Offshore Drilling Rigs Market Analysis

The Offshore Drilling Rigs Market size is estimated at USD 78.16 billion in 2025, and is expected to reach USD 108.51 billion by 2030, at a CAGR of 6.78% during the forecast period (2025-2030).

- Over the long term, factors such as increased global energy demand and exploration activities for untapped regions are expected to drive the market during the forecasted period.

- On the other hand, the rising environmental concerns over offshore drilling and its impact on the aquatic environment are expected to hinder the market's growth.

- Nevertheless, increasing deepwater and ultra-deepwater activities for exploration and production are expected to create several future market opportunities.

- North America is expected to be a major market due to the latest technology and infrastructure for offshore activities.

Offshore Drilling Rigs Market Trends

Deepwater and Ultra-deepwater Segment to Witness Significant Growth

- Deepwater and ultra-deepwater regions hold vast untapped oil and gas reserves. As onshore and shallow-water reserves deplete, oil and gas companies increasingly focus on exploring and extracting hydrocarbon resources from these deepwater and ultra-deepwater locations. It drives the demand for drilling rigs capable of operating in such challenging environments.

- Advances in drilling technologies, equipment, and subsea systems significantly improved the feasibility and efficiency of drilling operations in deepwater and ultra-deepwater areas. Innovations such as dynamic positioning systems, advanced drilling techniques, and remotely operated vehicles (ROVs) enable safer and more efficient drilling in these challenging offshore environments. The availability of advanced technology opened up previously inaccessible deepwater reserves, thereby driving the segment's growth.

- Moreover, deepwater and ultra-deepwater regions are known to host sizable oil and gas reserves. These reserves often include higher production potential compared to onshore and shallow-water fields. The large reserves in these offshore areas make them attractive investment opportunities for oil and gas companies, driving the demand for offshore drilling rigs capable of operating in these environments.

- Furthermore, governments and energy companies invest in offshore exploration and production activities to secure future energy supplies. Deepwater and ultra-deepwater regions are actively explored and developed in various parts of the world, including the Gulf of Mexico, Brazil's pre-salt reserves, West Africa, and the Asia-Pacific region. These investments contribute to the growing demand for deepwater and ultra-deepwater drilling rigs.

- According to Baker Hughes Rig Count, the offshore rig counts increased significantly between Oct 2023 and May 2022. In May 2022, there were only 193 rigs, while in October 2023, there were 219, signifying increased offshore activities in one year.

- In July 2022, Jindal Drilling & Industries revealed that it had secured a contract from Oil & Natural Gas Corporation (ONGC) to deploy the Jack-up Rig Discovery I. It is on a three-year charter hire basis, with an Estimated Daily Rate (EDR) of USD 46,907.57. The Jack-up, as mentioned above, Rig Discovery I, is engaged in operations under an existing contract awarded by ONGC to Jindal Drilling & Industries.

- Therefore, as per the above points, deepwater and ultra-deepwater segments are expected to grow significantly during the forecasted period.

Middle-East and Africa to Witness Significant Growth

- The Middle East and Africa region are known for their rich hydrocarbon reserves, particularly in offshore locations. Countries such as Saudi Arabia, United Arab Emirates, Qatar, Nigeria, Angola, and Egypt include substantial offshore oil and gas reserves. These regions' exploration and production activities drive the demand for offshore drilling rigs.

- Many countries in the Middle East and Africa are actively exploring and developing new offshore fields to enhance their oil and gas production capacities. For example, ongoing projects in the Persian Gulf and the Red Sea in the Middle East exist. Countries like Angola, Nigeria, and Mozambique invest in offshore fields in Africa. These new developments create opportunities for offshore drilling rig operators and service providers.

- Moreover, governments in the Middle East and Africa implemented favorable policies and regulations to attract offshore oil and gas investments. These policies include tax incentives, streamlined permitting processes, and partnerships with international oil companies. Such supportive government initiatives contribute to the growth of the offshore drilling rigs market in the region.

- For instance, in November 2022, ADNOC Drilling, based in the UAE, received the initial unit of a trio of newly constructed jack-up drilling rigs from Keppel Offshore & Marine, headquartered in Singapore. These three rigs were part of a larger batch of five rigs constructed by Keppel FELS for BorrDrilling.

- The Middle East and Africa regions also invest in developing offshore infrastructure, including ports, pipelines, and storage facilities. This infrastructure development supports offshore drilling activities' growth, enabling efficient logistics and transportation of extracted resources. The presence of well-developed infrastructure attracts offshore drilling rig operators to the region.

- Therefore, per the above points, the Middle East and Africa region are expected to grow significantly during the forecasted period.

Offshore Drilling Rigs Industry Overview

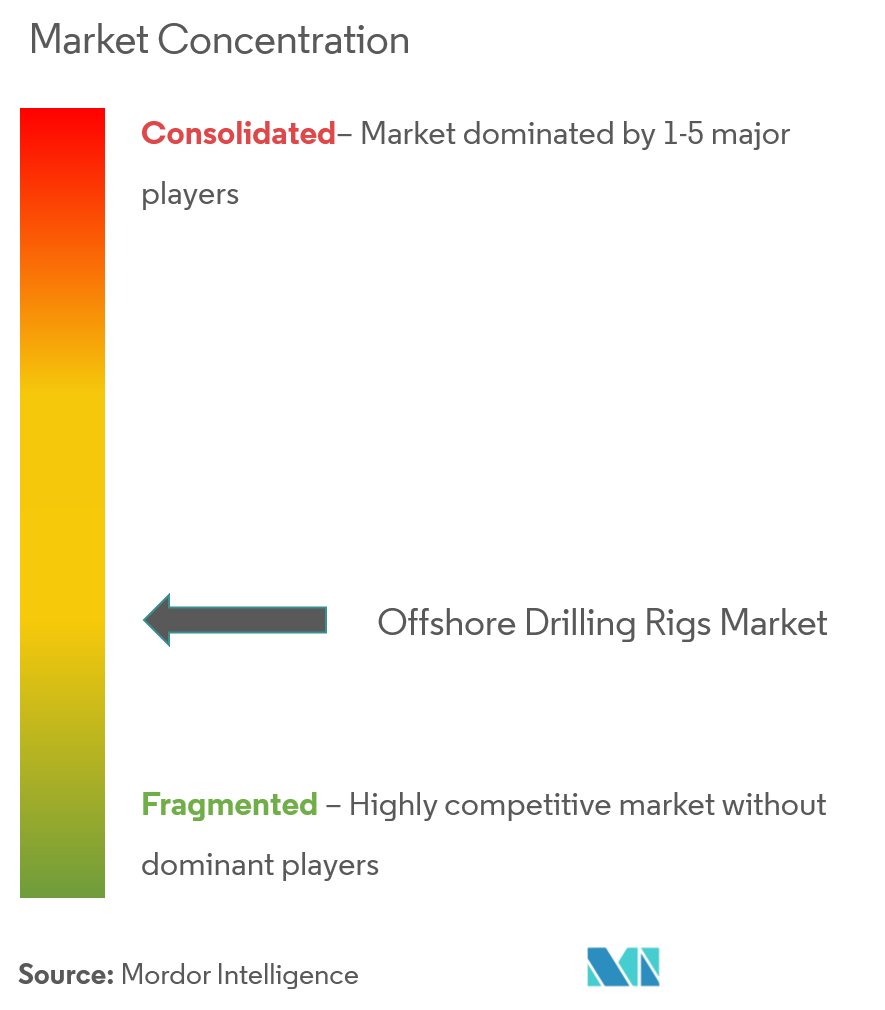

The offshore drilling rig market is semi-consolidated. Some major players (in no particular order) include Keppel Corporation Limited, Samsung Heavy Industries Co. Ltd, Sembcorp Marine Ltd, Transocean Ltd, and Seadrill Ltd., among others.

Offshore Drilling Rigs Market Leaders

-

Samsung Heavy Industries Co. Ltd

-

Sembcorp Marine Ltd

-

Seadrill Ltd

-

Keppel Corporation Limited

-

Transocean Ltd

- *Disclaimer: Major Players sorted in no particular order

Offshore Drilling Rigs Market News

- June 2023: Var Energi, a Norwegian offshore oil and gas producer, announced a long-term strategic cooperation with Halliburton, a US oilfield services firm, for drilling services to improve drilling and well performance and increase value creation. The partnership includes drilling services for Var Energi relating to exploration and production drilling across the Norwegian Continental Shelf. The contract is for five years with an option for an extra four years.

- June 2023: Vestigo Petroleum issued a Letter of Award to Malaysian offshore drilling company Velesto Drilling to provide a jack-up drilling rig. The deal is for Velesto's jack-up drilling rig NAGA 2, worth an estimated USD 10.9 million. The NAGA 2 is a high-end independent-leg cantilever jack-up rig with a drilling depth of 30,000 feet (9144 meters) and a rated operational water depth of 350 feet (106.68 meters).

Offshore Drilling Rigs Industry Segmentation

Offshore drilling rigs, or offshore platforms or drilling units, are structures used for drilling and extracting oil and gas reserves from beneath the seabed in offshore locations. These rigs are specifically designed to operate in various water depths, ranging from shallow to ultra-deepwater.

Type, water depths, and geography segment the Offshore Drilling Rigs Market. By types, the market is segmented into jack-ups, semisubmersibles, drill ships, and other types. The market is segmented by water depth into shallow water, deepwater, and ultra-deepwater. The report also covers the market size and forecasts for the offshore drilling rigs market across major regions. Each segment's market sizing and forecasts are based on revenue (USD).

| Type | Jackups | ||

| Semisubmersibles | |||

| Drill Ships | |||

| Other Types | |||

| Water Depth | Shallow Water | ||

| Deepwater and Ultra-deepwater | |||

| Geography Regional Market Analysis {Market Size and Demand Forecast till 2028 (for regions only)} | North America | United States | |

| Canada | |||

| Rest of North America | |||

| Europe | United Kingdom | ||

| Russia | |||

| Norway | |||

| Netherlands | |||

| Rest of Europe | |||

| Asia-Pacific | China | ||

| India | |||

| Australia | |||

| Malaysia | |||

| Rest of Asia-Pacific | |||

| South America | Brazil | ||

| Argentina | |||

| Venezuela | |||

| Rest of South America | |||

| Middle-East and Africa | Saudi Arabia | ||

| United Arab Emirates | |||

| Egypt | |||

| Nigeria | |||

| Rest of Middle-East and Africa | |||

Offshore Drilling Rigs Market Research FAQs

How big is the Offshore Drilling Rigs Market?

The Offshore Drilling Rigs Market size is expected to reach USD 78.16 billion in 2025 and grow at a CAGR of 6.78% to reach USD 108.51 billion by 2030.

What is the current Offshore Drilling Rigs Market size?

In 2025, the Offshore Drilling Rigs Market size is expected to reach USD 78.16 billion.

Who are the key players in Offshore Drilling Rigs Market?

Samsung Heavy Industries Co. Ltd, Sembcorp Marine Ltd, Seadrill Ltd, Keppel Corporation Limited and Transocean Ltd are the major companies operating in the Offshore Drilling Rigs Market.

Which is the fastest growing region in Offshore Drilling Rigs Market?

Middle-East and Africa is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Offshore Drilling Rigs Market?

In 2025, the North America accounts for the largest market share in Offshore Drilling Rigs Market.

What years does this Offshore Drilling Rigs Market cover, and what was the market size in 2024?

In 2024, the Offshore Drilling Rigs Market size was estimated at USD 72.86 billion. The report covers the Offshore Drilling Rigs Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Offshore Drilling Rigs Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Offshore Drilling Rigs Industry Report

Statistics for the 2025 Offshore Drilling Rigs market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Offshore Drilling Rigs analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.