Nuclear Reactor Construction Market Size

| Study Period | 2021 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | > 1.95 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

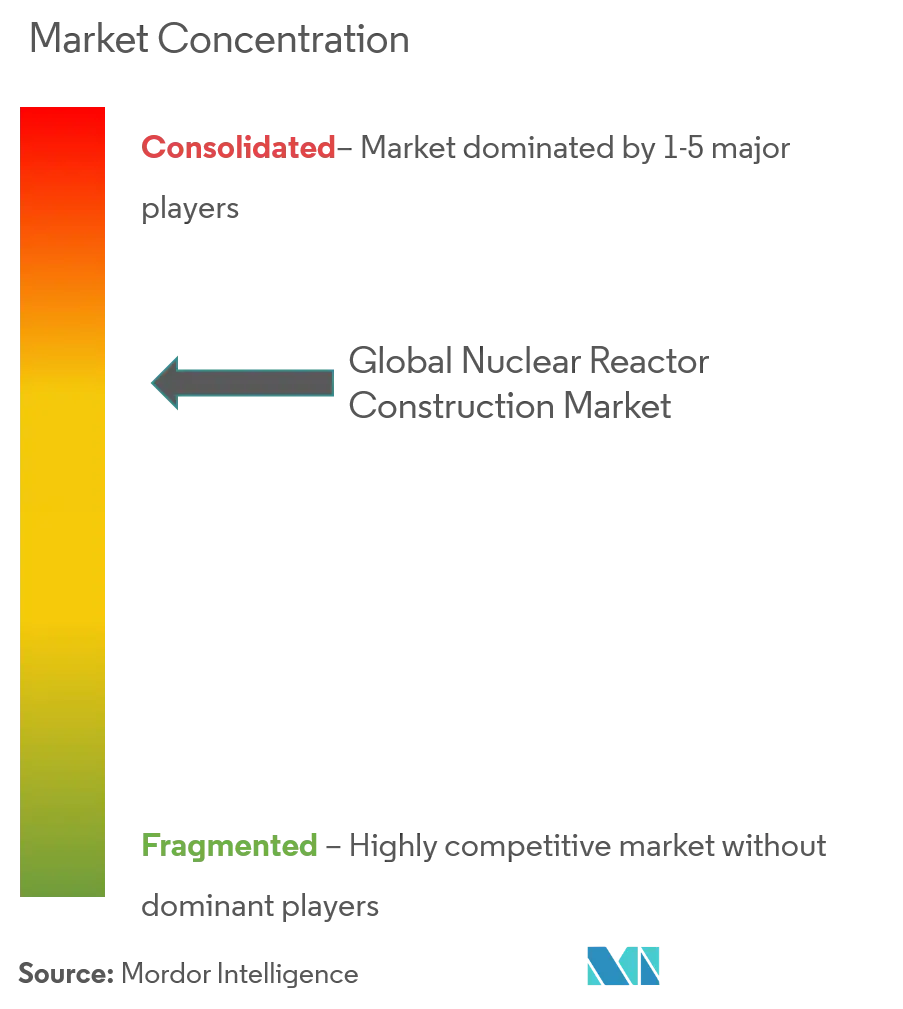

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Nuclear Reactor Construction Market Analysis

Nuclear Reactor Construction Market is expected to grow with more than a CAGR of 1.95% during the forecast period.

The market was negatively impacted by COVID-19. Presently the market has now reached pre-pandemic levels.

- The nuclear reactor construction market is expected to register significant growth during the forecast period, primarily due to the uptake in nuclear power plant construction projects. Moreover, globally there is a large number of reactors with ages exceeding 30 years, which is likely to drive the market over the forecast period. Technological advancements have emerged as one of the major factors driving the growth of the nuclear reactor construction market due to the techno-economic benefits associated with nuclear reactor technology.

- However, the low initial cost of setting up and the higher safety of renewable create additional demand for renewables to generate electricity which is likely to restrain the market's growth during the forecast period.

- The development of nuclear reactor technologies is expected to increase the influx of money in the nuclear reactor construction business, creating opportunities for the market in the future.

- Asia-Pacific is expected to be the fastest-growing region in the nuclear reactor construction market and is expected to grow further during the forecast period.

Nuclear Reactor Construction Market Trends

This section covers the major market trends shaping the Nuclear Reactor Construction Market according to our research experts:

Pressurized Water Reactor to Dominate the Market

- Operators choose pressurized water reactors because they are the safest of all the nuclear reactor types since there are growing worries about the safety of nuclear power facilities. The PWR reactor also guards against radioactive material contamination of water, preventing environmental harm.

- As of 2021, With a total capacity of around 390 GWe, there are over 440 commercial nuclear power reactors operating in about 30 different nations. There are now being built about 60 additional reactors. Over 50 nations run around 220 research reactors, and another 180 nuclear reactors provide power for 140 ships and submarines.

- Moreover, In 2021, global electricity production by nuclear energy accounted for 2653 billion kWh. With an annual growth rate of 3.9%, electricity production is expected to grow through nuclear energy, which, in turn, creates demand for pressurized water reactors in the forecast period.

- The PWR is expensive to build because it needs strong pipes and a large pressure vessel to keep the highly pressured water in a liquid form while sustaining high temperatures. Therefore, the market for nuclear power plant equipment is anticipated to be highly impacted by the rising demand for PWRs throughout the forecast period.

- More than 90% of the future plants will use the PWR type of reactor. Hence it is projected that the PWR will dominate the projects in the Asia-Pacific region, particularly in China. Other than the current projects, a number of PWRs are being planned for construction in the upcoming years, which would propel the market for nuclear power plant equipment over the anticipated period.

Asia-Pacific Expected to Witness Significant Growth

- Several nations in the Asia-Pacific are planning and building new nuclear power plants to meet their rising need for clean electricity, in contrast to North America and Europe where expansion in nuclear electricity generating capacity has been constrained for many years.

- China had the largest nuclear energy new-build program internationally as of 2022. The robust project pipeline is anticipated to improve the outlook for the Chinese nuclear power market, which has previously experienced regulatory challenges as a result of the government's decision to halt nuclear reactor approvals until a re-examination of the plans was completed following the Fukushima Disaster in Japan in 2011.

- China develops nuclear power facilities using the most cutting-edge technology and exacting standards, and it closely controls every stage of a nuclear power plant's life cycle, from design to construction to operation to decommissioning. China had 54 operational nuclear power reactors with a combined capacity of 52.15 GWe as of December 2022.

- To fulfill the nation's rising need for electricity, the Indian government is committed to expanding its nuclear power-producing capacity. The Indian government projects that by 2031, the nation's nuclear capacity will be around 22.5 GWe.

- As of December 2022, the country had 22 operable nuclear reactors with a combined capacity of 6.79 GWe, and eight reactors with a combined capacity of 6.02 GWe are in the construction stage.

- Therefore, owing to the above factors, Asia-Pacific is expected to witness significant market growth during the forecast period.

Nuclear Reactor Construction Industry Overview

The Nuclear Reactor Construction Market is moderately concentrated due to few companies operating in the industry with complex technology. The key players in this market ( not in a particular order ) include GE-Hitachi Nuclear Energy, Inc., Westinghouse Electric Company LLC (Toshiba), KEPCO Engineering & Construction, SKODA JS a.s., and China National Nuclear Corporation.

Nuclear Reactor Construction Market Leaders

-

GE-Hitachi Nuclear Energy

-

Westinghouse Electric Company LLC (Toshiba)

-

KEPCO Engineering & Construction

-

SKODA JS a.s.

-

China National Nuclear Corporation

*Disclaimer: Major Players sorted in no particular order

Nuclear Reactor Construction Market News

- October 2022: The United States and Japan announced a partnership with Ghana at the International Atomic Energy Agency Nuclear Power Ministerial Conference in Washington, DC, to support its goal of leading Africa to deploy small modular reactors. Since Ghana's nuclear power program is currently technology neutral, the collaboration will facilitate the deployment of Small Modular Reactor (SMR) technology in Ghana.

- March 2022: Department of Atomic Energy (DAE) representatives informed that India is getting ready to start building reactors in "fleet" mode, starting with the pouring of the first concrete for two 700 MWe Pressurized Heavy Water Reactors (PHWRs) at Kaiga in Karnataka.

Nuclear Reactor Construction Market Report - Table of Contents

1. INTRODUCTION

1.1 Scope of the Study

1.2 Market Definition

1.3 Study Assumptions

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET OVERVIEW

4.1 Introduction

4.2 Market Size and Demand Forecast, until 2027

4.3 Recent Trends and Developments in the Nuclear Power Industries

4.4 Investment Opportunities

4.5 Market Dynamics

4.5.1 Drivers

4.5.2 Restraints

4.6 Porter's Five Forces Analysis

4.6.1 Bargaining Power of Suppliers

4.6.2 Bargaining Power of Consumers

4.6.3 Threat of New Entrants

4.6.4 Threat of Substitutes Products and Services

4.6.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

5.1 Service

5.1.1 Equipment

5.1.1.1 Island Equipment

5.1.1.2 Auxiliary Equipment

5.1.2 Installation

5.2 Reactor Type

5.2.1 Pressurized Water Reactor and Pressurized Heavy Water Reactor

5.2.2 Boiling Water Reactor

5.2.3 High-temperature Gas Cooled Reactor

5.2.4 Liquid-metal Fast-Breeder Reactor

5.3 Geography

5.3.1 North America

5.3.2 Europe

5.3.3 Asia-Pacific

5.3.4 South America

5.3.5 Middle-East and Africa

6. COMPETITIVE LANDSCAPE

6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

6.2 Strategies Adopted by Leading Players

6.3 Company Profiles

6.3.1 GE-Hitachi Nuclear Energy, Inc.

6.3.2 Westinghouse Electric Company LLC (Toshiba)

6.3.3 KEPCO Engineering & Construction

6.3.4 SKODA JS a.s.

6.3.5 China National Nuclear Corporation

6.3.6 Bilfinger SE

6.3.7 Larsen & Toubro Limited

6.3.8 Doosan Corporation

6.3.9 Mitsubishi Heavy Industries Ltd

6.3.10 Dongfang Electric Corporation Limited

6.3.11 Shanghai Electric Group Company Limited

6.3.12 Rosatom Corp

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

Nuclear Reactor Construction Industry Segmentation

A collection of devices that can manage nuclear fission to generate electricity is known as a nuclear reactor or power plant. Uranium pellets are the fuel that nuclear reactors utilize to generate nuclear fission. Uranium atoms are split apart under extreme pressure in nuclear reactors.

The Nuclear Reactor Construction Market is segmented by Service and Reactor Type. By service, the market is segmented into Equipment and Installation. The market is segmented by reactor type into pressurized water and heavily pressurized water, boiling water, high-temperature gas-cooled, and liquid-metal fast-breeder. The report also covers the market size and forecasts for the nuclear reactor construction market across the major regions. For each segment, the market sizing and forecast is based on the revenue (USD Billion).

| Service | ||||

| ||||

| Installation |

| Reactor Type | |

| Pressurized Water Reactor and Pressurized Heavy Water Reactor | |

| Boiling Water Reactor | |

| High-temperature Gas Cooled Reactor | |

| Liquid-metal Fast-Breeder Reactor |

| Geography | |

| North America | |

| Europe | |

| Asia-Pacific | |

| South America | |

| Middle-East and Africa |

Nuclear Reactor Construction Market Research FAQs

What is the current Nuclear Reactor Construction Market size?

The Nuclear Reactor Construction Market is projected to register a CAGR of greater than 1.95% during the forecast period (2024-2029)

Who are the key players in Nuclear Reactor Construction Market?

GE-Hitachi Nuclear Energy, Westinghouse Electric Company LLC (Toshiba), KEPCO Engineering & Construction, SKODA JS a.s. and China National Nuclear Corporation are the major companies operating in the Nuclear Reactor Construction Market.

Which is the fastest growing region in Nuclear Reactor Construction Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Nuclear Reactor Construction Market?

In 2024, the North America accounts for the largest market share in Nuclear Reactor Construction Market.

What years does this Nuclear Reactor Construction Market cover?

The report covers the Nuclear Reactor Construction Market historical market size for years: 2021, 2022 and 2023. The report also forecasts the Nuclear Reactor Construction Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Nuclear Reactor Constructions Industry Report

Statistics for the 2024 Nuclear Reactor Constructions market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Nuclear Reactor Constructions analysis includes a market forecast outlook 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.