Project Logistics Market Analysis

The Project Logistics Market size is estimated at USD 462.30 billion in 2025, and is expected to reach USD 617.21 billion by 2030, at a CAGR of 5.95% during the forecast period (2025-2030).

Project logistics encompasses the comprehensive management and coordination of goods, materials, and information throughout the entire process of a project. The transportation of large-sized cargo requires specialized equipment, infrastructure, and experienced personnel. Dealing with cargo of unique dimensions poses a constant challenge for transporters, but shippers and service providers are becoming more adept at handling oversized and heavyweight shipments. The complexity of manufacturing also contributes to the difficulty, as parts and modular packages are produced in various locations and then shipped to their final destinations, necessitating meticulous planning. In recent years, there has been a growing trend of involving transportation providers in the early stages of the planning process.

The Asian-Pacific region leads the market in project logistics and is expected to experience the highest growth rate. Infrastructure investment has played a significant role in the economic development of Asia-Pacific countries, with some nations prioritizing the advancement of their domestic infrastructure.

Several established organizations, such as the Global Project Logistics Network (GPLN), specialize in project logistics on a global scale. GPLN members handle a wide range of industrial projects, including infrastructure and energy projects, providing services such as transportation, packing/crating, and the lifting of heavy, oversized, and out-of-gauge cargo.

During the height of the COVID-19 pandemic in 2020-21, air freight was in high demand within the project logistics sector for the transportation of essential items worldwide.

Project Logistics Market Trends

Increasing Usage of Renewable Energies Boosts Opportunities for Project Logistics Companies

According to the latest update from the International Energy Agency, global renewable power capacity is expected to increase by a third in 2023 due to factors such as growing policy support, higher fossil fuel prices, and concerns about energy security.

This growth will continue next year, with the world's total renewable electricity capacity reaching 4,500 gigawatts, equivalent to the combined power output of China and the United States. In 2023, global renewable capacity is projected to increase by 107 gigawatts, the largest absolute increase ever recorded, reaching over 440 gigawatts.

This expansion is happening in major markets worldwide, with Europe, the United States, India, and China leading the way. China, in particular, is expected to account for nearly 55% of global renewable power capacity additions in both 2023 and 2024.

Wind power installations are expected to experience a significant recovery in 2023, with a projected increase of nearly 70% compared to the previous year. This comes after a challenging period of slow growth in the industry. The improved growth can be attributed to the completion of projects that were delayed due to COVID-19 restrictions in China and supply chain issues in Europe and the United States.

However, the extent of growth in 2024 will depend on whether governments can offer more policy support to address obstacles related to permitting and auction design. Unlike the solar PV sector, the wind turbine supply chains are not expanding quickly enough to keep up with the growing demand in the medium term. This is primarily due to escalating commodity prices and difficulties in the supply chain, which are impacting the profitability of manufacturers.

This renewable energy requirement incorporates project logistics as the machines and other parts are so huge that they are shipped separately and then assembled at the site.

Growing Modular Construction Driving The Market

The need for sustainable infrastructure is driving the development of construction technology that is efficient and environmentally friendly. The traditional construction method may no longer be sufficient to meet the requirements of sustainable infrastructure. Modularization offers a solution to the inflexibility of conventional construction methods. By using modular construction, the cost of construction can potentially be reduced by 40%, and activities can be carried out simultaneously on site preparation and modular prefabrication.

The shift towards modular (offsite) construction methods creates a new market, particularly for developing countries that have low labor costs and ample land for prefabrication areas. In terms of supporting sustainable infrastructure development, prefabrication methods can lead to significant material savings, such as 60% less steel, 56% less concrete, and 77% less formwork compared to conventional construction methods of a similar scale.

However, there are still challenges with the modular prefabrication concept, such as the economics of scale and the complexity of transporting modular components that exceed the size of ISO containers. This offsite construction model also opens up opportunities for international trade within specific geographical regions, depending on each country's competitive advantages. The growth of international free trade provides broader business opportunities and potential for new trading connections. International and regional trade also increases the overseas trading of engineering, procurement, and construction (EPC) projects. The decision to use modular construction for overseas EPC projects impacts the development of project cargo movement and the overall investment in project logistics, including domestic and overseas logistics costs. Domestic logistics costs include manufacturing costs (fabrication, ready-mix concrete, bulk materials, rebar, and steel materials). In contrast, overseas logistics costs include vessel charter rates, bunker pricing, currency exchange, distance, volumetric sizing, insurance, and customs clearance.

Project Logistics Industry Overview

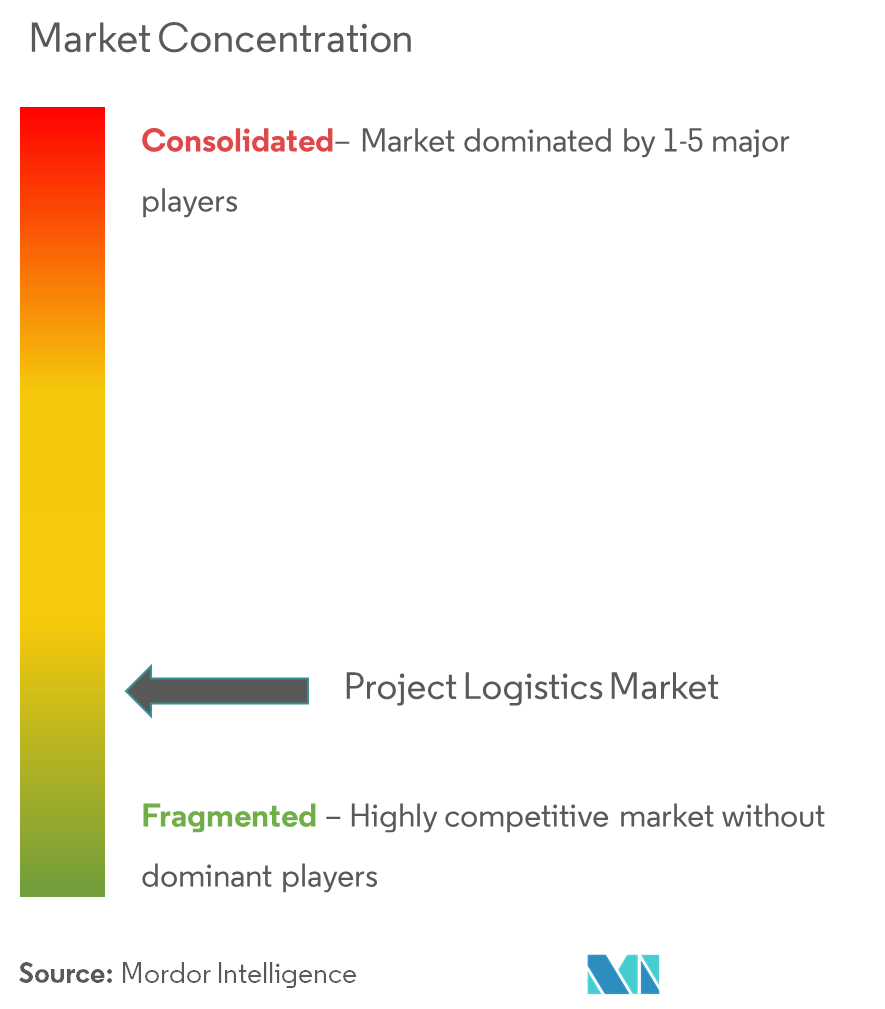

The project logistics market is fragmented, with the presence of global players and small- and medium-sized local players. Most global logistics players have a special project cargo division to meet the market needs and demand. Local players are also increasingly enhancing their capabilities in terms of fleet size, service offerings, industries served, and technology. Global manufacturers are making large and oversized components in the factory sites (off-site), which creates huge complexities for heavy cargo haulage companies. Global companies with high capital and assets can invest in upgraded fleets and benefit from this scenario. On the other hand, regional and local players are also coming up with better industry solutions to support the client's needs in executing the projects in the scheduled time.

Project Logistics Market Leaders

-

CH Robinson

-

Kerry Logistics

-

DB Schenker

-

Kuehne + Nagel International AG

-

Hellmann Worldwide Logistics

- *Disclaimer: Major Players sorted in no particular order

Project Logistics Market News

- August 2023 - Aprojects Austria, a member of the Project Logistics Alliance, joined forces together with their long-trusted partner, Antwerp Metal Logistics, to ship heavy loads comprising: A reactor weighing 359 tons, a pool condenser weighing 286 tons and a stripper weighing 243 tons. Given the cargo’s weight, the only viable approach was to load it directly onto the ocean vessel using the vessel’s equipment, as no shore crane in Constanța had the capability to lift such heavy loads, even with multiple cranes working in tandem.

- August 2023 - Huisman has been awarded a contract by Seaway7, part of Subsea7 Group, for the delivery of the entire monopile installation spread for jack-up vessel Seaway Ventus, consisting of a Monopile Gripper, an Upending Frame, and two sets of Monopile Storage Cradles.

Project Logistics Industry Segmentation

Project logistics—also known as bulk logistics—involves planning, organizing, managing, processing, and controlling the complete flow of goods, materials, and information associated with the successful completion of a specific project.

The scope of the report offers a complete background analysis of the project logistics market, including an assessment of the sector and its contribution to the economy, a market overview, market size estimation for key segments, key countries, and emerging trends in the market segments, market dynamics, and key project statistics. The report offers market size and forecasts for the project logistics market in value (USD) for all the above segments.

| Service | Transportation |

| Forwarding | |

| Inventory Management and Warehousing | |

| Other Value-added Services | |

| End User | Oil and Gas, Mining, and Quarrying |

| Energy and Power | |

| Construction | |

| Manufacturing | |

| Other End Users | |

| Geography | Asia-Pacific |

| Americas | |

| Europe | |

| Middle-East and Africa |

Project Logistics Market Research FAQs

How big is the Project Logistics Market?

The Project Logistics Market size is expected to reach USD 462.30 billion in 2025 and grow at a CAGR of 5.95% to reach USD 617.21 billion by 2030.

What is the current Project Logistics Market size?

In 2025, the Project Logistics Market size is expected to reach USD 462.30 billion.

Who are the key players in Project Logistics Market?

CH Robinson, Kerry Logistics, DB Schenker, Kuehne + Nagel International AG and Hellmann Worldwide Logistics are the major companies operating in the Project Logistics Market.

Which is the fastest growing region in Project Logistics Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Project Logistics Market?

In 2025, the Asia Pacific accounts for the largest market share in Project Logistics Market.

What years does this Project Logistics Market cover, and what was the market size in 2024?

In 2024, the Project Logistics Market size was estimated at USD 434.79 billion. The report covers the Project Logistics Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Project Logistics Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Project Logistics Industry Report

Statistics for the 2025 Project Logistics market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Project Logistics analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.