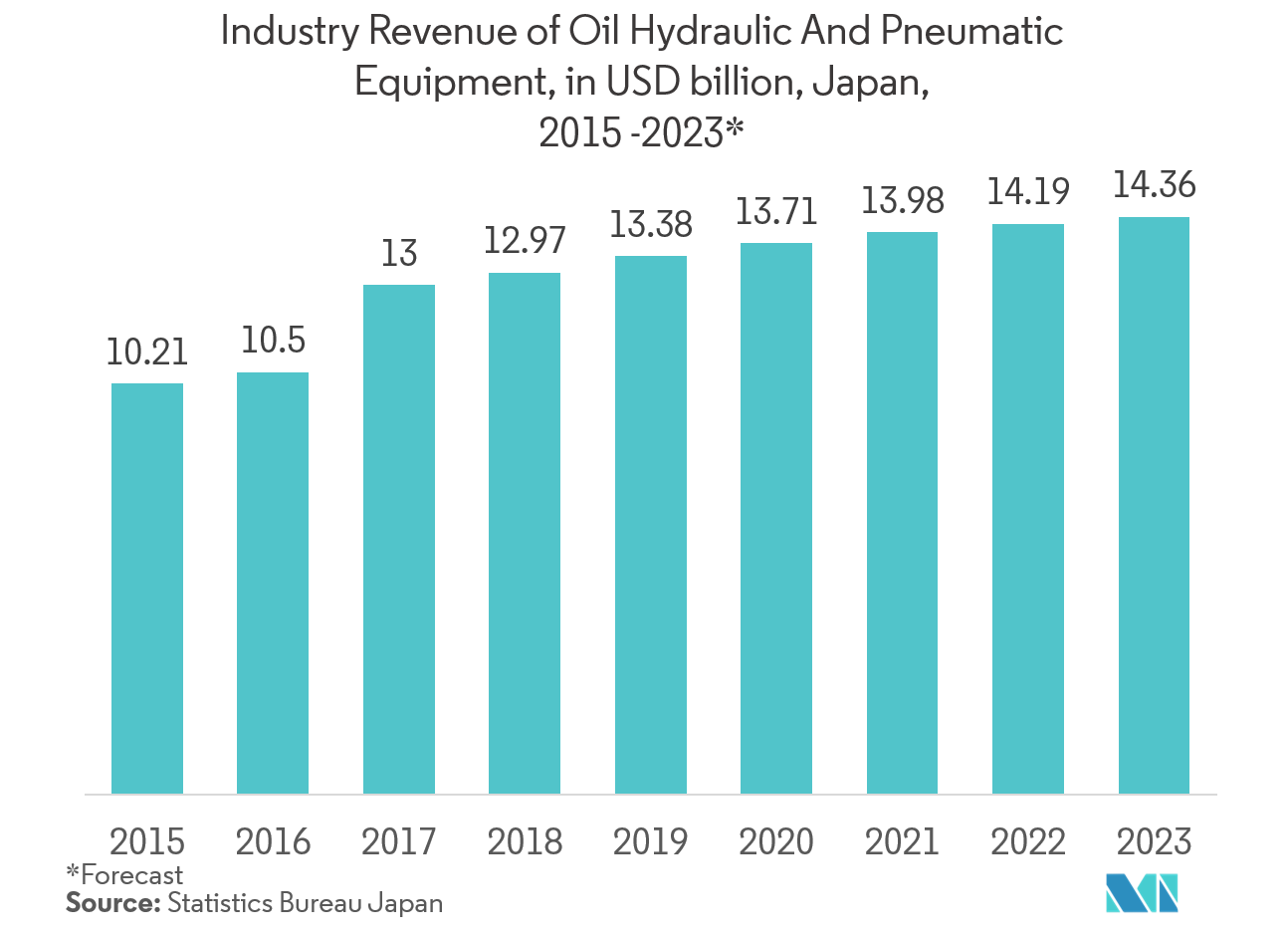

- With the increasing demand for oil and gas equipment, the demand for pneumatic components and its measuring tools are high and Japan holds major contributions in supplying and the expected demand is towards smart pneumatics components such as smart pneumatic valves and actuators which may hold a significant revenue under this category.

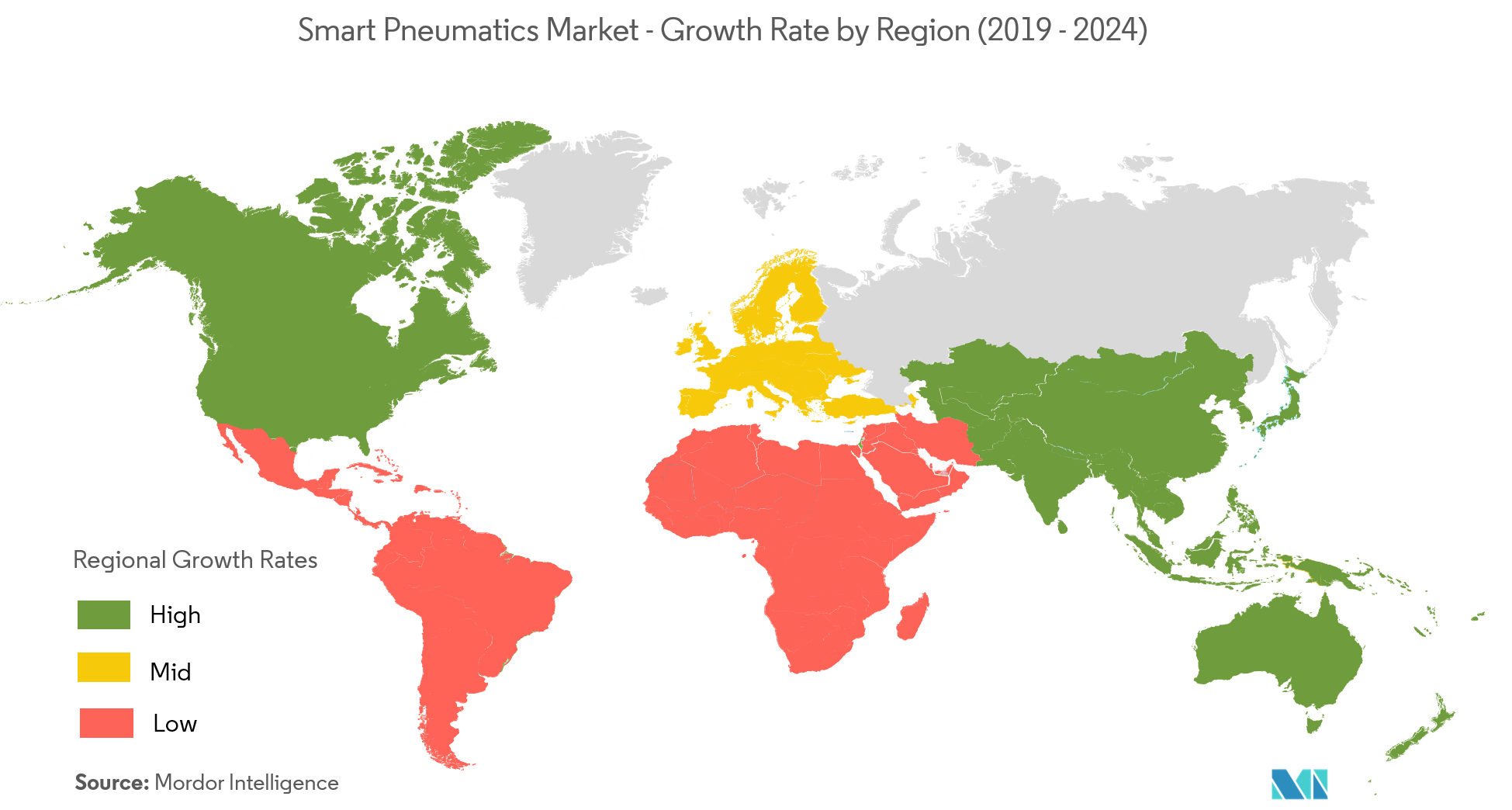

Asia-Pacific Account for Significant Market Growth

- The expanding population, increasing industrialization, and rapid urbanization in Asia-Pacific region, especially in developing countries, such as China and India will lead to the increasing demand for agricultural products, food, and chemicals, which use pneumatic equipment in their manufacturing plants.

- Increased investments in new plants such as in oil and gas, steel, power, and petrochemicals, and rising adoption of international safety standards and practices are predicted to hold the market growth. This is the only region to register an oil and gas capacity growth in recent years and about four new refineries were added in the region, which has added about 750,000 barrels per day, to the global crude oil production.

- Also,the Combodia government signed an agreement with the Japanese International Cooperation Agency to build wastewater treatment plant in Dangkor district. The project focused to improve the drainage system in the district for wastewater to flow straight to the plant rather than river by investing USD 25 million. Such projects across this region is estimated to drive the market for smart valves and actuators.

Smart Pneumatics Industry Overview

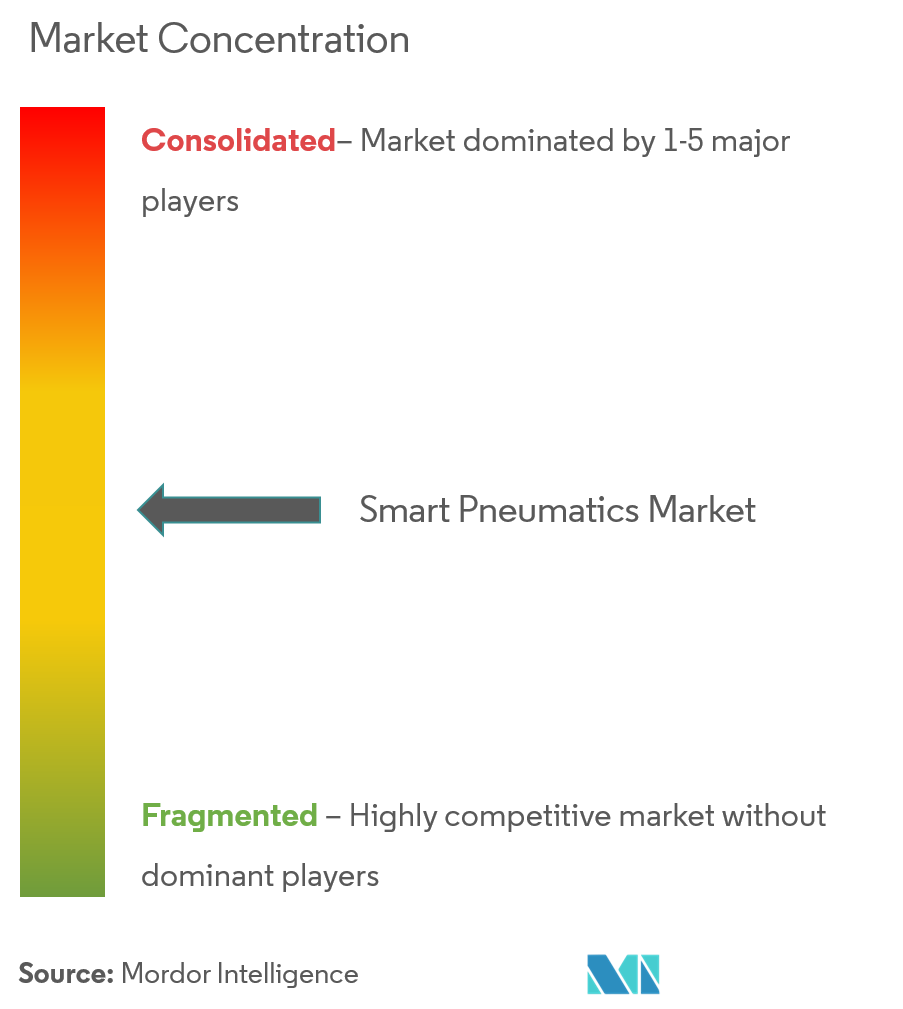

The market for smart pneumatics is presently in mid of fragmented and consolidateddue to the presence of low players in the market and various other companies are extensively investing in offering a wide range of technologies to the customers for application across the industries. Moreover, thesecompanies are continuously investing in adopting advanced technologies for developing valves and actuators. Key players are Emerson Electric Co., Parker Hannifin Corporation, Festo, etc. Recent developments in the market are -

- Sep 2019 -Parker Hannifin added an expanded range of features and capabilities to its H Series ISO valve platform as part of its global focus on factory automation. It is designed with a new universal manifold, where the new valves provide the opportunity to mix ISO 02, 01, 1 and 2 valve sizes on one common manifold without transition blocks. This ability enable right sizing in the field and the ISO design supports easy interchangeability for additions or changes to the valve and manifold assembly.

- Dec 2018 -The Ham-Let Group launched its first smart valve ready to connect to the Internet. The company has incorporated cloud-based technology into its products to increase reliability, reduce costs and open up new possibilities that were previously too expensive or too complex to implement. As a complete oil and gas portfolio company, Ham-Let continues to make efforts to supply unique safety solutions that bring best value in terms of total cost of ownership.

Smart Pneumatics Market Leaders

-

Emerson Electric Co.

-

Festo

-

Thomson Industries Inc.

-

Metso Corporation

-

Parker Hannifin

- *Disclaimer: Major Players sorted in no particular order

Smart Pneumatics Market News

Smart Pneumatics Industry Segmentation

With sensory data flowing in both directions, old pneumatic processes are being renovated into smart pneumatic systems, with data communicated to higher-level controllers and distributed to local networks through pneumatic components such as smart actuators, smart valves. This integration incorporates in various end-users such as manufacturing, industrial, etc.

| By End-User | Manufacturing | ||

| Healthcare | |||

| Industrial | |||

| Other End-Users | |||

| Geography | North America | United States | |

| Canada | |||

| Europe | Germany | ||

| United Kingdom | |||

| France | |||

| Rest of Europe | |||

| Asia-Pacific | China | ||

| Japan | |||

| India | |||

| Rest of Asia-Pacific | |||

| Rest of the World | Latin America | ||

| Middle-East & Africa | |||

Smart Pneumatics Market Research FAQs

What is the current Smart Pneumatics Market size?

The Smart Pneumatics Market is projected to register a CAGR of 6.94% during the forecast period (2025-2030)

Who are the key players in Smart Pneumatics Market?

Emerson Electric Co., Festo, Thomson Industries Inc., Metso Corporation and Parker Hannifin are the major companies operating in the Smart Pneumatics Market.

Which is the fastest growing region in Smart Pneumatics Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Smart Pneumatics Market?

In 2025, the North America accounts for the largest market share in Smart Pneumatics Market.

What years does this Smart Pneumatics Market cover?

The report covers the Smart Pneumatics Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Smart Pneumatics Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Smart Pneumatics Industry Report

Statistics for the 2025 Smart Pneumatics market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Smart Pneumatics analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.