Semiconductor Memory IP Market Size and Share

Semiconductor Memory IP Market Analysis by Mordor Intelligence

The Semiconductor Memory IP Market is expected to register a CAGR of 12.3% during the forecast period.

- Semiconductor memory IP is witnessing direct impact of the growing demand for high-performance memory systems across all the end-user verticals. Increasing complexity of the semiconductors and growing demand for intense memory operations are resulting in a demand for faster and efficient memory solutions in the market.

- Companies are investing in developing efficient memory solutions. IoT, automation, and autonomous vehicle technologies due to which expansion is happening at a rapid pace. There has been driving demand for new types of semiconductor infrastructure which will support the growth of this market.

- There are high costs associated with the technology. The cost of its adoption is high due to which it has hampered the growth of this market.

Global Semiconductor Memory IP Market Trends and Insights

Consumer Electronics is Expected to Witness Significant Growth

- The demand for Semiconductor Memory IP increases with the increased adoption rate of DRAM. DRAM is used in laptops, computers, workstations and video game consoles as well. DRAM memories can be used for several purposes such as graphic enhancements, networking, DVDs, Printers, Digital Cameras, Car navigation system, HDDs etc. For Instance, Samsung announced its first 8Gb LPDDR5 DRAM chip for mobile devices.

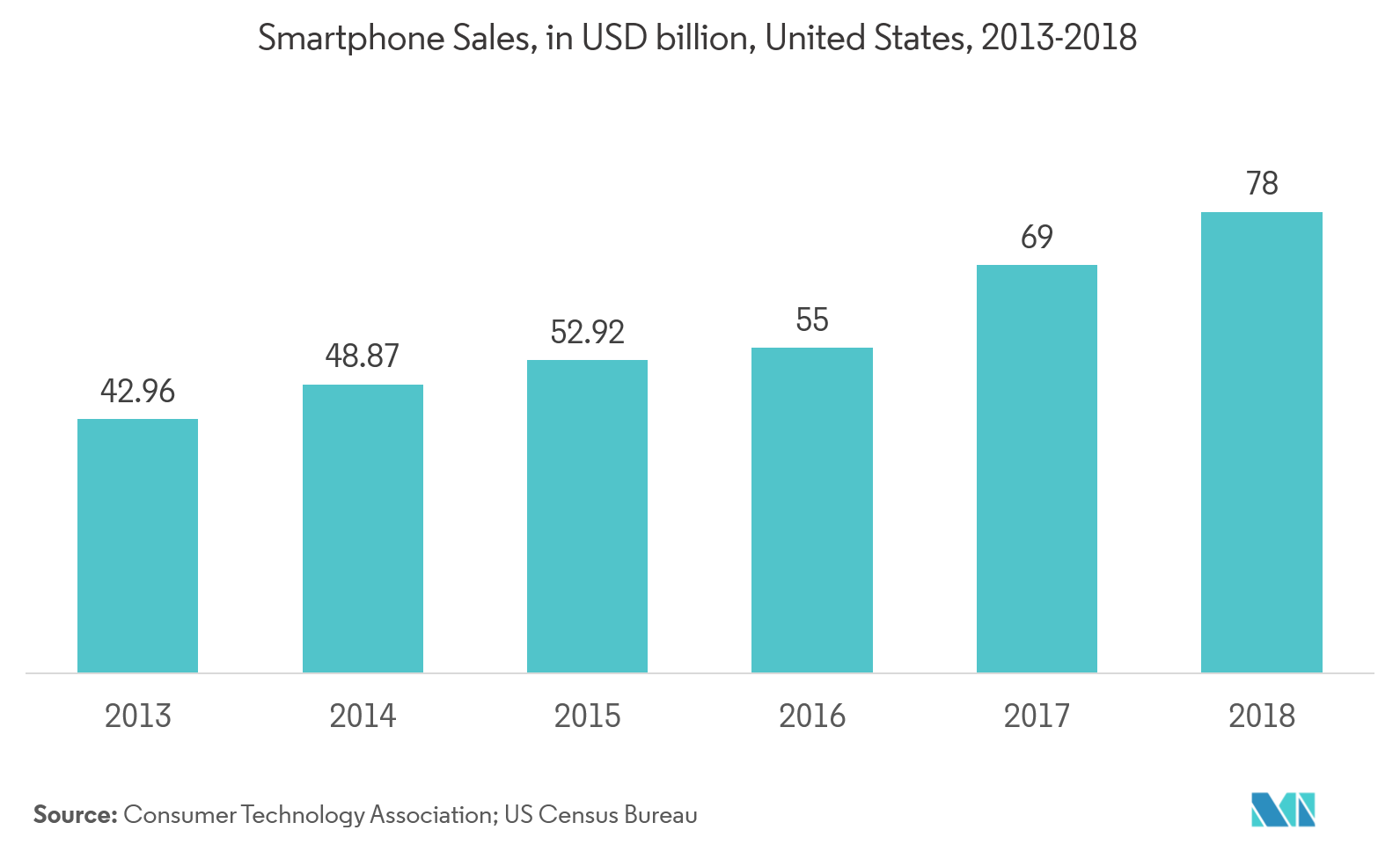

- Smartphones are the major contributor to consumer electronics growth. The technology of semiconductor memory is most prevalent in the smartphone industry. With smartphone sales increasing, there is a huge opportunity for semiconductor memory manufacturers to increase their adoption rates in smartphones.

- As Flash Memory is one of the most prevalent technology in the smartphone industry, Its adoption rate directly affects the impact of semiconductor memory in consumer electronics. Flash memory is widely used in many applications including memory cards for digital cameras, mobile phones, computer memory sticks, and many other applications

- The need and popularity of AI-enabled applications are stoking demand for faster processors, digital memory, and bigger and cheaper storage. CES saw major memory and storage companies demonstrating how they intend to enable the next generation of non-volatile memory and storage. These products included conventional hard disk drives and flash memory, but also included emerging non-volatile memory technologies, such as Resistive RAM (ReRAM) and Magnetic RAM (MRAM). For instance, at CES 2019, Thermaltake officially entered the memory market with two new kits of DDR4 3200 RAM which not only include integrated water blocks but also includes 16.8 million color RGB customization.

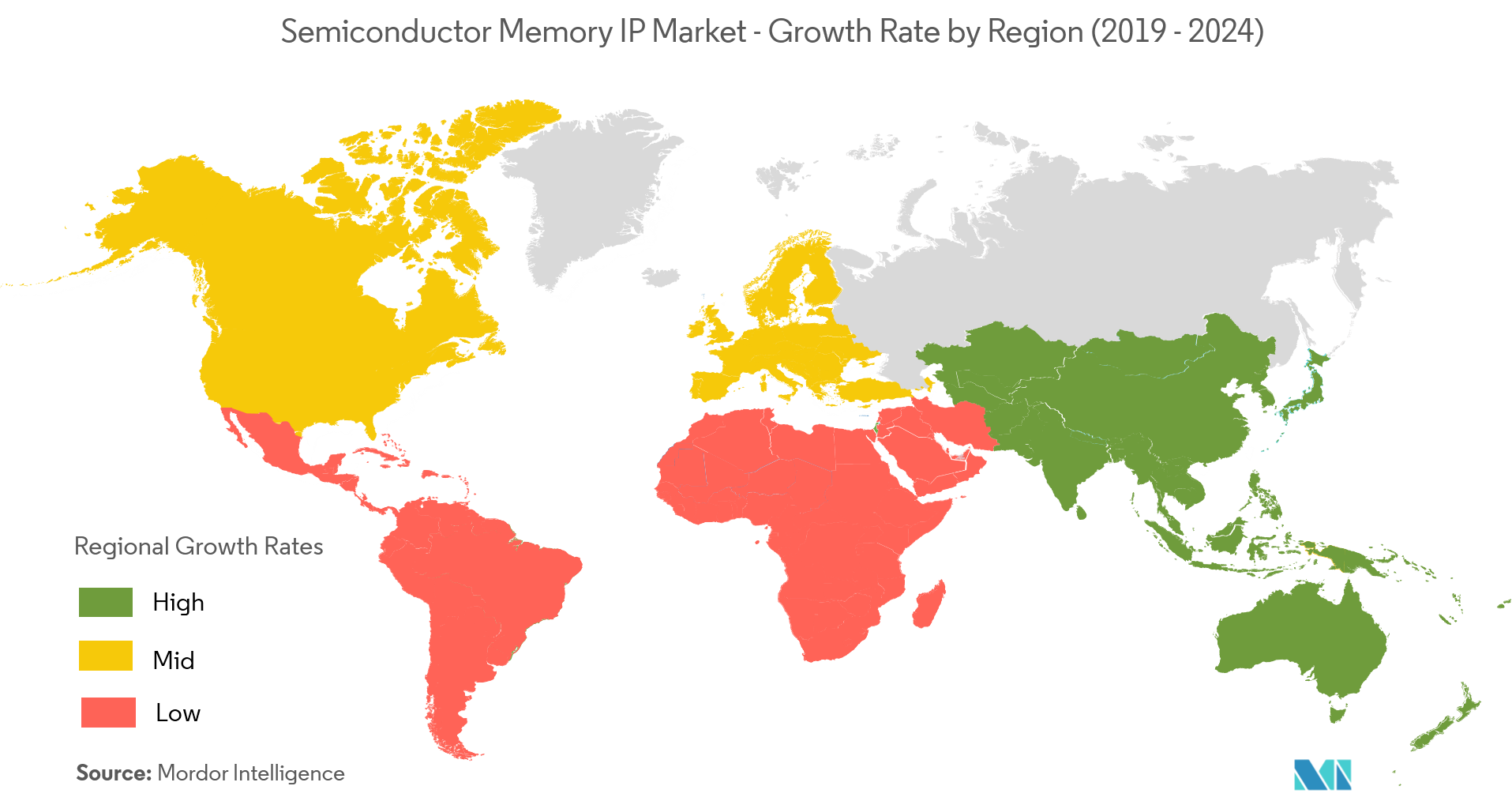

North America is Expected to Hold Significant Market Share

- The growing need for intelligent command and control in many industries in North America is presenting important market opportunities for many superconductor memory manufacturers. For instance, Hitachi, Ltd. and its subsidiary Hitachi America, Ltd., announced the merger of Hitachi America subsidiaries Hitachi Semiconductor (America) Inc., Brisbane, Calif., and Hitachi Micro Systems Inc., San Jose, Calif., to create a unified organization focused on the design, development and marketing of large-scale integrated semiconductor systems to focus greater resources on building a systems solution business in North America, while consolidating high-volume semiconductor production to a unified operating base to achieve greater operating efficiencies.

- According to SEMI, growth of semiconductor market sufferered (0.9% percent lower than the final September 2018 level of USD 2.07 billion, and is 2.0 percent higher than the October 2017 billings level of USD 2.02 billion), Although the growth rate has suffered but it is expected to to rise due to the increased demand of DRAMS as the most efficient semiconductor memory type.

- Due to the increase in number of data centers in the United States, the demand for DRAMS have increased significantly due to the efficiency they provide. The costs of running a data center include many aspects beyond the initial purchase of the base infrastructure. Modern IT organizations realize that a memory and storage hierarchy from DRAM to Solid State Drives (SSDs) to Hard Disk Drives can be an important data center feature that their users will depend on. According to AFCOM, Annual global IP traffic will reach 3.3 zettabytes by 2021. In 2016, global IP traffic was 1.2 ZB per year or 96 exabytes (one billion gigabytes) per month. With the increased amount of data generated.

Competitive Landscape

The Semiconductor Memory IP market is highly competitive and consists of several major players. In terms of market share, few of the major players currently dominate the market. The costs associated with the manufacturing needs to be reduced in order to save the expenses and thus investments in the research and development have been increasing. The manufacturers are adopting the practice of "fabless" in order to save on the expenses occurred.

April 2019 - SiFive, the leading provider of commercial RISC-V processor IP, announced the launch of the S2 Core IP Series at the Linley Spring Processor Conference in Santa Clara. The S2 Core IP Series is a 64-bit addition to SiFive's 2 Series Core IP and brings advanced features to SiFive's smallest microcontrollers. The S2 Series further adds to SiFive's extensive, vastly customizable, optimized, silicon-proven, embedded core IP portfolio, which comprises the 2, 3, 5, and 7 Core IP Series in E (32-bit) and S (64-bit) variants.

Semiconductor Memory IP Industry Leaders

-

ARM Limited

-

Rambus Inc

-

Cadence Design Systems, Inc.

-

Synopsys, Inc.

-

Mentor Graphics Corporation

- *Disclaimer: Major Players sorted in no particular order

Global Semiconductor Memory IP Market Report Scope

| Volatile Memory |

| Non - Volatile Memory |

| Other Products |

| Consumer Electronics |

| Industrial |

| Automotive |

| Networking |

| Other End-user Industries |

| North America | United States |

| Canada | |

| Europe | United Kingdom |

| Germany | |

| France | |

| Rest of Europe | |

| Asia Pacific | China |

| Japan | |

| South Korea | |

| Taiwan | |

| Rest of Asia-Pacific | |

| Rest of the World | Latin America |

| Middle-East & Africa |

| By Product | Volatile Memory | |

| Non - Volatile Memory | ||

| Other Products | ||

| By End -user Industry | Consumer Electronics | |

| Industrial | ||

| Automotive | ||

| Networking | ||

| Other End-user Industries | ||

| Geography | North America | United States |

| Canada | ||

| Europe | United Kingdom | |

| Germany | ||

| France | ||

| Rest of Europe | ||

| Asia Pacific | China | |

| Japan | ||

| South Korea | ||

| Taiwan | ||

| Rest of Asia-Pacific | ||

| Rest of the World | Latin America | |

| Middle-East & Africa | ||

Key Questions Answered in the Report

What is the current Semiconductor Memory IP Market size?

The Semiconductor Memory IP Market is projected to register a CAGR of 12.3% during the forecast period (2025-2030)

Who are the key players in Semiconductor Memory IP Market?

ARM Limited, Rambus Inc, Cadence Design Systems, Inc., Synopsys, Inc. and Mentor Graphics Corporation are the major companies operating in the Semiconductor Memory IP Market.

Which is the fastest growing region in Semiconductor Memory IP Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Semiconductor Memory IP Market?

In 2025, the Asia Pacific accounts for the largest market share in Semiconductor Memory IP Market.

What years does this Semiconductor Memory IP Market cover?

The report covers the Semiconductor Memory IP Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Semiconductor Memory IP Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Page last updated on:

Semiconductor Memory IP Market Report

Statistics for the 2025 Semiconductor Memory IP market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Semiconductor Memory IP analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.