On-Board Connectivity Market Analysis

The On-board Connectivity Market is expected to register a CAGR of 13.8% during the forecast period.

There is high cost associated with the deployment of on-board connectivity equipment on airplanes causing a rise in the overall weight of aircraft.These factors may hamper the growth of on-board connectivity market. The surge in the use of portable electronic devices and growing inclination of people to travel in airlines is creating huge opportunities for this market. Various regulatory frameworks & certification are taking place in the market.However, the mounting demand for Wi-Fi connectivity and technological developments are creating opportunities which will increase the demand for on-board connectivity market.

Companies are investing enormous amounts in installing connectivity solutions. For instance, Inmarsat PLC has invested billions in wholly-owned and operated global satellite networks and has a strategy for further investment. The investment in networking equipment is growing due to the increasing demand for high speed and network connectivity by passengers. Also, government initiatives to enhance customer services are providing huge opportunities to vendors as most airlines, railways, and marines are emphasizing on the installation of connectivity services.

On-Board Connectivity Market Trends

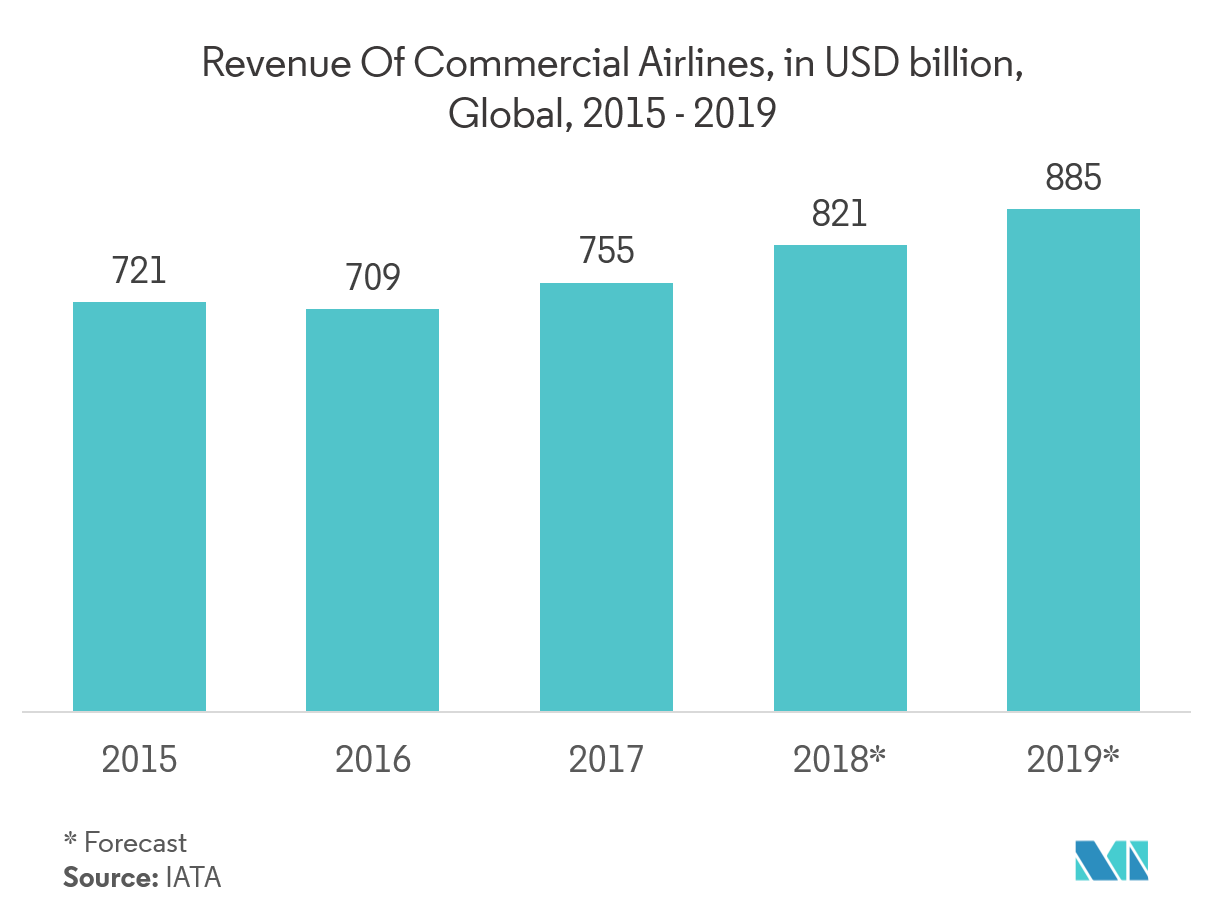

Aviation Industry Expected to Witness Significant Growth

Many commercial airlines and private jet companies use in-cabin Wi-Fi systems and inflight internet provided either through a satellite or air to the ground network. Airplanes deliver Wi-Fi either using air-to-ground services (connecting to towers on the ground that deliver data to smartphone or laptop) or through increasingly satellite-based service. There is a rise in IT spending in the aviation industry which will further decrease operating expenditure and modern technologies such as the Internet of Things (IoT), wireless connectivity, automated solutions, and check-in kiosks can be installed.

For instance, Airplane manufacturer Boeing was the first to implement inflight connectivity. Boeing's inflight online internet connectivity service Connexion was designed to deliver in-flight broadband to commercial airlines and private jets.

Airbus A380 provides data communication via a satellite system that allows travelers to connect to the internet from individual in-flight entertainment units.

According to a survey conducted by Inmarsat, around 44 % of the passengers are no longer interested in flying with their preferred airline in the coming years if they are not offered in-flight connectivity. Many new aviation technologies are being developed to improve an aircraft’s ability to deliver fast and uninterrupted inflight Wi-Fi. For example, ATG-4 is one such technology with four antenna placed strategically along a plane's fuselage.

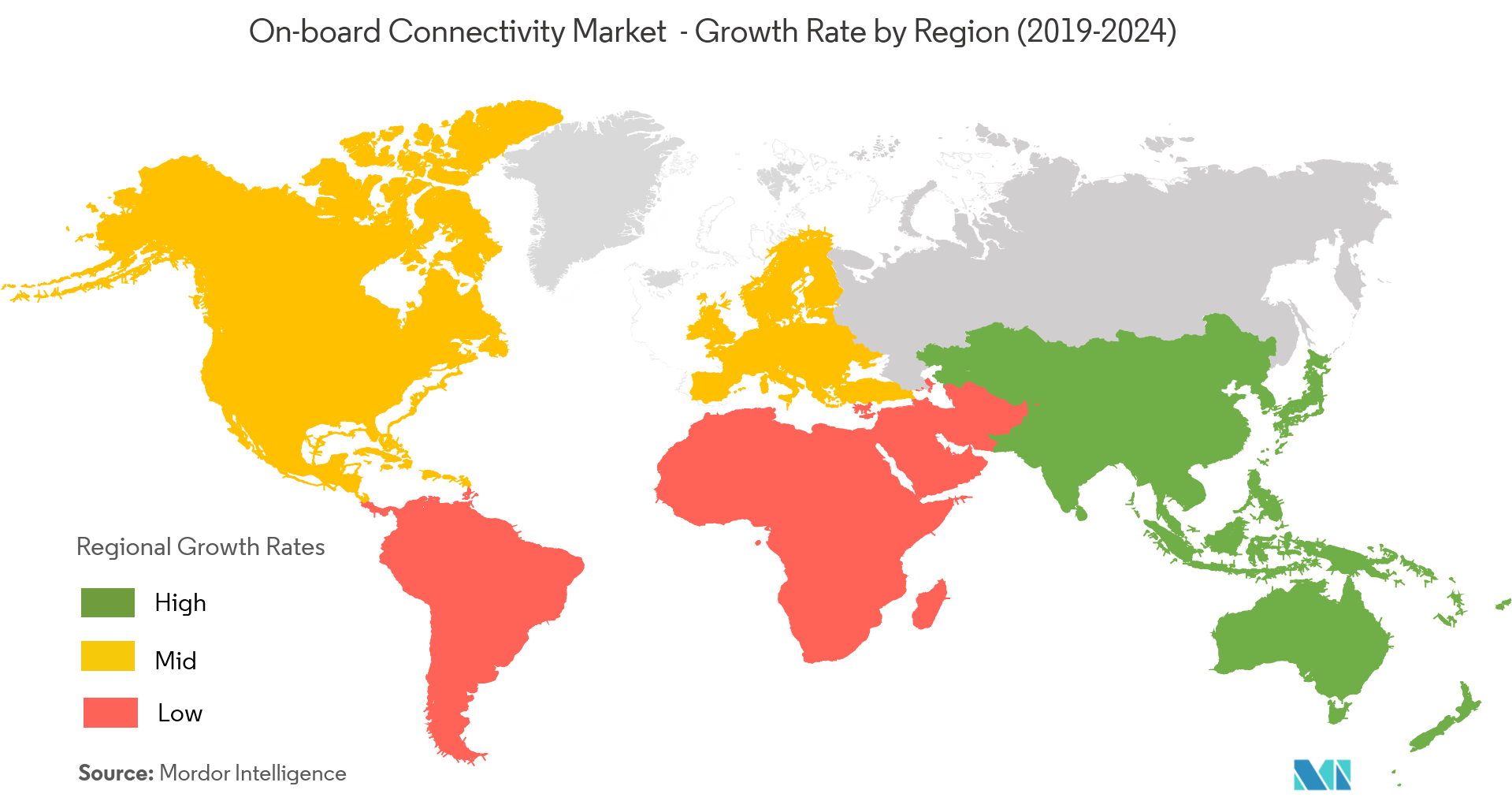

North America Expected to Hold Significant Market Share

North America is expected to hold a significant share in the on-board connectivity market during the forecast period. Growth in this region is due to technological advancements and strong adoption and penetration of on-board connectivity platform across the region. Additionally, presence of major key players in countries of North America along with increasing IT and huge investment by leading vendors to enhance travelling experience are some factors expected to drive the growth of the North America market.

In the United States, all electronic devices can be left on during take-off and landing with airlines that have proven to Federal Aviation Authority (FAA) officials that these devices won’t interfere with their equipment. There is an increase in investments by government organizations in this region.

According to Gogo which provides inflight broadband internet service for business aircraft, the market for onboard connectivity in this region is becoming saturated, and demand is lowering due to increase in the on-board connectivity services provided by airlines outside North America region.

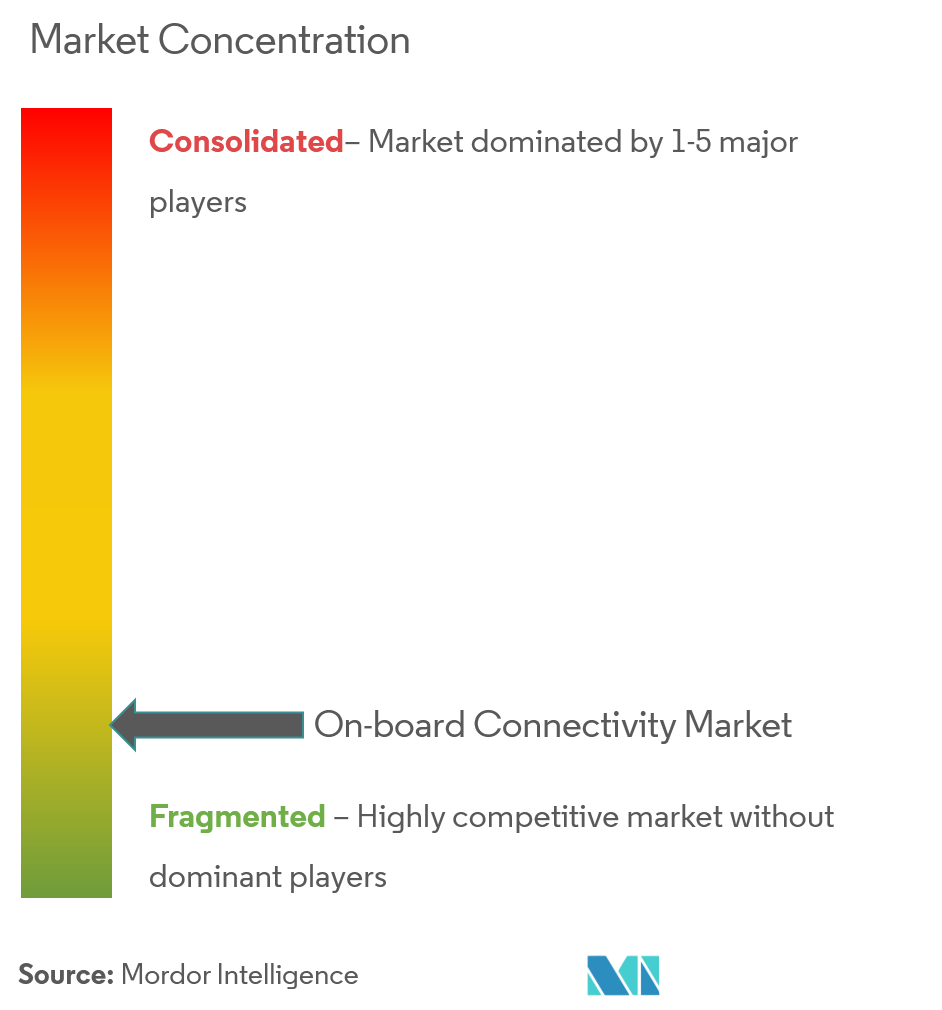

On-Board Connectivity Industry Overview

The on-board connectivity market is fragmented. The solution providers of on-board connectivity are expanding their product portfolio through various mergers and acquisitions which will provide them a larger customer base with enhanced and advanced connectivity solutions. Companies are focusing on long-term contracts and are providing different technologies to their customers.

Nov 2018: Airbus and Huawei collaborate to develop new inflight connectivity and smart manufacturing. Airbus China Innovation Centre (ACIC) has signed a Memorandum of Understanding (MoU) with Huawei, to cooperate on research and applications for inflight connectivity and the Internet of Things (IoT) at Airshow China.

July 2018: Honeywell International Inc. confirms its first high-speed JetWave satellite communications hardware in Africa, bringing a high-speed, global and consistent in-flight Wi-Fi solution to business jets on the African continent for the first time.

April 2018: Bombardier Singapore service center completed its first Ka-Band installation on global 6000 aircraft. Bombardier is the first OEM to offer the revolutionary Ka-band system on its business aircraft. Ka-Band technology delivers the industry's first fastest in-flight Wi-Fi connectivity, consistent performance, and seamless coverage worldwide.

On-Board Connectivity Market Leaders

-

Nokia Corp. (Alcatel Lucent Enterprise Inc.)

-

AT & T Inc.

-

Bombardier Aerospace Inc.

-

Honeywell International Inc.

-

Huawei Technologies Co. Ltd.

- *Disclaimer: Major Players sorted in no particular order

On-Board Connectivity Industry Segmentation

On-board connectivity offers internet connectivity in ships, aircrafts, railways or other transportation systems. On-board connectivity services offer wireless internet access, mobile phone internet access, data sharing services, and group internet packages.The services offered by on-board connectivity allow mobile devices to send and receive text messages and multi-media messages.

| By Type | Solution | ||

| Service | |||

| By End-user Industry | Transportation | Aviation | |

| Maritime | |||

| Railway | |||

| Entertainment | |||

| Monitoring | |||

| Communication | |||

| Geography | North America | US | |

| Canada | |||

| Europe | Germany | ||

| UK | |||

| France | |||

| Asia Pacific | China | ||

| Japan | |||

| India | |||

| Rest of the world | |||

On-Board Connectivity Market Research FAQs

What is the current On-board Connectivity Market size?

The On-board Connectivity Market is projected to register a CAGR of 13.8% during the forecast period (2025-2030)

Who are the key players in On-board Connectivity Market?

Nokia Corp. (Alcatel Lucent Enterprise Inc.), AT & T Inc., Bombardier Aerospace Inc., Honeywell International Inc. and Huawei Technologies Co. Ltd. are the major companies operating in the On-board Connectivity Market.

Which is the fastest growing region in On-board Connectivity Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in On-board Connectivity Market?

In 2025, the North America accounts for the largest market share in On-board Connectivity Market.

What years does this On-board Connectivity Market cover?

The report covers the On-board Connectivity Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the On-board Connectivity Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

On-board Connectivity Industry Report

Statistics for the 2025 On-board Connectivity market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. On-board Connectivity analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.