Robotic Waste Sorting System Market Analysis

The Robotic Waste Sorting System Market is expected to register a CAGR of 19.5% during the forecast period.

- Tightening government regulations are playing a major role in shaping the market landscape. For instance, in July 2019, Shanghai Household Waste Management Regulation took place. In September 2018, The Indian Union Ministry of Environment, Forests and Climate Change (MoEF&CC) notified the new Solid Waste Management Rules (SWM), 2016. These will replace the Municipal Solid Wastes (Management and Handling) Rules, 2000, which have been in place for the past 16 years.

- Much of the world's waste is sold to China for recycling. But in April 2019, China introduced stricter standards for the amount of contamination it will accept anything more that 0.5% impure will go in the ground. This creates the need to introduce robots in waste sorting facilities.

- However, initial cost of setting up a robotic waste sorting facility is hindering the market growth. It is usually in the long term that savings are fully realized. They also need to undergo routine maintenance and occasional repair, which is difficult for small facilities to conduct due to limited financial budget.

Robotic Waste Sorting System Market Trends

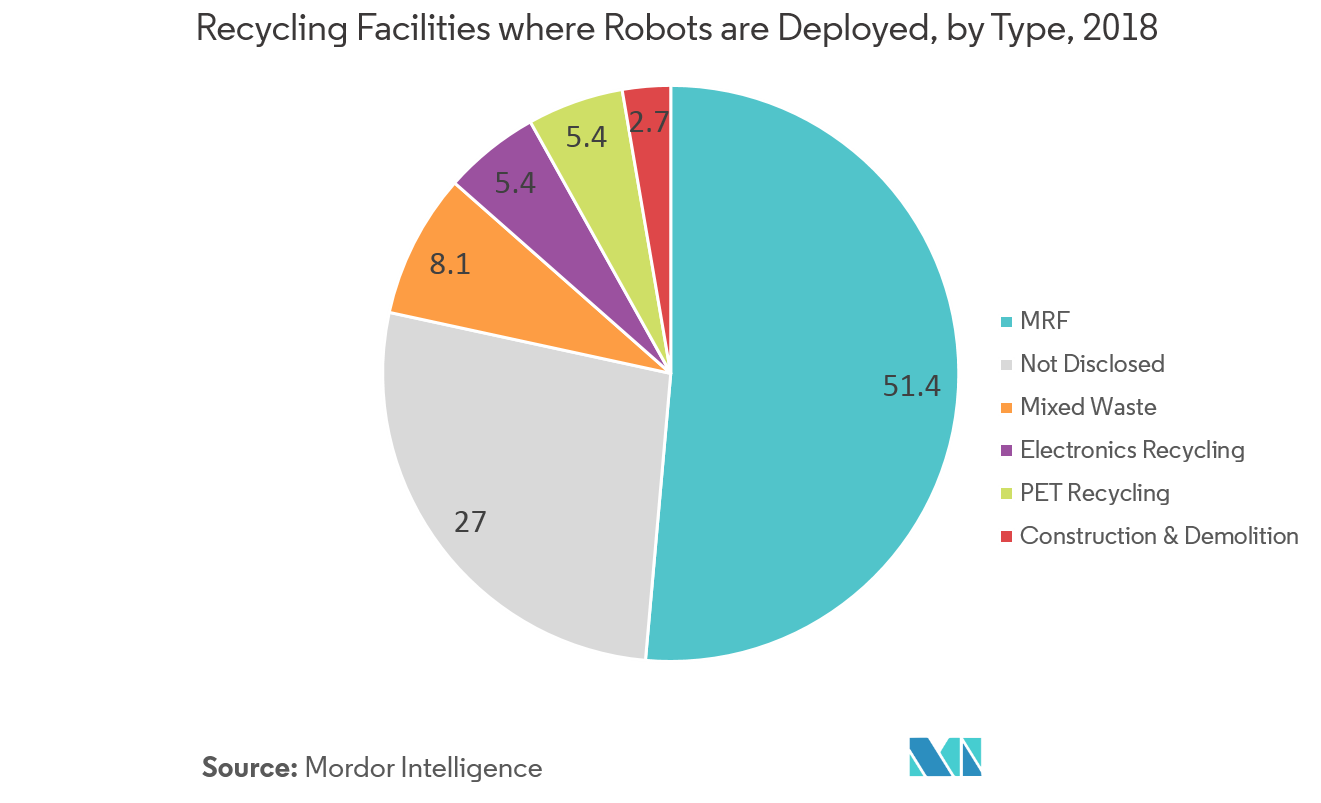

Materials Recovery Facility (MRF) to Witness the Highest Growth

- Recent policies pertaining to scrap imports into China are making exporting some post-consumer recyclables increasingly difficult. Material recovery facility (MRF) operators are trying to find new technologies or processes to help them meet China’s stricter quality requirements.

- Operators of material recovery facilities (MRFs) and other recycling plants also face the risk of being bombarded with technical terms as they go through proposals from technology and machinery vendors. This drives the MRFs to deploy robots for waste sorting system.

- As per Resource Recycling, or the most part, robots are working in single-stream MRFs.

- In May 2018, Machinex revealed its new sorting robot, SamurAI. At a materials recycling facility (MRF), SamurAI is designed to reduce reliance on manual sorting, therefore reducing ongoing operating costs while improving overall system performance.

- In June 2018, Lakeshore Recycling Systems announced the installation of this robot at its Heartland Recycling Center.It reduced LRS’ reliance on manual labor in the single-stream recycling facility, which in turn decreased the operation costs while improving productivity.

- In April 2017, Bulk Handling Systems announced the installation of Max-AI Technology, an artificial intelligence system which identifies recyclables and other items for recovery, at a materials recycling facility in Sun Valley, California.

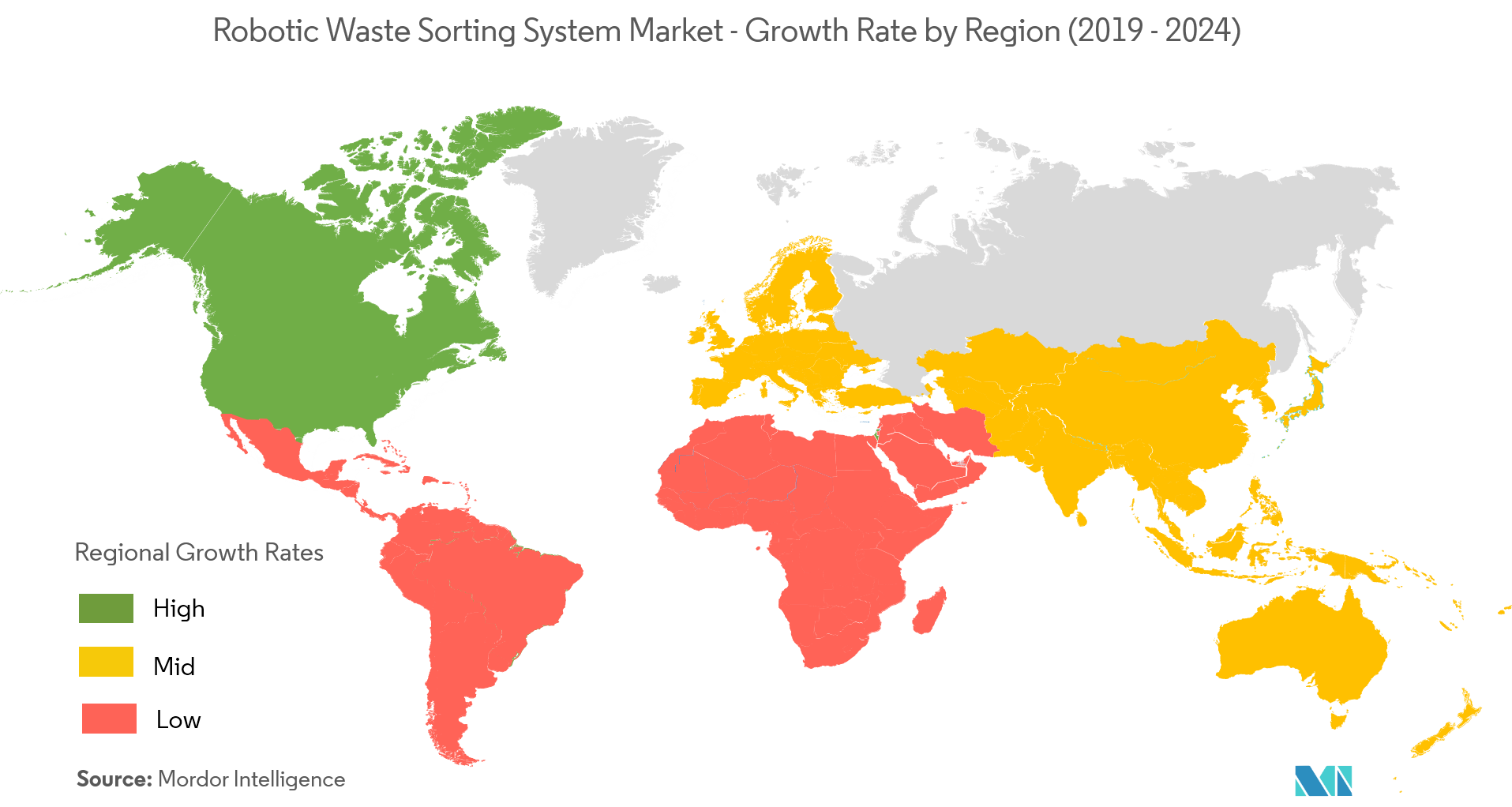

North America to Dominate the Market

- North America is the largest and the fastest-growing market due to its increasing consumption of products that are toxic to the environment.

- Also after compiling data from major robot providers, Resource Recycling estimates over 80 robots are either working or have been purchased in the U.S. and Canada.They’re sorting residential and commercial recyclables, mixed-waste, plastics, shredded electronics, and construction and demolition debris.

- Canadian government has announced that announced in March 2019 that Sustainable Development Technology Canada (SDTC) is investing USD 1.4 million in Waste Robotics, a company that makes intelligent recycling robots. The investment will help Quebec-based Waste Robotics develop a high-capacity, multi-arm robot waste sorting system that uses artificial intelligence (AI) to better sort commercial waste.

- Plessisville, Quebec-based recycling equipment provider Machinex announced in March 2019 that its SamurAI technology has been deployed in partnership with AMP at a Quebec MRF.

- Denver-based AMP Robotics has developed software — a AMP Neuron platform that uses computer vision and machine learning, so robots can recognize different colors, textures, shapes, sizes and patterns to identify material characteristics so they can sort waste.

Robotic Waste Sorting System Industry Overview

The market is highly concentrated with only a few players dominating the market share. Recycling industries are actively employing robotic waste sorting system to increase their productivity.

- May 2019 - AMP Robotics launchedits new AMP Cortex dual-robot system (DRS) focused on material recovery in Municipal Solid Waste (MSW), Electronic Waste (E-waste), and Construction and Demolition (C&D). It isguided by the AMP Neuron AI platform and uses two high-performance robots that rapidly sort, pick, and place materials at speed of 160 pieces per minute, creating optimum productivity.

- January 2019 -Oregon based recycling equipment manufacturer,Bulk Handling Systems (BHS), launched theMax-AIAQC-C, a solution that is comprised of Max-AI VIS (for Visual Identification System) and at least one collaborative robot (CoBot).

- January 2018 - US-based Zanker Recycling , a pioneer inconstruction and demolition (C&D) materials processing systems and recyclingawardeda contract toPlexus Recycling Technologies, the North American distributor of ZenRobotics.The ZenRobotics ZRR2 AI Robot wasthe second to operate in the U.S. and became operational by fall 2018.

Robotic Waste Sorting System Market Leaders

-

Machinex Industries Inc

-

AMP Robotics Corporation

-

Bulk Handling Systems

-

ZenRobotics Ltd

-

Sadako Technologies

- *Disclaimer: Major Players sorted in no particular order

Robotic Waste Sorting System Industry Segmentation

The market can be segmented by robots deployed in various recycling facilities, such as for electronics recycling, materials recovery facility, PET Recycling, Mixed Waste, Construction and Demolition. The market is also segmented by its presence in various regions such as North America, Europe and Asia-Pacific.

| By Robots Deployed in Recycling Facilities | Electronics Recycling |

| Materials Recovery Facility | |

| PET Recycling | |

| Mixed Waste | |

| Construction and Demolition | |

| Others | |

| Geography | North America |

| Europe | |

| Asia-Pacific | |

| Rest of the World |

Robotic Waste Sorting System Market Research FAQs

What is the current Robotic Waste Sorting System Market size?

The Robotic Waste Sorting System Market is projected to register a CAGR of 19.5% during the forecast period (2025-2030)

Who are the key players in Robotic Waste Sorting System Market?

Machinex Industries Inc, AMP Robotics Corporation, Bulk Handling Systems, ZenRobotics Ltd and Sadako Technologies are the major companies operating in the Robotic Waste Sorting System Market.

Which is the fastest growing region in Robotic Waste Sorting System Market?

North America is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Robotic Waste Sorting System Market?

In 2025, the North America accounts for the largest market share in Robotic Waste Sorting System Market.

What years does this Robotic Waste Sorting System Market cover?

The report covers the Robotic Waste Sorting System Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Robotic Waste Sorting System Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Waste Sorting Robots Industry Report

Statistics for the 2025 Robotic Waste Sorting System market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Robotic Waste Sorting System analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.