Rice Transplanter Market Analysis

The Global Rice Transplanter Market size is estimated at USD 1.58 billion in 2025, and is expected to reach USD 2.09 billion by 2030, at a CAGR of 5.77% during the forecast period (2025-2030).

The global rice transplanter market is growing due to increasing demand for efficient, labor-saving farming equipment. These machines automate rice seedling transplanting, improving productivity, reducing labor costs, and enhancing crop quality. Rice transplanters provide precise spacing and depth control, resulting in improved yield and resource utilization.

Population growth is increasing food demand, particularly in Asia, creating a higher need for agricultural machinery like rice transplanters. Urban migration has reduced agricultural labor availability, compelling farmers to adopt mechanization. The International Labor Organization reports that the global share of agricultural workers decreased from 27% in 2020 to 26% in 2022. The Indian Council of Food and Agriculture projects a 25.7% reduction in India's agricultural workforce by 2050, making mechanical transplanters necessary to replace manual labor. This mechanization trend addresses both labor shortages and rising labor costs in rural areas.

The global rice cultivation area increased from 160.3 million hectares in 2019 to 165.0 million hectares in 2022, strengthening demand for rice transplanters. Major rice-producing countries, including China, India, and Japan, are advancing agricultural modernization and promoting these technologies. While adoption barriers exist for smaller farmers due to high costs and specialized skill requirements, technological advancements and government support continue to drive market growth. Innovations such as GPS-guided systems and automated seedling feeding mechanisms are improving efficiency and usability, expanding potential adoption across different farmer segments.

The rice transplanter market has evolved through technological innovations that improve machine efficiency, precision, and adaptability to various field conditions. Automated and semi-automated transplanters deliver improved planting accuracy, reduced seed wastage, and better seedling management, contributing to higher yields. Battery-powered and fuel-efficient models are gaining popularity by reducing operational costs and supporting sustainable farming practices. Models like the Kubota GR1600 and Yanmar SPW Series feature electric drive systems that improve fuel efficiency and operational ease, increasing adoption across rice-growing regions.

Rice Transplanter Market Trends

Ride-on Rice Transplanter Hold Significant Position

The ride-on rice transplanter maintains a significant position in the rice transplanter market due to its advantages in large-scale rice farming operations. These machines are preferred by large-scale farmers for their efficiency, speed, and capacity to handle extensive fields. They are designed for single-operator use, allowing the operator to ride while planting rice seedlings, enabling efficient transplanting across large areas.

In numerous rice-producing countries, governments provide subsidies and financial incentives to promote mechanized farming equipment adoption. This is evident in countries like India, China, and Indonesia, where governments prioritize agricultural productivity enhancement and food security. Government subsidies for ride-on rice transplanters have increased their affordability for farmers. In China, the government subsidizes mechanized agricultural equipment purchases, including ride-on rice transplanters, to enhance rice productivity and reduce labor costs. In 2023, China's Ministry of Agriculture and Rural Affairs (MOA) and financial authorities allocated 10 billion yuan ($1.46 billion) in subsidies for agricultural material purchases, including machinery.

Asia-Pacific Dominates the Market

Rice is the staple crop for many Asian countries, particularly China and India, with the Asia Pacific region accounting for nearly 90% of global rice production. The increasing population in Asian countries is driving up food demand, especially in India, which has become the most populous country in the region. According to the World Bank, India's population reached 1.42 billion in 2023. This population growth has intensified the food demand in the region. As rice serves as the primary staple food in over 100 countries, increasing rice production is essential for addressing hunger, particularly in Asia.

In India, small-scale farmers typically perform rice transplanting manually, a process that requires approximately 238 man-hours per hectare. Evaluations of different rice establishment methods have shown that the system of rice intensification, followed by mechanical transplanting, yields the highest grain productivity. The decreasing availability of agricultural labor has led to increased adoption of mechanical transplanters in India.

China, the world's largest rice producer, contributes 30% of global rice production using various planting methods, including manual and mechanical techniques. Manual transplanting is declining in rural areas due to skilled labor shortages. It remains common in densely populated areas with smaller land parcels and higher labor availability. China dominates the regional market, exporting paddy to other Asian countries. Rice cultivation occurs in nearly every Chinese province, with the country producing more than one-quarter of the world's rice annually. While Indian farmers prefer manually operated machines, China and other Asian countries are experiencing higher demand for riding-type rice transplanter machines.

Rice Transplanter Industry Overview

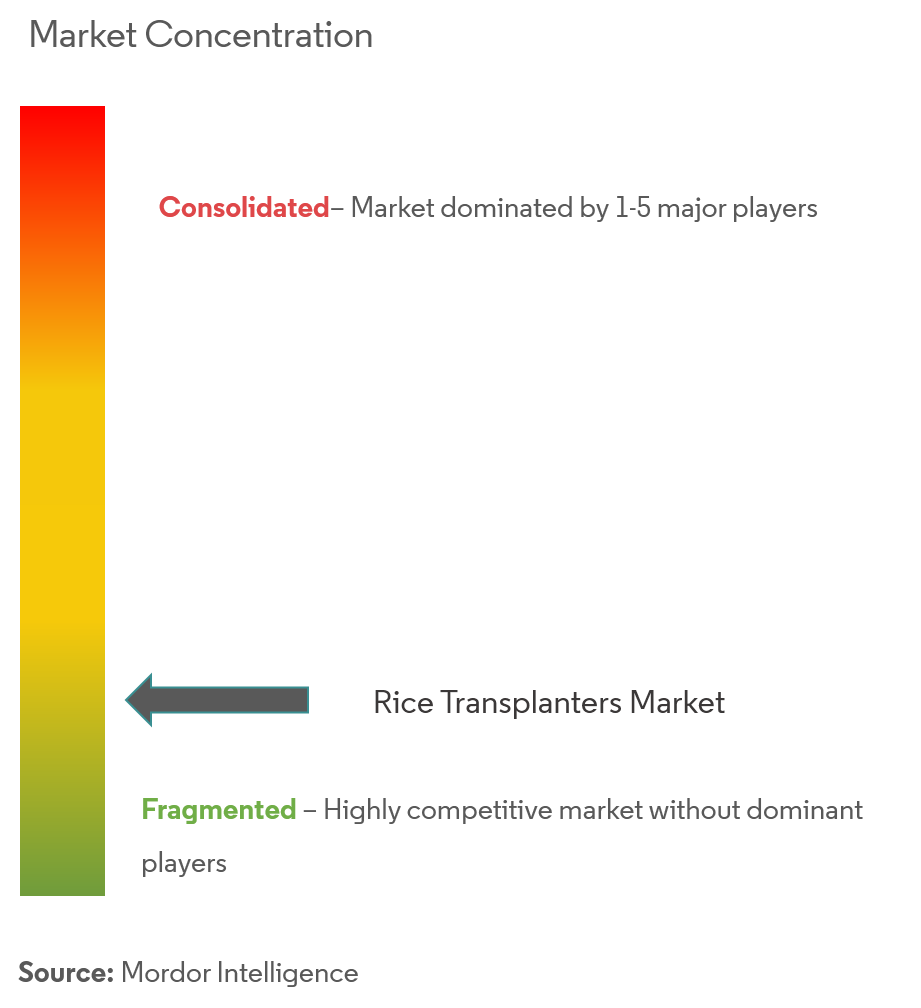

The rice transplanter market is fragmented, with numerous small and medium-sized companies competing intensely. The emergence of regional markets and local manufacturers across different geographical regions contributes to this market fragmentation. Major players are focusing on innovation to maintain their competitive positions. The primary companies operating in the market include Kubota Corporation, ISEKI & CO., LTD., Mitsubishi, CLASS KGaA mbH, and CNH Industrial.

Rice Transplanter Market Leaders

-

Mitsubishi

-

CNH Industrial

-

ISEKI & CO.,LTD.

-

Kubota Corporation

-

CLASS KGaA mbH

- *Disclaimer: Major Players sorted in no particular order

Rice Transplanter Market News

- June 2024: Mahindra recently launched the 6RO Paddy Walker, a new transplanter designed to improve paddy cultivation efficiency. Its features include stable seedling transplanting, consistent seeding feed, and horizontal control, which aim to enhance crop growth and yield. The Mahindra 6RO Paddy Walker is projected to reduce labor costs and increase productivity in paddy farming across India.

- October 2022: Kubota launched its Agri-Robo Rice transplanter with the help of its R&D team and young innovators. This Agri-robo rice transplanter made transplanting a beautiful process and provided 'expert full-field planting' that saves farmers both effort and labor.

Rice Transplanter Industry Segmentation

A rice transplanter is a specialized transplanter fitted to transplant rice seedlings onto paddy fields. The global rice transplanter market is segmented by product type (ride-on rice transplanters and walking rice transplanter) and geography (North America, Europe, Asia Pacific, South America, and Africa). The report offers market estimation and forecasts in value (USD) for the above-mentioned segments.

.

| Product Type | Ride-on Rice Transplanter | ||

| Walking Rice Transplanter | |||

| Geography | North America | United States | |

| Canada | |||

| Mexico | |||

| Rest of North America | |||

| Europe | Germany | ||

| United Kingdom | |||

| France | |||

| Italy | |||

| Spain | |||

| Russia | |||

| Rest of Europe | |||

| Asia Pacific | China | ||

| Japan | |||

| India | |||

| Australia | |||

| Rest of Asia-Pacific | |||

| South America | Brazil | ||

| Argentina | |||

| Rest of South America | |||

| Africa | South Africa | ||

| Rest of Middle East & Africa | |||

Global Rice Transplanter Market Research Faqs

How big is the Global Rice Transplanter Market?

The Global Rice Transplanter Market size is expected to reach USD 1.58 billion in 2025 and grow at a CAGR of 5.77% to reach USD 2.09 billion by 2030.

What is the current Global Rice Transplanter Market size?

In 2025, the Global Rice Transplanter Market size is expected to reach USD 1.58 billion.

Who are the key players in Global Rice Transplanter Market?

Mitsubishi, CNH Industrial, ISEKI & CO.,LTD., Kubota Corporation and CLASS KGaA mbH are the major companies operating in the Global Rice Transplanter Market.

Which is the fastest growing region in Global Rice Transplanter Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Global Rice Transplanter Market?

In 2025, the Asia Pacific accounts for the largest market share in Global Rice Transplanter Market.

What years does this Global Rice Transplanter Market cover, and what was the market size in 2024?

In 2024, the Global Rice Transplanter Market size was estimated at USD 1.49 billion. The report covers the Global Rice Transplanter Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Global Rice Transplanter Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Global Rice Transplanter Industry Report

Statistics for the 2025 Global Rice Transplanter market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Global Rice Transplanter analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.