Offshore Contract Drilling Market Analysis

The Offshore Contract Drilling Market is expected to register a CAGR of greater than 6% during the forecast period.

- The deep and ultra-deep water is expected to grow at a higher rate share in the offshore contract drilling market, in 2019, owing to the upcoming exploration and production projects in countries such as Brazil, Nigeria, and others.

- Factors, such as technological improvements and increasing viability of offshore oil & gas projects, several new markets, such as Gabon, Senegal, Guyana, Trinidad & Tobago, Egypt, and the Mexican side of the Gulf of Mexico are actively promoting the development of offshore reserves, especially the deepwater and ultra-deepwater reserves. This, in turn, is expected to create significant opportunities to the operating companies in the near future.

- The increasing oil and gas discoveries coupled with the liberalization in the industry globally, has been leading to creation of new opportunities for the players to invest in Europe, hence making it the largest market for offshore contract drilling market during the forecast market.

Offshore Contract Drilling Market Trends

Development of Deepwater and Ultra-Deepwater Reserves to Drive the Market

- The investments related to deepwater projects are expected to be limited, before 2025. These resources are typically more expensive to develop, take a longer time to reach full production, and require additional investment in infrastructure, because of their presence in remote locations. However, most of the projects that are currently under development are expected to continue their operations.

- Despite high fixed costs and the requirement of long lead times from project conception to the first production, offshore deepwater oil projects provide large production volumes that can achieve relatively low per-barrel operating costs over the reservoir life cycle.

- The majority of deepwater or ultra-deepwater production takes place in four countries: Brazil, the United States, Angola, and Norway. Brazil is a world leader in the development of deepwater and ultra-deepwater projects. This positive growth trend in crude oil production, from deepwater and ultra-deepwater resources in these regions, is expected to drive the demand for offshore contract drilling market, during the forecast period.

- In 2018, Brazil and the United States together accounted for more than 90% of ultra-deepwater production globally. The presence of the most experienced international oil companies in the deepwater development and largest deepwater reserves makes the United States and Brazil the most attractive countries for upstream deepwater investment.

- All the above-mentioned factors have been driving the demand for offshore contract drilling market over the study period.

Europe to Dominate the Market

- Europe is expected to dominate the offshore contract drilling market and is expected to grow at a significant rate over the forecast period.

- Russia had a 106.2 billion barrel proved reserve, as of 2018. Whereas daily oil production in the country is about 11.4 million barrel, and annual export is of approximately USD 129.2 billion. There are already more than 9,500 wells drilled, as of 2019.

- In total, 102 wells were drilled on the UKCS in 2018 (85 development, eight exploration, and nine appraisal). With the most recent tax break, production activities in discoveries, as mentioned earlier, are expected to commence during the forecast period.

- The Norwegian parliament has opened most of the North Sea, the Norwegian Sea, and Barents Sea South (including Southeast) for petroleum activities. The Norwegian Petroleum Directorate has estimated that around 47% of all the remaining resources on the shelf are still undiscovered. In the Norwegian shelf, between 2007 and 2017, about 380 wildcat wells were completed. More than 50%, of which, have resulted in discoveries, which is a high success rate per wildcat well by international standards.

- Therefore, rising offshore oil and gas activities in the region are expected to increase the demand for offshore contract drilling market over the forecast period in European region.

Offshore Contract Drilling Industry Overview

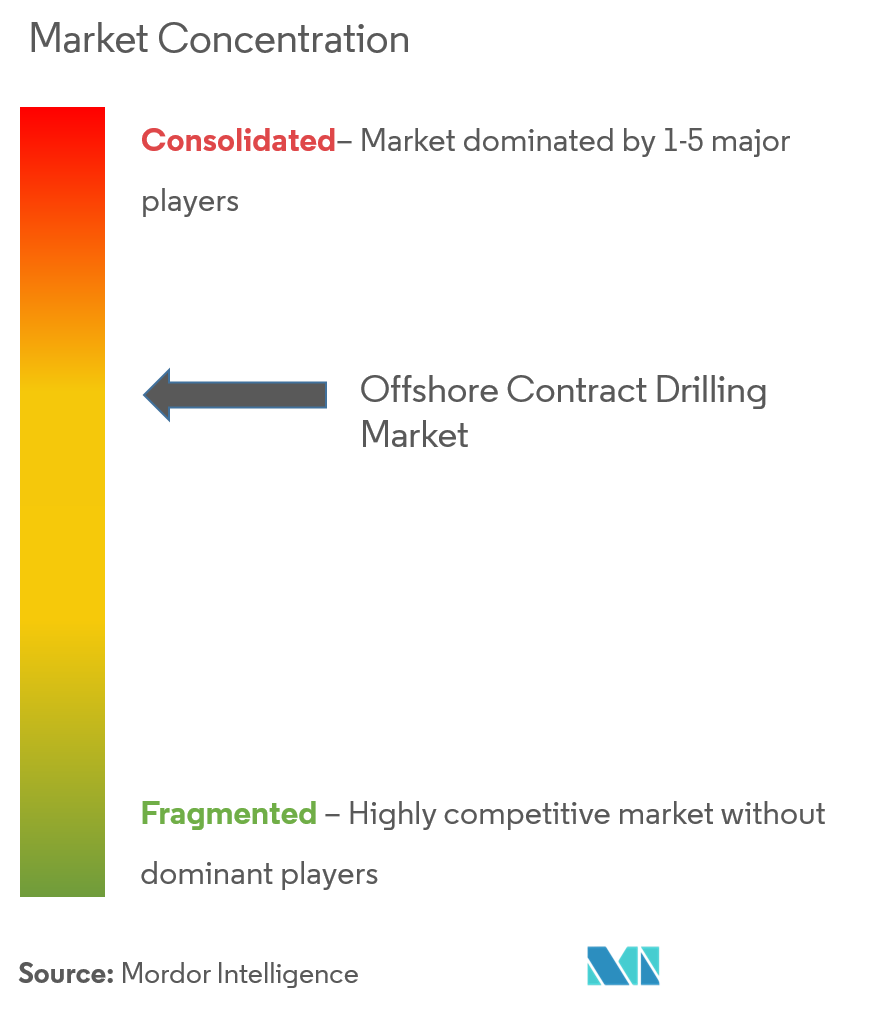

The global offshore contract drilling market is partially consolidated, due to the small number of companies operating in the industry. The key players in this market include Transocean Ltd, Seadrill Ltd, Diamond Offshore Drilling Inc., China Oilfield Services Limited and Saipem SpA.

Offshore Contract Drilling Market Leaders

-

Transocean Ltd

-

Seadrill Ltd

-

Diamond Offshore Drilling Inc.

-

China Oilfield Services Limited

-

Saipem SpA

- *Disclaimer: Major Players sorted in no particular order

Offshore Contract Drilling Industry Segmentation

The offshore contract drilling market report include:

| Type | Jackups |

| Semisubmersibles | |

| Drill Ships | |

| Other Types | |

| Water Depth | Shallow Water |

| Deep and Ultra-deepwater | |

| Geography | North America |

| Europe | |

| Asia-Pacific | |

| South America | |

| Middle-East and Africa |

Offshore Contract Drilling Market Research FAQs

What is the current Offshore Contract Drilling Market size?

The Offshore Contract Drilling Market is projected to register a CAGR of greater than 6% during the forecast period (2025-2030)

Who are the key players in Offshore Contract Drilling Market?

Transocean Ltd, Seadrill Ltd, Diamond Offshore Drilling Inc., China Oilfield Services Limited and Saipem SpA are the major companies operating in the Offshore Contract Drilling Market.

Which is the fastest growing region in Offshore Contract Drilling Market?

South America is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Offshore Contract Drilling Market?

In 2025, the Europe accounts for the largest market share in Offshore Contract Drilling Market.

What years does this Offshore Contract Drilling Market cover?

The report covers the Offshore Contract Drilling Market historical market size for years: 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Offshore Contract Drilling Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Offshore Contract Drilling Industry Report

Statistics for the 2025 Offshore Contract Drilling market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Offshore Contract Drilling analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.