North America Fats & Oil Market Analysis

The North America Fats and Oils Market is expected to register a CAGR of 3.2% during the forecast period.

- Changing consumer dietary habits is projected to positively influence the fats & oils market over the forecast period. The rise in processed food consumption coupled with high-quality edible oil demand is expected to have a positive impact on the fats & oils market.

- An increase in awareness of obesity and its association with heart diseases and diabetes are responsible for the changing food trend among consumers. Oils and fats' manufacturers are focusing on manufacturing healthier products, including low-cholesterol and low-carbohydrate foods, in order to cater to the growing demand from health-conscious consumers.

- Shifting consumer buying patterns have gained the attraction of fats & oil suppliers, prompting them to update their product portfolios for reflecting potential demand for varieties along with added benefits.

North America Fats & Oil Market Trends

Rise in the Consumption of Olive Oil

Consumption of olive oil is continuously rising in the region, as it is considered to be healthy dietary fat. Olive oil constitutes a considerable amount of monounsaturated fatty acids. As per the Food and Drug Administration (FDA), eating two tablespoons of olive oil a day may reduce the risk of heart diseases. Consumption of olive oil has several other benefits, such as lowering the risk of osteoporosis, blood pressure, diabetes, and cholesterol. Furthermore, fatty acids (such as omega-3 and omega-6) essential for brain health are also present in extra-virgin olive oil. Due to the tremendous benefits offered by the consumption of olive oil, the demand for oil has increased to a greater extent across the United States and other North American markets.

United States Dominates the Regional Market

North America Fats & Oil Industry Overview

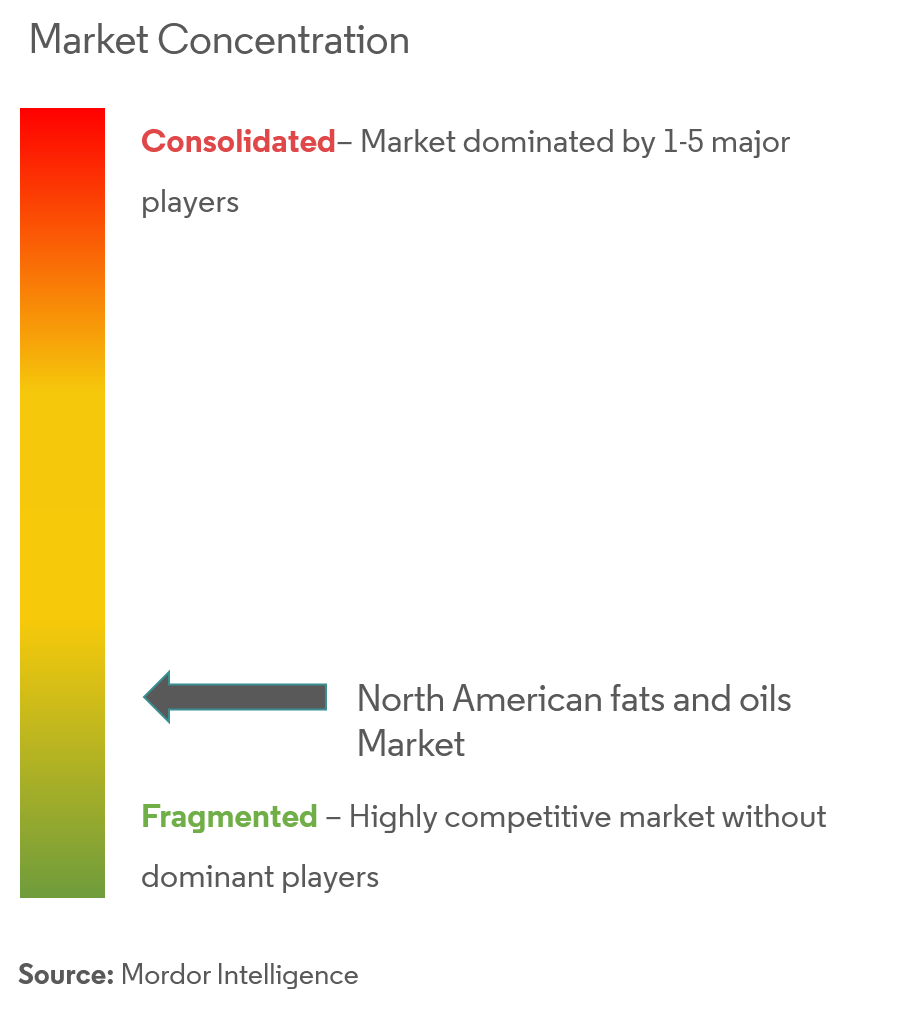

The North American fats and oils market is a fragmented market and comprises of regional and international competitors. ADM, Bunge Limited, Wilmar, and Cargill are some of the prominent companies operating in the market. The sustainable competitive advantage through differentiation is high. Manufacturers are increasingly introducing product innovations, in terms of ingredients, price and functionalities. This has led to a high degree of competition in the market.

North America Fats & Oil Market Leaders

-

Ag Processing Inc.

-

Wilmar International Ltd

-

Archer Daniels Midland

-

Cargill Incorporated

-

Bungee Limited

- *Disclaimer: Major Players sorted in no particular order

North America Fats & Oil Industry Segmentation

Based on product type, the market studied is segmented into fats and oils. Based on fats, the market studied is further segmented into butter, lard, and other fats. Based on oils, the market studied is further segmented into soybean oil, canola oil, palm oil, sunflower seed oil, olive oil, and other oils. Based on the application, the market studied is segmented into food and beverages, animal feed, personal care and cosmetics, and other applications. Based on food and beverages, the market is further segmented into bakery and confectionery, savory snacks, dairy, and other food and beverage. Based on the country, the market studied is segmented into the United States, Canada, Mexico, and the rest of North America.

| Product | Oils | Soybean Oil | |

| Canola Oil | |||

| Palm Oil | |||

| Olive Oil | |||

| Sunflower Seed Oil | |||

| Other Oils | |||

| Fats | Butter(Excluding Dairy Butter) | ||

| Lard | |||

| Other Fats | |||

| Application | Food and Beverage | Bakery and Confectionary | |

| Savory Snacks | |||

| Dairy | |||

| Other Food and Beverage | |||

| Animal Feed | |||

| Personal Care and Cosmetics | |||

| Other Applications | |||

| By Geography | United States | ||

| Canada | |||

| Mexico | |||

| Rest of North America | |||

North America Fats & Oil Market Research FAQs

What is the current North America Fats and Oils Market size?

The North America Fats and Oils Market is projected to register a CAGR of 3.2% during the forecast period (2025-2030)

Who are the key players in North America Fats and Oils Market?

Ag Processing Inc., Wilmar International Ltd, Archer Daniels Midland, Cargill Incorporated and Bungee Limited are the major companies operating in the North America Fats and Oils Market.

What years does this North America Fats and Oils Market cover?

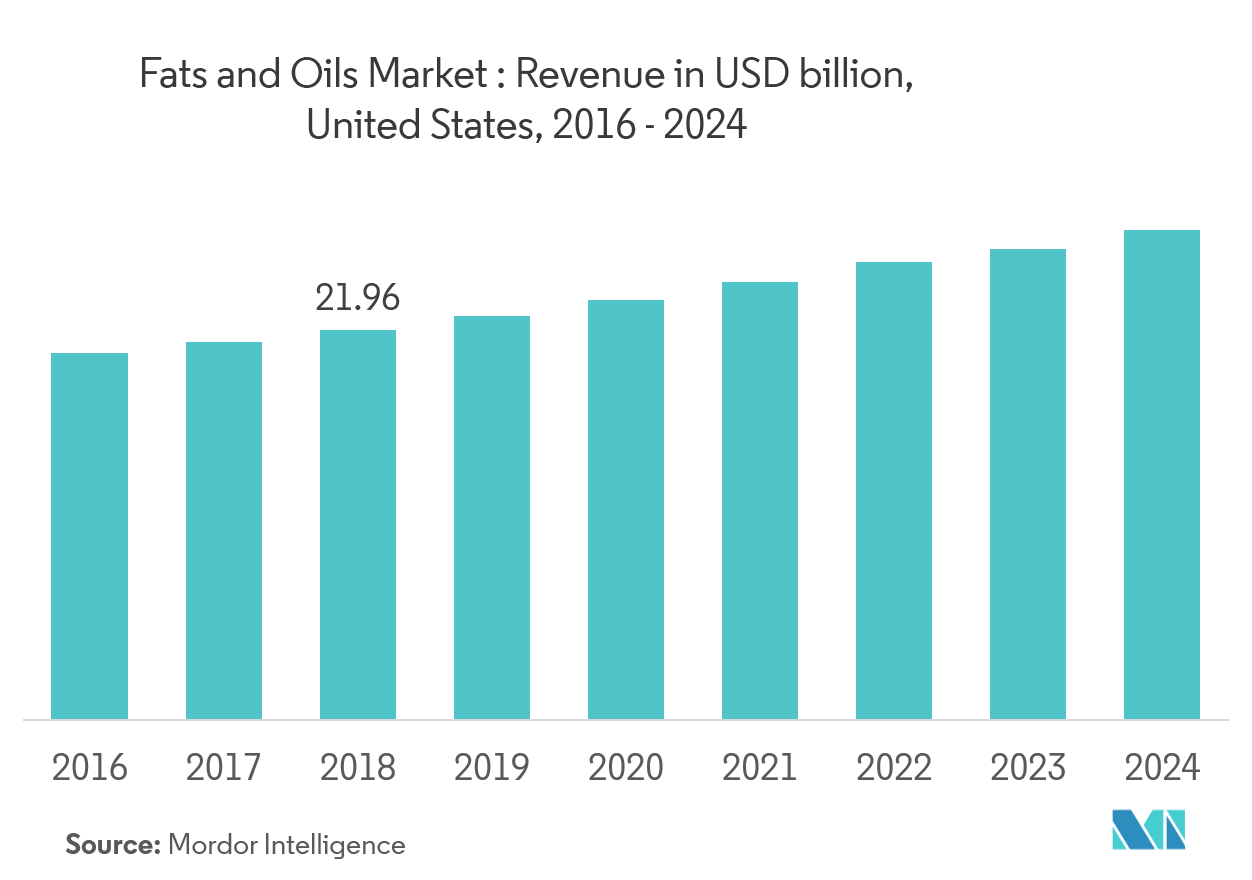

The report covers the North America Fats and Oils Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the North America Fats and Oils Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

North America Fats and Oils Industry Report

Statistics for the 2025 North America Fats and Oils market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. North America Fats and Oils analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.