Market Trends of Mobile Biometrics Industry

This section covers the major market trends shaping the Mobile Biometrics Market according to our research experts:

Mobile Banking is Expected to Hold a Significant Share

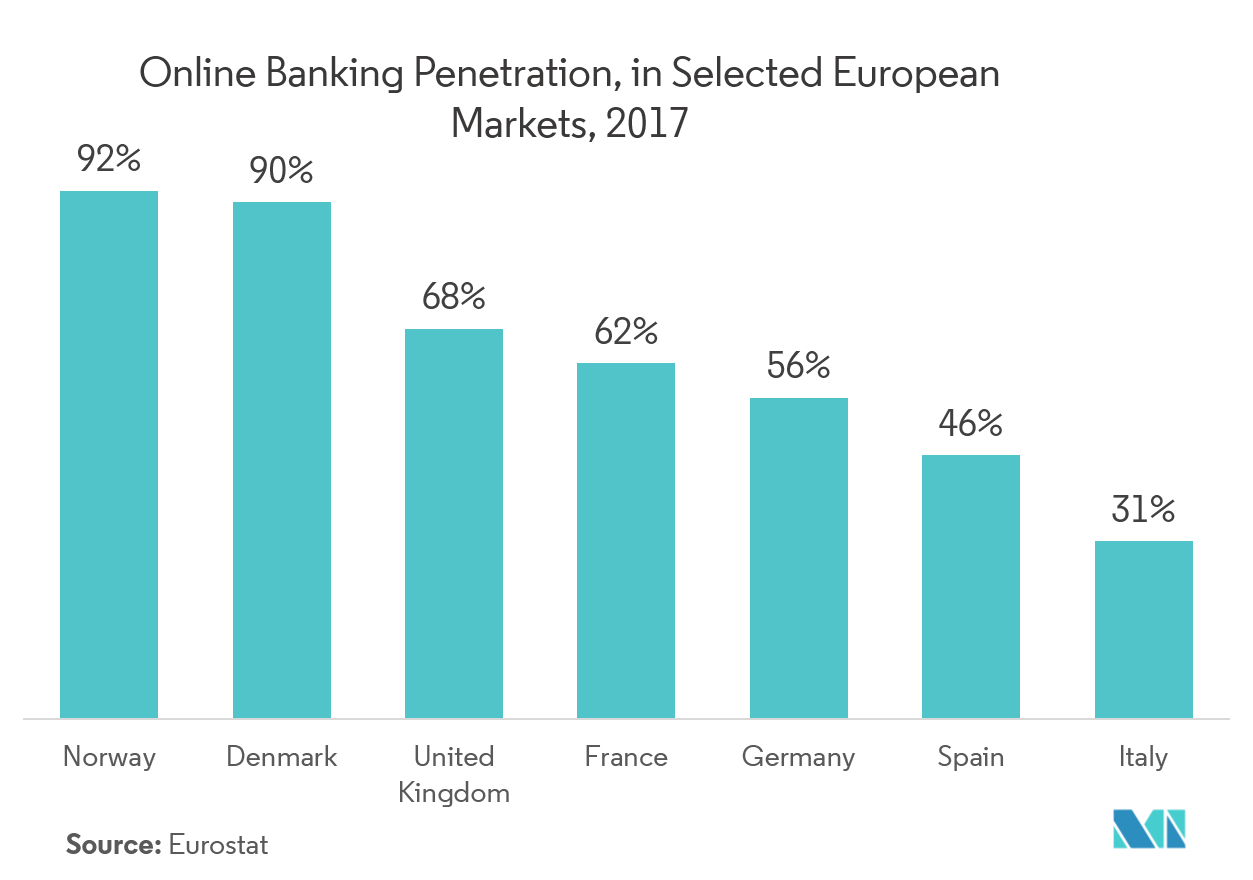

- The utilization of banking and financial services through online portals is increasing at a high pace, which creates a demand for advanced authentication to protect the vital data of consumers associated with the banking organization. Furthermore, with the rise in online transaction and banking, the risk for fraud and potential exposure of personal information are ascending.

- Owing to the adoption of online banking, mobile and e-banking are being increasingly used daily to transfer and perform a transaction, which creates potential avenues for cybercriminals to compromise a user’s account to extract money. With banking service providers investing in mobile app service to operate, the pressure to provide safe banking services through mobile apps persists. This is expected to influence the demand for the mobile biometrics market.

- Facial recognition is expected to emerge owing to the release of mobile phones with facial recognition software (iPhone X). A few used cases are evident across the United Kingdom, by people who have upgraded their mobile banking apps compatible with the new iPhone facial recognition software. Banking giants like HSBC (HSBCnet app) have extended their touch ID biometric authentication to voice recognition, Selfie ID, and even log-in with a photo.

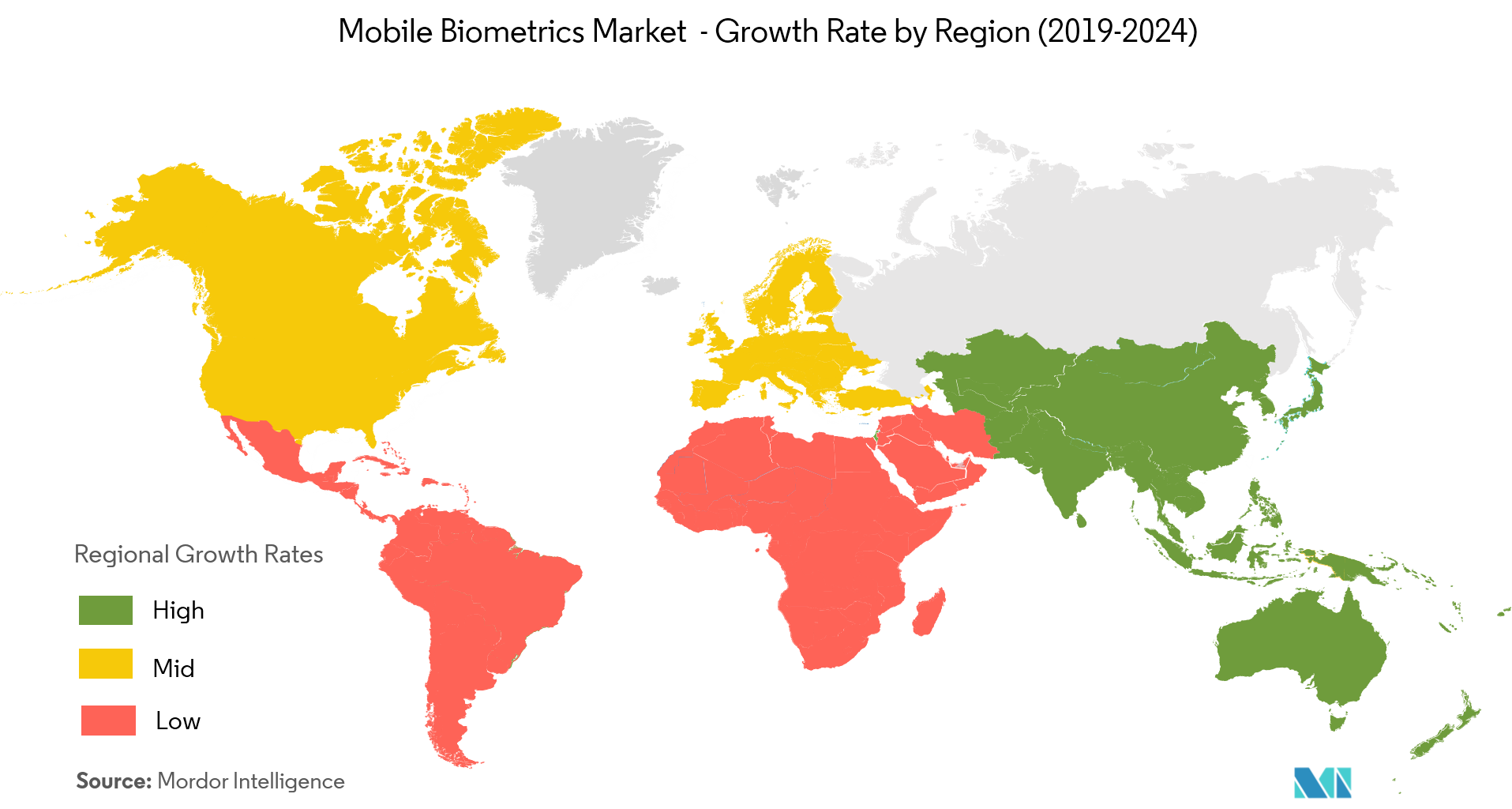

Asia-Pacific is Expected to Witness Rapid Growth

- Growing mobile transaction in countries, such as India and China is expected to be one of the significant drivers for the mobile biometrics market in the region.

- China is witnessing a high mobile transactional volume, which is expected to create a demand for authentication solutions, such as biometrics. For instance, as of October 2017, the mobile payment was recorded at CNY 81 trillion as compared to CNY 58.8 trillion in 2016.

- The State Bank of India is planning to launch a multi-mode biometric authentication for its mobile applications. It will comprise of either fingerprint or face recognition or by using voice recognition software. In addition to this, the bank is also planning to use biometrics for various mobile banking products, including Unified Payment Interface transactions. With other banks to follow suit, it is expected to bolster the demand of the market in the region.