Unlocking Market Potential for Solid-State Transformers

3 Min Read

The Nigeria Oil and Gas Market Report is Segmented by Sector (Upstream, Midstream, and Downstream), Location (Onshore and Offshore), and Service (Construction, Maintenance and Turn-Around, and Decommissioning). The Market Sizes and Forecasts are Provided in Terms of Value (USD).

Market Overview

| Study Period | 2020 - 2030 |

|---|---|

| Base Year For Estimation | 2024 |

| Forecast Data Period | 2025 - 2030 |

| Market Size (2025) | USD 8.25 Billion |

| Market Size (2030) | USD 10.22 Billion |

| Growth Rate (2025 - 2030) | 4.38 % CAGR |

| Market Concentration | High |

Major Players *Disclaimer: Major Players sorted in no particular order Image © Mordor Intelligence. Reuse requires attribution under CC BY 4.0. |

Nigeria’s 37.5 billion barrels of proven crude reserves and 209.26 trillion cubic feet of proven gas reserves anchor long-term supply security, while the Petroleum Industry Act (PIA) lowers fiscal uncertainty and unlocks fresh upstream spending.[1]Editorial Team, “Nigeria Passes Petroleum Industry Act,” AllAfrica, allafrica.com The ramp-up of the 650,000-barrels-per-day Dangote refinery reduces reliance on imported products, spurs domestic crude demand, and cuts foreign-exchange outflows by an estimated USD 15 billion per year. Ongoing divestments by international oil companies (IOCs) are accelerating the rise of agile local operators who quickly monetize acquired assets and deploy digital oilfield technology to increase recovery rates and reduce methane losses. Nonetheless, persistent militancy, pipeline vandalism, and foreign-exchange scarcity inflate operating costs and temper near-term production gains.

Key Report Takeaways

Drivers Impact Analysis

| Driver | (~) % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline | |||

|---|---|---|---|---|---|---|

Abundant

proven oil & gas reserves

Abundant

proven oil & gas reserves

| 1.8% | National, with concentration in Niger Delta and offshore basins | Long term (≥ 4 years) | (~) %

Impact on CAGR Forecast:

1.8%

|

Geographic

Relevance

:

National,

with concentration in Niger Delta and offshore basins

|

Impact

Timeline

:

Long

term (≥ 4 years)

|

Dangote

mega-refinery boosting domestic processing

Dangote

mega-refinery boosting domestic processing

| 1.2% | National, with primary impact in Lagos and Southwest Nigeria | Medium term (2-4 years) | |||

Petroleum

Industry Act (PIA) unlocking fresh investments

Petroleum

Industry Act (PIA) unlocking fresh investments

| 0.9% | National, with enhanced focus on frontier basins | Medium term (2-4 years) | |||

Rising

domestic gas demand for power & industry

Rising

domestic gas demand for power & industry

| 0.7% | National, with priority corridors in Lagos-Kano axis | Long term (≥ 4 years) | |||

IOC

divestment creating space for agile indigenous firms

IOC

divestment creating space for agile indigenous firms

| 0.6% | Niger Delta onshore and shallow water areas | Short term (≤ 2 years) | |||

Digital

oil-field & methane-detection adoption curbing losses

Digital

oil-field & methane-detection adoption curbing losses

| 0.4% | National, with early adoption in major producing fields | Medium term (2-4 years) | |||

| Source: Mordor Intelligence | ||||||

Abundant Proven Oil & Gas Reserves

Nigeria holds 37.5 billion barrels of crude and 209.26 trillion cubic feet of gas, giving the Nigeria oil and gas market a production runway well beyond the forecast horizon. Reserve certainty encourages multiyear work programs and supports financing for both greenfield and brownfield projects. Deepwater prospects, long stalled by fiscal ambiguity, now attract renewed interest after PIA revisions to profit-oil splits. Indigenous firms leverage reserve bookings to secure development loans from local banks that previously shied away from upstream risk. The sizable gas endowment underpins the country’s “Decade of Gas” strategy, positioning Nigeria as a regional supplier amid tightening LNG markets.

Dangote Mega-Refinery Boosting Domestic Processing

The privately owned Dangote refinery is approaching full 650,000 barrels-per-day throughput, trimming gasoline and diesel imports by roughly 60% and creating a structurally tight domestic crude market that supports higher wellhead prices. Preferential Domestic Crude Supply Obligations ensure stable feedstock flows, thereby locking in sales volumes for producers. The complex’s petrochemical units open fresh revenue streams from polypropylene and fertilizer within West Africa. Spillover benefits include a construction boom for associated tank farms and jetties. Operational teething issues—chiefly payment delays for cargoes—remain, yet the facility’s scale catalyzes additional modular-refinery proposals, reinforcing downstream diversification.

Petroleum Industry Act Unlocking Investments

Since taking effect, the PIA has produced 25 new regulations, converted 50 marginal fields to Petroleum Prospecting Licenses, and launched streamlined bid rounds that attracted robust interest in 2024. Lower signature bonus fees and a Cost Efficiency Incentive that directly rewards sub-benchmark operating costs address Nigeria’s historic USD 25-40 per-barrel cost disadvantage.[2]Anderson Tax, “Cost Efficiency Incentive in Upstream Petroleum Operations Order 2025,” andersennigeria.com Clarity on royalty tiers and stability clauses has revived deferred deepwater final-investment decisions. Implementation snags persist—especially lengthy approvals for field plan amendments—but early production from re-licensed fields demonstrates tangible progress.

Rising Domestic Gas Demand for Power & Industry

Gas demand is projected to climb at a 16.6% CAGR through 2030 as Nigeria seeks to displace diesel in power generation and industrial boilers.[3]Michael Oti, “Decade of Gas: Demand Outlook,” ICLG, iclg.com Five mini-LNG plants commissioned in February 2025 kick-start decentralized supply chains for remote factories. The ANOH Gas Processing Plant expansion and the 23.3 km custody-transfer pipeline increase domestic processing capacity by 25%, ensuring a steady supply of feedstock for gas-fired plants along the Ajaokuta-Kaduna-Kano corridor. Regulatory enforcement of Domestic Gas Supply Obligations now prioritizes local allocations ahead of exports, trimming flare volumes to 7.58% of total production in 2024. Compressed natural gas for transport and clean-cooking LPG programs broaden end-use diversity.

Restraints Impact Analysis

| Restraint | (~) % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline | |||

|---|---|---|---|---|---|---|

Militancy,

theft & pipeline vandalism

Militancy,

theft & pipeline vandalism

| -1.1% | Niger Delta region, with spillover effects nationwide | Short term (≤ 2 years) | (~) %

Impact on CAGR Forecast:

-1.1%

|

Geographic

Relevance

:

Niger

Delta region, with spillover effects nationwide

|

Impact

Timeline

:

Short

term (≤ 2 years)

|

Persistent

regulatory execution gaps post-PIA

Persistent

regulatory execution gaps post-PIA

| -0.8% | National, with particular impact on frontier areas | Medium term (2-4 years) | |||

Forex

scarcity inflating equipment-import costs

Forex

scarcity inflating equipment-import costs

| -0.6% | National, affecting all operators requiring imported equipment | Short term (≤ 2 years) | |||

ESG-driven

capital flight from fossil projects

ESG-driven

capital flight from fossil projects

| -0.4% | National, with greater impact on new project financing | Long term (≥ 4 years) | |||

| Source: Mordor Intelligence | ||||||

Militancy, Theft & Pipeline Vandalism

Pipeline sabotage costs the Nigeria oil and gas market more than USD 1 billion in lost revenue annually, with up to 30% of onshore throughput at risk of theft. Nigeria LNG operated under force majeure for much of 2024, curtailing exports and trimming plant utilization to 67%. Operators resort to costly security escorts and barging, inflating logistics expenses and insurance premiums. Government amnesty programs and community trust funds yield uneven results due to under-funding. Continued unrest drives IOCs to divest onshore stakes, shifting both opportunity and decommissioning liability to domestic buyers.

Persistent Regulatory Execution Gaps Post-PIA

Although the PIA streamlines fiscal terms, overlapping approvals from the Nigerian Upstream Petroleum Regulatory Commission, the Nigerian Content Development Board, and joint-venture committees prolong contracting cycles beyond 18 months in some cases.[4]Ugochukwu Onyeije, “Regulatory Bottlenecks Under PIA,” Mondaq, mondaq.com The absence of statutory response times for field plan variations introduces scheduling risk for lenders. Capacity shortages within oversight agencies delay metering audits and flare-penalty assessments, thereby undermining the credibility of enforcement. Smaller operators lacking robust regulatory affairs teams face higher compliance costs. These gaps temper investor confidence and may erode some of the PIA’s intended growth stimulus unless staffing and process digitization improvements are made.

By Sector: Upstream Dominance Drives Market Expansion

Upstream activities captured 75.2% of Nigeria's oil and gas market share in 2024, as high-impact drilling and workovers ramped up after fiscal reforms. This segment is projected to clock the fastest 6.1% CAGR, adding substantial barrels that support the growth of the Nigerian oil and gas market size. January 2025 production of 1.53 million barrels per day marked the first on-quota performance in years, aided by digital well-surveillance tools that cut unplanned downtime by 15%. Midstream gas processing rose in tandem with ANOH and other capacity additions, creating a clearer pathway for flare capture and power-sector delivery. Downstream moves center on Dangote's refinery, which absorbs local crude and triggers fresh tank-farm and jetty construction, boosting EPC revenues.

Upstream momentum reflects a wave of indigenous takeovers of IOC divested assets, most notably Seplat's purchase of ExxonMobil's onshore portfolio and Oando's acquisition of Nigerian Agip blocks. These transfers often include sizeable abandoned-well inventories, prompting operators to budget decommissioning funds as mandated under PIA abandonment rules. Digital asset-loss controls, such as NUPRC's Advance Cargo Declaration system, help stem crude theft by enabling real-time verification of shipments. Meanwhile, the Cost Efficiency Incentive program offers tax credits to operators who deliver barrel-lifting costs below USD 20, thereby stimulating the broader adoption of predictive maintenance and downhole analytics.

Note: Segment shares of all individual segments available upon report purchase

By Location: Offshore Operations Lead Market Growth

Offshore fields accounted for 66.9% of Nigeria's oil and gas market revenues in 2024 and are forecast to grow at a healthy 4.9% CAGR to 2030, underpinning further gains in the overall Nigerian oil and gas market size. Deepwater blocks avoid onshore militancy, drawing sustained IOC capital for high-volume projects. Regulatory approval for the country's first floating LNG (FLNG) unit in OML 104 underscores offshore gas monetization potential and aligns with global LNG supply tightness. Subsea compression and high-integrity pipeline designs reduce maintenance interventions, thereby cutting life-of-field costs despite the complexity of deepwater operations.

Onshore operations remain cost-competitive in terms of capital expenditure, yet they frequently suffer from downtime due to vandalism and spills. Indigenous firms now dominate these blocks after securing asset divestments; they hedge security risk through community-based surveillance contracts and bunker-proofed pipeline segments. Shallow-water assets act as a bridge between the two extremes, balancing security exposure and cost. PIA royalty-rebate schemes for frontier basin exploration incentivize new seismic shoots in under-explored offshore zones such as the Dahomey Basin, potentially broadening Nigeria's production geography over the long term.

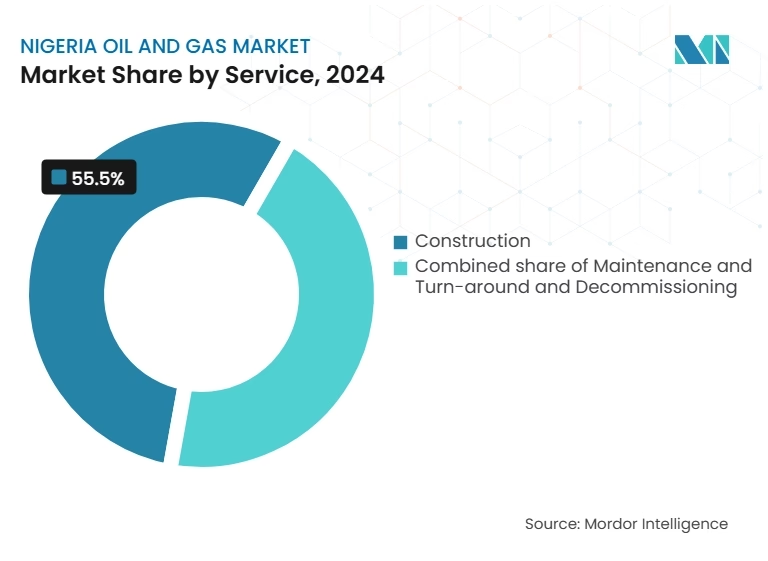

By Service: Construction Leads While Decommissioning Accelerates

Construction accounted for 55.5% of total service spending in 2024, driven by megaprojects such as LNG Train 7 and the Ajaokuta-Kaduna-Kano gas pipeline, thereby solidifying the Nigeria oil and gas market's size on the services side. EPC contractors meet a 55% local-content threshold on engineering person-hours, spurring the flow stationsgrowth of indigenous fabrication yards in Port Harcourt and Lagos. The downstream build-out—centered on Dangote, BUA, and a wave of modular refineries—creates follow-on demand for storage terminals, jetty upgrades, and product pipelines.

Decommissioning, however, is the fastest-growing service niche, with a 7.3% CAGR, as legacy wellheads and flow stations reach the end of their life. The PIA mandates annual escrow contributions and full abandonment plans, forcing acquirers of onshore and shallow-water assets to front-load retirement liabilities. Chevron's 2025 plug-and-abandon campaign signals a step-change in spending on well plugbacks and site remediation. Digital-twin models aid in cost estimation and scheduling, while ROV-assisted cutting tools reduce offshore campaign duration. Maintenance and turnaround activities hold steady because operators seek incremental recoveries from brownfields before irreversible shutdown.

Note: Segment shares of all individual segments available upon report purchase

The Niger Delta remains the production heartland, accounting for more than 90% of the nation's output through a blend of mature onshore clusters and prolific offshore blocks. Rivers State hosts Nigeria LNG’s six-train complex and the upcoming Train 7, making it the epicenter of LNG revenue and skilled-labor demand. Akwa Ibom is poised for heightened offshore attention once the UTM FLNG unit targets the Yoho field, potentially adding 2.8 million tonnes per year of export capacity. Meanwhile, Bayelsa and Cross River balance pipeline-vandalism risks with Host Community Trust funding, which channels 3% of operator spending into local infrastructure.

Lagos gains unprecedented downstream significance with the Dangote refinery cluster, positioning the state as a West African fuel hub and trimming inland freight costs. Its deepwater port and free-zone incentives attract tank-farm investors targeting regional re-exports. Northern Nigeria, historically absent from the hydrocarbon map, is set to receive its first gas flows via the Ajaokuta-Kaduna-Kano pipeline, catalyzing the development of industrial parks in Kano and Kaduna.

Federal oversight intensifies nationwide under NUPRC’s satellite-enabled metering audits, enhancing transparency across states. However, security interventions remain Delta-centric, reflecting the region’s outsized share of both production and risk exposure. Collectively, these geographic shifts reinforce Nigeria’s strategic intent to diversify its value-added centers while safeguarding its crude oil cash cows.

Reports are available across multiple geographies.

Gain in-depth market insights across regions to support informed decisions.

Market concentration is moderate, as the top five producers hold roughly 55% of the combined crude output, and this share is slipping as IOC divestments continue. Seplat’s USD 1.3 billion takeover of ExxonMobil’s shallow-water portfolio, Oando’s purchase of Nigerian Agip assets, and Chappal Energies’ acquisition of onshore TotalEnergies blocks exemplify a localized consolidation wave. Digital oilfield adoption distinguishes early movers: Seplat’s edge analytics platform lifted uptime by 12%, while Oando’s methane-detection rollout captured sales-grade gas once vented or flared.

NNPC Ltd. leverages its national champion status, partnering with Golar LNG on floating liquefaction and co-investing in new refinery projects to ensure crude placement security. International players continue to dominate the deepwater segment; TotalEnergies advanced the Ubeta gas field toward first gas by allocating USD 550 million in 2024, reinforcing its offshore commitment. EPC giants such as Saipem and Daewoo retain a foothold through LNG Train 7 and pipeline lots but now source more fabrication work locally to meet tightened content rules.

White-space opportunities cluster around FLNG, modular refining, and efficiency-linked tax incentives. Operators delivering lifting costs below USD 20 per barrel qualify for credits that can offset up to 20% of annual tax liabilities until 2035. Venture capital is slowly entering the mini-LNG and compressed natural gas distribution market, betting on demand from diesel-to-gas industrial conversions. These competitive vectors sharpen the strategic imperative to adopt technology, manage costs, and engage host communities credibly.

*Disclaimer: Major Players sorted in no particular order

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Landscape

5. Market Size & Growth Forecasts

6. Competitive Landscape

7. Market Opportunities & Future Outlook

The oil and gas industry refers to the sector involved in the exploration, extraction, refining, transportation, and distribution of petroleum products, natural gas, and related resources. It encompasses various activities and processes that are essential for the production and utilization of hydrocarbon-based energy sources.

Nigeria's oil and gas market is segmented by sector. By sector, the market is segmented into Upstream, Midstream, and Downstream. The report offers the size and forecasts for the oil and gas markets in production volume for all the above segments.

| By Sector | Upstream |

| Midstream | |

| Downstream | |

| By Location | Onshore |

| Offshore | |

| By Service | Construction |

| Maintenance and Turn-around | |

| Decommissioning |

Unlocking Market Potential for Solid-State Transformers

3 Min Read

Wealth Management Intelligence for the Middle East

4 Min Read

Driving Growth in the Embedded Insurance Market

4 Min Read

When decisions matter, industry leaders turn to our analysts. Let’s talk.