Safety Drives and Motors Market Analysis by Mordor Intelligence

The Safety Drives and Motors Market is expected to register a CAGR of 6.63% during the forecast period.

-

Electric motors are used to power a wide range of machinery, including conveyer systems and heavy industrial equipment. Growing adoption of automation has created a need for accurate control of industrial machinery to realize optimal use of resources and maintain predefined quality of operation.

-

Electric drives aredeployed to control the movements and speeds of the machinery and other devices. This need is particularly high in manufacturing environments that deal with sensitive, fragile or explosive products. Growing focus on safety in such industries is driving the demand for safety drives and motor systems globally.

-

However, considerable slowdown in the mining industry is restraining the growth of the market. All the major mining giants, including countries, like Canada, Australia, Ukraine, Russia, etc., have recorded slow growth or in some case, decline in the mining market. Increasing regulatory constraints stand to be the major cause for slowdown in the market.

Global Safety Drives and Motors Market Trends and Insights

Oil & Gas to Occupy the Maximum Market Share

- Electric drives and motors play a major role in the oil & gas production and distribution, pumping systems for oil and compression drive trains for gas infrastructure.

- According to GE, unplanned outages from moto failure can cause a refinery revenue loss of USD 1.1 million for every half hour offline.

- With this, VFDs (Variable Frequency Drives) are increasingly being used in the oil & gas industry to control the flow, by adjusting speed that avoids energy wastage in the throttling valves.

- France-based Leroy Somer is a pioneer in drive system for oil & gas supply chain. Some of their products are Dyneo® Permanent Magnet Synchronous Motors, ATEX Dust and Gas Safety Motors, Powerdrive MD2 AC Drives which are known for offering reliability, robustness, efficiency and flexibility.

- GE is providing a complete solution to drive the main refrigerant compressors using electrical motors (synchronous or induction) powered by high-power drives based on thyristor technology (for LCI) or IGBT technology. This would assist LNG supply chain in processing, transport and distribution network.

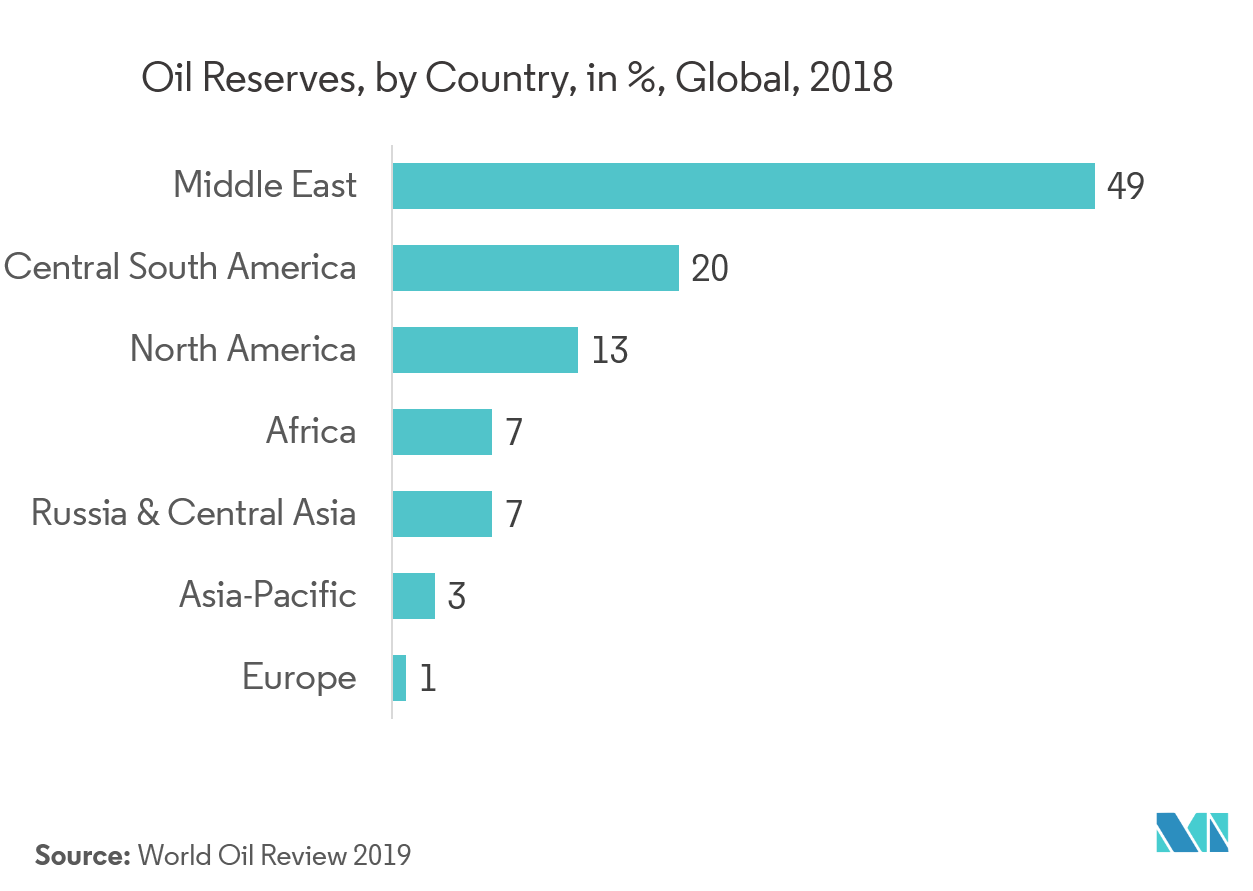

- There are many active and planned project work in the oil and gas sector across the Middle East, which is the largest producer of oil & gas.

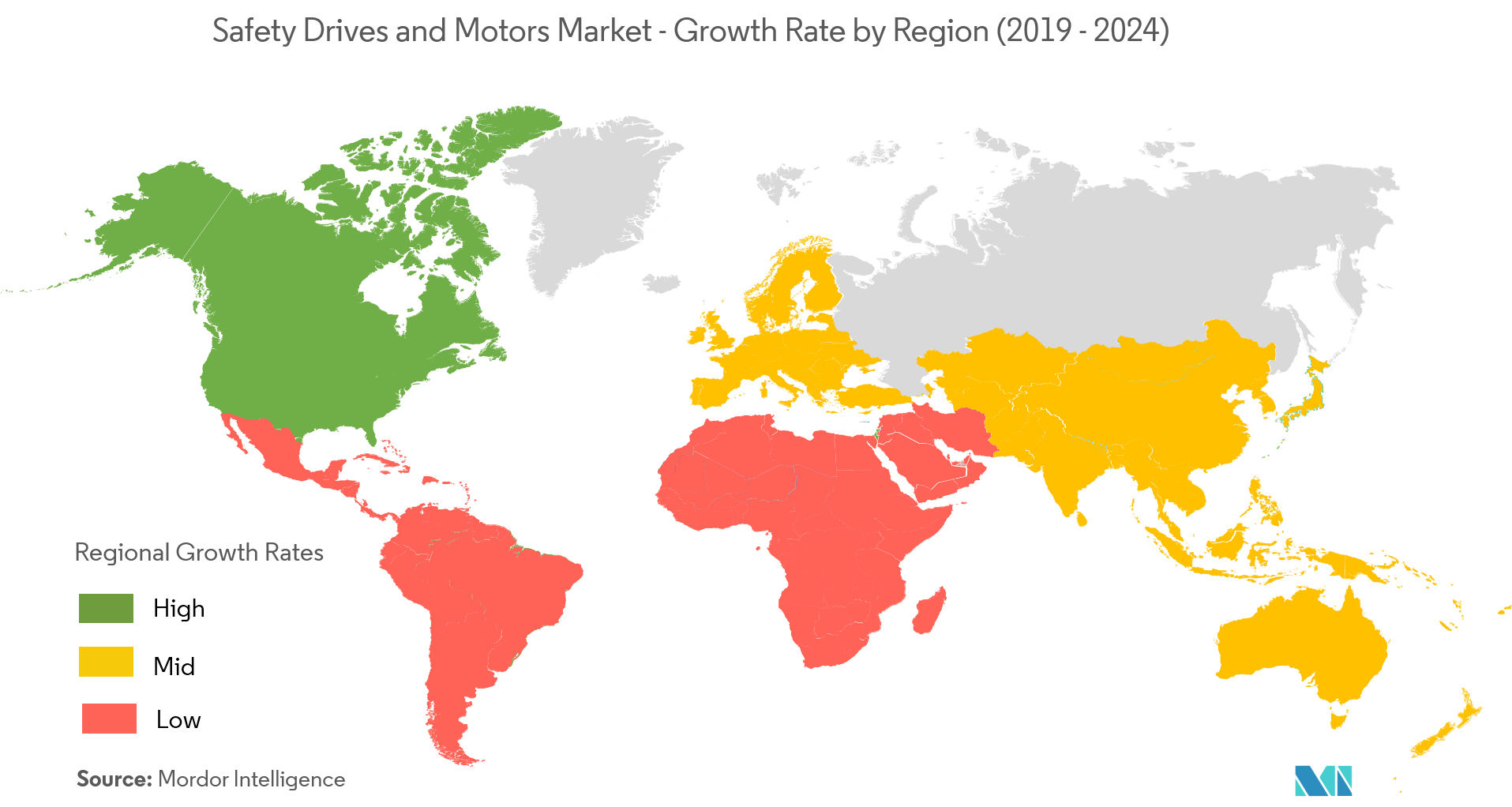

North America to Occupy Major Market Share

- North America is one of the largest markets for safety drives and motors globally. The region has a high demand form the upstream oil and gas sector and industrial segment. In fact it is one of the largest adopter of industry 4.0 policies in the world. Additionally, the US government’s policies to increase production and depend less on exports is expected to be the primary driver for demand from the industrial sector.

- According to BP Statistical Review of World Energy 2019, global oil production rose by 2.2 million b/d. Maximum net increase was accounted for by the US, with their growth in production of 2.2 million b/d. Growth in gas consumption was also driven by the United States at 78 bcm.

- Moreover, with the United States Department of the Interior (DoI) planning to allow offshore exploratory drilling in about 90% of the outer continental shelf (OCS) acreage, under the National Outer Continental Shelf Oil and Gas Leasing Program (National OCS Program) for 2019-2024, the oil and gas sector in the region is expected to open up new opportunities to the market.

- However declining mining industry in Canada is restraining the market growth in this region. According to the Mining Association of Canada, value of total mining projects planned and under construction from 2018 to 2028 has reduced by 55% since 2014. This was due to an increasing interest in Canada’s emerging cannabis sector, which gained attention after recreational use of marijuana was legalized in October 2018.

Competitive Landscape

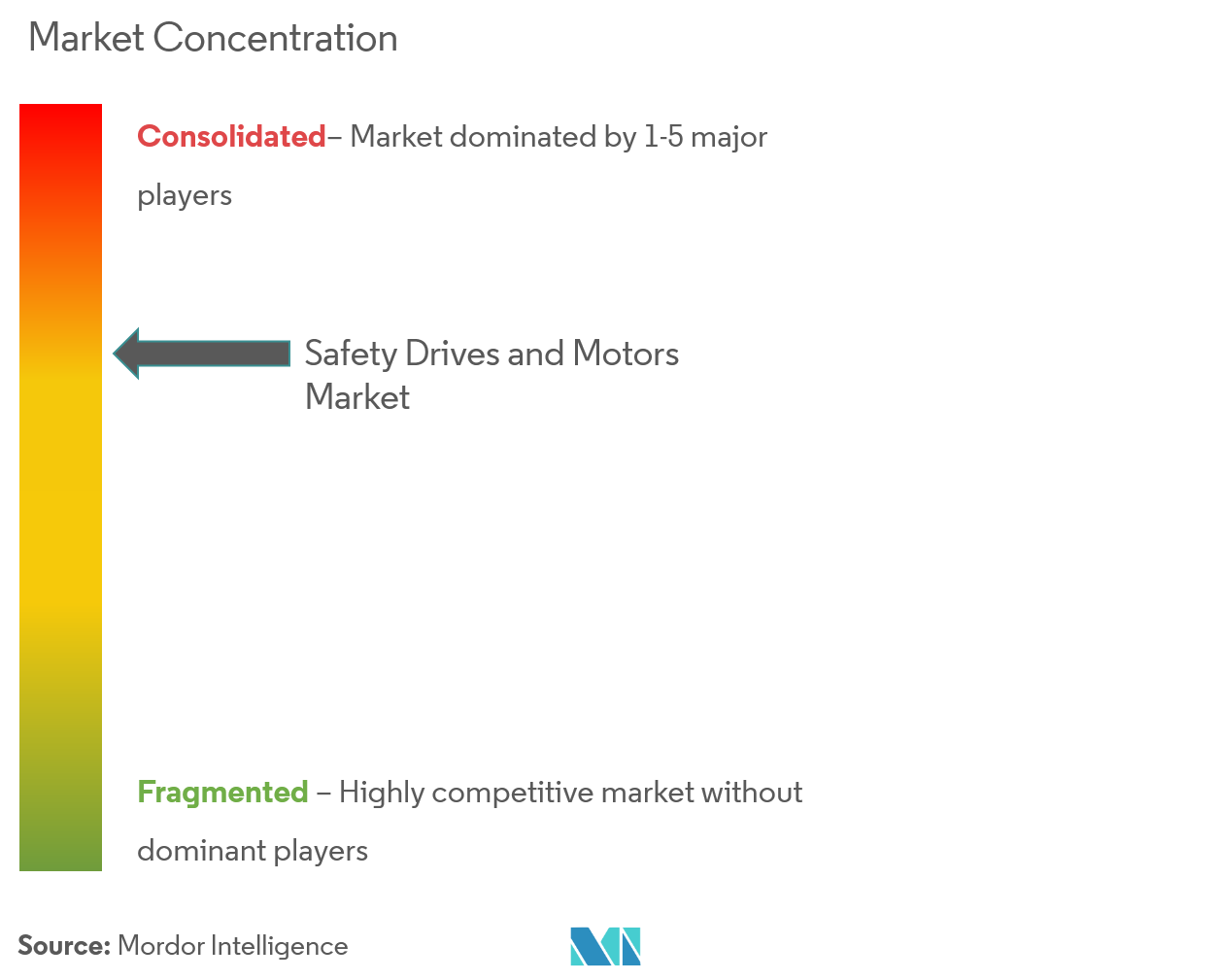

The market is concentrated with some major players occupying maximum market share which are in demand byOil and Gas, Petrochemicals and Chemicals, and Energy utility industries.

- June 2019 - The Linz-based KEBA Groupacquired LTI Motion Group, a pioneer of drive solutions from Germany. It servescustomers in mechanical engineering sectors. The acquisition makes KEBA a total solution provider in the area of industrial automation.

- October 2018 - Rockwell Automation launched theIntegrated Safety Functions Option Module which offers several safety functions based on IEC 61800-5-2 standards for Allen-Bradley PowerFlex 755 and 755T AC drives. It includes the ability to monitor speed, direction and position on an EtherNet/IP network.

- September 2019 -Beckhoff Automationexpanded its footprint in the Northeast region with new offices in Greater Boston and Philadelphia. It now offerseducational opportunities for Beckhoff customers who want to increase their expertise in PC-based control, advanced motion control, mechatronics and EtherCAT industrial Ethernet technology.

Safety Drives and Motors Industry Leaders

-

Rockwell Automation Inc.

-

SIGMATEK Safety Systems

-

ABB Ltd

-

Beckhoff Automation GmbH

-

KOLLMORGEN Corporation

- *Disclaimer: Major Players sorted in no particular order

Global Safety Drives and Motors Market Report Scope

Oil and Gas, Petrochemicals and Chemicals, and Energy utility industries are the major sources of the demand for safety drives and motors in the current market scenario. Additionally, there is a considerable demand from manufacturing, mining and construction sectors owing to the rapid adoption of Industry 4.0 policies.

| Drives | AC |

| DC | |

| Motors | AC |

| DC |

| Energy and Power |

| Manufacturing |

| Mining |

| Oil and Gas |

| Chemical and Petrochemical |

| Construction |

| Other End-user Verticals |

| North America |

| Europe |

| Asia-Pacific |

| Latin America |

| Middle East & Africa |

| By Type | Drives | AC |

| DC | ||

| Motors | AC | |

| DC | ||

| By End-user Vertical | Energy and Power | |

| Manufacturing | ||

| Mining | ||

| Oil and Gas | ||

| Chemical and Petrochemical | ||

| Construction | ||

| Other End-user Verticals | ||

| Geography | North America | |

| Europe | ||

| Asia-Pacific | ||

| Latin America | ||

| Middle East & Africa | ||

Key Questions Answered in the Report

What is the current Safety Drives and Motors Market size?

The Safety Drives and Motors Market is projected to register a CAGR of 6.63% during the forecast period (2025-2030)

Who are the key players in Safety Drives and Motors Market?

Rockwell Automation Inc., SIGMATEK Safety Systems, ABB Ltd, Beckhoff Automation GmbH and KOLLMORGEN Corporation are the major companies operating in the Safety Drives and Motors Market.

Which is the fastest growing region in Safety Drives and Motors Market?

North America is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Safety Drives and Motors Market?

In 2025, the North America accounts for the largest market share in Safety Drives and Motors Market.

What years does this Safety Drives and Motors Market cover?

The report covers the Safety Drives and Motors Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Safety Drives and Motors Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Page last updated on:

Safety Drives and Motors Market Report

Statistics for the 2025 Safety Drives and Motors market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Safety Drives and Motors analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.