North America Plowing & Cultivating Machinery Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| Forecast Data Period | 2024 - 2029 |

| Historical Data Period | 2019 - 2022 |

| CAGR | 2.96 % |

| Market Concentration | High |

Major Players

*Disclaimer: Major Players sorted in no particular order |

North America Plowing & Cultivating Machinery Market Analysis

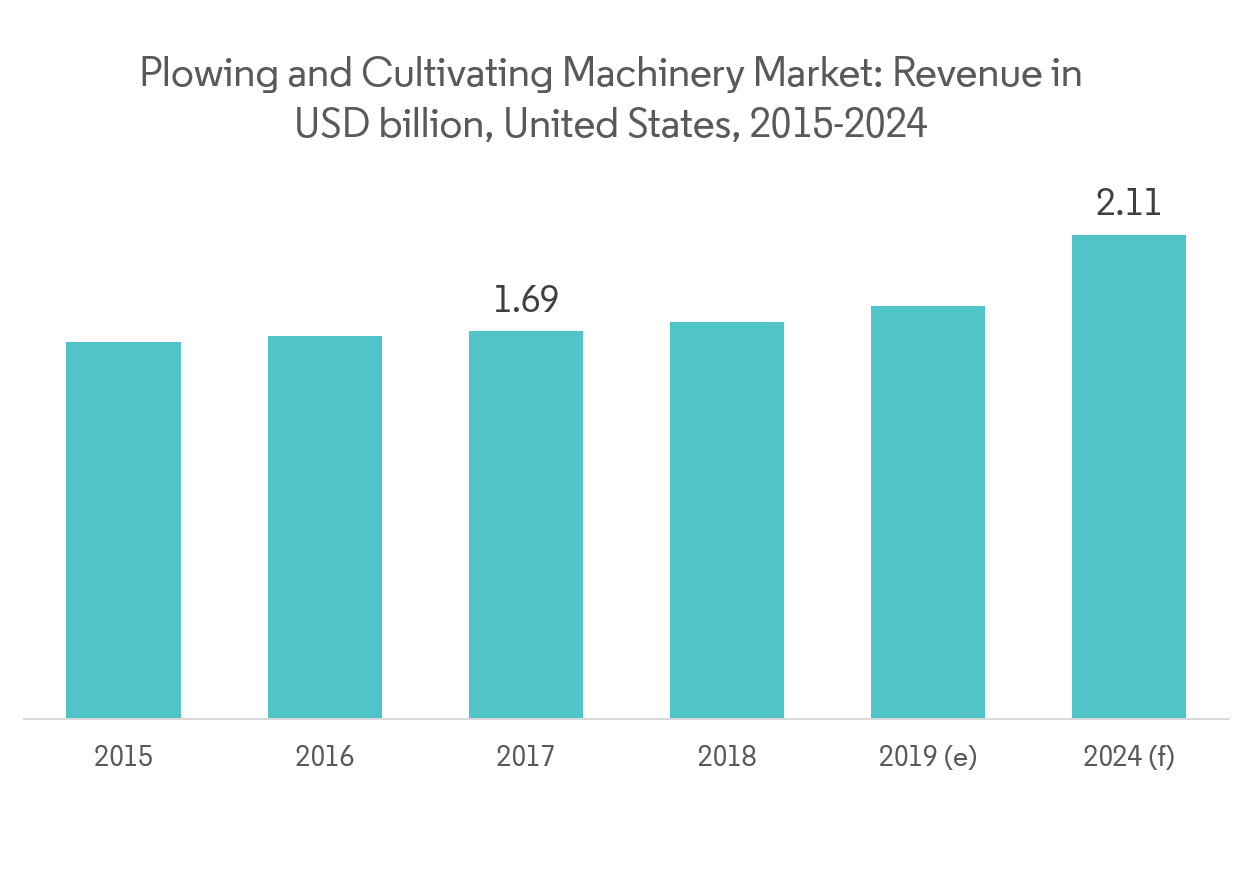

The North American plowing and cultivating machinery market was valued at USD 3.9 billion in 2018 and is expected to reach USD 866 million by 2024, at a CAGR of 2.96% during the forecast period, 2019-2024.

North America is the largest market for agricultural machinery in the world, thanks to the use of advanced farming over extensive areas, with support from new technologies used in farm machinery. Some of the advanced technologies used in ploughing and cultivating operations extensively in North America include GPS-enabled equipment, extensive soil sampling, and real-time monitoring of soil moisture content using sensors, among others.

North America Plowing & Cultivating Machinery Market Trends

Scarcity of Low Cost Labor influencing Increased Adoption of Farm Mechanization

During the period between 2002 and 2014, the population of field and crop workforce in the United States saw a decline of 22.9%, on average. Increase in wages is a clear indication of the labor shortage on US farms. In 2014, more than half of all hired farmworkers, or roughly half a million workers in the United States were immigrants. The increasing shortage of labor is encouraging farmers, mainly large-scale, to adopt farm mechanization. Anticipation of the shortage of labor, specifically skilled labor, may drive higher demand for farm mechanization, which may result in higher demand for agricultural machinery, including plowing and cultivation machinery, in North America.

United States dominates the Regional Market

The US plowing and cultivating machinery market accounted for 44.4% market share in the North American region in 2017, despite the growing popularity of no-till farming in the country. Plowing and tillage are the primary causes of soil erosion, and thus, there is an increasing demand for no-till farming- a type of soil conservation farming that prepares the land for plowing without mechanically disturbing the soil. In the United States, in 2015, nearly 35% of cropland was under no-tilled cultivation and more than 10 million acres of cover crops were seeded across the country. The no-tillage farming technique is gaining immense popularity in the country, owing to significant economic benefits, including low soil erosion, high soil biological activity, and improved soil organic matter. Moreover, these benefits are expected to provide additional economic gains to farmers over time. Thus, the widespread no-tillage farming practice is expected to hold back the US plowing and cultivating machinery market’s growth during the forecast period.

North America Plowing & Cultivating Machinery Industry Overview

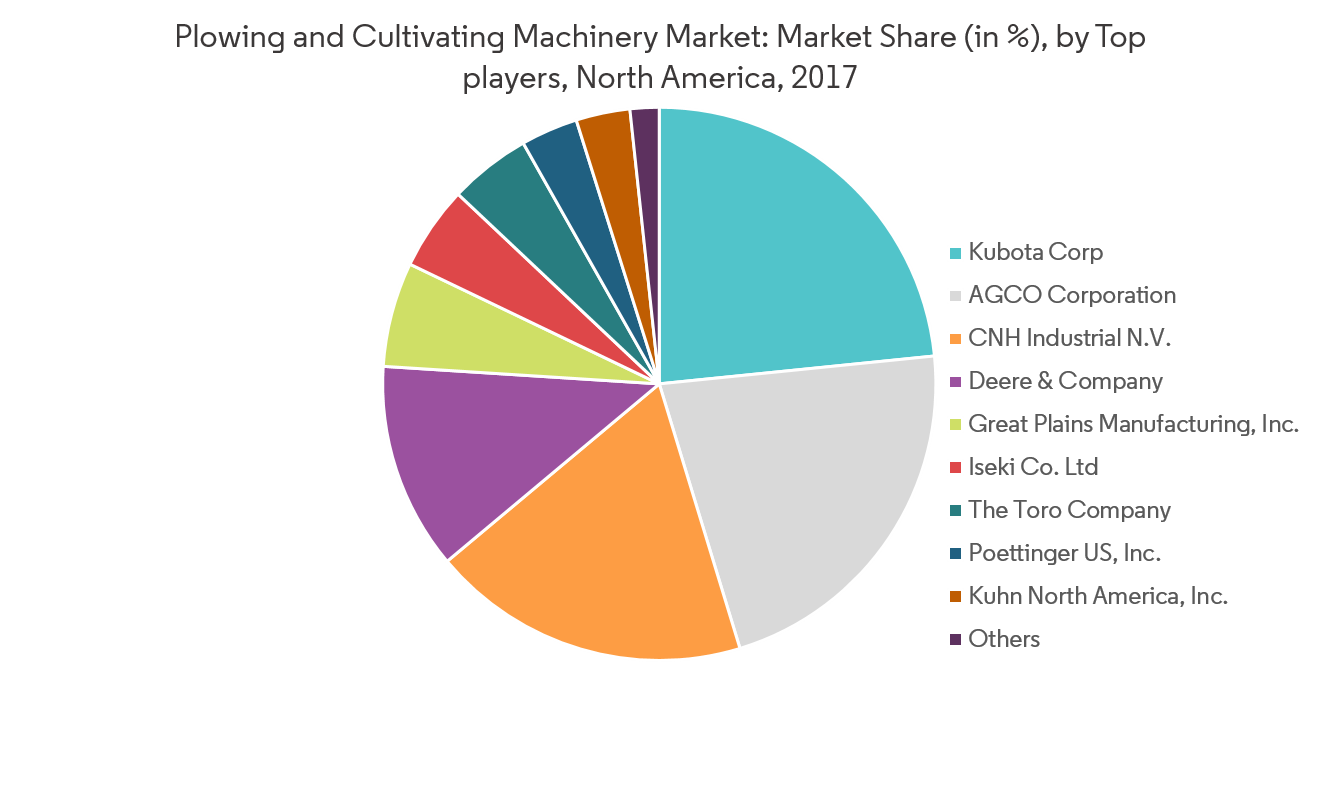

The North American plowing and cultivating machinery market is highly consolidated, with the top five companies holding more than 60% of the market share. Apart from the major players, there are a lot of local companies cornering smaller shares in the North American plowing and cultivating machinery market.

North America Plowing & Cultivating Machinery Market Leaders

-

Kubota Corporation

-

AGCO Corporation

-

CNH Industrial NV

-

Kuhn Group

-

Deere & Co.

*Disclaimer: Major Players sorted in no particular order

North America Plowing & Cultivating Machinery Market Report - Table of Contents

-

1. INTRODUCTION

-

1.1 Study Deliverables

-

1.2 Study Assumptions

-

1.3 Scope of the Study

-

-

2. RESEARCH METHODOLOGY

-

3. EXECUTIVE SUMMARY

-

4. MARKET DYNAMICS

-

4.1 Market Overview

-

4.2 Introduction to Market Drivers and Restraints

-

4.3 Market Drivers

-

4.4 Market Restraints

-

4.5 Porter's Five Force Analysis

-

4.5.1 Bargaining Power of Suppliers

-

4.5.2 Bargaining Power of Buyers

-

4.5.3 Threat of New Entrants

-

4.5.4 Threat of Substitutes

-

4.5.5 Competitive Rivalry

-

-

-

5. MARKET SEGMENTATION

-

5.1 By Product Type

-

5.1.1 Plows

-

5.1.2 Harrows

-

5.1.3 Cultivators and Tillers

-

5.1.4 Other Product Types

-

-

5.2 By Application Type

-

5.2.1 Soil Loosening

-

5.2.2 Clod Size Reduction

-

5.2.3 Clod Sorting

-

5.2.4 Other Application Types

-

-

5.3 Geography

-

5.3.1 United States

-

5.3.2 Canada

-

5.3.3 Mexico

-

5.3.4 Rest of North America

-

-

-

6. COMPETITIVE LANDSCAPE

-

6.1 Most Adopted Strategies

-

6.2 Market Share Analysis

-

6.3 Company Profiles

-

6.3.1 Deere & Co.

-

6.3.2 AGCO Corporation

-

6.3.3 CNH Industrial NV

-

6.3.4 Bush Hog Inc.

-

6.3.5 Kubota Corporation

-

6.3.6 Kuhn North America, Inc.

-

6.3.7 Lemken GmbH & Co. KG

-

6.3.8 Dewulf B.V.

-

6.3.9 Kverneland AS

-

6.3.10 The Toro Company

-

6.3.11 Great Plains Manufacturing, Inc.

-

6.3.12 Gregoire-Besson S.A.S

-

6.3.13 Bednar Fmt s.r.o.

-

6.3.14 Horsch L.L.C.

-

6.3.15 Landoll Corporation

-

6.3.16 Titan Machinery

-

6.3.17 Iseki & Co. Ltd

-

6.3.18 Opico Corporation

-

6.3.19 McFarlane Mfg. Co.

-

6.3.20 Poettinger US Inc.

-

- *List Not Exhaustive

-

-

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

North America Plowing & Cultivating Machinery Industry Segmentation

Plowing and cultivating machines are used prior to sowing or planting of the crop to enhance the soil permeability, which increases fertility and conditions the soil. It homogenizes and conditions up to 12-25 cm of topsoil and enhances nutrient availability for the crop.

| By Product Type | |

| Plows | |

| Harrows | |

| Cultivators and Tillers | |

| Other Product Types |

| By Application Type | |

| Soil Loosening | |

| Clod Size Reduction | |

| Clod Sorting | |

| Other Application Types |

| Geography | |

| United States | |

| Canada | |

| Mexico | |

| Rest of North America |

North America Plowing & Cultivating Machinery Market Research FAQs

What is the current North America Plowing and Cultivating Machinery Market size?

The North America Plowing and Cultivating Machinery Market is projected to register a CAGR of 2.96% during the forecast period (2024-2029)

Who are the key players in North America Plowing and Cultivating Machinery Market?

Kubota Corporation, AGCO Corporation, CNH Industrial NV, Kuhn Group and Deere & Co. are the major companies operating in the North America Plowing and Cultivating Machinery Market.

What years does this North America Plowing and Cultivating Machinery Market cover?

The report covers the North America Plowing and Cultivating Machinery Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the North America Plowing and Cultivating Machinery Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

North America Plowing And Cultivating Equipment Industry Report

Statistics for the 2024 North America Plowing And Cultivating Equipment market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. North America Plowing And Cultivating Equipment analysis includes a market forecast outlook 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.