Smart Home Installation Service Market Analysis

The Smart Home Installation Service Market is expected to register a CAGR of 25% during the forecast period.

- An increase in the adoption of cognitive systems and connectivity technologies by end users drives the smart home installation service market. The adoption of intelligent assistance-embedded consumer devices (products) has increased rapidly over the last few years, owing to their advanced features, especially portability.

- The rising adoption of personal assistants in smart homes is expected to create new opportunities for smart home installation service providers in the next few years. This is primarily because consumers are adopting technologically-advanced devices, including artificial intelligence-embedded devices such as smart TVs, smart speakers, and gaming devices.

- Leading service providers are challenging the easy installation claims made by home improvement and DIY kits and using this strategy as an essential weapon for the expansion of their consumer base in the smart home installation services market. OEMs and retailers in the smart homes industry are offering consultation, product selection, and installation services under one roof to bolster their growth in the smart home installation services industry.

- During Covid-19, industries were closed down, and production was impacted due to the restrictions on crossing international and national borders; the pandemic has disrupted organizational efficiency and impacted value networks. Existing smart goods like Televisions and refrigerators continued to be in demand because they helped customers who were compelled to stay at home with their leisure and convenience needs. The supply of raw materials was negatively impacted by the value chain, which harmed the growth of the smart house industry.

- The cyber security industry has highlighted smart homes as one of the most significant concerns. Hence, data privacy and security are the primary factors hindering the growth of the smart home installation service market.

Smart Home Installation Service Market Trends

E-commerce Boosting the Growth of Smart Home Installation Service Market

- The increasing popularity of E-Commerce channels is expected to create new opportunities in the smart home installation services market. With nearly 60% of consumers having at least one smart home device, consumers are finally beginning to embrace these products. This offers a chance for e-commerce businesses to join the smart home and promote device purchases.

- The pandemic has helped to reshape the future of online purchasing and forced businesses to adapt to meet new needs and demands, forcing many customers to change how they purchase necessities, gadgets, and apparel.

- Many companies collaborate with E-Commerce channels to expand their reach into their target customer segments. For instance, eBay announced partnerships with three service providers in the smart home companies - InstallerNet, Handy, and Porch. This allowed end users to book smart home installation services on eBay's inventory.

North America Expected to Have Significant Market Share

- One of the main factors propelling the market for smart home installation services in North America is the rising acceptance of network-linked devices there. The region's dominant position in the world market for smart home installation services may be attributed to the tendency of early technology adoption and the large presence of industry players like Vivint, Inc., Red River Electric, and Miami Electric Masters.

- Smart homes are on the rise, with nearly 30 million U.S. households projected to add smart home technology in the near future. Consumers are adding products to their homes, including connected cameras (highest demand), video doorbells (2nd highest demand), connected light bulbs, smart locks, and smart speakers of late.

- According to a recent survey in the U.S., security-focused smart home products are in demand, as family safety is a significant factor in adopting smart home technology. However, the biggest driver for the market in this region is that consumers are adopting smart home technology like smart lighting solutions and energy management solutions to simplify their lives with greater convenience.

- Similarly, house owners in Candan are regressors looking for solutions that help them save on energy and reduce their carbon footprint. Further, Schneider Electric launched a suite of connected living products to help more homeowners take advantage of this emerging technology, addressing the most common demands of Canadian homeowners when shopping for smart home technology, such as ease of installation and use, long-term durability, and sustainability.

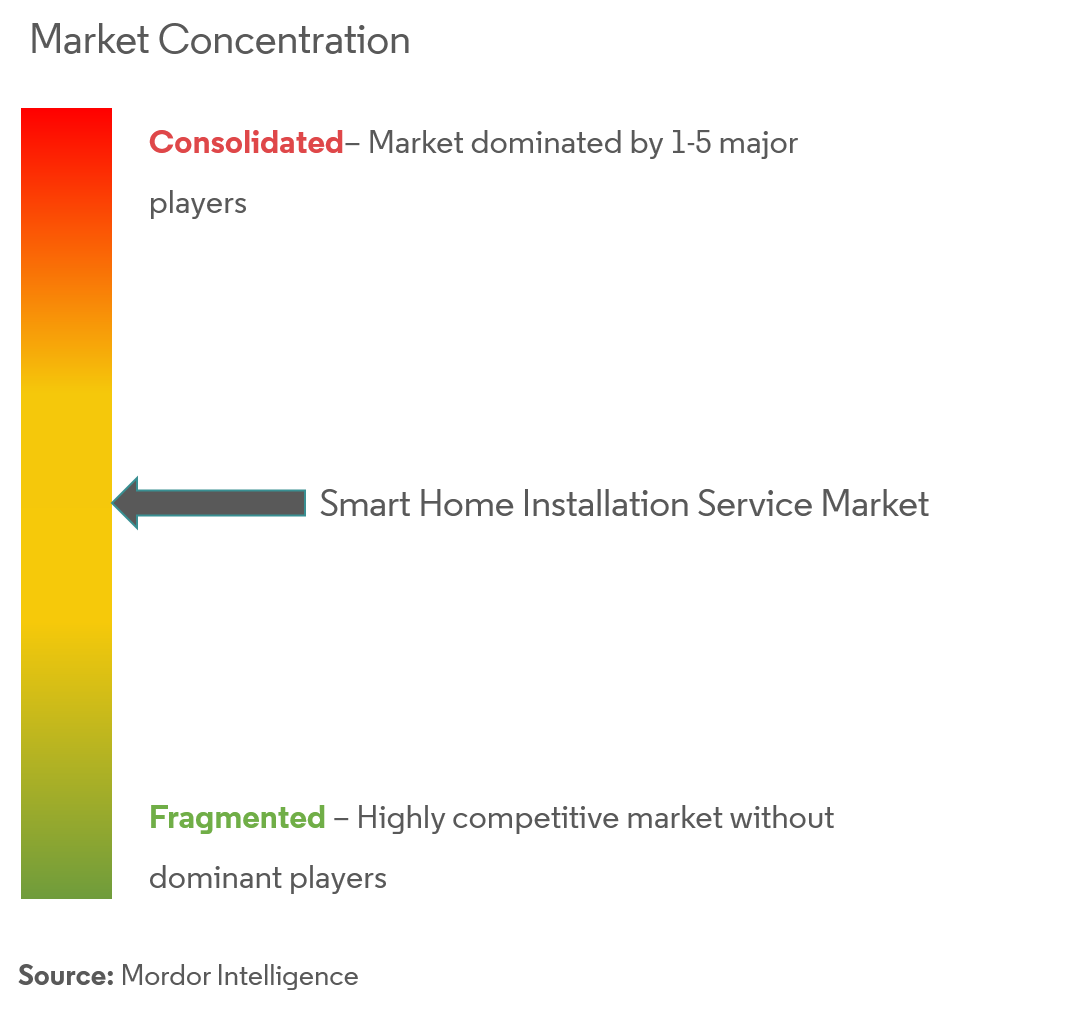

Smart Home Installation Service Industry Overview

The smart home installation market is neither fragmented nor consolidated. The companies are formulating their business strategies that reflect an increased focus on expanding their existing distributor networks across the world. The major players are following strategies like product innovation, mergers, and acquisitions to expand their reach and hold their market position.

- January 2022 - Walmart has joined Agni to create another professional service to install smart air conditioners and other modern technology. This collaboration has been launched to assist with the mounting of televisions, the installation of smart air conditioners, and the completion of other DIY tasks around the home. According to Angi, over 150 popular home projects will be available for purchase from over 4,000 Walmart locations as well as Walmart online.

Smart Home Installation Service Market Leaders

-

Calix Inc.

-

HelloTech Inc.

-

Red River Electric Inc.

-

Vivint Inc.

-

Insteon Inc.

- *Disclaimer: Major Players sorted in no particular order

Smart Home Installation Service Market News

- July 2022 - Xiaomi unveiled a new product In its native market of China. The new Xiaomi Smart Home Display 6 has just been introduced on the company's official Weibo account.

- May 2022 - Vivint Smart Home announced the launch of a new product that will enhance the company's unique smart home experience and provide intelligent new solutions that set the standard for what a smart home should be, including an all-new Doorbell Camera Pro, Outdoor Camera Pro, Spotlight Pro, and Indoor Camera Pro.

Smart Home Installation Service Industry Segmentation

Smart home installation service is a part of smart home technology which helps to provide homeowners security, comfort, convenience, and efficiency by giving them access to control smart devices through the smartphone app. Smart home installation services help to keep house connected and functioning as a whole. It helps to control everything from lights, thermostat, doors and entertainment items from a central control hub or smartphone.

The Smart Home Installation Service Market is segmented by System (Lighting Control, Home Monitoring/Security, Thermostat, Smart Appliances, Video Entertainment), Channel (Retailers, OEM, E-commerce), and Geography (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa).

The market sizes and forecasts are provided in terms of value (USD million) for all the above segments.

| By System | Lighting Control |

| Home Monitoring/Security | |

| Thermostat | |

| Video Entertainment | |

| Smart Appliances | |

| Other Systems | |

| By Channel | Retailers |

| E-Commerce | |

| OEM | |

| Geography | North America |

| Europe | |

| Asia-Pacific | |

| Latin America | |

| Middle East & Africa |

Smart Home Installation Service Market Research FAQs

What is the current Smart Home Installation Service Market size?

The Smart Home Installation Service Market is projected to register a CAGR of 25% during the forecast period (2025-2030)

Who are the key players in Smart Home Installation Service Market?

Calix Inc., HelloTech Inc., Red River Electric Inc., Vivint Inc. and Insteon Inc. are the major companies operating in the Smart Home Installation Service Market.

Which is the fastest growing region in Smart Home Installation Service Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Smart Home Installation Service Market?

In 2025, the North America accounts for the largest market share in Smart Home Installation Service Market.

What years does this Smart Home Installation Service Market cover?

The report covers the Smart Home Installation Service Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Smart Home Installation Service Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Smart Home Installation Industry Report

Statistics for the 2025 Smart Home Installation Service market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Smart Home Installation Service analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.