Returnable Transport Packaging Market Analysis

The RTP Market is expected to register a CAGR of 5.9% during the forecast period.

- Returnable transport packaging (RTP) is a multi-trip packaging medium in which goods are transported more than once between the customers and vendors. The factors, like rising cost of packaging, damage to goods in transit, availability of packaging material, and the cost of disposing of the packaging material, have drawn the attention of the companies to sustainable packaging. Hence, the businesses are realizing the importance of having a sustainable and low-cost packaging system in place.

- RTP is increasingly gaining prominence worldwide, due to its positive effects on the environment. The packaging materials have contributed immensely to the depletion of natural resources.

- According to the global environment facility (GEF), the production of plastics, one of the most used packaging materials, increased by about twenty folds between 1964 and 2015, with an annual output of 322 million metric ton. The production is expected to be double by 2035 and quadruple by 2050.

- While plastics contribute to the economic growth, their current production and usage pattern, on a linear model of 'take, make, use, and dispose of', are the primary reasons for the depletion of natural resource, waste, environmental degradation, and climate change. These factors lead to adverse effects on human health. In addition, the usage of wood has exerted a tremendous pressure on forests.

- In addition, packaging has significantly contributed to global warming and the ozone layer depletion. It has placed excessive pressure on the environment, owing to the unceasing disposal of waste. Packaging also contributes to landfill space and serves as a source of toxic materials, with health implications and the risk of groundwater contamination.

- To deal with these negative consequences of packaging, RTP enables the firms to reduce their operational costs and reduce the environmental impact, while conforming with the government's regulations for sustainable supply chains.

Returnable Transport Packaging Market Trends

Drums and Barrels to Witness Significant Market Growth

- Drums play an essential role in the returnable transport packaging industry, as it is widely used to store and transport hazardous and non-hazardous liquids, ensuring maximum protection. Drums are majorly used in Oil & Gas and Petrochemicals industry, which is largely used for oil spill protection, during storage and transport.

- Various kinds of drums widely available in the market are plastic drums, steel drums, salvage drums, and fiber drums. Plastic drums used in the food industry are required to be suitably decontaminated and certified safe for carrying and storing consumable items in the long term. The plastic drums used in the food industry are also needed to be food grade approved and comply with other food safety standards.

- Besides the food industry, plastic drums are majorly used in the chemicals and oil industry, for their storage and transport. The extensive usage of plastic drums across industries is increasing due to its benefits, such as cost-efficiency, durability, and reusability.

- nRecently, the Intermediate bulk container and PE drum specialist Schütz Australia, invested approximately USD 20 million in technology and facilities in the manufacturing plant, to better service the Australian market. The company is majorly involved in the manufacturing and reconditioning of IBCs and polyethylene (PE) drums.

- However, the rising concerns towards the substantial increase in plastic waste generation, globally, alternative materials are being adopted to create industrial drums. For instance, steel drums are the most preferred option after plastic drums. This is due to the several benefits it offers over plastic, such as recyclability, ability to withstand extreme conditions, and lower lifecycle cost, among others.

North America to have Significant Growth

- The North American region is one of the largest regions for the pharmaceutical plastic packaging industry due to its large pharmaceutical manufacturing base and the ability to introduce technological advancements to pharmaceutical packaging. According to PMMI, The Association for Packaging and Processing Technologies, there are more than 700 North American Manufacturers of equipment, components, and materials for processing and packaging.

- The returnable transport packaging market in the United States is bolstered by the presence of major market players and strong manufacturing industries, such as chemicals, pharmaceuticals, food and beverages, and automotive.

- The rigid plastic bulk containers are used in various industries, such as the food and beverage industry, industrial chemical industry, pharmaceutical industry, paints, inks, and dyes industry, and petroleum and lubricant industry. The Rigid Intermediate Bulk Container Association of North America fosters the interests of persons, firms, and corporations engaged in the business of manufacturing or assembling rigid intermediate bulk containers.

- The Unites States is the third-largest exporter after China and the European Union, and the second-largest importer of goods in the world. These goods mainly consist of industrial machinery, medical equipment, petroleum products, and automotive parts and supplies

- For instance, the United States reported a rise in exports from USD 13.6 billion from the previous month resulting in USD 158.3 billion in June 2020. Further, the region experienced the first gain in demand for exports of industrial goods and services since February thereby suggesting an improvement in global demand after being depressed by the pandemic.

Returnable Transport Packaging Industry Overview

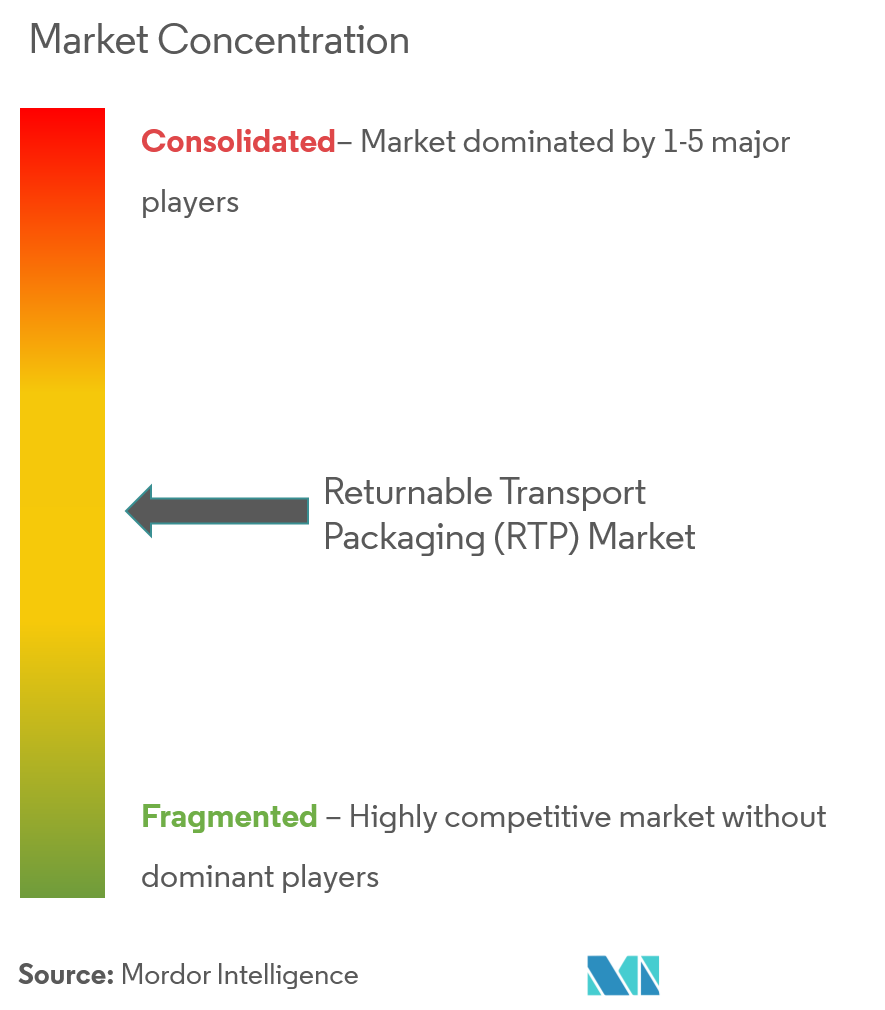

The major players include IFCO System, Kuehne+Nagel, Schoeller Allibert, SSI Schaefer, Rehrig Pacific, and SSI Schaefer LTD, amongst others. The market concentration is moderate since there is no significant competition going on in the market because the companies are mainly focusing on the improved quality of transport packaging rather than focusing on the competitors since most of them are unorganized and local players.

- January 2020 - Societa Gestione Impianti Nucleari SpA (Sogin), the state-owned company responsible for dismantling Italy's nuclear power plants, said the shipment marks the launch of the second and final phase of the transport programme. Arranged in four containers, the first 162 drums were shipped on two trucks.

- February 2020 - CHEP Australia has officially opened it's first 'Plant of the Future' upgrade in Melbourne. The CHEP DerrimutService Centre is the first of four service centers nationally to be upgraded as part of a global plant automation strategy. It creates more than a dozen jobs for the local community, greater efficiencies for industrial customers, and better sustainability results for the environment.

Returnable Transport Packaging Market Leaders

-

IFCO Systems

-

Nefab AB.

-

SSI Schaefer Limited

-

Rehrig Pacific Company

-

brambles limited (CHEP)

- *Disclaimer: Major Players sorted in no particular order

Returnable Transport Packaging Industry Segmentation

Returnable transport packaging (RTP) is a kind of packaging where it can be used for more than one trips. These goods can be transported in the city, nationally or could be internationally between vendors and customers. The transport is done in pallets, drums, containers, etc. Transportation is mainly done in the automotive sector and in the consumer goods industry.

| Material | Plastic |

| Metal | |

| Wood | |

| Product | Containers |

| Drums & Barrels | |

| Pallets | |

| Crates, Totes, Trays & Bins | |

| Intermediate Bulk Containers (IBC's) | |

| Other Product Types | |

| Application | Automotive |

| Food and Beverages | |

| Consumer Goods | |

| Industrial | |

| Others | |

| Geography | North America |

| Europe | |

| Asia Pacific | |

| Latin America | |

| Middle East and Africa |

Returnable Transport Packaging Market Research FAQs

What is the current RTP Market size?

The RTP Market is projected to register a CAGR of 5.9% during the forecast period (2025-2030)

Who are the key players in RTP Market?

IFCO Systems, Nefab AB., SSI Schaefer Limited, Rehrig Pacific Company and brambles limited (CHEP) are the major companies operating in the RTP Market.

Which is the fastest growing region in RTP Market?

North America is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in RTP Market?

In 2025, the Asia Pacific accounts for the largest market share in RTP Market.

What years does this RTP Market cover?

The report covers the RTP Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the RTP Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

RTP Industry Report

Statistics for the 2025 RTP market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. RTP analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.