Size and Share of Refining Industry Automation and Software Market

Analysis of Refining Industry Automation and Software Market by Mordor Intelligence

The Refining Industry Automation and Software Market is expected to register a CAGR of 3% during the forecast period.

- Refining industry automation means providing automatic control for operations of various types of machines in various chemical engineering units which convert raw materials into valued products. Automation has provided huge benefits to the companies in terms of saving labor costs, and providing accurate and highly precise solutions.

- Growth in the manufacturing and energy market is also fuelling global refining industry automation and software market. Many oil companies are investing heavily in this market. Demands for refined petroleum products are increasing steadily which is also a major driving factor in the growth of this market.

- However, high Investment cost and set up cost is hindering the growth of the refining industry automation and software market.

Insights and Trends of Refining Industry Automation and Software Market

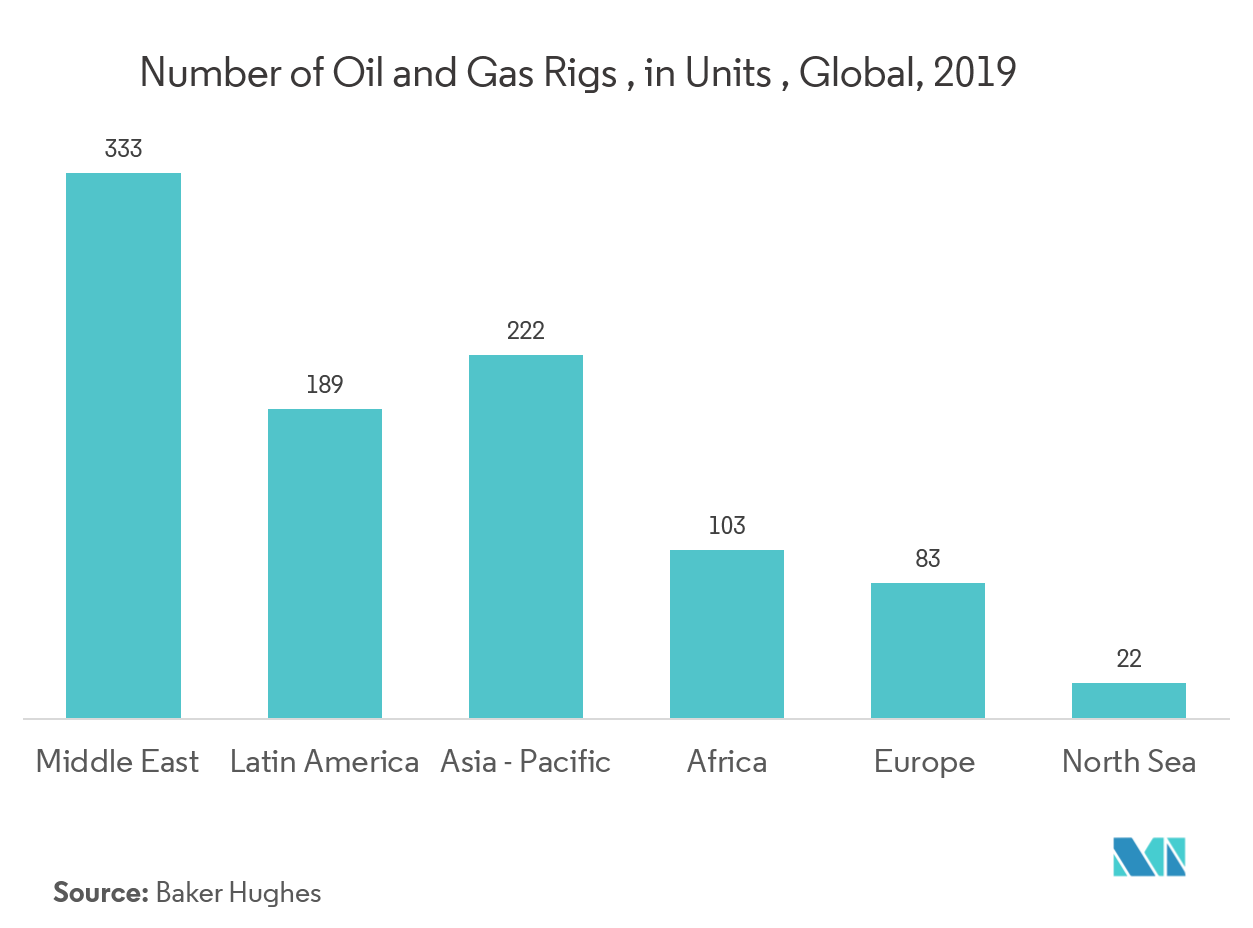

Increase in Drilling Activity is Driving the Market

- Drilling activity has been most affected by the downturn in the upstream oil & gas industry. Automatic control of pipe handling and managed pressure drilling have reduced the risk significantly and speeded up the drilling process. It also reduces operational downtime.

- Offshore oil & gas industry uses dynamic positioning rig for station keeping of floaters and drillships, drones for inspection of the platform, monitoring of gas emission, and others. The offshore drilling activity is to increased activity in the Golden Triangle - Gulf of Mexico, Brazil, and West Africa, along with the discovery of Egypt’s mammoth offshore natural gas field “Zohr.”

- In the case of onshore the United States is expected to lead the market regarding drilling activity. As a result, the demand from drilling activities and refineries are expected to drive the refining industry automation and software market.

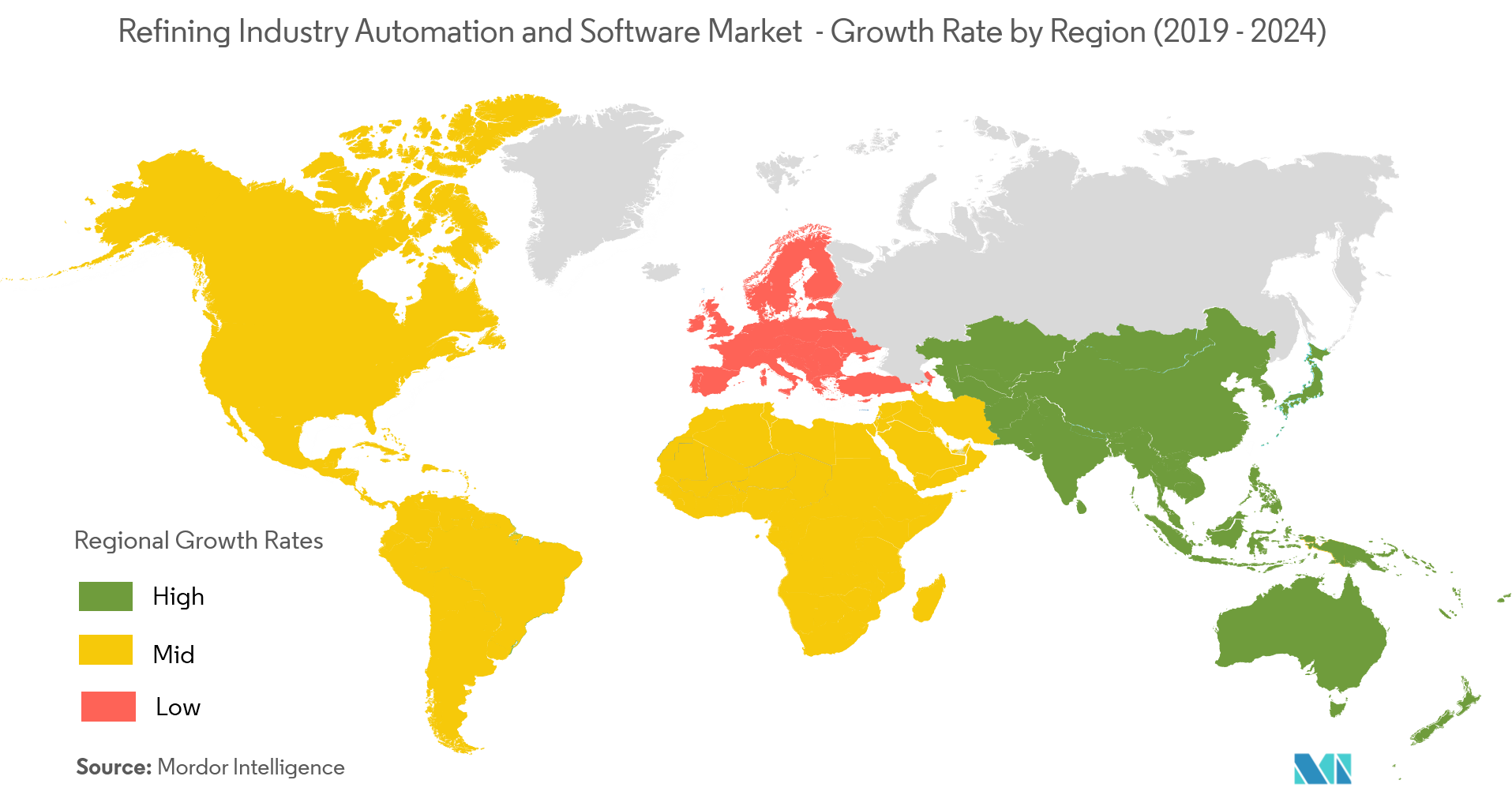

Growing Refinery Sector in Asia-Pacific is Supporting the Market Growth

- The development of digital technologies, automation, and software systems has improved efficiency and better monitoring in the oil & gas refining sector. The refining industry uses a Distributed Control System (DCS) to reduce the chances of downtime, potentially dangerous and damaging conditions, as DCS includes operational redundancy.

- The demand for refined fuels in Asia-Pacific is expected to outperform other regions in absolute volume terms, expanding by 17.2% between 2017 and 2026 (average annual growth rate of 1.8%).

- Several refinery projects are lined up in China and other countries in the region. As a result, the demand for automation in Asia-Pacific’s refinery is expected to support the market in the forecast period.

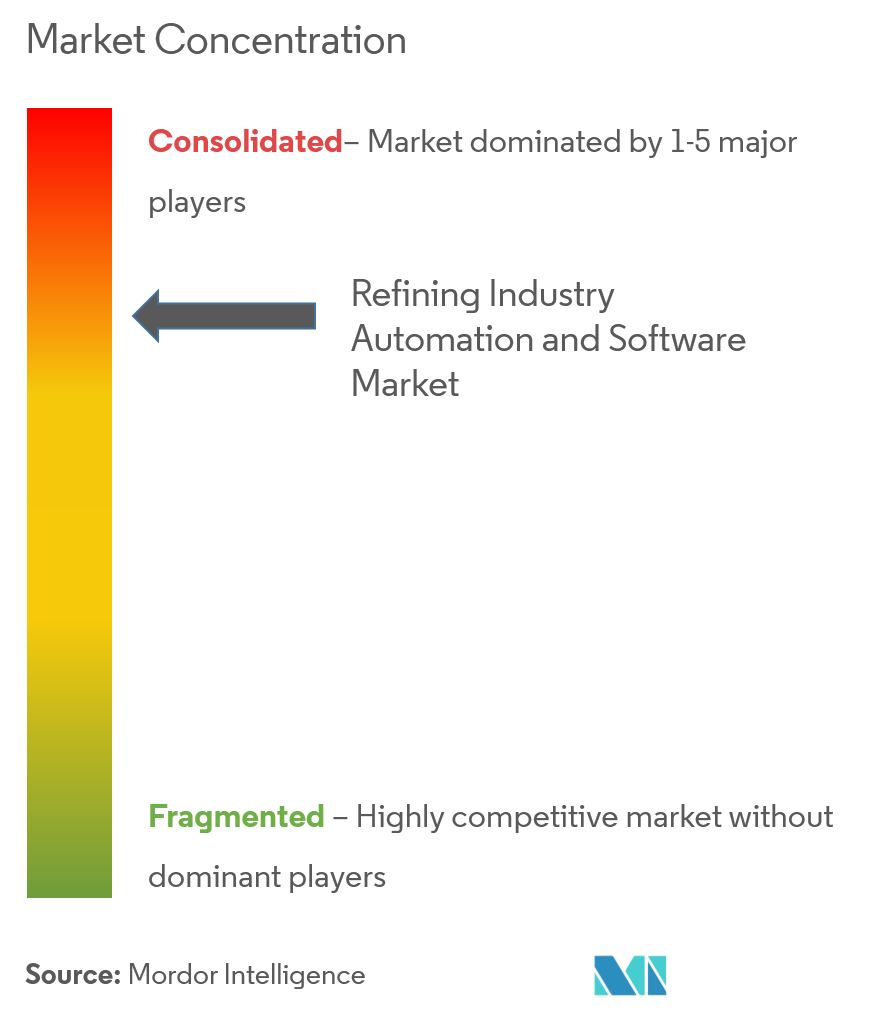

Competitive Landscape

The refining industry automation and software marketis consolidated due tothe majority of the market share are owned by top players in the industry.Some of the key players includeHoneywell Process Solutions,ABB Limited,Siemens AG,Emerson Process Management, Aspen Technology, Schneider Electric, among others.

- May 2019 -Siemens enteredthe Permian gas processing market with innovative electric-drive centrifugal compression solution.The projectmarkedDelaware Basin gas plant customer's first order with Siemens. Fully integrated electric-drive centrifugal compression configuration will significantly reduce footprint, capital, and operating costs.

- April 2019 -Honeywell, the global technology leader,launched its new Honeywell Masdar Innovation Center in Abu Dhabi.The Center, located in Masdar City, will be home to the latest automation solutions from across the globe and the region, including those assembled in the UAE. It includes cutting-edge solutions for smart buildings and cities as well as technology for fire, security, personal safety, and intelligent wearables. Innovative digital solutions for oil and gas processing plants providing enhanced safety, reliability and competency within a cyber-secure environment will also be on display. The solutions showcased at the innovation center focus on making these industries smarter, safer, more efficient, productive and sustainable.

Leaders of Refining Industry Automation and Software Market

-

Honeywell Process Solutions

-

ABB Limited

-

Siemens AG

-

Emerson Process Management

-

Schneider Electric

- *Disclaimer: Major Players sorted in no particular order

Scope of Report on Refining Industry Automation and Software Market

The refining industry is the group of chemical engineering unit process where the raw materials are being converted or refined into specific product value. Automation means the automatic control of various control systems for operating different types of machinery that are being used in factories, boilers, and other industrial purposes. It provides a huge benefit in terms of saving labor, energy, and materials that help in maintaining accuracy, quality, and precision. Different types of automated refineries are made in use by a different product.

| Programmable Logic Controller (PLC) |

| Distributed Control System (DCS) |

| Human Machine Interface (HMI) |

| Product Lifecycle Management (PLM) |

| Other Solution Types |

| North America |

| Europe |

| Asia-Pacific |

| Latin America |

| Middle East & Africa |

| By Solution Type | Programmable Logic Controller (PLC) |

| Distributed Control System (DCS) | |

| Human Machine Interface (HMI) | |

| Product Lifecycle Management (PLM) | |

| Other Solution Types | |

| Geography | North America |

| Europe | |

| Asia-Pacific | |

| Latin America | |

| Middle East & Africa |

Key Questions Answered in the Report

What is the current Refining Industry Automation and Software Market size?

The Refining Industry Automation and Software Market is projected to register a CAGR of 3% during the forecast period (2025-2030)

Who are the key players in Refining Industry Automation and Software Market?

Honeywell Process Solutions, ABB Limited, Siemens AG, Emerson Process Management and Schneider Electric are the major companies operating in the Refining Industry Automation and Software Market.

Which is the fastest growing region in Refining Industry Automation and Software Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Refining Industry Automation and Software Market?

In 2025, the Middle East and Africa accounts for the largest market share in Refining Industry Automation and Software Market.

What years does this Refining Industry Automation and Software Market cover?

The report covers the Refining Industry Automation and Software Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Refining Industry Automation and Software Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Page last updated on:

Report on Refining Industry Automation and Software Market

Statistics for the 2025 Refining Industry Automation and Software market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Refining Industry Automation and Software analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.