Retail Analytics Market Analysis

The Retail Analytics Market size is estimated at USD 6.60 billion in 2025, and is expected to reach USD 8.12 billion by 2030, at a CAGR of 4.23% during the forecast period (2025-2030).

Retail data analytics follows analyzing historical data to enable smarter decisions, improve operations, and increase sales. Both end-user data and back-end processes, such as supply chain and inventory management, have been primary sources for data analytics.

- Business Intelligence and Analytics systems have been integrated with back-end applications to understand better shoppers' behavior to facilitate consistent customer conversation. The omnichannel strategies being adopted led analytics to cater to multiple channels by consolidating disparate data sources and communicating with customers on their preferred channel. A further step towards intense personalization has strengthened the typical customer Lifetime Value and touchpoints. Therefore, current retailers have been more inclined to collect and analyze data like Location, Social sentiment, Clickstream, etc.

- Digitalization to improve consumer experience and retail operations by obtaining consumer behavior data is propelling the retail analytics industry forward. The major advantage of employing retail analytics is that it provides particular and meaningful data on customer behavior. When business managers understand how to estimate financial returns, it makes managing any area of a firm much easier, and retail analytics gives information that businesses use to make choices. Retail analytics give merchants with a clear picture of the business, from analyzing social media comments to understanding a campaign's effects on store conversion rates.

- According to an IBM survey, executives estimated that COVID-19 had expedited their digitalization by 67%; moreover, the outbreak drove them to prioritize 'Improve operational efficiency' as its top priority by 92%.

- The advent of e-commerce has rendered traditional growth avenues across brick-and-mortar store expansions as outdated. Online platforms, localized assortments, and international market expansions have transformed the way merchandising analytics is approached. Significant competition from the online platforms led retailers to enter that space and offered a clearer picture of assortment, pricing, promotions, sourcing, replenishment, and in-store planning and execution.

- The COVID-19 outbreak has triggered the global digitalization of retail enterprises. The pandemic forced a radical shift away from conventional retail and toward modern e-commerce strategies centered on powerful digital tools like Al and analytics. The growing popularity of online consumption habits has intensified the demand for digital innovation and disruption. Growing the use of Al to customize shopping experiences, increase customer retention, and improve sales efficiency would benefit corporate growth.

Retail Analytics Market Trends

In-store Operation Hold Major Share

- In-store-operation-based analytics has become an indispensable part of a brick-and-mortar retailer's operating strategy. With benefits ranging from offering the right product to the right customer, further insight on loyal customers leads to the development of strategies to increase customer stickiness.

- When retailers deliver customized experiences to their consumers using several technology such as evaluating customer preferences, recognizing customer location in-store, targeted promotions, and purchase habits, they accomplish digital transformation in shops. The shop monitoring technology analyzes these trends to offer valuable insights that assist merchants in increasing revenue, sales, and footfalls.

- For instance, in June 2022, Amazon launched its new Store Analytics service. The e-commerce behemoth is now attempting to profit on its physical storefronts by providing marketers with data on what customers buy.

- According to NewGenApps, merchants who choose to fully utilize the potential of big data analytics may improve their operating profits by 60%. Furthermore, the omnichannel retailer may monitor in-store buyer behaviour and deliver timely deals to customers to incentivize in-store purchases or later online sales, therefore keeping the transaction within the retailer's fold.

- Quantzig, a data analytics and advisory firm, increased its in-store sales through micro-targeting and the profits by 12% for a fashion retailer based out of Germany. The retailer faced challenges focused on delivering insights to the right resource at the right time, lack of clearly articulated analytics strategy, and poor data quality.

Europe to Hold Significant Share

- The European segment is strong, owing to the presence of large players like IBM Corporation and SAP SE, which are the leading providers of predictive analytics and advanced retail analytics software. Moreover, more than six million companies are active in this region and employ more than 33 million people. Europe is home to many of the large-scale retailers in the world, such as Tesco, Carrefour, Lidl, Metro AG, and Aldi.

- One of the most popular online hobbies is internet shopping. It offers a large range of items to customers and a plethora of sales difficulties to e-commerce firms. Furthermore, the growing use of cloud services in the retail business will provide possibilities in the European retail analytics market in the near future.

- For example, in October 2022, Avery Dennison announced a collaboration with SAP to address waste concerns in the retail industry by connecting their individual analytic product cloud, enabling supermarkets to monitor and optimize the expiry dates of their items. The firms have agreed to incorporate SAP Analytics Cloud into Avery Dennison's atma.io connected product cloud through an OEM arrangement. According to reports, the data is provided to the SAP Analytics tool via atma.io, as well as items labeled using Avery Dennison's digital identifying technology, such as radio frequency identification (RFID).

- The use of sophisticated analytics to make internet shopping smarter and the combining of physical and online data can assist merchants in customizing their targeting, leading to incremental improvements in e-commerce sales and contributing to the expansion of the market's European sector.

Retail Analytics Industry Overview

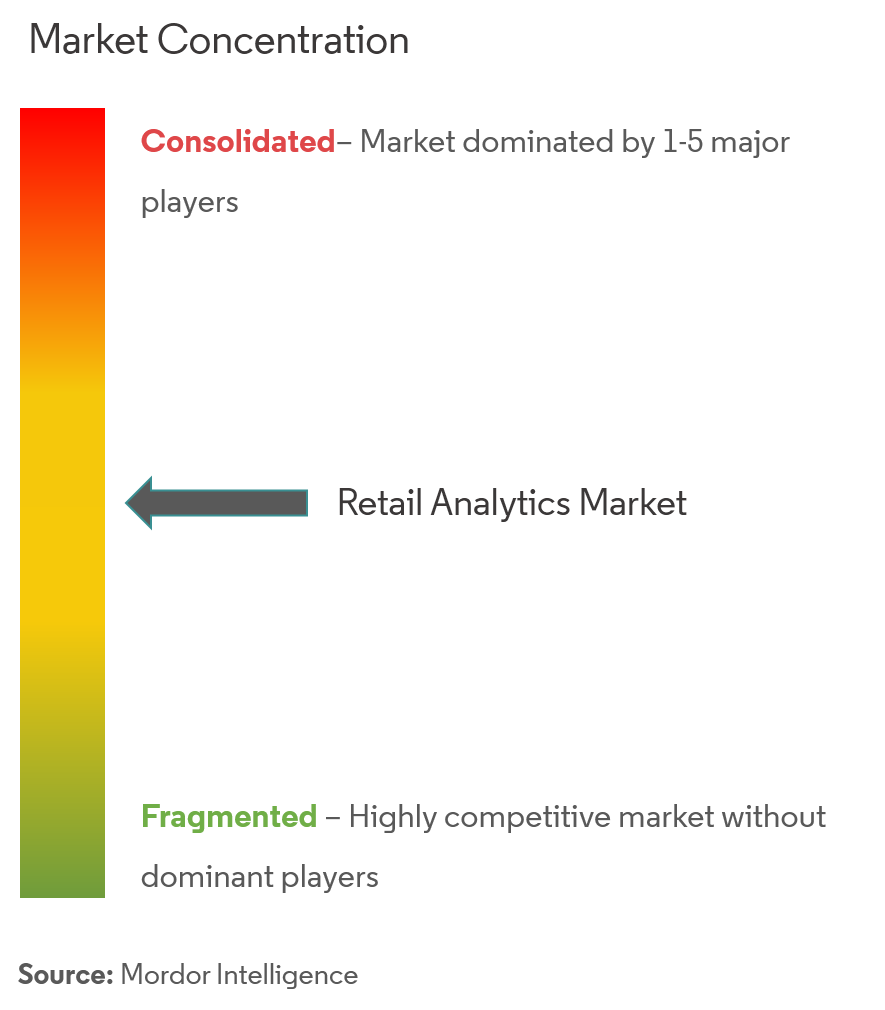

The Retail Analytics Market is moderately competitive. Some of the major players operating in the market include IBM Corporation, Oracle Corporation, SAP SE, SAS Institute Inc., and Salesforce.com Inc. (Tableau Software Inc.), among others. The players in the market are innovating in providing strategic solutions to increase their market presence and customer base. This enables them to secure new contracts and tap new markets. Some of the key developments in the market are:

- In September 2023, Oracle, in partnership with Uber, announced Collect and Receive, a new offering on the Oracle Retail platform connecting retailers and consumers to enhance and enrich last-mile delivery. Supported by the Oracle Retail Data Store and cloud platform technologies, retailers can link to Uber Direct, the company's delivery solution, through pre-integrated APIs. This joint solution allows retailers to rebalance inventory while giving customers more choices, including same-day and scheduled delivery options, order pickup, and returns to the closest retail or postal location.

- In June 2023, in partnership with Google, Salesforce expanded strategic partnerships to help businesses utilize data and AI to deliver more personalized customer experiences, better understand customer behavior, and run more effective campaigns at a lower cost across marketing, sales, service, and commerce. Two new data and AI innovations will bring real-time data sharing with enhanced predictive and generative AI capabilities. Businesses can use their data and custom AI models to better predict customer needs and reduce the cost, risk, and complexity of synchronizing data across platforms.

Retail Analytics Market Leaders

-

IBM Corporation

-

Oracle Corporation

-

SAP SE

-

SAS Institute Inc.

-

Salesforce.com Inc. (Tableau Software Inc.)

- *Disclaimer: Major Players sorted in no particular order

Retail Analytics Market News

- September 2023 - Priority Software acquired Retailsoft, a developer of innovative technology solutions for optimizing retail business efficiency and enhancing revenue growth. In addition, Priority is expanding the scope of its Retail Management Products and delivering significant value to Retailers by integrating Retailsoft's solutions. Retailsoft provides a dynamic platform with operational modules tailored to each organization's needs. These modules comprise work scheduling, communication tools, objective setting, and real-time access to POS data across all locations. Such features empower businesses with trend analysis, monitoring, and strategy optimization, facilitating data-driven decisions, sales goal setting, and fostering competition among branches.

- January 2023 - AiFi, a startup that aims to enable retailers to deploy autonomous shopping tech, partnered with Microsoft to launch a preview of a cloud service called Smart Store Analytics. It provides retailers using AiFi's technology with shopper and operational analytics for their fleets of "smart stores." With Smart Store Analytics, AiFi will handle store setup, logistics, and support, while Microsoft will deliver models for optimizing store payout, product recommendations, and inventory, among others.

Retail Analytics Industry Segmentation

Retail analytics is the process of providing analytical data on inventory levels, supply chain movement, consumer demand, sales, etc., which are crucial for marketing and procurement decisions. It also offers detailed customer insights, along with insights into the business and processes of the organization, with the scope and needs for improvement.

The retail analytics market is segmented by solution (software and service), deployment (cloud and on-premise), function (customer management, in-store operation, supply chain management, marketing and merchandising, others), and geography (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa). The market sizes and forecasts are provided in terms of value (USD) for all the above segments.

| By Solution | Software | ||

| Service | |||

| By Deployment | Cloud | ||

| On-premise | |||

| By Function | Customer Management | ||

| In-store Operation (Inventory Management and Performance Management) | |||

| Supply Chain Management | |||

| Marketing and Merchandizing (Pricing and Yield Management) | |||

| Other Functions (Transportation Management, Order Management) | |||

| By Geography | North America | United States | |

| Canada | |||

| Europe | Germany | ||

| United Kingdom | |||

| France | |||

| Russia | |||

| Rest of Europe | |||

| Asia-Pacific | China | ||

| Japan | |||

| India | |||

| Rest of Asia-Pacific | |||

| Latin America | |||

| Middle East and Africa | |||

Retail Analytics Market Research FAQs

How big is the Retail Analytics Market?

The Retail Analytics Market size is expected to reach USD 6.60 billion in 2025 and grow at a CAGR of 4.23% to reach USD 8.12 billion by 2030.

What is the current Retail Analytics Market size?

In 2025, the Retail Analytics Market size is expected to reach USD 6.60 billion.

Who are the key players in Retail Analytics Market?

IBM Corporation, Oracle Corporation, SAP SE, SAS Institute Inc. and Salesforce.com Inc. (Tableau Software Inc.) are the major companies operating in the Retail Analytics Market.

Which is the fastest growing region in Retail Analytics Market?

North America is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Retail Analytics Market?

In 2025, the Europe accounts for the largest market share in Retail Analytics Market.

What years does this Retail Analytics Market cover, and what was the market size in 2024?

In 2024, the Retail Analytics Market size was estimated at USD 6.32 billion. The report covers the Retail Analytics Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Retail Analytics Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Retail Analytics Software Industry Report

Statistics for the 2025 Retail Analytics market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Retail Analytics analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.