| Study Period | 2019 - 2030 |

| Base Year For Estimation | 2024 |

| Forecast Data Period | 2025 - 2030 |

| CAGR | 9.00 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

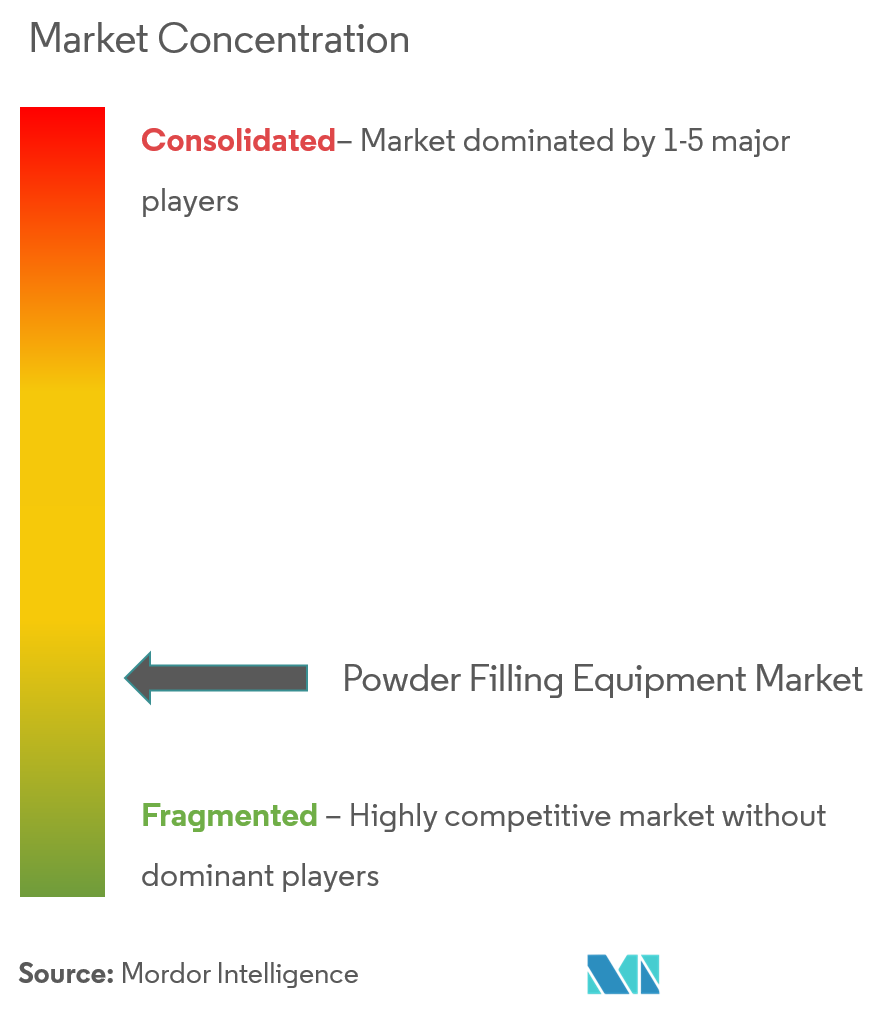

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Powder Filling Equipment Market Analysis

The Powder Filling Equipment Market is expected to register a CAGR of less than 9% during the forecast period.

- The increasing adoption of the automation across packaging lines in a bid to boost productivity, and the proliferation of key industry trends, including 'single-use' packs and 'on-the-go' packaging are some of the prominent factors that would boost the adoption of the powder filling equipment over the forecast period.

- Also, the rising demand for hygiene has propelled the players across the various end-user industries to replace the traditional filling methods with the new automated and aseptic filler machines. Food and pharmaceutical sectors being the most important sectors that require hygiene, cleanliness and sterility, the growth in these sectors is expected to fuel the market growth.

- In October 2019, Romaco announced its plans to launch the new Macofar MicroMaxX 24 aseptic powder filling machine that provides an output of up to 24,000 vials an hour. The machine is also equipped with a dual powder dosing disc which allows multiple dosing into the same vial.

- The increasing initiatives by the governments and the related regulated authorities to promote safe and sterile usage and handling of chemicals is propelling the players in the various end-user industries to adopt the technology. This is expected to fuel market growth over the forecast period.

- For instance, in June 2019, Jarrow Industries purchased the Capsylon Encapsulation System From Bosch Packaging Technology. The GKF Capsylon 3005 provides an economically viable option for filling powder, pellets, and granulates.

Powder Filling Equipment Market Trends

Pharmaceutical Sector is Expected to Hold the Largest Share

- The players in the pharmaceutical sector that are handling powdered substances are governed by regulatory bodies such as FDA, CDC and many more. The increasing initiatives by such bodies that set out regulations and rules regarding the safe, secure and restricted human intervention is expected to boost the adoption of the powder filling equipment over the forecast period.

- The packaging of powdered substances require High Filling accuracy, Microprocessor controls, zero rippings, accurate slippage control, Fills Free Flowing, 100% in process control, and thereby eliminating costly hand weighing, etc. This is propelling the players in the industry to deploy powder filling equipment that enables them to achieve such objectives.

- Some of the prominent players in the industry through research and development are innovating their offerings and are engaged in product development that enables them to not only further the technology but also boost market growth.

- In December 2019, Uflex launched its SP-L automatic stick pack machine, a High-speed liquid and powder packaging machine for pharma at CPhI and P-Mec 2019.

North America is Expected to Hold the Largest Share

- With advanced primary medical community, extensive medical and life science research activities, high healthcare spending intensity, and large pharmaceutical and medical supply and device industries, the United States accounts for one of the world’s largest markets for healthcare and pharmaceutical services.

- The increasing expenditure on medicines has resulted in the increased consumption that is driving the demand for such drugs in the region. This is expected to propel the players in the region to deploy automated solutions such as powder filling equipment that enables them to meet those demands.

- According to the IQVIA, a Human Data Science Company, the United States expenditure on medicine is expected to reach USD 655 billion in 2023. Such facts indicate the potential opportunities in the emerging markets for the vendors.

- All-Fill Inc. announced its plans to open a new facility in Phoenix, Arizona in January 2020 to better serve its west coast clients and expand operations. In a move that would allow the company to carry stock machines and offer quick delivery. In turn, enabling to expand its market footprint and fueling the market growth.

Powder Filling Equipment Industry Overview

The competitive rivalry in thepowder filling equipment market is high owing to the presence of some key players such asPaxiom Group,Romaco Group and many more.Through research and development, these companies have gained a competitive advantage by continually innovating their offerings. These players through strategic partnerships and mergers & acquisitions have been able to gain a strong footprint in the market as well as being able to further develop the technology.

- August 2019 - Ohlson Packaging plans to launch cup & tray filling solution, and a high-speed rotary pouch filling machine at PACK EXPO to provide automated packaging to its customers. The inline cup and tray systems are designed for liquid, powder, scale, volumetric, hand, and specialty filling, and can accommodate up to 6 lanes of cups or trays ranging from 2 in. to 12 in. in width, with up to 20 cycles/min per line.

- September 2019 - MG2, announced its plans to launch the EXTRUDORdosing unit at Pack Expo. The unit would be installed on the intermittent-motion capsule filler model AlternA70N, which can both reach speed up to 70,000 capsules/hour and be equipped with powder and pellets dosing unit, also in combination. It can handle capsule sizes from 00 to 5, including elongated and tamper-proof capsules.

Powder Filling Equipment Market Leaders

-

Romaco Group

-

Paxiom Group

-

Allfill Inc.

-

Nalbach Engineering Company

-

GEA Group Aktiengesellschaft

- *Disclaimer: Major Players sorted in no particular order

Powder Filling Equipment Industry Segmentation

Powder Filling Machines are suitable for sterile, injectable, dry syrup powder and granule filling. These machines are used to fill containers with granules, powders, and sprays for consumer, bulk and original equipment manufacturer (OEM) various end-user industries products. This report segments the market by End-user Industry(Pharmaceutical, Food, Personal Care, Chemicals) and Geography.

| By End-user Industry | Pharmaceutical |

| Food | |

| Personal Care | |

| Chemicals | |

| Geography | North America |

| Europe | |

| Asia-Pacific | |

| Latin America | |

| Middle East and Africa |

Powder Filling Equipment Market Research FAQs

What is the current Powder Filling Equipment Market size?

The Powder Filling Equipment Market is projected to register a CAGR of less than 9% during the forecast period (2025-2030)

Who are the key players in Powder Filling Equipment Market?

Romaco Group, Paxiom Group, Allfill Inc., Nalbach Engineering Company and GEA Group Aktiengesellschaft are the major companies operating in the Powder Filling Equipment Market.

Which is the fastest growing region in Powder Filling Equipment Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Powder Filling Equipment Market?

In 2025, the North America accounts for the largest market share in Powder Filling Equipment Market.

What years does this Powder Filling Equipment Market cover?

The report covers the Powder Filling Equipment Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Powder Filling Equipment Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Powder Packaging Equipment Industry Report

Statistics for the 2025 Powder Filling Equipment market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Powder Filling Equipment analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.