North America Phytosterols Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| Forecast Data Period | 2024 - 2029 |

| Historical Data Period | 2019 - 2022 |

| CAGR | 8.10 % |

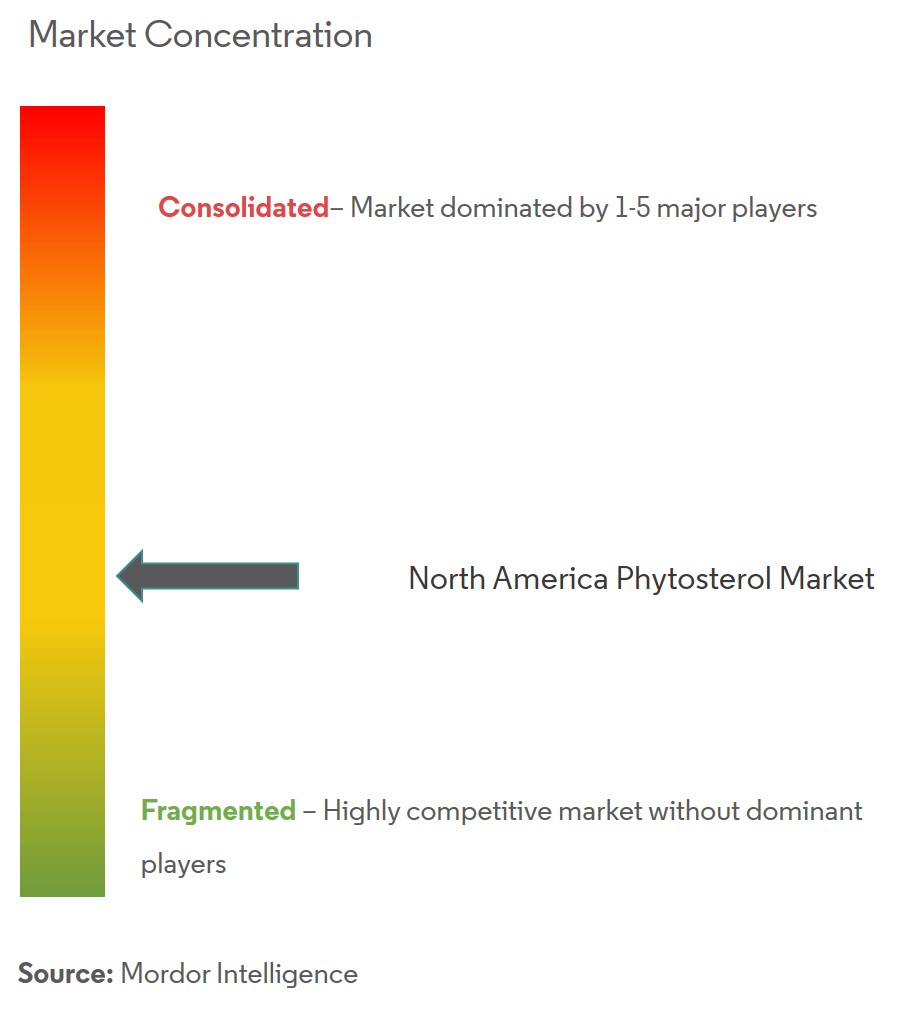

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

North America Phytosterols Market Analysis

North America Phytosterols market forecasted to reach USD 312.02 million by 2025growing at a CAGR of 8.1% during the forecast period.

- In the North America region, the United States leads the phytosterol market, due to the high population and increase in heart diseases at an alarming rate. The US Food and Drug Administration has given the GRAS (generally recognized as safe) status to the addition of plant sterols in food products.

- The government regulatory divisionin North Americasuch asHealth Canada and the Canadian Food Inspection Agency (CFIA) is actively promoting the use of phytosterols in the food productsin the region bysetting parameters for products having more than 1.0 g phytosterol in the product.

North America Phytosterols Market Trends

This section covers the major market trends shaping the North America Phytosterols Market according to our research experts:

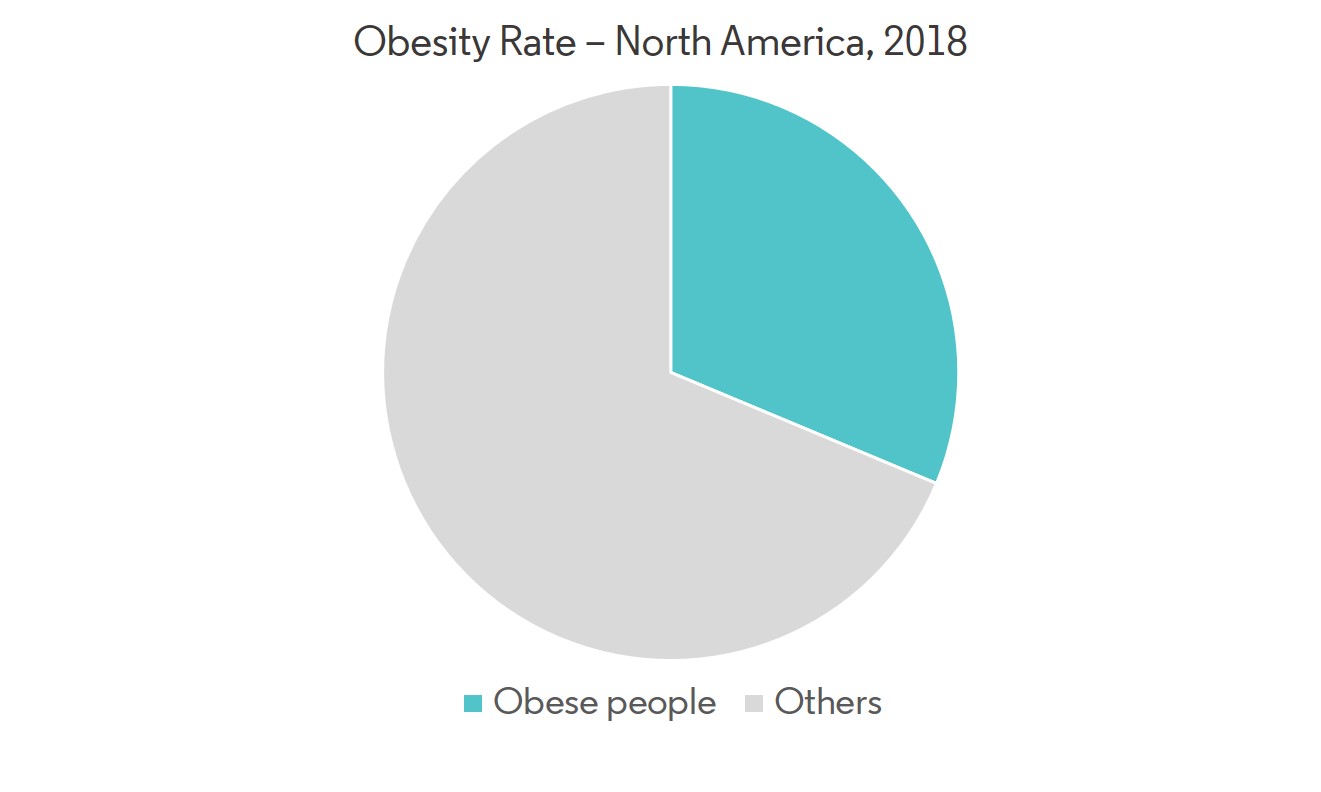

Prevalence of Obesity

In the North America region, the United States leads the phytosterol market, due to the high population and increase in obesity at an alarming rate. According to a recent survey, the obesity rate in the region increased by 5 percent accounting for about 31.3% in 2018. The obesity rate is highest among the middle-aged population. The American Society of Family Physicians (AAFP) and U.S Preventive Services Task Force (USPSTF) is also promoting the usage of Phytosterols because of its health benefits along with rising demand for phytosterol infused products is augmenting the growth phytosterols in the American market.

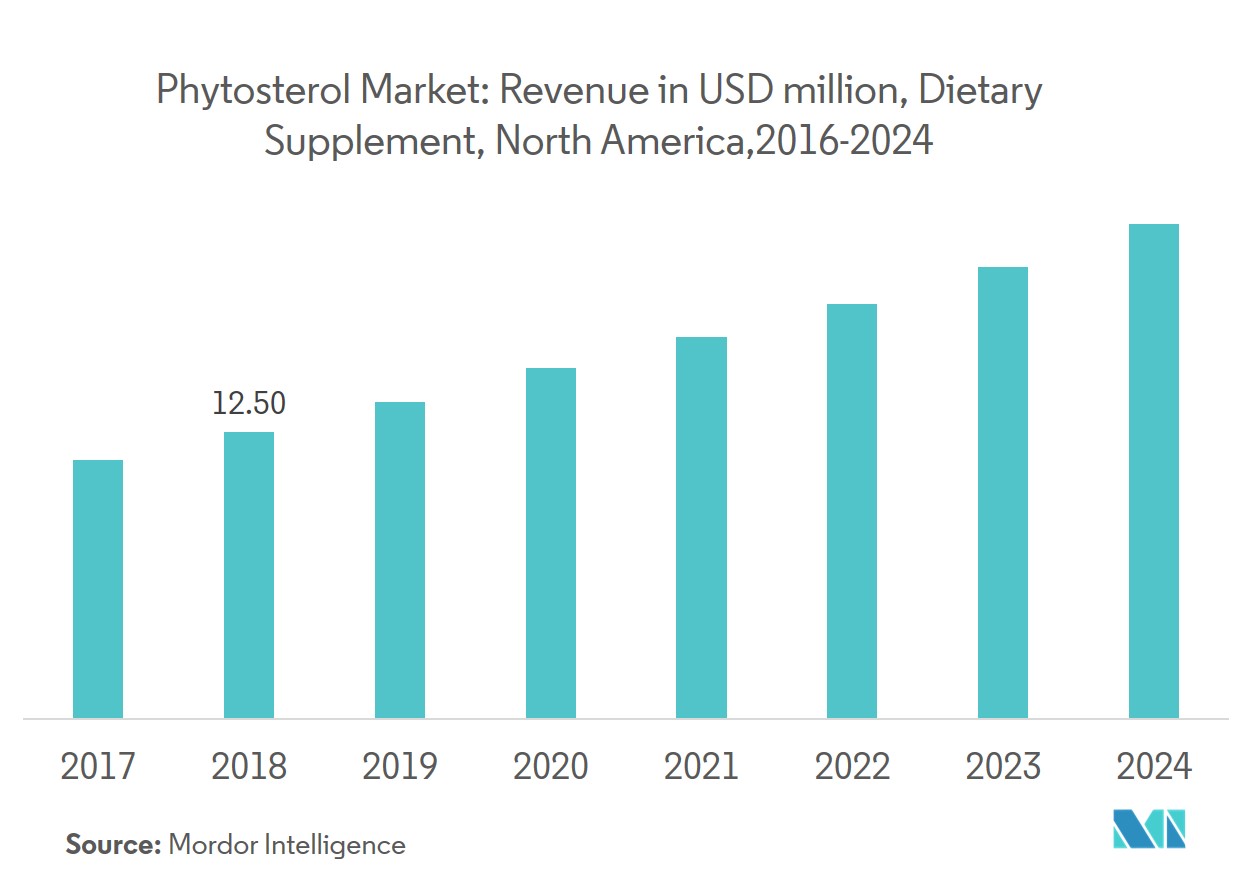

The Growing Demand for Phytosterol Infused Dietary Suppliments

The dietary supplement segment is registering a high CAGR, because of the growing demand for phytosterols in the functional food segment. Moreover, growing health concerns have further elevated the demand for dietary supplement products over the past few years. The per capita consumption of phytosterols are considerably higher for the United States, which is facilitated by the booming dietary supplement and pharmaceutical industries. The US dietary supplements market is by far the most advanced, in terms of product offerings and market penetration.

North America Phytosterols Industry Overview

The major players in the North America phytosterol market are BASF SE, Archer Daniels Midland, Arboris LLC, and Cargill Incorporated. In recent years, the companies have adopted new launches as the key strategy, along with expansions and partnerships. This, in turn, has helped to gain a competitive edge over the competitors. Also, the companies are enhancing their product portfolio, in order to cater to the consumers across various demographics and thus strengthen their presence in the market.

North America Phytosterols Market Leaders

-

Cargill, Incorporated

-

Archer Daniels Midland Company

-

Berkshire Hathaway Inc.

-

Ashland Global Holdings Inc

-

Härting S.A.

*Disclaimer: Major Players sorted in no particular order

North America Phytosterols Market Report - Table of Contents

-

1. INTRODUCTION

-

1.1 Study Deliverables

-

1.2 Study Assumptions

-

1.3 Scope of the Study

-

-

2. RESEARCH METHODOLOGY

-

3. EXECUTIVE SUMMARY

-

3.1 Market Overview

-

-

4. MARKET DYNAMICS

-

4.1 Market Drivers

-

4.2 Market Restraints

-

4.3 Porters Five Forces Analysis

-

4.3.1 Threat of New Entrants

-

4.3.2 Bargaining Power of Buyers/Consumers

-

4.3.3 Bargaining Power of Suppliers

-

4.3.4 Threat of Substitute Products

-

4.3.5 Intensity of Competitive Rivalry

-

-

-

5. MARKET SEGMENTATION

-

5.1 By Product Type

-

5.1.1 Beta-Sitosterol

-

5.1.2 Campesterol

-

5.1.3 Stigmasterol

-

5.1.4 Other Product Types

-

-

5.2 By Application

-

5.2.1 Food and Beverage

-

5.2.1.1 Dairy Products

-

5.2.1.2 Sauces and Condiments

-

5.2.1.3 Beverages

-

5.2.1.4 Bakery and Confectionery

-

5.2.1.5 Other Processed Food

-

-

5.2.2 Pharmaceuticals

-

5.2.3 Cosmetics

-

5.2.4 Dietary Supplements

-

5.2.5 Animal Feed

-

-

5.3 Geography

-

5.3.1 United States

-

5.3.2 Canada

-

5.3.3 Mexico

-

5.3.4 Rest of North America

-

-

-

6. COMPETITIVE LANDSCAPE

-

6.1 Vendor Market Share

-

6.2 Mergers & Acquisitions

-

6.3 Company Profiles

-

6.3.1 Archer Daniels Midland

-

6.3.2 Cargill, Incorporated

-

6.3.3 Ashland Global Holdings Inc.

-

6.3.4 Harting S.A

-

6.3.5 Berkshire Hathaway Inc.

-

6.3.6 Merck Group

-

6.3.7 BASF SE Group

-

6.3.8 Avanti Polar Lipids

-

- *List Not Exhaustive

-

-

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

North America Phytosterols Industry Segmentation

The type of phytosterols present in the North America market namely, beta-setosterol, campesterol, stigmasterol, and other types are drived from two primary sources which includes wood sterol and vegetable oil sterols. The sterols present in the market hold applications in differed food and beverage industries which includes, dairy products, sauces and condiments, beverages bakery and confectionery and other processed foods. The sterols also hold the application in pharmaceutical industries such as cosmetics, dietary supplements, and animal feed.

| By Product Type | |

| Beta-Sitosterol | |

| Campesterol | |

| Stigmasterol | |

| Other Product Types |

| By Application | |||||||

| |||||||

| Pharmaceuticals | |||||||

| Cosmetics | |||||||

| Dietary Supplements | |||||||

| Animal Feed |

| Geography | |

| United States | |

| Canada | |

| Mexico | |

| Rest of North America |

North America Phytosterols Market Research FAQs

What is the current North America Phytosterols Market size?

The North America Phytosterols Market is projected to register a CAGR of 8.10% during the forecast period (2024-2029)

Who are the key players in North America Phytosterols Market?

Cargill, Incorporated, Archer Daniels Midland Company, Berkshire Hathaway Inc., Ashland Global Holdings Inc and Härting S.A. are the major companies operating in the North America Phytosterols Market.

What years does this North America Phytosterols Market cover?

The report covers the North America Phytosterols Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the North America Phytosterols Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

North America Phytosterols Industry Report

Statistics for the 2024 North America Phytosterols market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. North America Phytosterols analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.