Optical Pulse Sensor Market Size and Share

Optical Pulse Sensor Market Analysis by Mordor Intelligence

The Optical Pulse Sensor Market is expected to register a CAGR of 9.3% during the forecast period.

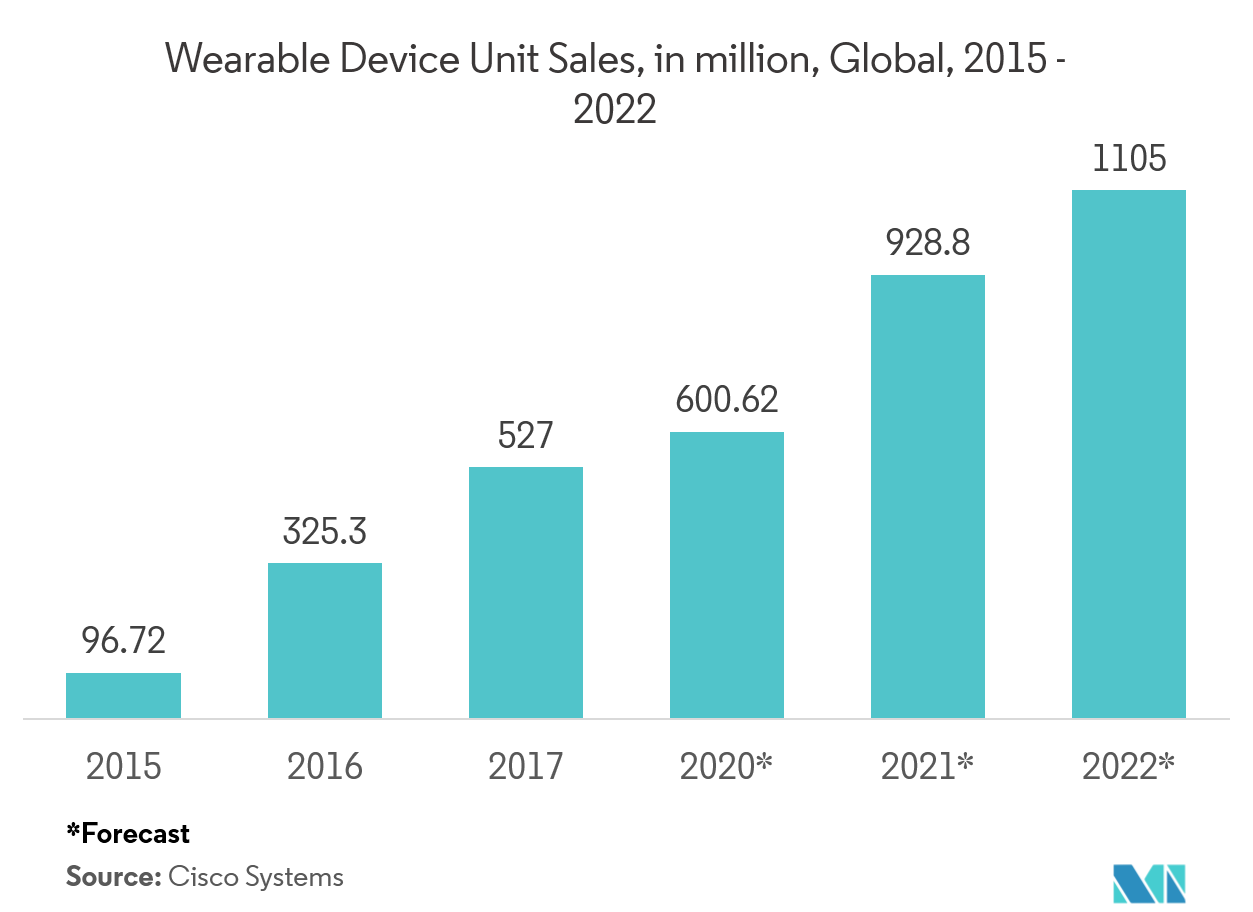

- The rise in the use of diagnostic wearable medical devices for regular personal health monitoring is expected to drive the optical pulse sensor market.

- Advancements in some diagnostic wearable medical devices led to an increased number of individuals to use these devices. The integration of IT in most diagnostic wearable medical devices is on the rise, and the automated generation of medical records in digital format [electronic health record (EHR)] has driven the demand for advanced devices.

- Wearable devices and analytical software revolutionized sports and fitness training, by engaging in performance improvement and injury prevention. Companies in the market are implementing strategic initiatives to meet the rising demand in the market.

Global Optical Pulse Sensor Market Trends and Insights

Smart Band is Expected to Hold the Significant Market Share

- Smart bands are portable devices used to monitor a person's real-time fitness, heart rate, sleep statistics, and calorie control, as well as provide other health insights. These bands are equipped with miniaturized electronic devices, such as microchips and sensors, which gather data, record activities, and offer and transform information on a real-time basis.

- Manufacturers are developing smart bands using advanced actuators and sensors to provide a more natural sense of touch to human-computer interaction. With a rising demand for smart wearable fitness devices, different vendors across the supply chain are making strategic partnerships to support and boost the development of wearable device technology.

- There has been an increasing demand for portable devices with greater energy savings and miniaturization. Among wearables, such as smart bands, heart rate monitoring capability became mainstream, with continuous additions of new functions. However, the limited battery capacity makes it necessary to reduce power consumption as much as possible, in order to prolong operating time.

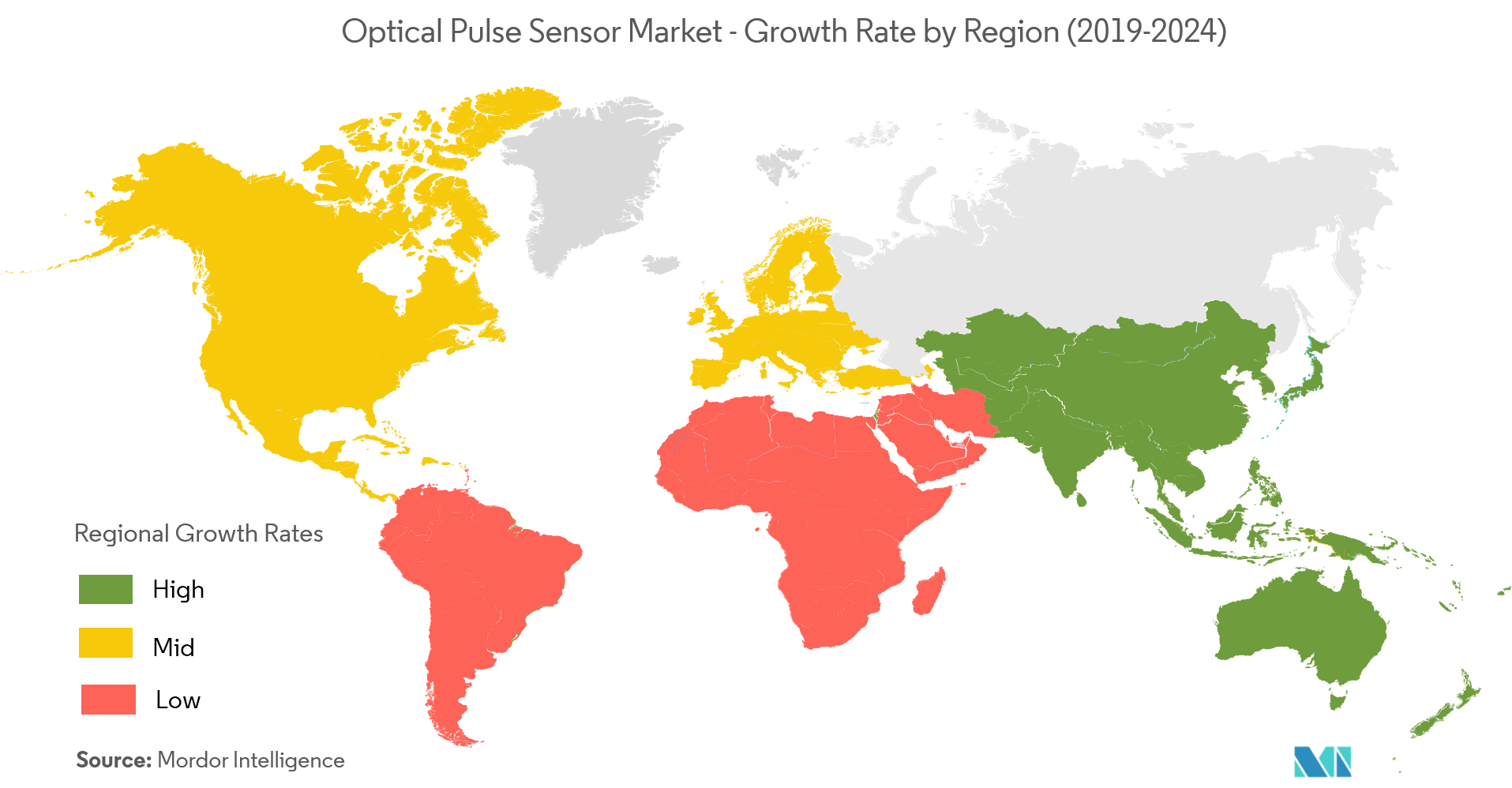

North America is Expected to Hold the Largest Market Share

- According to the Centers for Disease Control and Prevention (CDC), approximately 70 million people in the United States have high blood pressure. Furthermore, nearly 600,000 deaths occur every year in the United States, due to various heart diseases. The increasing need to reduce hospital costs and the launch of new products are expected to drive the demand for activity monitors.

- The demand for diagnostic wearable medical devices is expected to be augmented by factors, such as an increase in the incidences of chronic diseases among people of all ages, prevalence of heart and respiratory disorders, and a rise in premature births. The increasing need for continuous diagnosis and growing awareness among the general population may drive the market. New advances in technology, approval for new products by the US FDA, and subsequent product launches are driving the optical pulse sensors market.

Competitive Landscape

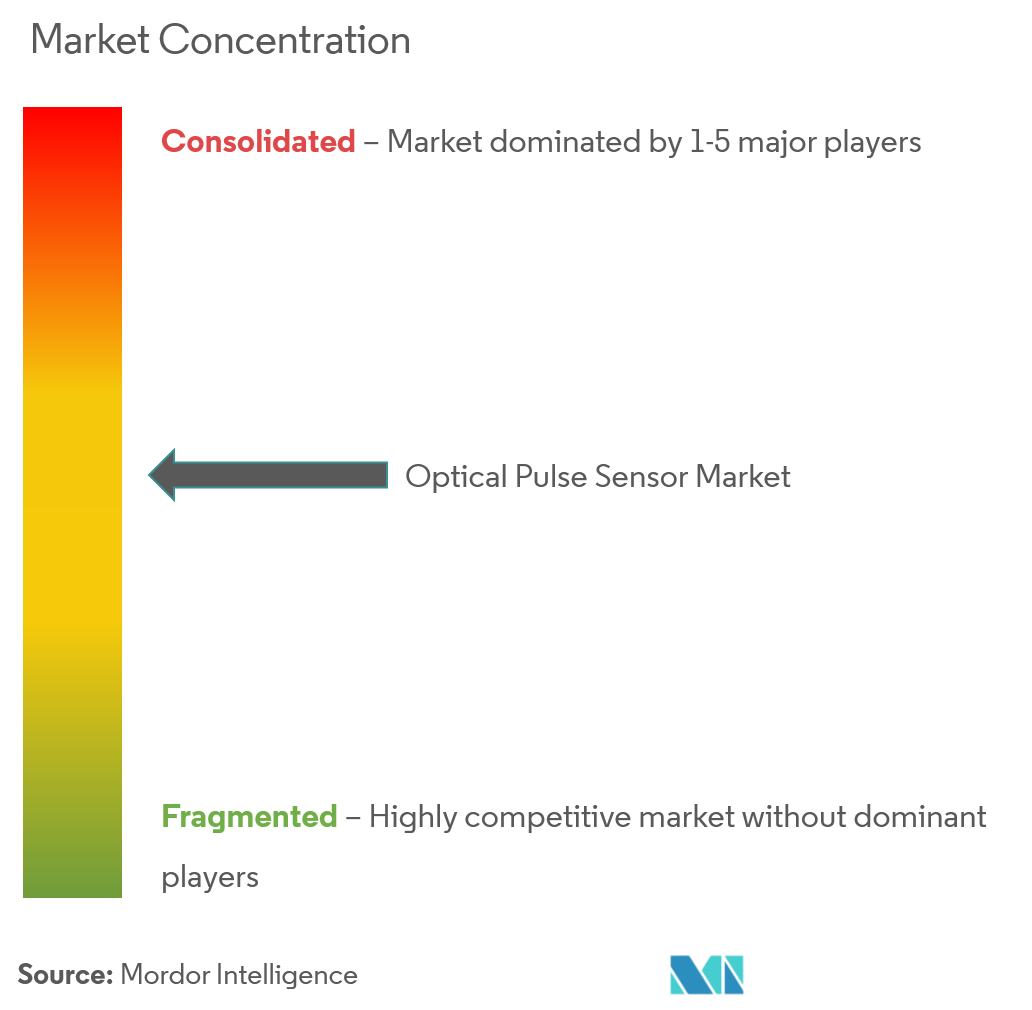

The optical pulse sensormarket is moderately competitive and consists of several major players. In terms of market share, few of the major players currently dominate the market. However, with growth in technological innovationacross the wearablessegment, most of the companies are increasing their market presence by securing new contracts and tapping into new markets.

- April 2019-Osram Opto Semiconductorsannounced that it is part of a new project, whichis exploring the principles of high-resolution visualization solutions using µLEDs (micro LEDs). The project, which began in November 2018, is funded by the Bavarian State Ministry for Economic Affairs, Regional Development, and Energy. The project is expected to be completed in October 2021, with an initial demonstrator.

- June 2018 - Texas Instruments announced the addition of new microcontrollers (MCUs) with integrated signal-chain elements and an extended operating temperature range to its MSP430 value line portfolio.

Optical Pulse Sensor Industry Leaders

Maxim Integrated Products Inc.

Osram Licht AG

ROHM Co. Ltd

Texas Instruments Inc.

Silicon Laboratories Inc.

- *Disclaimer: Major Players sorted in no particular order

Global Optical Pulse Sensor Market Report Scope

Optical sensors are devices that convert light or infrared rays into electronic signals. They can function in the presence of light or infrared spectrum, and form a part of a huge electronic system. The recent progress in optical technology allows easy integration of these sensors into various systems, with improved performance for new functions in new domains using innovative technologies.

| Smart watch |

| Smart Bands |

| Smartphones |

| Other Applications |

| North America | United States |

| Canada | |

| Europe | United Kingdom |

| Germany | |

| France | |

| Rest of Europe | |

| Asia-Pacific | China |

| India | |

| Japan | |

| Rest of Asia-Pacific | |

| Latin America | Brazil |

| Argentina | |

| Mexico | |

| Rest of Latin America | |

| Middle East & Africa | United Arab Emirates |

| Saudi Arabia | |

| South Africa | |

| Rest of Middle East & Africa |

| By Application | Smart watch | |

| Smart Bands | ||

| Smartphones | ||

| Other Applications | ||

| Geography | North America | United States |

| Canada | ||

| Europe | United Kingdom | |

| Germany | ||

| France | ||

| Rest of Europe | ||

| Asia-Pacific | China | |

| India | ||

| Japan | ||

| Rest of Asia-Pacific | ||

| Latin America | Brazil | |

| Argentina | ||

| Mexico | ||

| Rest of Latin America | ||

| Middle East & Africa | United Arab Emirates | |

| Saudi Arabia | ||

| South Africa | ||

| Rest of Middle East & Africa | ||

Key Questions Answered in the Report

What is the current Optical Pulse Sensor Market size?

The Optical Pulse Sensor Market is projected to register a CAGR of 9.3% during the forecast period (2025-2030)

Who are the key players in Optical Pulse Sensor Market?

Maxim Integrated Products Inc., Osram Licht AG, ROHM Co. Ltd, Texas Instruments Inc. and Silicon Laboratories Inc. are the major companies operating in the Optical Pulse Sensor Market.

Which is the fastest growing region in Optical Pulse Sensor Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Optical Pulse Sensor Market?

In 2025, the North America accounts for the largest market share in Optical Pulse Sensor Market.

What years does this Optical Pulse Sensor Market cover?

The report covers the Optical Pulse Sensor Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Optical Pulse Sensor Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Page last updated on:

Optical Pulse Sensor Market Report

Statistics for the 2025 Optical Pulse Sensor market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Optical Pulse Sensor analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.