North America Food Hydrocolloids Market Analysis by Mordor Intelligence

The North America Food Hydrocolloids Market is expected to register a CAGR of 4.9% during the forecast period.

- North America is one of the largest marketfor hydrocolloids; the specific demand for the substance for oil and fat reduction exists in the region given the food habit and eating practices of the consumers. It acts as a barrier for oils and fats in breaded/fried foods consumed heavily in US.

- By using hydrocolloids, calorie-dense fats and oils can be replaced with what is essentially structured water. Therefore, consumers would prefer products low in oil and fat, which possible through proper use of hydrocolloids.

- The major types of hydrocolloids in the North America hydrocolloid market are gellan gum, xanthan gum, guar gum, locust bean gum, and pectin, among others.

North America Food Hydrocolloids Market Trends and Insights

Gellan Gum is the Largest Market Segment

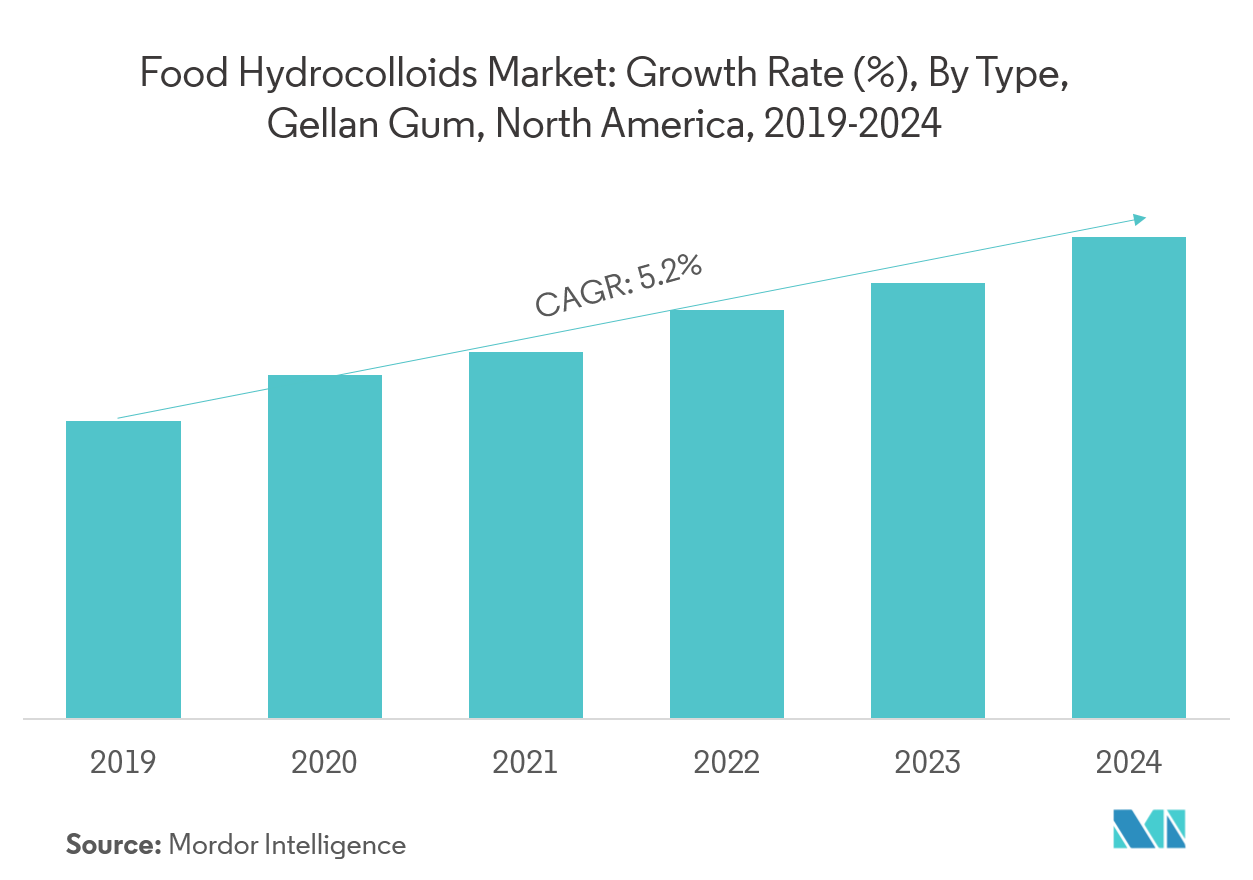

North America is the largest market for gelatin-based hydrocolloids. Gellan gum is an important hydrocolloid in the food industry and is widely used as a food additive in healthy food due to its high content of protein and amino acid. The hydrocolloidal nature of gellan gum has numerous applications in confectionery products (for imparting chewiness, texture, and foam stabilization), jelly deserts (for creaminess, fat reduction, and mouthfeel), dairy products (for stabilization and texturization), and meat products (for water-binding). Owing to the high prices, gellan gum is witnessing a slow growth from the last few years. In the US market, gellan gum is seeing competition from low priced xanthan gum and hence, witnessing slow growth.

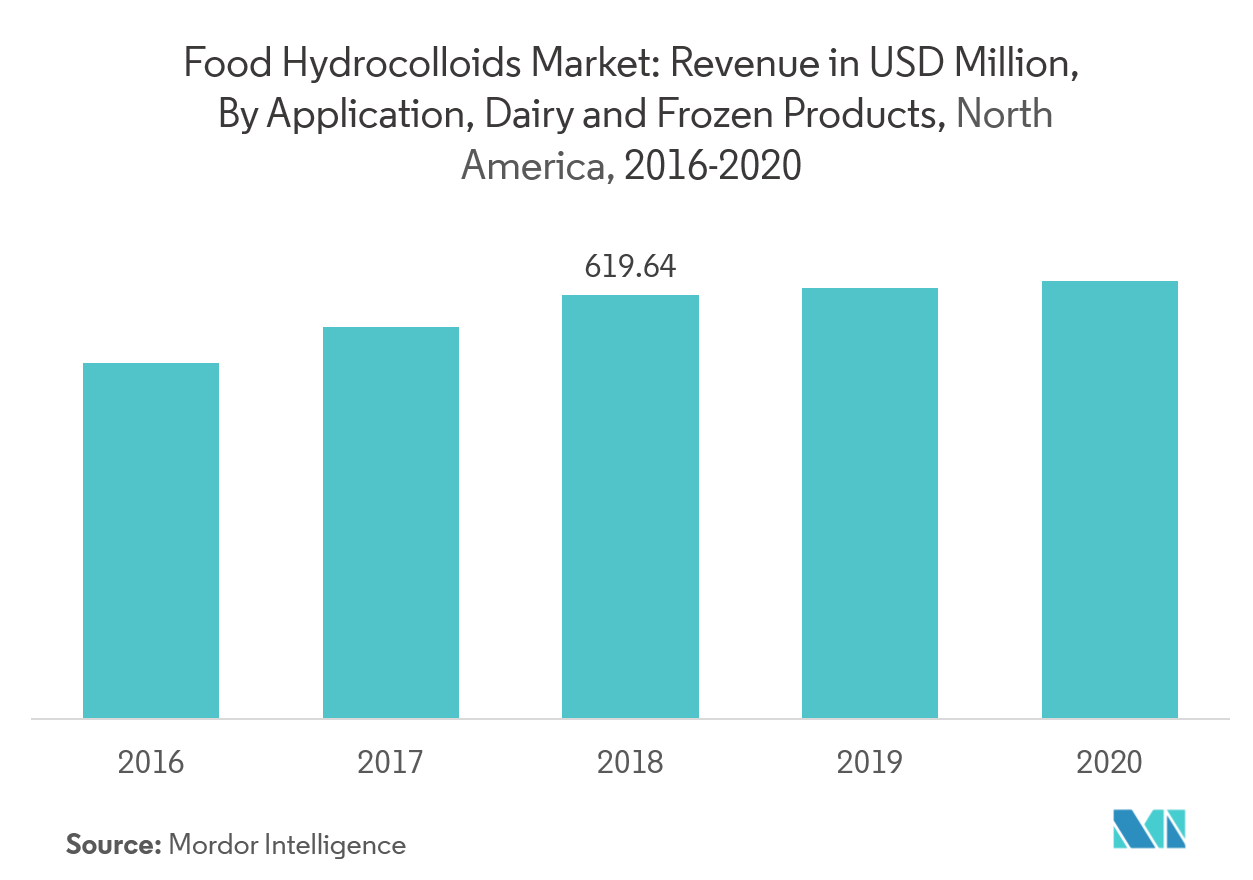

Dairy & Frozen Products Holds the Largest Market Share by Application

Dairy & frozen products and confectionery are the highest in North America market followed by meat, poultry & seafood products, beverages, and bakery. In the United States, the current trend toward new, low-fat dairy products with lower total solids contents has created a further scope of demand for stabilizers; a combination of hydrocolloids can be more effective, rather than applying a single stabilizer in dairy and frozen products. This led to the development of a large number of blended hydrocolloids formulated for specific dairy products. Beyond white milk and natural cheese, almost all dairy products may benefit from the addition of hydrocolloids. In yogurt, sour cream and other cultured dairy products, hydrocolloids modify texture by emulsifying, thickening and gelling, in addition to controlling syneresis.

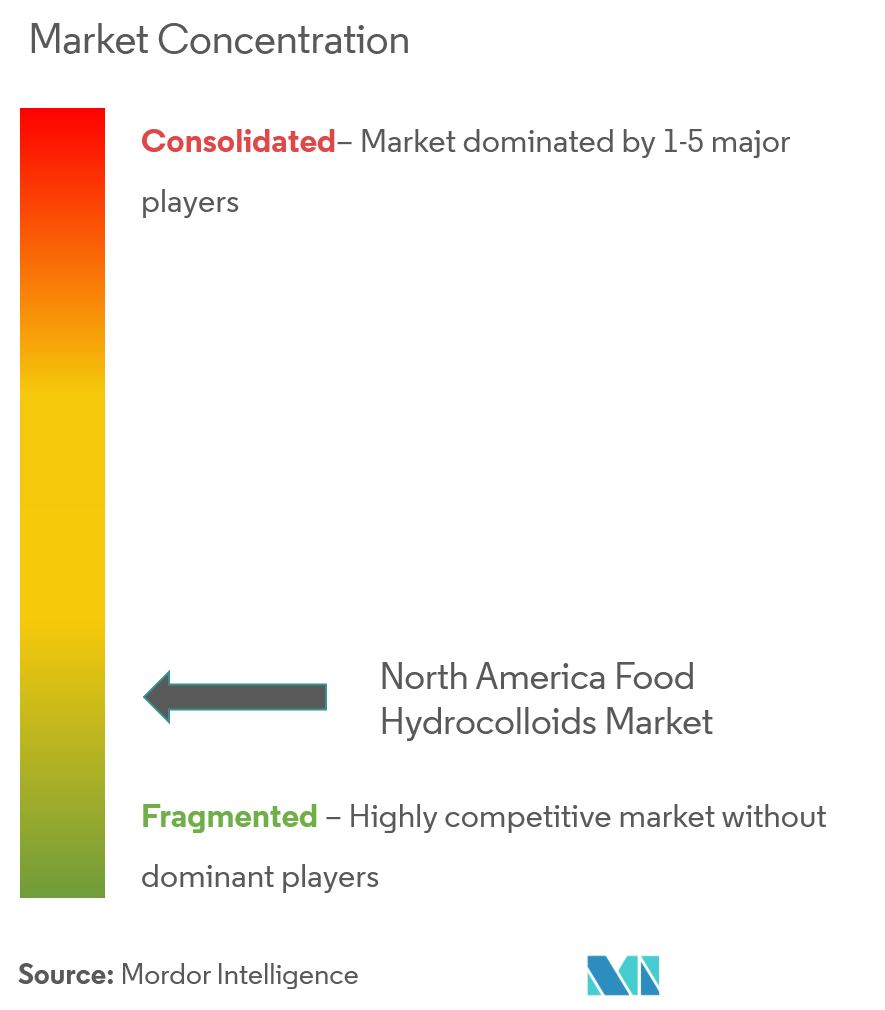

Competitive Landscape

With several players existing in the market, the global market is highly competitive. The leading players of the market are Cargill, CP Kelco U.S., Inc. and Kerry Group. Strategies of leading players focus on developing innovative solutions that address the taste, texture, and nutritional profile of processed foods, in turn, extending the shelf-life of the final consumer product.

North America Food Hydrocolloids Industry Leaders

Cargill, Incorporated

CP Kelco U.S., Inc.

Koninklijke DSM N.V.

Kerry Group

- *Disclaimer: Major Players sorted in no particular order

North America Food Hydrocolloids Market Report Scope

The market has been segmented by type, application, and geography. Based on type, the market is further segmented into gellan gum, pectin, xanthan gum, guar gum, carrageenan, gelatin, and other types. Based on application, the market is further segmented into dairy and frozen products, bakery, beverages, confectionery, meat and seafood products, and other applications. By geography, market covers developed countries of the region including the United States, Canada, and Mexico.

| Gellan Gum |

| Carrageenan |

| Pectin |

| Xanthan Gum |

| Guar Gum |

| Gelatin |

| Others |

| Dairy and Frozen Products |

| Bakery |

| Beverages |

| Confectionery |

| Meat and Seafood Products |

| Other Applications |

| North America | United States |

| Canada | |

| Mexico | |

| Rest of North America |

| By Type | Gellan Gum | |

| Carrageenan | ||

| Pectin | ||

| Xanthan Gum | ||

| Guar Gum | ||

| Gelatin | ||

| Others | ||

| By Application | Dairy and Frozen Products | |

| Bakery | ||

| Beverages | ||

| Confectionery | ||

| Meat and Seafood Products | ||

| Other Applications | ||

| Geography | North America | United States |

| Canada | ||

| Mexico | ||

| Rest of North America | ||

Key Questions Answered in the Report

What is the current North America Food Hydrocolloids Market size?

The North America Food Hydrocolloids Market is projected to register a CAGR of 4.9% during the forecast period (2025-2030)

Who are the key players in North America Food Hydrocolloids Market?

Cargill, Incorporated, CP Kelco U.S., Inc., Koninklijke DSM N.V. and Kerry Group are the major companies operating in the North America Food Hydrocolloids Market.

What years does this North America Food Hydrocolloids Market cover?

The report covers the North America Food Hydrocolloids Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the North America Food Hydrocolloids Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Page last updated on:

North America Food Hydrocolloids Market Report

Statistics for the 2025 North America Food Hydrocolloids market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. North America Food Hydrocolloids analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.