Market Trends of Refining Industry Automation and Software Industry

This section covers the major market trends shaping the Refining Industry Automation & Software Market according to our research experts:

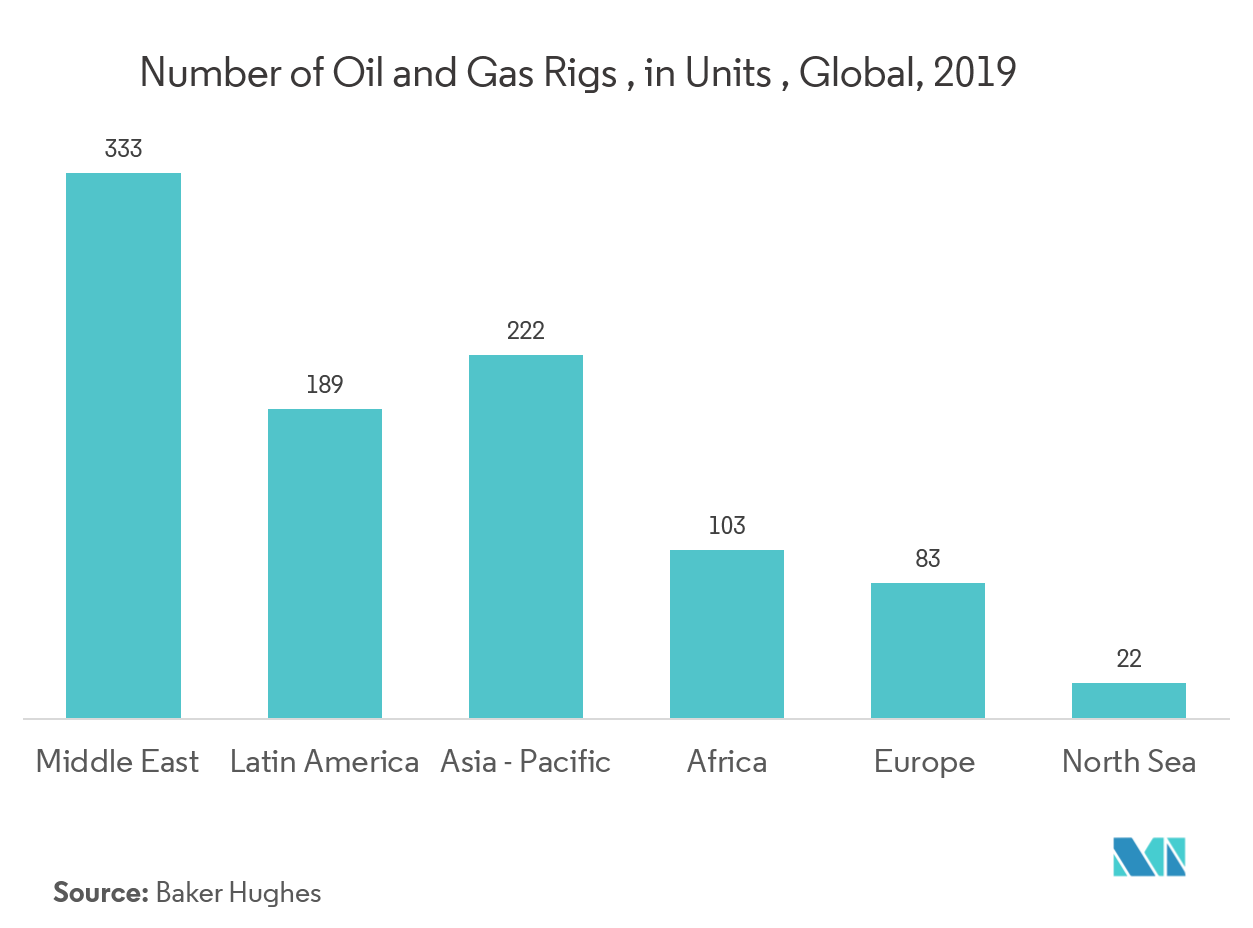

Increase in Drilling Activity is Driving the Market

- Drilling activity has been most affected by the downturn in the upstream oil & gas industry. Automatic control of pipe handling and managed pressure drilling have reduced the risk significantly and speeded up the drilling process. It also reduces operational downtime.

- Offshore oil & gas industry uses dynamic positioning rig for station keeping of floaters and drillships, drones for inspection of the platform, monitoring of gas emission, and others. The offshore drilling activity is to increased activity in the Golden Triangle - Gulf of Mexico, Brazil, and West Africa, along with the discovery of Egypt’s mammoth offshore natural gas field “Zohr.”

- In the case of onshore the United States is expected to lead the market regarding drilling activity. As a result, the demand from drilling activities and refineries are expected to drive the refining industry automation and software market.

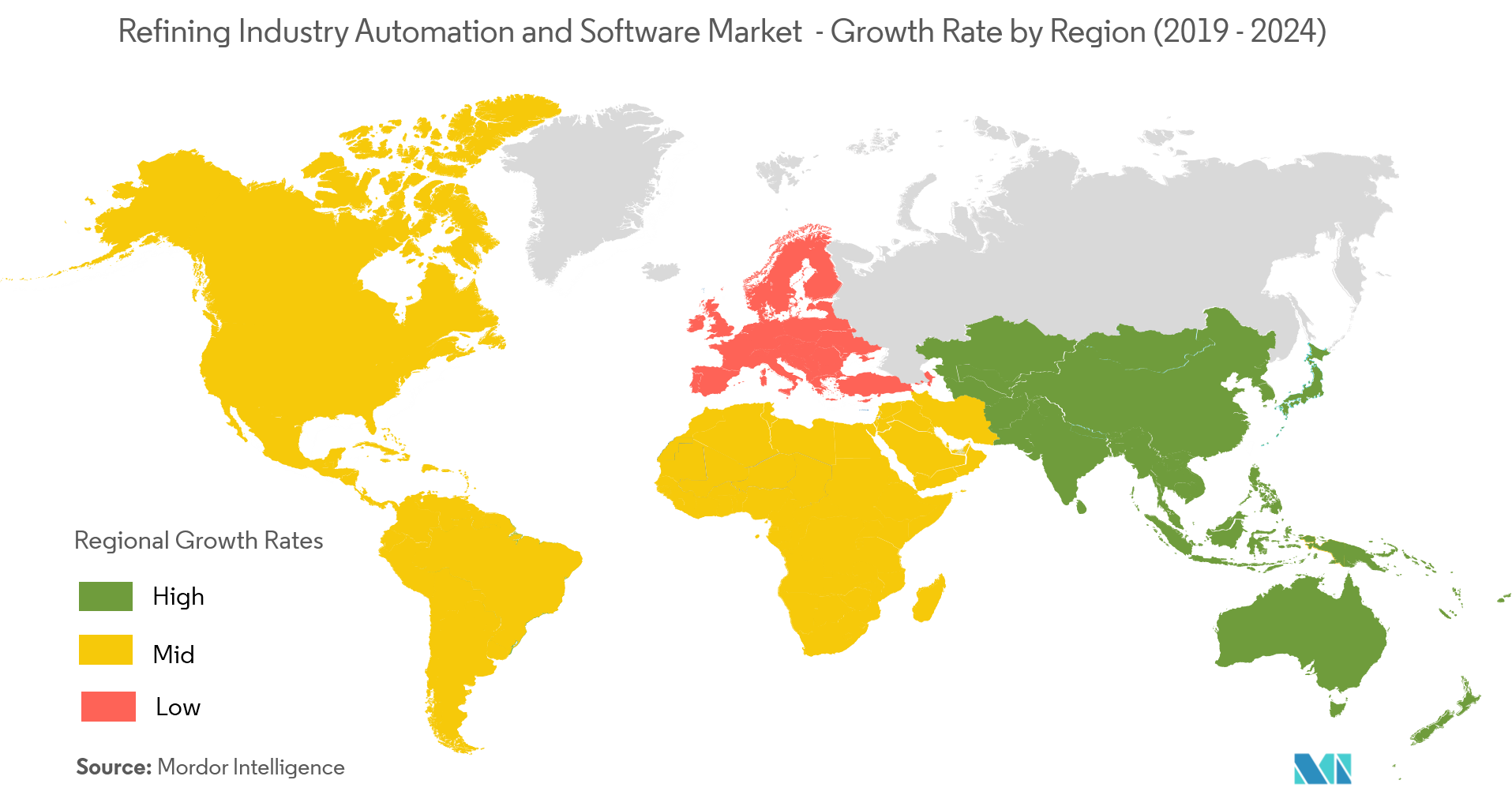

Growing Refinery Sector in Asia-Pacific is Supporting the Market Growth

- The development of digital technologies, automation, and software systems has improved efficiency and better monitoring in the oil & gas refining sector. The refining industry uses a Distributed Control System (DCS) to reduce the chances of downtime, potentially dangerous and damaging conditions, as DCS includes operational redundancy.

- The demand for refined fuels in Asia-Pacific is expected to outperform other regions in absolute volume terms, expanding by 17.2% between 2017 and 2026 (average annual growth rate of 1.8%).

- Several refinery projects are lined up in China and other countries in the region. As a result, the demand for automation in Asia-Pacific’s refinery is expected to support the market in the forecast period.