North America Food Sweetener Market Analysis by Mordor Intelligence

The North America Food Sweetener Market is expected to register a CAGR of 1.22% during the forecast period.

- The demand for natural sweeteners in North America is primarily due to the health food trend. The rising awareness regarding the harmful effects of excessive sugar consumption is augmenting the market’s growth.

- However, an increase in the awareness about the negative effects of sugar on consumer’s health is likely to hinder the market growth, providing more opportunities for low-calorie sweeteners, especially in beverage, and bakery and dairy products.

- The beverages category is most dominant, followed by bakery, confectionary, and dairy products. Based on type, Stevia and Xylitol are expected to witness high growth rates.

North America Food Sweetener Market Trends and Insights

Demand for Low Calorie Sugar Substitutes

With the growing trends for clean label, low-calorie sweeteners (LCS) are used in various beverages and foods like frozen desserts, yogurt, candies, baked goods, chewing gum, breakfast cereals, gelatins, and puddings. Foods and beverages containing low-calorie sweeteners carry the label “sugar-free” or “diet.” U.S. Food and Drug Administration (USDA) has listed six LCS under Generally Recognized as Safe (GRAS). Brands such as Equal®, NutraSweet®, Sugar Twin®, Splenda®, are few of those brands that are categorized under GRAS.

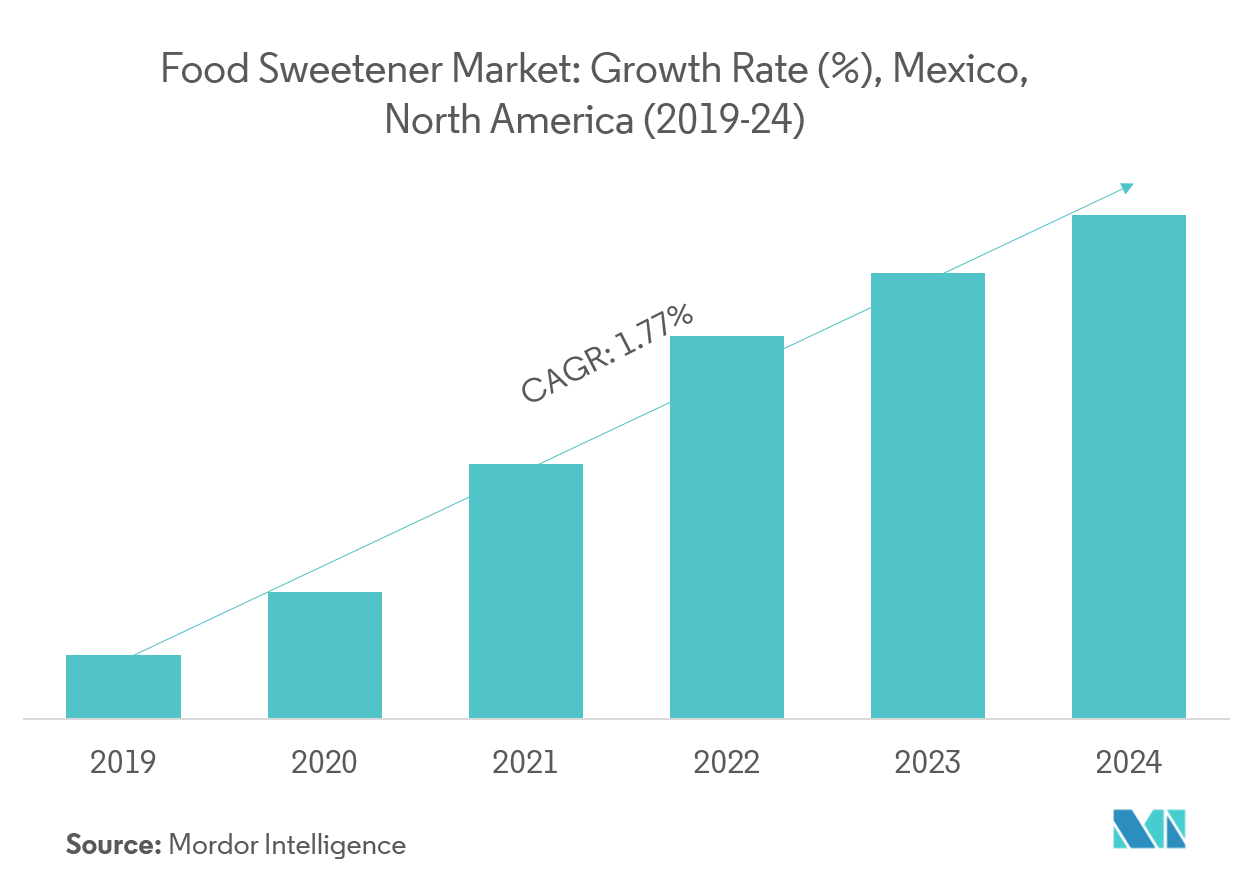

Mexico Remains the Fastest Growing Market

Mexico is a high potential market for natural and artificial sweetener products. The country has a high proportion of the obese population. The Mexican government’s decision to increase the tax on sugary drinks by 10% highlights its serious intent in reducing sugar consumption. The purchasing power is expected to increase, along with the economy and the number of urban dwellings. In developing nations, the demand for artificial sweeteners is closely related to these factors. Thus, Mexico is expected to emerge as an attractive destination for sweetener products. In the country, over the review period, sugar consumption was adversely affected by strong campaigns from the government, primarily to spread awareness regarding he harmful effects of obesity.

Competitive Landscape

North America food sweeteners market is driven by a large number of prominent players. Currently, there are several active players in this industry, such as Cargill Inc., Tate & Lyle, Kerry Group,and Ingredion, among others. Acquisitions, new product launches, joint ventures, and expansion are the most preferred growth strategies.

North America Food Sweetener Industry Leaders

-

Cargill, Incorporated

-

Archer Daniels Midland Company

-

Stevia First Corporation

-

Tate & Lyle

-

Ingredion Incorporated

- *Disclaimer: Major Players sorted in no particular order

North America Food Sweetener Market Report Scope

North America food sweetener market is segmented by type as sucrose, starch sweeteners and sugar alcohols, high-intensity sweeteners (HIS). Starch sweeteners and sugar alcohols include dextrose, HFCS, maltodextrin, sorbitol, xylitol, others. The other starch sweeteners and sugar alcohols include glucose syrup, glucose-fructose syrup, fructose-glucose syrup, isoglucose, fructose, mannitol, maltitol, erythritol, lactitol, isomalt. High-Intensity sweeteners include sucralose, aspartame, saccharin, cyclamate, ace-k, neotame, stevia and others. The other HIS includes glycyrrhizin, mogroside V, Luo Han Guo, thaumatin, monatin. By application as dairy, bakery, beverages, confectionery, soups, sauces and dressings and others.

| Sucrose | |

| Starch Sweeteners and Sugar Alcohols | Dextrose |

| High Fructose Corn Syrup (HFCS) | |

| Maltodextrin | |

| Sorbitol | |

| Xylitol | |

| Others | |

| High Intensity Sweeteners (HIS) | Sucralose |

| Aspartame | |

| Saccharin | |

| Cyclamate | |

| Ace-K | |

| Neotame | |

| Stevia | |

| Others |

| Dairy |

| Bakery |

| Soups, Sauces and Dressings |

| Confectionery |

| Beverages |

| Others |

| North America | United States |

| Canada | |

| Mexico | |

| Rest of North America |

| By Product Type | Sucrose | |

| Starch Sweeteners and Sugar Alcohols | Dextrose | |

| High Fructose Corn Syrup (HFCS) | ||

| Maltodextrin | ||

| Sorbitol | ||

| Xylitol | ||

| Others | ||

| High Intensity Sweeteners (HIS) | Sucralose | |

| Aspartame | ||

| Saccharin | ||

| Cyclamate | ||

| Ace-K | ||

| Neotame | ||

| Stevia | ||

| Others | ||

| By Application | Dairy | |

| Bakery | ||

| Soups, Sauces and Dressings | ||

| Confectionery | ||

| Beverages | ||

| Others | ||

| Geography | North America | United States |

| Canada | ||

| Mexico | ||

| Rest of North America | ||

Key Questions Answered in the Report

What is the current North America Food Sweetener Market size?

The North America Food Sweetener Market is projected to register a CAGR of 1.22% during the forecast period (2025-2030)

Who are the key players in North America Food Sweetener Market?

Cargill, Incorporated, Archer Daniels Midland Company, Stevia First Corporation, Tate & Lyle and Ingredion Incorporated are the major companies operating in the North America Food Sweetener Market.

What years does this North America Food Sweetener Market cover?

The report covers the North America Food Sweetener Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the North America Food Sweetener Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Page last updated on:

North America Food Sweetener Market Report

Statistics for the 2025 North America Food Sweetener market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. North America Food Sweetener analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.