Residential Routers Market Size and Share

Residential Routers Market Analysis by Mordor Intelligence

The Residential Routers Market size is estimated at USD 13.51 billion in 2025, and is expected to reach USD 20.85 billion by 2030, at a CAGR of 9.06% during the forecast period (2025-2030).

- The integration of IoT devices into households is heavily reliant on robust internet connections and networks. A smart home can only function seamlessly if all automation devices are properly connected to the internet at the location where they are installed. This is where the router comes into play as it manages internet connectivity within the home. Thus, a router plays a crucial role in ensuring uninterrupted and smooth network functioning.

- In March 2022, Vodafone-Idea launched the Vi MiFi, a pocket-sized 4G router that enables users to connect up to 10 Wi-Fi-enabled devices. This router boasts a high battery capacity of 2700 mAh, which can last for up to 5 hours on a single charge. Additionally, in August 2022, Reliance Jio launched the Jio Wi-Fi Mesh router, which expands network coverage across homes, covering an area of up to 1000 sq ft across a single floor.

- The Covid-19 pandemic led to a significant increase in network traffic, with a 40% surge observed in the first few weeks. As the outbreak spread, traffic patterns shifted from business parks to residential areas, leading to a continued surge in content consumption, gaming, and OTT demand. This highlights the need for efficient home routers.

- It is worth noting that the distance between the router and the device can greatly impact Wi-Fi speed and connection strength. Therefore, it is essential that routers are designed to provide a strong and wide signal to reach all areas of the house. To withstand the competitive market, router manufacturers require constant innovation and technological advancements.

Global Residential Routers Market Trends and Insights

Wireless Connectivity to Witness the Market Growth

- The Internet has become more affordable and accessible over the years, particularly in urban areas, and has even made its way to semi-urban and rural areas with the widespread adoption of wireless technology. This has not only brought convenience to people's lives but has also significantly improved productivity, as wireless connections do not require cables and are faster than wired connections. As a result, Wi-Fi routers have become a norm in most houses.

- In March 2023, Qualcomm, in partnership with WeSchool, Telecom Italia (TIM), and Acer, launched the 5G Smart Schools program to provide next-generation wireless technology solutions to schools in Italy. The program aims to develop digital skills among secondary school students and provide professional development opportunities for teachers.

- Moreover, Cox Private Networks is running Fixed Wireless (FWA) trials to deliver high-speed internet in rural areas. This initiative will help bridge the digital divide and provide access to the internet to people living in remote areas.

- In March 2022, the US Government raised 14.2 billion USD for the Affordable Connectivity Program (ACP) to help rural communities pay for their internet service. With mid-band frequencies, Citizens Band Radio Service (CBRS) will offer broadband in rural communities. Broadband, a regional internet provider, debuted CBRS-based Fixed Wireless Access services focused on rural areas, further improving access to the internet in remote locations.

- Overall, the increasing accessibility and affordability of the Internet, along with the development of new wireless technologies, are bringing numerous benefits to people's lives and improving opportunities for education, communication, and economic growth.

North America Is Expected to Hold Significant Market Share

- Based on the latest report from GSMA, 5G is currently booming in North America and is projected to dominate the wireless services sector by 2025. The United States is expected to have the world's second-highest 5G adoption rate, with only South Korea surpassing it. By 2025, 5G is forecasted to account for almost all mobile capex as operators increase mid-band spectrum deployments. As a result, 5G revenues are expected to increase from 294 billion USD in 2021 to 333 billion USD in 2025, showing the immense growth potential for this technology.

- Moreover, 5G is expected to cover 92% of the Canadian population and 100% of the US population. Major telcos in the US are leveraging 5G Fixed Wireless Access (FWA) technology to gain market share from cable providers in the fixed broadband sector. Among them, T-Mobile, with 0.98 million FWA subscribers as of Q1 2022, is the largest single provider of 5G FWA services.

- In October 2022, Transaction Network Services (TNS) launched its Smart Sim capability for Global Wireless Access, which benefits processors, ISOs, and merchants across the US. TNS's extensive local and international wireless coverage allows North American customers to take advantage of the same dependable and secure wireless connectivity, with round-the-clock assistance, wherever they need to deploy, providing access to roaming and domestic connectivity choices in various geographies.

- In summary, 5G is experiencing rapid growth in North America and is expected to continue to dominate the wireless services sector by 2025. The US is poised to have one of the highest 5G adoption rates globally, with T-Mobile leading the charge in 5G FWA services. With TNS's Smart Sim capability, North American customers can benefit from reliable and secure wireless connectivity for their business needs, backed by comprehensive coverage and support.

Competitive Landscape

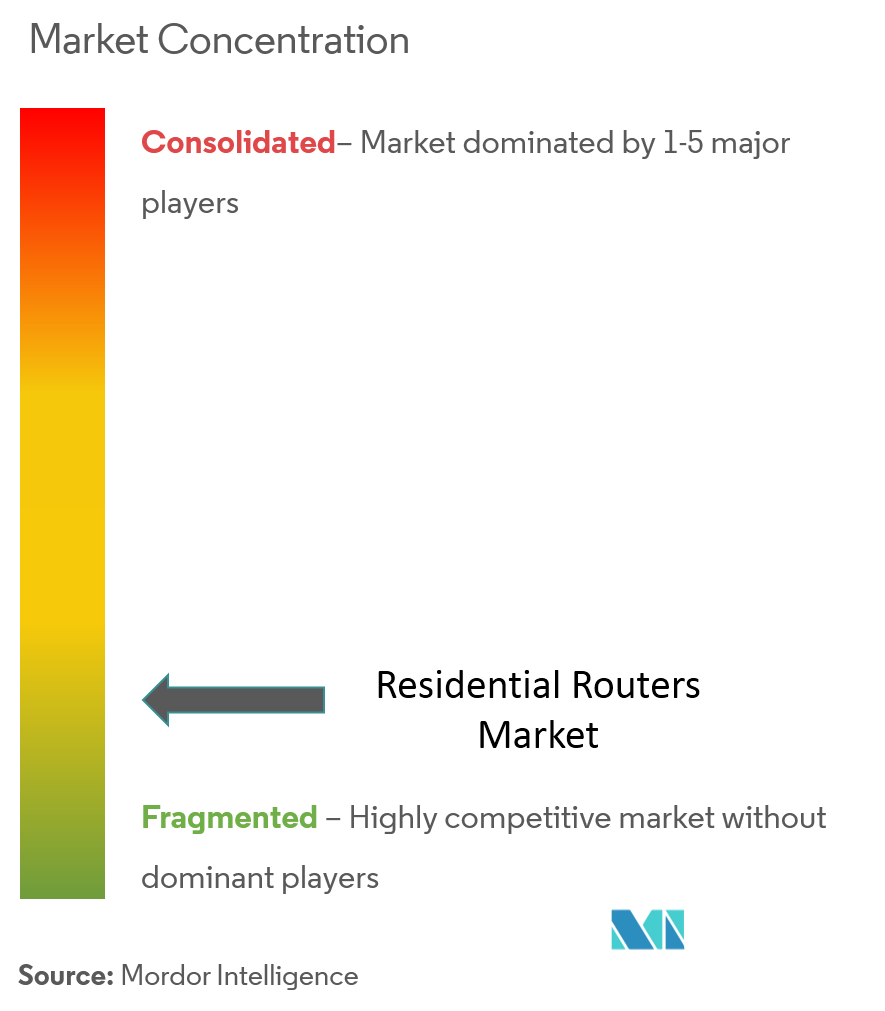

The residential router market is experiencing significant changes as new bandwidth usage and service delivery scenarios are reshaping network infrastructures. Equipment manufacturers are responding by developing carrier-class routers that support a broader range of services and applications and offer capacity scalability and higher data rates. With many players involved in this sector, the market is highly fragmented and has the potential to grow further as manufacturers invest in innovative hardware and software features in their products. Some significant players offering their services in this sector include D-Link Corporation, Netgear Inc., Linksys Group (Foxconn), Synology Inc., and more.

In May 2022, HFCL Limited collaborated with Wipro to introduce 5G transport solutions that enable enterprises to realize their 5G-enabled vision and increase the speed with which they can bring high-quality 5G solutions to the market. In October 2022, MediaTek partnered with Invendis to launch Made in India 5G Routers and Wi-fi solutions, providing consumers and enterprise customers with secure, strong, and seamless wireless networking solutions. And in February 2023, Telecom26 and Trasna Solutions partnered to develop eSIM management solutions for cellular routers, offering router manufacturers an efficient and user-friendly way to manage eSIMs on their existing SIM-based devices.

Residential Routers Industry Leaders

-

Netgear Inc.

-

D-Link Corporation

-

TP-Link Technologies Co. Ltd

-

Linksys Group (Foxconn)

-

TRENDnet Inc.

- *Disclaimer: Major Players sorted in no particular order

Recent Industry Developments

- March 202: NETGEAR launched its first Wi-Fi 7-capable router, claiming to be the world's fastest consumer-grade networking device capable of 19 Gbps peak data rate. The router will support low-latency AR/VR gaming, UHD Zoom calls, and 8k simultaneous streaming. It is designed to house antennas for 360-degree coverage of up to 3,500 square feet. For additional coverage, two or more RS700 units can mesh together.

- March 2023: Siemens launched the first 5G industrial router, which will benefit the manufacturing industry. According to Siemens, these new products can improve mobile broadband transmission, reliable low latencies, and massive machine-type communication. The routers can be utilized to monitor and service plants, and control elements, machines, and other industrial devices through a public 5G network, such as flexibility and data rates. These devices can also be utilized in modern communication networks, such as monitoring data traffic and protecting against unauthorized access.

- January 2023: Synology expanded its product line of critically-acclaimed routers by launching powerful Wi-Fi 6 routers designed to provide fast, secure, and safe internet connectivity to busy households and businesses. The routers are designed to handle the difficulties of contemporary network environments, such as the enormous increase in connected devices and the need to safeguard users from ever-rising security risks.

Global Residential Routers Market Report Scope

A router is a gateway that passes data between one or more local area networks. It is a device that provides Wi-Fi and is typically connected to a modem. The router that is installed in homes to share a single internet connection to multiple devices is a residential router. These internet-connected devices in the home form a local area network (LAN).

The residential routers market is segmented by connectivity type (wired and wireless), standard (802.11b/g/n, 802.11ac, 802.11ax), and geography.

The market sizes and forecasts are provided in terms of value (USD million) for all the above segments.

| Wired |

| Wireless |

| 802.11b/g/n |

| 802.11ac |

| 802.11ax |

| North America | United States |

| Canada | |

| Europe | United Kingdom |

| Germany | |

| Rest of Europe | |

| Asia-Pacific | China |

| Japan | |

| India | |

| Rest of Asia-Pacific | |

| Latin America | |

| Middle East and Africa |

| Connectivity Type | Wired | |

| Wireless | ||

| Standard | 802.11b/g/n | |

| 802.11ac | ||

| 802.11ax | ||

| Geography | North America | United States |

| Canada | ||

| Europe | United Kingdom | |

| Germany | ||

| Rest of Europe | ||

| Asia-Pacific | China | |

| Japan | ||

| India | ||

| Rest of Asia-Pacific | ||

| Latin America | ||

| Middle East and Africa | ||

Key Questions Answered in the Report

How big is the Residential Routers Market?

The Residential Routers Market size is expected to reach USD 13.51 billion in 2025 and grow at a CAGR of 9.06% to reach USD 20.85 billion by 2030.

What is the current Residential Routers Market size?

In 2025, the Residential Routers Market size is expected to reach USD 13.51 billion.

Who are the key players in Residential Routers Market?

Netgear Inc., D-Link Corporation, TP-Link Technologies Co. Ltd, Linksys Group (Foxconn) and TRENDnet Inc. are the major companies operating in the Residential Routers Market.

Which is the fastest growing region in Residential Routers Market?

Asia-Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Residential Routers Market?

In 2025, the North America accounts for the largest market share in Residential Routers Market.

What years does this Residential Routers Market cover, and what was the market size in 2024?

In 2024, the Residential Routers Market size was estimated at USD 12.29 billion. The report covers the Residential Routers Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Residential Routers Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Page last updated on:

Residential Routers Market Report

Statistics for the 2025 Residential Routers market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Residential Routers analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.