North America Baby Food Market Analysis by Mordor Intelligence

The North America Baby Food Market is expected to register a CAGR of 5.25% during the forecast period.

- Today's young American parents want the best food to be served to their children and are conscious of the nutrient content their children take, irrespective of the product's cost. Infants and children are vulnerable to foodborne illnesses because their immune systems are not fully developed to fight infections. Thus, factors like premium quality products and their safety are among the essential criteria influencing the buyer's decision. Due to the convenience and improved nutrition that packaged baby food provides, parents have increasingly adopted it over the past few years.

- A rise in public knowledge of the numerous health benefits of feeding newborn baby food has significantly fueled the growth of the baby food market in North America. It's not surprising that parents choose organic, GMO-free, and additive/preservative-free items for their children as consumers choose fewer processed foods.

- Although parents desire greater flavor, they do not desire additional sugar and are monitoring their child's calorie intake. Instead, parents concur that producers can enhance cereal's flavor and nutritional value by incorporating superfoods like blueberries and pomegranates and a wider choice of whole grains.

- There's plenty at stake for the baby care manufacturers, as the competition in the baby care markets is stiff due to the presence of numerous branded and store-brand products offering their products at a competitive price. The existing baby food manufacturers have expanded their product ranges to include organic variants, sometimes through mergers and acquisitions. New entrants have also forayed into this sector with specialized offerings to tap the vast potential.

- For instance, in July 2020, the early childhood nutrition leader, Gerber, expanded its organic snacks line with the introduction of Gerber Organic BabyPops™, new puffed corn and oat snack in a fun, popcorn-like shape made just the right size for little fingers learning to pick up. BabyPops come in three varieties - peanut, tomato and banana raspberry - and do not contain any added sweetener or salt, plus organic is always non-GMO..

North America Baby Food Market Trends and Insights

Busy Lifestyle of Parents Fostering RTE Product Adaptation

- The role of a parent or mother/father is considered vital for a baby's overall development, especially regarding dietary and nutritional requirements. The changing societal landscape worldwide has ensured that the contribution of women toward the workforce and the economy is ever-increasing.

- For instance, according to the Bureau of Labor Statistics, the female participation rate in the labour force of the United States increased to 56.1% in 2021. It became challenging for working parents to take their time preparing regular meals for their babies. Thus, in the United States, where the female labour force participation rate is one of the highest globally, the demand for commercial baby food formulations is increasing in this regard due to the busy lifestyles of parents. Parents of 18- to 34-year-olds are North America's most significant demographic group of organic food buyers.

- Moreover, convenient packaging in the form of spouted squeeze pouches, which can be consumed straight from the refrigerator or by heating minimally in the microwave, is one of the major factors adding to the comfort of providing ready-to-eat baby foods. Manufacturers are increasingly offering baby food to restore the nutritional value of fruits and vegetables added to these ready-to-eat products.

- Packaging sustainability, now ranked highly by consumers at large, is also taking up its parts. At the same time, innovation, wherein in 2020, Nestlé launched a single-material pouch for its baby food products designed for the future of recycling. It will be 100% recyclable through Gerber's national recycling program with TerraCycle.

United States dominates the North America Baby Food Market

- In North America, the baby care industry is highly regulated, so consumers are conscious that their baby food products will be safe and nutritious. The United States was the dominant segment in the studied market, and the country accounted for a significant market share due to rising demand driven by a high birth rate.

- For instance, according to US Census Bureau, in 2021, the Hinesville metro area in Georgia ranked first with 20.4 births per 1,000 residents , followed by Odessa in Texas with 18.99 births per 1,000 residents.

- Additionally, changing lifestyles due to rising living standards and consumer awareness about nutritional diets for babies are expected to propel regional market growth further. Moreover, online channels are anticipated to experience encouraging expansion throughout the analysis. E-commerce websites are becoming increasingly popular with American customers. Growing modernization and many internet users are accelerating the expansion of online channels that sell infant food.

- Furthermore, the market has strong penetration of prepared organic baby food among United States consumers due to growth in dual-income families that has led convenience to be an integral part of the diet. The same can be seen in the ready meal segment growth. For organic baby foods, the growing demand for pouches and cup holders has been prominent over the past years.

Competitive Landscape

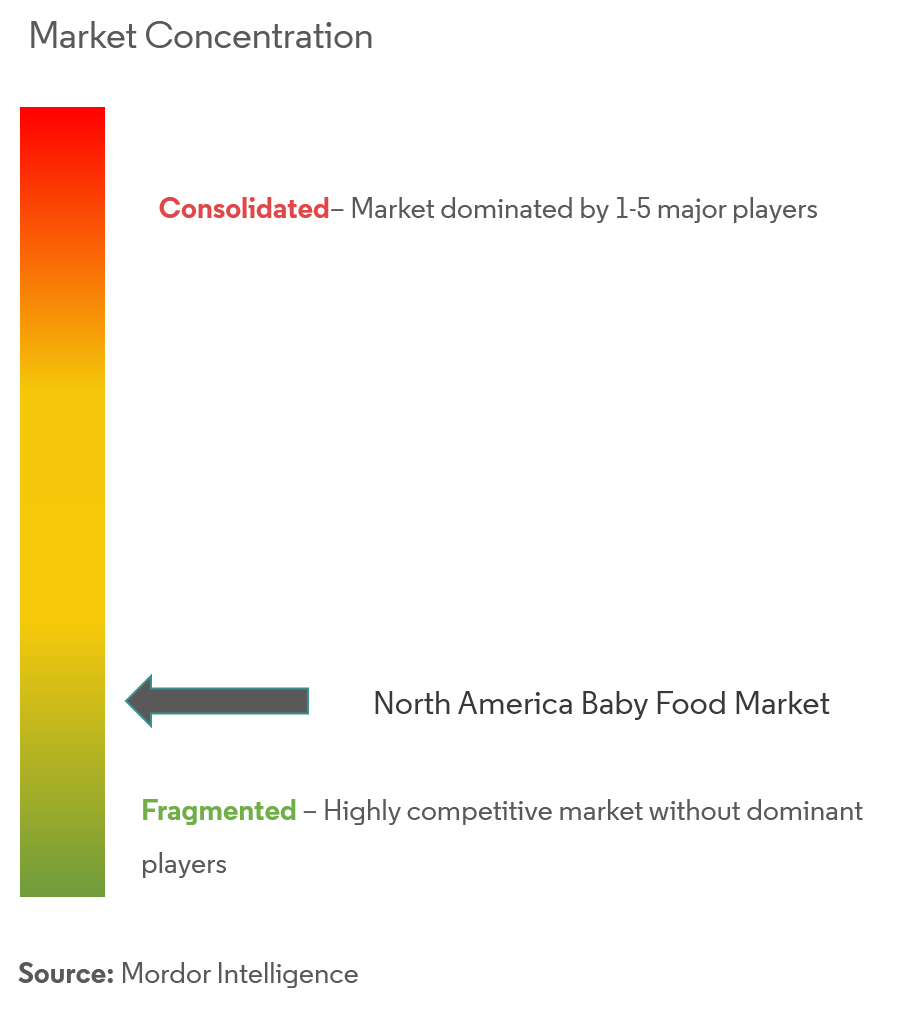

The North American baby food market is competitive, with various operating players and many new entrants registering to grab the market share. Companies are focusing on expanding facilities and product portfolios due to the growing demand for baby food. Some of the major key players in the North American baby food market are Hero Group (Beech-Nut Nutrition Corporation), Nestlé S.A., Danone S.A., Abbott Laboratories, and Hain Celestial Group, Inc. Mergers and acquisitions and partnerships are the two other strategies that are being widely witnessed in the market. Companies adopted these strategies to compete with the other players, expand their global presence, and broaden their product range.

North America Baby Food Industry Leaders

Hero Group (Beech-Nut Nutrition Corporation)

Nestlé S.A.

Danone S.A.

Abbott Laboratories

Hain Celestial Group, Inc.

- *Disclaimer: Major Players sorted in no particular order

Recent Industry Developments

- April 2022: Gerber, a Nestlé brand, announced the debut of plant-tastic, a new line of carbon-neutral, plant-protein baby food. Plant-tastic offers a variety of organic pouches, snacks, and meals made with nutrient-dense plant-based ingredients. Chickpeas, black beans, navy beans, and lentils are used in every plant-tastic recipe.

- April 2021: Sun-Maid Growers of California acquired Plum Organics, a premium, organic baby food and kids snack brand, from Campbell Soup Company. Plum Organics offers a wide range of organic foods and snack products to meet the nutritional needs of babies, toddlers, and kids. Plum Organics' products are certified organic and non-GMO.

- January 2021: Baby Gourmet, a Canadian organic meal and snack brand for babies and toddlers, was acquired by The Hero Group. Slammers Snacks, a Baby Gourmet-owned organic United States children's snack brand, is included in the acquisition.

North America Baby Food Market Report Scope

Baby food is any readily digestible, soft meal created specifically for infants between the ages of four to six months and two years old. It does not include breastmilk or infant formula.

The North American baby food market is segmented by product type, distribution channel, and geography. The baby food market, by product type, is segmented as milk formula, dried baby food, prepared baby food, and other product types. By distribution channel, the market is segmented into hypermarkets/supermarkets, convenience stores, drug/pharmacies, online retail stores, and other distribution channels. By geography, the market is segmented into the United States, Canada, Mexico, and the Rest of North America.

For each segment, the market sizing and forecasts have been done on the basis of value (in USD million).

| Milk Formula |

| Dried Baby Food |

| Prepared Baby Food |

| Other Product Types |

| Hypermarket/Supermarket |

| Drugstores/Pharmacies |

| Convenience Stores |

| Online Retail Stores |

| Other Distribution Channels |

| United States |

| Canada |

| Mexico |

| Rest of North America |

| Product Type | Milk Formula |

| Dried Baby Food | |

| Prepared Baby Food | |

| Other Product Types | |

| Distribution Channel | Hypermarket/Supermarket |

| Drugstores/Pharmacies | |

| Convenience Stores | |

| Online Retail Stores | |

| Other Distribution Channels | |

| Geography | United States |

| Canada | |

| Mexico | |

| Rest of North America |

Key Questions Answered in the Report

What is the current North America Baby Food Market size?

The North America Baby Food Market is projected to register a CAGR of 5.25% during the forecast period (2025-2030)

Who are the key players in North America Baby Food Market?

Hero Group (Beech-Nut Nutrition Corporation), Nestlé S.A., Danone S.A., Abbott Laboratories and Hain Celestial Group, Inc. are the major companies operating in the North America Baby Food Market.

What years does this North America Baby Food Market cover?

The report covers the North America Baby Food Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the North America Baby Food Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Page last updated on:

North America Baby Food Market Report

Statistics for the 2025 North America Baby Food market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. North America Baby Food analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.